Summary:

- Lucid Group announced the launch of a lower-priced version of the Lucid Air last week, indicating potential demand problems for its other EV models.

- The launch of a lower-priced version may result in margin pressure going forward.

- LCID’s valuation remains high despite recent challenges and investors have no reason to buy into LCID ahead of Q3 earnings.

KanawatTH

After Lucid Group (NASDAQ:LCID) disappointed multiple times with its delivery achievements in FY 2023 and dropped its EV prices by a considerable percentage, the electric vehicle company on October 5, 2023, announced that it was producing a lower-cost version of the Lucid Air, Lucid’s first-ever production car and flagship electric vehicle model. The announcement of a low-price Lucid Air version this early in the production cycle comes with a number of problems that, in my opinion, could signify future margin problems and it also raises questions about Lucid Air’s revenue potential.

I believe the launch of a low-price Lucid Air Pure version, which is said to sell for $77,400, is indicative of demand problems and may result in escalating margin pressure at a time when the EV manufacturer hasn’t even managed to drive the start-up into the profitability zone. Therefore, Lucid retains an unfavorable risk profile after the news and investors may best stay on the sidelines until the company has delivered its third-quarter earnings report!

Previous rating

I placed a hold rating on Lucid after the EV company submitted its second-quarter earnings sheet in August – Lucid Group’s Q2 Earnings: A Mixed Bag.

Issues that I saw with Lucid were underwhelming delivery growth and pricing pressure, due to Tesla (TSLA) kicking off a price war in the EV industry. Lucid delivered only 1,404 electric vehicles to customers in the second quarter which resulted in Lucid down-grading its full-year guidance to just about 10 thousand EVs. On October 5, 2023, Lucid added yet another concern to the mix by announcing the launch of a lower-cost version of the Lucid Air Pure.

Price cuts, weak demand and new strategic actions to deliver a more price-competitive EV in the luxury market

Lucid is firmly focused on servicing a niche segment in the electric vehicle market: premium luxury passenger sedans. While I liked the strategy from the beginning, there is mounting evidence that the EV firm suffers from demand weakness following recent problems with the supply chain.

Lucid greatly underperformed production and delivery expectations in FY 2022 due to supply chain entanglements and logistics problems. While some of those issues have been resolved, the launch of a lower-cost Lucid Air Pure, less than two years after product launch, and at a time when the firm only expects to sell about 10 thousand EVs in FY 2023 is concerning.

In an announcement last week, Lucid said that the new Lucid Air Pure Rear-Wheel Drive will retail for $77,400 while the regular AWD Lucid Air version has a price of $82,400. The Lucid Air Pure with Rear-Wheel Drive is estimated to have a range of 410 miles and is available for order.

However, I believe the launch of a lower-cost version is problematic in a number of ways. Launching a discounted price Lucid Air version so early in the production cycle — the model was introduced in FY 2021 — may indicate that the demand situation for the Lucid Air Pure is weaker than expected. Some analysts already suspected that weak demand for its luxury EVs was the reason behind Lucid no longer reporting reservation numbers… a practice that the EV company stopped earlier this year. Investors also need to remember that Lucid broadly lowered prices for its EV products recently. The prices for high-performance Touring and Grand Touring models, for example, dropped by more than $12,000 while the price for the Lucid Air Pure fell $5,000.

