Summary:

- Lucid is struggling to scale even after numerous cuts to guidance through 2022, with Q1 deliveries dipping nearly 34% q/q.

- A high valuation at $14.3 billion is not worth the risk of failing to scale substantially, with Lucid valued more richly than EV leader Tesla for 0.3% of the volume.

- Lucid is operating at ~25% of its originally projected scale from its SPAC forecasts for 60% of the $24B valuation.

- Assuming a relatively rich 4.5x forward EV/revenue multiple for Lucid, compared to Tesla’s 5.5x and Polestar’s 2.3x, returns a fair value of $3.25.

Justin Sullivan/Getty Images News

Lucid Motors (NASDAQ:LCID) recently revealed Q1 production and delivery figures, showing that the OEM still is struggling to scale even after numerous cuts to guidance through 2022. Lucid’s rich valuation at $14.3 billion is not worth the risk of failing to scale substantially, as the OEM is struggling to get on its feet and falling further behind rivals.

Q1 Production & Delivery Recap

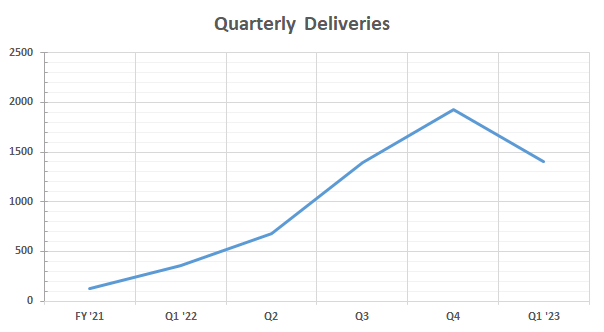

During Q1, Lucid produced just 2,314 vehicles, down -33.8% q/q, and delivered just 1,406 vehicles, down -27.2% q/q; this rather sharp decline q/q could reflect either weakening demand or typical EV seasonality. Reservations do reflect cancellations — Lucid said it had more than 34,000 reservations in late November 2022, which was then updated to more than 28,000 by late February 2023 — over that time span, Lucid likely delivered no more than 1,500 vehicles, suggesting about 3 cancellations per reservation fulfilled.

Author calculations (data from Lucid)

Lucid has guided for production levels between 12,000 to 14,000 vehicles for 2023, with Q1’s results putting the manufacturer squarely on track to reach that target with ~25% q/q growth moving through the rest of the year.

As seen in the chart above, deliveries had been scaling quite slowly — from 679 vehicles in Q2 ’22 to just 1,406 vehicles in Q1 ’23 as deliveries dipped q/q. On a y/y basis, deliveries have more than tripled, but again, the scale of deliveries is so small that it hardly makes a difference — Lucid’s 2023 guidance of 13,000 vehicles at midpoint is barely one-quarter of its original SPAC projection of 49,000 vehicles.

So while that y/y tripling may look impressive, failing to deliver 2,000 units quarterly is abysmal when compared to that SPAC projection which placed volumes in excess of 10,000 units/quarter on average this year.

To put it in perspective, Lucid failed to even sell off its excess inventory from Q4 — Lucid had produced 1,561 vehicles more than it delivered during Q4, then delivered only 1,406 vehicles in Q1. The balance sheet reflects a pretty substantial q/q growth in inventory from Q3 to Q4, from $685 million to $834 million, which is expected to rise further in Q1 as deliveries fell.

