Summary:

- I was very bearish about Lucid in 2023, and it did age well as the stock lost around 70% of its price over the last twelve months.

- Lucid’s EV sales growth lags behind competitors, indicating it is losing ground in the luxury segment.

- My valuation analysis suggests the stock still has vast room to tank.

ROBYN BECK/AFP via Getty Images

Investment thesis

I have been extremely bearish about Lucid (NASDAQ:LCID) in 2023, and this pessimism has aged well. The stock has tanked by 44% since I last covered it in August 2023, and today, I want to share my view about the developments that have unfolded over the last half a year and update my valuation estimate. Of course, Lucid has a wealthy investor backing the business and a fortress balance sheet. But at the same time, the company has a very weak track record with consistently failing to meet consensus expectations, and the company’s EV sales growth significantly lags behind competitors, even despite small scale and easy to amplify comps. Furthermore, my valuation analysis suggests the stock is around three times overvalued under fairly optimistic assumptions. All in all, I reiterate my “Strong Sell” rating for Lucid.

Financial analysis update

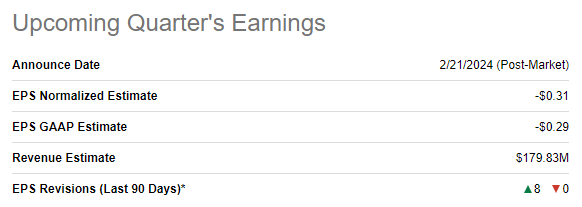

The company reports its December 2023 quarter earnings on February 21. I see notable optimism from consensus estimates since there were 8 EPS upward revisions over the last 90 days. Despite revenue projected to jump sequentially by 30%, the adjusted EPS is expected to shrink from -$0.25 to -$0.31 on a QoQ basis. From the YoY perspective, the picture is even worse since LCID’s top line is projected to dip by around 31%.

Seeking Alpha

For a young company that still has not achieved profitability, it is quite difficult to forecast probabilities of beating consensus estimates, but when I look at Lucid’s earnings history, it gives me a high level of conviction that the company will miss expectations. Since the company first started publicly releasing its quarterly earnings in FQ3 2021, Lucid has never topped consensus estimates in terms of both revenue and EPS. That said, I am quite pessimistic about the upcoming earnings release.

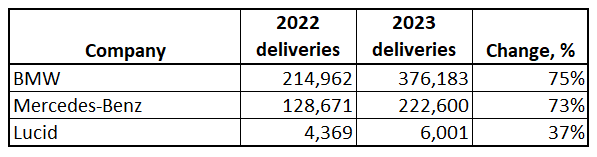

My pessimism is also fueled by the 2023 production and delivery numbers. Since Lucid positions itself as a luxury EV, I think that considering Mercedes-Benz (OTCPK:MBGAF) and BMW (OTCPK:BMWYY) as competitors would be fair. Let’s see how Lucid’s EV deliveries’ 2022 vs 2023 dynamics looked compared to the two famous German OEMs. As observed below, the rise in deliveries for BMW and Mercedes closely paralleled each other. However, Lucid trailed significantly, with sales growth lagging by more than double. It’s important to note that, purely from a mathematical standpoint, smaller-scale OEMs should exhibit more substantial growth as comparisons are easier to amplify. I think that the above table is a huge red flag indicating that Lucid is losing the luxury segment.

Compiled by the author from OEM’s official press releases

I would also like to add that given a massive secular EV trend and the relatively loose EV luxury segment, I expect the competition to intensify. Apart from well-known German legacy automakers, there are Chinese EV startups like NIO (NIO) and Li Auto (LI), which already operate at a much larger scale than Lucid does. Chinese EV makers are still not expanding overseas aggressively, but once they start doing so, I believe they will have a chance to become notable players in the developed world.

It is also crucial to remember that the world’s largest legacy automaker, Toyota Motor (TM), luxury brand Lexus is also well-known and earned solid reputation in the U.S. That said, once Toyota starts ramping up more toward the EV transition, I believe that Lexus will also likely become a solid force in the luxury EV segment. There are also vibrant British high-end brands like Rolls-Royce (OTCPK:RYCEY) and Bentley, which also have full-electric ramp-up plans.

To be able to fight with such dangerous competitors possessing vibrant brands, Lucid’s execution shall be flawless. On the contrary, the company has a history of falling substantially behind its ambitious pre-IPO promises to investors, and a multibillion-dollar cash burn rate is still massive.

