Summary:

- Lucid’s shares have plummeted over 90% from their peak due to consistent failures in meeting long-term targets and high cash burn.

- Despite a recent delivery record, falling average selling prices and large losses highlight ongoing financial struggles.

- Lucid’s valuation remains inflated compared to peers, with a price-to-sales ratio more than double the average of similar companies.

Justin Sullivan/Getty Images News

When it comes to the electric vehicle space, there have been a number of names that have not lived up to the hype. One of those names is Lucid (NASDAQ:LCID), which has seen its shares fall more than 90% from their all-time highs as the company has consistently failed to meet its long term targets. As Lucid gets set to launch its second vehicle in the coming months, it is now time for management to prove it is the real deal.

Previous coverage on the name:

It was back in August when I last covered the company, right after Lucid had reported its Q2 results. While the Q2 reported revenue figure beat dramatically reduced street estimates, large losses and cash burn continued. Management also announced its latest capital raise, again getting assistance from an affiliate of the Saudi Public Investment Fund (“PIF”), its largest supporter to date. This raise was a combination of a $750 million preferred equity deal and a $750 million delayed draw term loan facility.

At that time, I continued to rate Lucid shares as a sell, a rating that I’ve held on the name for more than two years back to when shares were trading in the high teens. I’ve been unimpressed by the company’s financials from the start, along with its premium valuation. Since my article a little more than two months ago, shares have rallied nearly 10%, but that figure has trailed the S&P 500 by a couple of percentage points. The rally has also been significantly less than a number of EV peers that have risen sharply on a combination of lower US interest rates as well as a dramatic rally in Chinese equities on the hopes of more stimulus in that country.

A look at Q3 initial results:

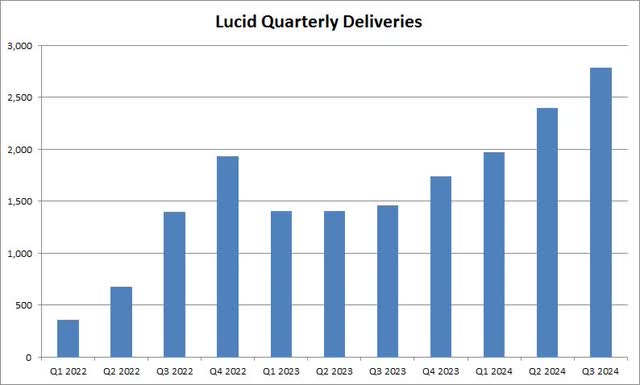

Last week, the company issued its third quarter production and deliveries report. Production did drop about 300 vehicles sequentially to 1,805, but as the chart below shows, deliveries set a new quarterly record for the company. Lucid was able to deliver 2,781 Air sedans in the period, with all three quarters so far in 2024 being quarterly records at their respective time.

Lucid Quarterly Deliveries (Lucid Investor Relations)

While the new delivery record is certainly nice to see, it does come with a bit of an asterisk. The company has been seeing average selling prices come down in record quarters, and there has been a lot of discounting of the Air sedan lately. While the delivery number showed more than 90% growth over the prior year period, as of Monday, the average street analyst estimate for the quarter calls for year over year revenue growth of just 37%.

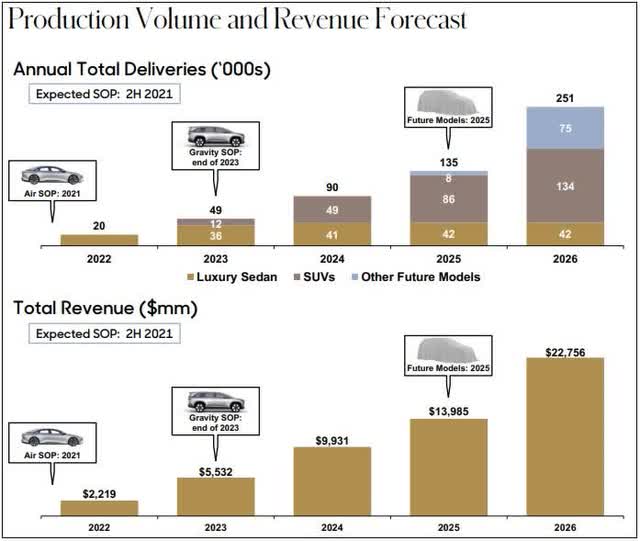

We’ll get full quarterly results from Lucid on November 7th. While that report could be important for shares in the short term, the bigger thing to watch for the rest of this year will be the production start of the company’s Gravity SUV. This vehicle has been delayed by a year already, part of the reason why Lucid has continually missed its longer-term growth forecasts. In the graphic below, you can see how Lucid was originally calling for deliveries of roughly 90,000 vehicles this year, with more than half of that coming from the Gravity. The Air sedan has also fallen well short of targets, with production expected to be around 9,000 units this year, and perhaps deliveries will be a little higher as inventory levels come down.

