Summary:

- Lucid posted a hugely underwhelming Q1 deliveries and production report, suggesting that its outlook for 2023 is at significant risk of a miss.

- The company could face more significant headwinds in H2 as consumer spending is expected to slow. Moreover, the recent price cuts could put more pressure on its deliveries.

- Investors betting on a recovery at the current levels have no margin of safety. So a lot is at stake for Lucid to justify its valuation.

Justin Sullivan/Getty Images News

Lucid (NASDAQ:LCID) dropped a bombshell deliveries report for Q1FY23 as the Peter Rawlinson-led company posted deliveries of just 1,406 vehicles. In addition, its production slate of 2,314 vehicles implies a deliveries/production ratio of a low 61%. It’s way below Tesla’s (TSLA) 96%, and even Rivian (RIVN) delivered a better ratio of 85%.

Despite producing fewer vehicles than Rivian and Tesla, Lucid couldn’t sell them out. Fellow upstart Polestar (PSNY) delivered 12K units for Q1, well below its annualized delivery run rate target of 80K. However, management blamed “unusual seasonality” that beset its performance. Notwithstanding, Polestar relies on Volvo’s (OTCPK:GELYF) production line and therefore has different manufacturing ramp challenges than Lucid.

Rivian’s Q1 deliveries were also well below its annualized run rate. While Tesla posted a much healthier deliveries/production ratio, it suggests that the auto industry could face significant headwinds as consumer spending is expected to slow further.

Compounded by Tesla’s ongoing price cuts (and not expected to be over yet), even General Motors (GM) turned cautious in a recent conference. Management updated investors that GM “may take longer to meet its goal of selling 400,000 EVs cumulatively in North America between 2022 and mid-2024.”

Therefore, we believe Lucid has been hammered by the multitudinous headwinds of competition, macroeconomic uncertainty, and poor forecasting.

Management forecasts are way off based on its SPAC estimates, which could put significant pressure on even meeting the downgraded Wall Street projections.

Accordingly, management telegraphed a revised midpoint production outlook of 12K in February. As such, Lucid must deliver an average of 3.23K vehicles per quarter from Q2 to meet its production outlook.

However, the critical question is whether Lucid could improve its sales momentum, as its recent deliveries/production ratio suggests hugely underwhelming performance.

With the Chinese EV market also facing a price war as automakers attempt to gain share against slower growth, we believe the increasing prospects of a recession in 2023 could see LCID continue to underperform.

Wall Street average estimates are in line with management’s 12K production outlook. However, based on Lucid’s ASPs of $96K based on its most recent quarter, we believe analysts’ revenue estimates of $1.345B are likely too optimistic, considering its deliveries of just 1,406 vehicles for Q1.

As such, the following three quarters could either see Lucid finding the sales momentum to meet its initial outlook or face the moment of reckoning of pushing out its profitable production ramp further.

Either way, further dilutive fundraising activities (leading to weaker buying sentiments) or a stock price plunge to reflect its poor performance is in store for buyers who are betting on a recovery.

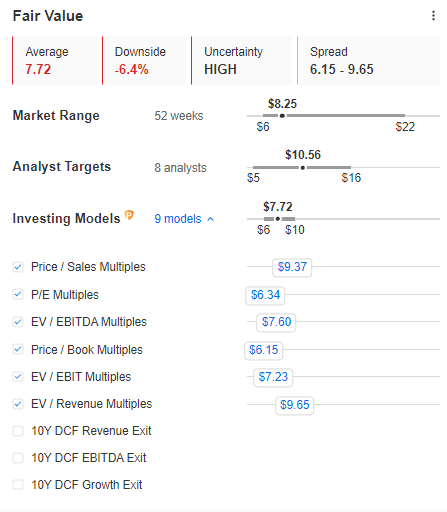

LCID blended fair value estimate (InvestingPro)

However, investors considering picking up the pieces from the sellers are left with no margin of safety at the current levels. While it’s arguably within the fair value zone, we urge investors to consider a highly significant margin of safety if they decide to add exposure.

We will consider at least a 35% implied upside to its fair value as the minimum to even think about a speculative position.

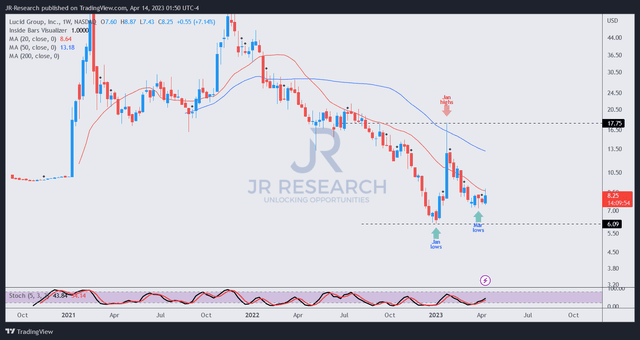

LCID price chart (weekly) (TradingView)

LCID’s momentum surge from its takeover rumor has been digested. It attempted to consolidate over the past five weeks, as buyers appeared committed to “preventing” it from sliding toward its January lows.

However, with the recent report, we believe further downside volatility should not be ruled out, as Lucid’s production outlook for 2023 looks in danger of falling apart, hampered by Tesla’s price cuts and worse macroeconomic worries.

Rating: Hold (Reiterated). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. Our cautious/speculative ratings carry a higher risk profile. They are only intended for sophisticated investors/traders. We urge new or inexperienced investors to avoid relying on such ratings. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified. Moreover, investors must exercise prudence and devise appropriate risk management strategies, such as pre-defined stop-loss/profit-taking targets, within a suitable risk exposure.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!