Valuation update

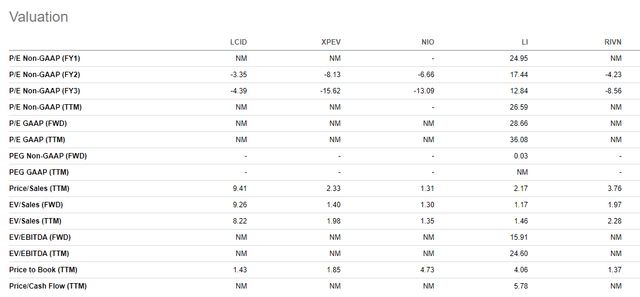

LCID lost 70% of its value over the last 12 months, significantly lagging behind the broader U.S. stock market. Since Lucid is still deeply unprofitable, there are not many valuation ratios available, but comparing the price-to-sales [P/S] ratio to peers looks like a fair exercise. Lucid’s 9.3 forward P/S ratio is an apparent outlier, while Rivian (RIVN) and the three most famous Chinese EV startups have a P/S ranging from 1.3 to 2.3. That said, Lucid is still very expensive from the P/S/ perspective, even after a massive stock plunge over the last 12 months.

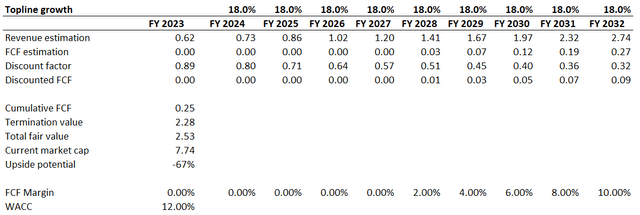

Now, let me move on to the discounted cash flow [DCF] simulation. Since there are three rate cuts planned in 2024, I decrease WACC from 12% to 11.25%, assuming it will be a 25-basis point step each time. For revenue growth, I usually rely on consensus estimates, but they look too optimistic to me when we speak about Lucid because Wall Street analysts project a staggering 51% CAGR for the decade. This looks absolutely unrealistic to me, considering the fact that the global luxury EV segment is expected to compound almost three times slower at an 18% CAGR. With the competition in the luxury EV segment intensifying and Lucid’s history of disappointing investors, I believe the projected luxury segment’s 18% revenue CAGR will be much more reliable. Determining the free cash flow margin is exceptionally tricky for LCID because Wall Street analysts expect the EPS to hit positive only in FY 2028. The level of uncertainty is extreme, but I believe that aligning the FCF margin breakeven with the EPS projection looks like a conservative choice. I expect the FCF margin to achieve 2% in FY 2028 and expand by two percentage points yearly. I ignore the current solid net cash position because the company’s cash burn rate is high, and these reserves will highly likely be utilized far earlier than the company starts generating positive FCF.

According to my DCF simulation, the business’s fair capitalization is $2.53 billion. This is more than three times lower than the current market cap, meaning there is still a massive downside potential. To conclude the valuation process, I encourage readers to honestly consider whether, given more than sufficient resources, they would invest $7.7 billion in full ownership of Lucid.

Risks to my bearish thesis

The stock is highly volatile and can demonstrate short periods of sharp stock price spikes, which LCID bears should be aware of. That said, short-term movements in the direction opposite to my thesis are probable. At the same time, given the weak fundamentals, these spikes are unlikely to be sustainable. For example, the stock is currently around 25% more expensive than it was just ten days ago.

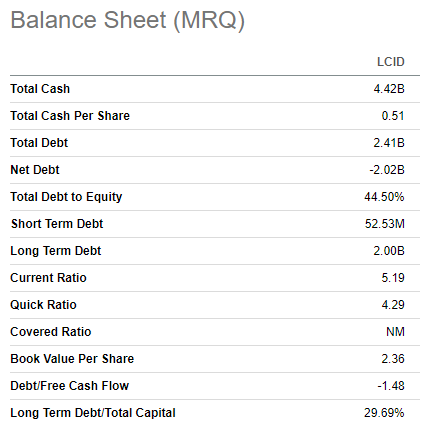

As it is widely known, Lucid is backed by one of the largest sovereign funds in the world, the Saudi Arabian Public Investment Fund. The fund has around $777 billion in assets under management, and it looks like such a large fund will be able to continue betting big and financing Lucid for a long time. Lucid’s success might even be the top priority for the PIF given an ambitious Saudi Vision 2030 strategic plan to become “the heart of the Arab and Islamic worlds”, which will be impossible without innovation. Since the global transition to EVs is one of the largest technological trends in the 21st century, I believe that it is highly likely that being at the forefront of the EV trend is one of the priorities of the Saudi side. That said, I will be unsurprising if Saudi Arabia starts supporting Lucid more aggressively so the company can offer attractive terms to the industry’s brightest engineers, designers, and marketing leaders. With massive financial resources behind its back, there is always a possibility that any company might make an impressive turnaround.

Seeking Alpha

Bottom line

To conclude, I urge my readers not to try to catch this falling knife because several fundamental factors point out that LCID deserves a “Strong Sell” rating to be reiterated. Despite having a robust balance sheet supported by the Saudi PIF, there appears to be a disconnect between Lucid’s resources and their effective utilization by management to maximize shareholder value. The stark contrast in delivery growth, lagging behind Mercedes and BMW by more than double in 2023, signals a significant concern. This performance gap raises doubts about Lucid’s ability to withstand the intense competition in the market, which will likely only continue to intensify.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.