Struggling To Ramp

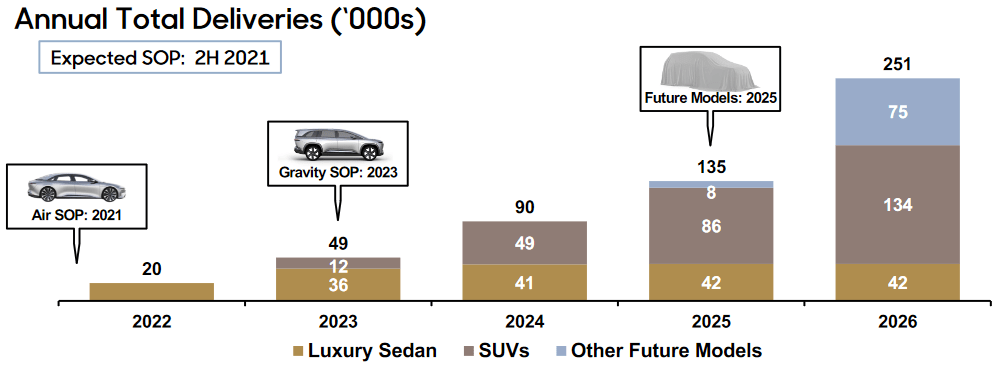

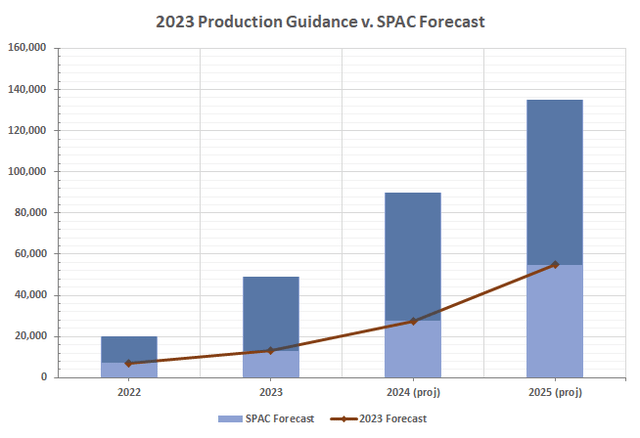

There’s no question Lucid is struggling to ramp — the manufacturer is miles off of its SPAC projections, and falling further behind peers. The charts below show how far Lucid is from its original SPAC projections that helped it to secure a $24B valuation at its $15 PIPE price. Investors had a seemingly large appetite for shares late in 2021, sending shares more than 130% higher in just one month in November to over $55 per share. However, buying the story that Lucid would be able to quickly scale production and revenue shortly after product launches (i.e. projecting Project Gravity growth of 4x in 2024 relative to ’23), has led to major losses since production kicked off in late 2021.

Lucid

Lucid originally forecast 49,000 deliveries in 2023, suggesting production volumes between 55,000 to 60,000 vehicles for the year, given the company’s fulfillment ratio. Project Gravity, yet to be launched, was expected to contribute 12,000 deliveries — the current expectation for production.

As seen below, Lucid is far behind its initial targets — should the manufacturer even be able to reach 12,000 deliveries (the low-end of production guidance), it would be operating at ~25% its originally projected scale for 60% of the valuation — essentially, Lucid is much more expensive now at $7.50, valued at more than $1.1 million per vehicle at the midpoint of its current guidance compared to less than $490K per vehicle at the $15 PIPE/$24B valuation.

Author calculations (data from Lucid)

Looking further out towards 2025, Lucid again is likely to be far off from its targets unless it can quickly scale deliveries (more than quadruple) in 2024. Currently, Lucid looks likely to produce around 29,000 vehicles in 2024 and 55,000 in 2025, a far stretch from the 90,000 and 135,000 tallies from the SPAC projection.

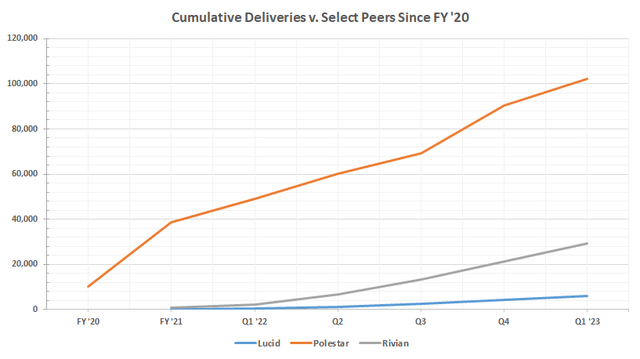

Comparison Versus Select Peers

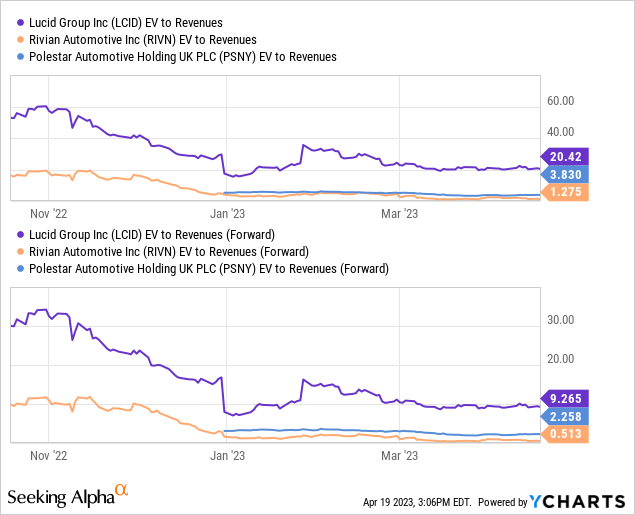

A quick comparison versus a select group of peers — Rivian (RIVN) and Polestar (PSNY) — shows that Lucid again is far behind. Rivian and Polestar are both valued significantly lower than Lucid, but operate at larger scales; Polestar has delivered in excess of 100,000 vehicles cumulatively since FY20, yet its forward EV/revenue multiple of ~2.3x is a mere fraction of Lucid’s ~9.3x multiple. Rivian, which commenced production and deliveries in FY21, just like Lucid, has shown a much better ability to scale — its cumulative deliveries are nearing 30,000 vehicles, with production volumes topping 10,000 per quarter in Q4 ’22.

