Summary:

- Lucid Group delivered only 1,734 vehicles in Q4, falling short of estimates and experiencing a 39% YoY decrease in revenues.

- The company lost $425,000 per vehicle sold last quarter and lacks substantial demand and profitability.

- Lucid’s competition with Tesla and other established players in the luxury EV market poses challenges for its niche automaker.

- Lucid’s operating loss widened by 19% YoY, indicating a lack of efficiency and profitability, and the company is at risk of becoming a penny stock.

Bloomberg/Bloomberg via Getty Images

Lucid Stock Outlook

Lucid Group, Inc. (NASDAQ:LCID) makes a pretty stunning vehicle. It’s unfortunate that the company failed to mass-produce and sell the Lucid Air at a profit. Despite extremely high hopes and rich estimates, Lucid only sold 6,001 cars last year of the 8,428 it built.

The car company recently reported earnings, and the results were horrendous. Lucid delivered just 1,734 vehicles in Q4, resulting in only $157.51M in revenues, $24.25M shy of estimates, and down by a staggering 39% YoY.

Now, I was bullish on Lucid when it first came out. The EV sector was the hot new segment. Tesla, Inc. (TSLA) made it look easy for others like Lucid and Rivian Automotive, Inc. (RIVN) to repeat success.

Unfortunately for Lucid, it has proven much more challenging to create substantial demand while improving efficiency, building out economies of scale, increasing competitive advantages, and so on.

Lucid’s average price per vehicle, “ASP,” appeared to be around $90,836 in Q4 (from the 8-K calculation). While it’s competitive with Tesla’s Model S’s $88.5K base, consumers can get Tesla’s Model S Plaid, which starts at only around $108.5K. To get a similar performance, we would need to go with the Sapphire Edition Lucid, which would set you back approximately $250K.

Therefore, while Lucid makes an excellent vehicle, it makes too few of them, lacks a compelling infrastructure, and is nowhere near selling its cars at a profit. The truth is that Lucid lost $425,000 per vehicle that it sold last quarter.

I’ve been bearish on Lucid stock for almost a year, and I am happy that I exited my latest stake after taking a minor loss. I won’t touch this stock unless specific, material, and operational improvements are made.

Also, I continue to rate Lucid a sell as it could become a penny stock soon due to its insane cash burn and the need to raise capital to fund endless costly manufacturing operations continuously. There is even a chance of a “restructuring” on Lucid’s horizon if the Saudi Arabian PIF throws in the towel.

Have You Seen These Losses?

If you haven’t seen Lucid’s losses, they’re staggering. Also, I want to emphasize that Lucid is no Tesla (in my book), and as a niche automaker, it is questionable how long the company can withstand such losses.

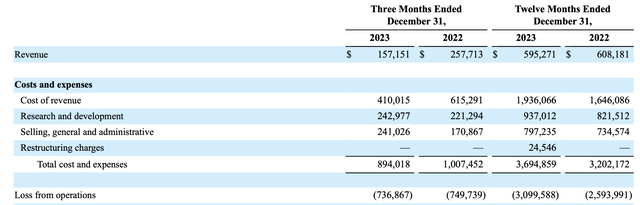

Lucid’s Operating Income Statement

Income statement (ir.lucidmotors.com )

Lucid’s revenue dropped by almost 40% YoY, illustrating anemic demand for its Lucid Air vehicle. The Lucid Gravity SUV is coming out soon, but that may not make a huge difference. After all, the Gravity SUV would likely be similar to the luxury EV SUV market as the AIR is to the luxury EV sedan segment.

These are niche segments for Lucid, primarily because of intense competition from established players, especially Tesla, in this space. In any case, Lucid’s sales are dropping while operating costs are rising.

Lucid’s SG&A expenses and R&D costs were much higher than last year’s quarter. Also, the only reason production costs decreased was because Lucid sold fewer cars. Lucid’s Q4 operating loss came in at about $737M and roughly $3.1 billion for 2023. The operating loss widened by 19% YoY, which is a terrible sign.

This dynamic illustrates that Lucid has not become more efficient or profitable with time or scale. In fact, there isn’t really any scale to discuss, considering the ultra-soft demand for its cars.

Lucid Air Remains A Niche Vehicle

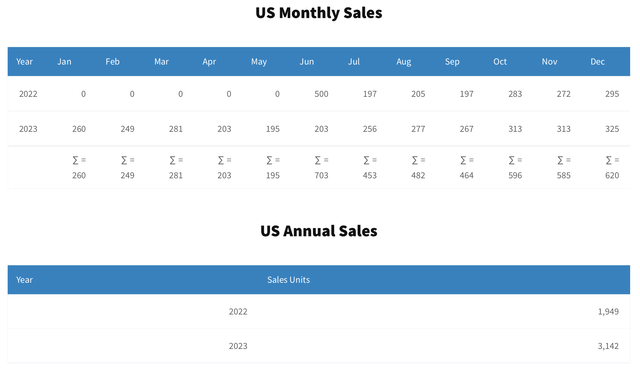

U.S. sales (godcarbadcar.net )

Lucid Air competes with the Tesla Model S and other 100% luxury EV sedans. However, it is challenging to compete with Tesla when you can have such a tremendous performance upgrade for $20K (to a Model S Plaid). It would take an extra $160K to get an upgrade to Lucid’s Sapphire addition, which produces similar performance as the Plaid.

Tesla sells tens of thousands of vehicles in the U.S. monthly. Of course, Lucid will find it very challenging to compete with them. Tesla also has an extensive supercharging, services and repair, and networking program. Lucid has a mobile services program where a van drives out to fix minor issues. However, I wonder how efficient and cost-effective this strategy is for Lucid.

Don’t let Lucid’s annual sales increase deceive you. Lucid Air deliveries began in June 2022. If we count the last seven months’ sales in 2022 and 2023, Lucid’s unit sales are down by 16.8% YoY, 1,949 vs. 1,641 vehicles.

The Gravity Won’t Save Lucid

I wrote before why the Gravity likely won’t save Lucid. It’s a pretty SUV, but it’s in the same spot the Air vehicle is. Tesla’s Model X, Model Y, and other premium full-size SUVs and crossovers have swamped the market with high-quality EVs. Again, Lucid faces the issue of enough demand leading to increased production efficiency, economies of scale, etc.

Lucid has not demonstrated that it can build a vehicle profitable, with the Air. In fact, Lucid appears to be losing a staggering $425K per vehicle on an operational basis. What makes analysts believe that Lucid will do better with the Gravity SUV? On the contrary, Lucid could run into production bottlenecks, increased costs with the ramp-up process, and other factors that could exacerbate its losses, further weakening Lucid’s already fragile financial position.

The Bottom Line: Why Waste Time And Money On LCID?

I’m staying away from Lucid. There are much better EV companies out there. My favorite remains Tesla (for many reasons). NIO has potential, but it faces some issues (similar to Lucid), and I am losing patience with its stock. Still, the losses at NIO are nowhere as bad as at Lucid. Plus, NIO continues expanding, selling more vehicles, and improving production. Sadly, I cannot say the same for Lucid. The stock is a very high-risk investment here, and it remains a clear sell for me!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!