Summary:

- Lucid Q1 2023 deliveries barely above Q3 2022 level.

- Job cuts not enough to stem massive losses.

- Another capital raise likely needed.

bymuratdeniz/E+ via Getty Images

One of the most disappointing electric vehicle startups in recent years has been Lucid (NASDAQ:LCID). The luxury car maker has fallen well short of expectations time and time again, leading to significant losses and cash burn. After the bell on Thursday, the company announced its Q1 unit volumes, which continue to show that sales remain a challenge.

For the March ending period, the company produced 2,314 vehicles during Q1 at its manufacturing facility in Arizona and delivered 1,406 vehicles during the same period. While there can be seasonality in the auto business from the fourth quarter to the first, these numbers were barely above what we saw in Q3 last year, and the delivery number was a few hundred units short of street expectations. Lucid has been selling cheaper versions of its Air sedan lately, and it did offer a discount recently equal to the US tax credit that the Air doesn’t qualify for.

A few weeks ago, the company announced a major restructuring effort, one that’s a bit late and doesn’t address the most important issue here. Lucid will be letting go of about 1,300 employees, or roughly 18% of its workforce. This process should mostly be completed by the end of Q2, with the company taking up to $30 million in charges. I don’t know why it took so long for management to announce this, as the Q4 results again showed the expense base was nowhere near where it needed to be.

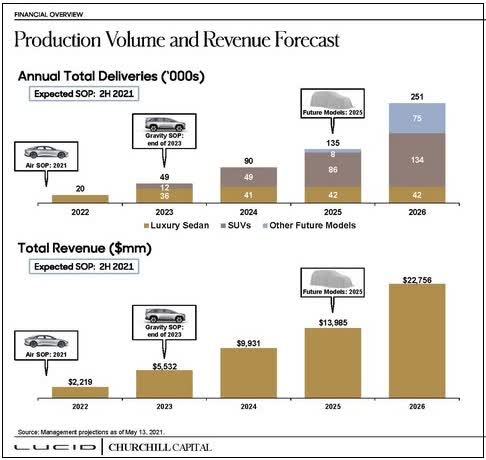

As a reminder, Lucid went public through a SPAC with hopes of tremendous growth. The initial goal for 2022 was to deliver 20,000 units of its Air sedan, but that was changed to production of just 7,000 in the end. In total last year, Lucid didn’t even reach 4,400 deliveries. Management is targeting production of 10,000 to 14,000 units for 2023, which would be less than a third of what the company’s SPAC presentation below originally detailed. It’s rather obvious that Lucid this year won’t be doing anywhere near the $5.5 billion in revenue that management was projecting. In fact, current street estimates don’t even see the company doing $1.35 billion.

LCID SPAC Figures (Company Presentation)

Back in late January, I detailed how problems for Lucid were only increasing thanks to the round of major price cuts we saw from EV giant Tesla (TSLA). The Tesla Model S, a competitor to the Lucid Air, has seen its prices come down twice more since then, including another reduction last week, along with the Model X that will square off with the Lucid Gravity when it finally gets to market. The luxury part of the EV space is quite crowded when you include the likes of Audi, Mercedes, Porsche, and even Polestar (PSNY) which will have another new offering for consumers later this year.

Last year, Lucid reported that its cost of goods sold was over $1.6 billion. That figure is more than the street is looking for this year’s revenues, and it doesn’t even include another billion and a half of operating expenses. There’s only so much fat to trim here if you are trying to grow your business at the rates that management and investors are hoping for. While the job cuts will eventually help, the effort right now looks like someone hastily trying to empty a flooded basement with a coffee cup. The low volumes for Q1 aren’t going to get the company towards profitability anytime soon.

Lucid finished Q4 with over $4 billion in cash, but it burned about $3.3 billion last year and had to dilute investors a bit in Q4 with a $1.5 billion equity raise. It seems likely that more capital will be needed either this year or next, especially to bring another vehicle to market in 2024. If this was a normal company, I would say that bankruptcy could be an option, but Lucid has major backing from the Saudi Investment Fund. There remains the possibility that the Saudis eventually buy the rest of Lucid that they don’t already own, but that’s doesn’t necessarily have to be at a premium for current investors.

Going into Thursday’s news, the average price target on the street was $10.56, implying about 28% upside from the latest close. However, that figure has come down more than $3 since the Q4 report alone, and much more if you go back a few quarters. Lucid goes for just below 4.5 times currently expected 2024 revenues, which is about 0.2 times more than Tesla trades at for next year’s expected sales. It doesn’t make sense to me to pay that much for Lucid that just keeps disappointing and has terrible results, while Tesla has decent profitability and cash flow. Lucid’s price to sales valuation looks better if you go a few more years out, but that assumes that revenues surge as expected and there’s little confidence of that right now.

In the end, Lucid’s Q1 production and delivery report was not very impressive, leading shares to drop 6% in the after-hours session. While some seasonality was to be expected, the company only sold 8 more vehicles than Q3 2022, despite discounts and an effort to sell lower priced variants. With large losses and cash burn likely to continue until unit volumes improve significantly, it would not surprise me to see new lows at some point this year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.