Lucid may not grow its top line as fast as expected

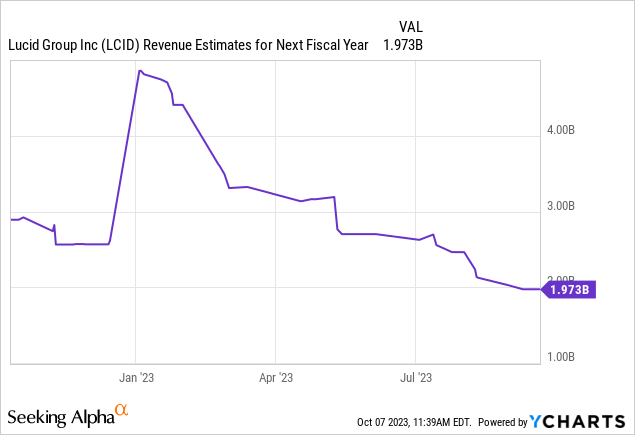

What all this means is that Lucid is likely desperate to grow its volume at the expense of strong pricing which may have two consequences going forward: (1) It could pressure margins at a time when the company is still making losses (Lucid’s net losses ballooned from $220.4M in Q2’22 to $764.2M), and (2) revenue growth may continue to moderate, especially if Lucid loses higher-value sales to lower-value sales. Revenue estimates have already declined significantly and reflect analysts and investors losing confidence in Lucid…

On a positive note…

Lucid also announced lately that it kicked off production in Saudi Arabia in its new Advanced Manufacturing Plant, dubbed AMP-2, and the firm affirmed its longer term production target of more than 150 thousand units annually. Saudi Arabia is already involved with Lucid in a number of ways, including providing long term financing through the Public Investment Fund whose affiliates own approximately 60% of the EV maker. Saudi Arabia also made a commitment to purchase 100,000 electric vehicles from the EV manufacturer by the end of the decade. Lucid is set to use its AMP-2 plant to service the Middle Eastern market.

Lucid’s valuation

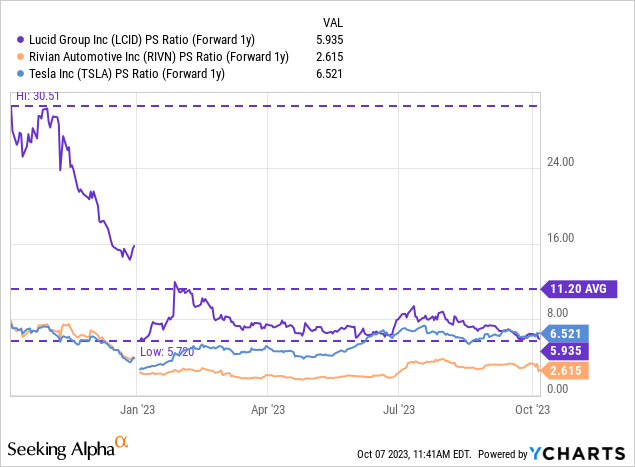

Lucid has seen a sharp downside revaluation of its shares in the last year and they are barely holding on to the $5 price level now. Still, shares of the EV company are not a bargain and are currently valued at 5.9X FY 2024 revenues. While Lucid is said to have the strongest year over year top line growth rate in FY 2024 in the industry group — consisting of Rivian Automotive (RIVN) and Tesla — the EV maker demands a premium valuation that I don’t believe is justified after Lucid’s most recent news. Currently, I see significant rebound potential with Rivian due to massive progress in terms of production growth and investors overreacting to the $1.5B convertible senior notes offering: Rivian: Buy The Panic (Rating Upgrade).

Risks with Lucid

I have already highlighted the risks that I see with Lucid: They include deteriorating pricing power (resulting in secondary margin risks), potential issues with demand that forced the launch of a lower-price version of the Lucid Air Pure, an overall weak production outlook for FY 2023, dilution risk related to new equity raises and expanding net losses as the EV firm ramps its production. On the positive side, Lucid has Saudi Arabia in its corner and a solid balance sheet.

Final thoughts

I believe the launch of a lower-cost version of the Lucid Air Pure this early in the production cycle is a warning sign that demand may not be as strong as many investors and analysts might have previously assumed. In connection with recent price decreases for all models, I believe Lucid is setting itself up for declining margins going forward. Additionally, Lucid is still not profitable and there are growing signs of demand problems which may result in weaker-than-expected top-line growth going forward. With everything that is going on with Lucid, I believe investors have no reason to buy the EV maker’s shares ahead of the Q3 earnings report.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.