Author calculations (data from Lucid, Polestar, and Rivian)

Put in perspective, Lucid is scaling at a crawl — it has delivered less than 6,000 vehicles cumulatively, one-fifth of rival Rivian and not even 6% of Polestar’s volumes. Yet it commands a much larger valuation, currently trading at 20.4x EV/revenues compared to Rivian’s 3.8x and Polestar’s 1.3x. That 20.4x multiple is also a significant premium to EV leader Tesla’s (TSLA) 6.9x multiple — for barely 0.3% of the quarterly volume.

Assigning Lucid a valuation in line with the two selected peers suggests shares could have significant downside potential — at 1.8x forward EV/revenues of $1.1 billion, Lucid would be worth approximately $2 billion, or about $1.50 per share. So there’s a substantial valuation mismatch here between the trio, with Lucid holding the most risks within its inability to rapidly scale production and deliveries, and an inability to fulfill orders. Compared to Polestar and Rivian (which look relatively undervalued compared to Lucid’s multiples), Lucid looks severely overvalued; even assuming a 4.5x forward EV/revenue multiple for Lucid suggests shares are worth just $3.25.

Lucid’s financial picture reflects the view that $3.25 may actually be a fair price for shares given that inability to scale — it’s operating deep in the red, with gross margins at -171.7%, operating margins at -426.6%, EBITDA loss widening 107.6% y/y to ($1.97B). Combined with of a projected $3.5 billion cash burn in FY23, an inability to make margin on vehicles, and an increased risk for a multi-billion dollar cash raise late this year, the financial picture does not support that ‘premium’ valuation

Outbound Logistics A Key Focus

As mentioned above, Lucid not only faces key competitive risks from its inability to scale, but also its inability to fulfill reservations, leading to higher rates of cancellations. Lucid’s outbound logistics looks to be the primary cause — the OEM has struggled to fulfill more than two-thirds of its production volume each quarter, while more established EV leaders like Tesla fulfill in excess of 93% of production on average.

In Q1, Lucid delivered just 60.7% of its production volume; in Q4, that figure was just 55.3%. For FY22, Lucid’s fulfillment rate was just 60.8% of production volume — while it’s easy to dismiss this as just being a byproduct of operating at a small scale, it’s an area that needs major improvement. Think of it this way: if Lucid operated at 10x the scale from Q4 — 23,000 vehicles produced — if it does not manage to improve its outbound logistics, it’s only delivering 14,300 vehicles.

That level of deliveries relative to production suggests Lucid is going to continue to struggle with margins. Lucid already is facing challenges to reach margin this year and through next, given FY22’s gross margin of -171.7% and production volumes forecast to barely exceed 3,000 per quarter on average. Lucid won’t be able to recuperate the cost of production with such a major gap in between produced and delivered quantities — revenues generated simply won’t be large enough.

Currently, Lucid isn’t projected to break-even until FY27, leaving more than a dozen quarters for the company to work on improving the bottom line; given the importance of scaling deliveries for revenue generation and realizing cost efficiencies, improving outbound logistics should be the first step.

Outlook

Lucid Motors is on a rocky path to start FY23, with deliveries dipping q/q to 1,406 vehicles, as outbound logistics have failed to improve from last year. Lucid still remains on track at the moment to reach its 12,000 to 14,000 vehicle production target, but failing to improve that fulfillment rate means it’s likely to deliver 8,500 to 9,000 vehicles at best this year.

Shares are trading at a significant premium to select peers and industry leaders for a fraction of the scale, while the financial picture offers no support to that premium valuation. Assuming Lucid can generate $1.1 billion in revenues in FY23, a valuation at 4.5x EV/revenue — richer than select rival Rivian and Polestar and a slight discount to Tesla’s 5.5x multiple — places a fair value of just $3.25 on shares. A multiple more in-line with Rivian and Polestar’s current valuations, for a more challenged financial picture and a fraction of the scale, projects a fair value of just $1.50.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.