Lucid Production & Revenue Forecast (Company SPAC Presentation)

Growth expectations come crashing down:

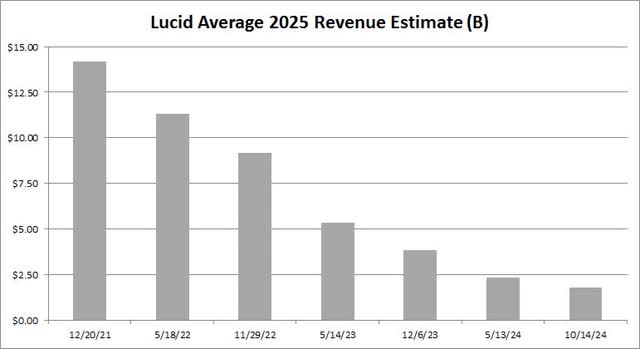

Even if Lucid has a decent production ramp with the Gravity, it will be nearly impossible for the company to meet its original delivery guidance for 2025. We have also already seen management push back the company’s third vehicle. As detailed in the Gravity production launch link above, the midsize platform is only scheduled to start production in late 2026. It’s possible that Lucid doesn’t even produce 20,000 vehicles next year, a level that was originally supposed to be hit in 2022 with only the Air Sedan being manufactured. As a result, we’ve seen street revenue estimates come crashing down, as seen in the chart below.

Lucid 2025 Revenue Estimate Average (Seeking Alpha)

The average 2025 revenue estimate has already dropped by more than 87% since the above December 2021 date shown. Still, the current estimate for next year implies that Lucid will grow revenues by more than 134% over the currently expected 2024 figure. We may have to wait until the Q4 report, which probably will come in February of next year, to get official production and or delivery guidance, but I’m sure analysts will try to press management on those items next month.

There are currently two risks for those betting against the name. The first one is that the Saudis just take this company private, buying out the rest of Lucid that they don’t already own, possible at a premium to current levels. The second risk is that there’s a meaningful improvement in the company’s financial results in 2025, sparking some enthusiasm for the midsize platform the year after. With a whopping 26.5% of the reported float short currently, any piece of good news could potentially lead to a decent short squeeze.

An inflated valuation compared to peers:

While Lucid is expected to show some decent revenue percentage growth in the coming years, it also remains a very expensive stock currently. As the chart below shows, only Tesla (TSLA) has a price to sales ratio, based on current respective 2025 analyst estimates, that is higher than Lucid. The other names in this space I’ve used as a comparison are VinFast (VFS), Rivian (RIVN), XPeng (XPEV), BYD (OTCPK:BYDDF), NIO (NIO), and Polestar (PSNY).

EV Companies Price to Expected 2025 Sales (Seeking Alpha)

If you average the 7 names other than Lucid, the result is about 1.98 times expected 2025 revenue. Lucid in early Monday trade was going for about 4.34 times, more than double the average for this comparison group. If we exclude Tesla, that average drops to just 1.31 times, and these numbers don’t include traditional US automakers like Ford (F) or General Motors (GM) that trade at around 0.30 times their expected revenues for next year.

Final thoughts and recommendation:

As we approach the start of production for Lucid’s Gravity SUV, it is time for management to finally get this company going. While Air sedan deliveries are finally starting to rise a bit, they are nowhere near company projections from a few years back. The company is also still losing tons of money and burning through cash, which has required multiple capital raises over the years. Lucid had nearly $4 billion in cash before the Q3 raise, against $2 billion in debt, but the production ramp of the Gravity could require another capital infusion sometime in 2025 if cash burn trends don’t improve significantly.

I am continuing to rate Lucid shares as a sell today, a rating that has done quite well since I initiated it at over $18 a share. The company has badly missed its long-term growth targets, and it still trades at a premium valuation in the space. Should the Gravity production ramp struggle, or Air sedan growth flatten out, it’s possible that Lucid shares could set new lows. Until we start to see some meaningful financial improvement, I just cannot recommend holding these shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.