Summary:

- Lucid and Rivian were my previously chosen winners for their innovative and competitive products in the electric vehicle market.

- The luxury branding of Lucid may hinder its success as consumers in that market often prioritize brand image over superior technology.

- Lucid’s reliance on support from the Saudi Arabian government raises questions about the actual demand for its vehicles.

jetcityimage/iStock Editorial via Getty Images

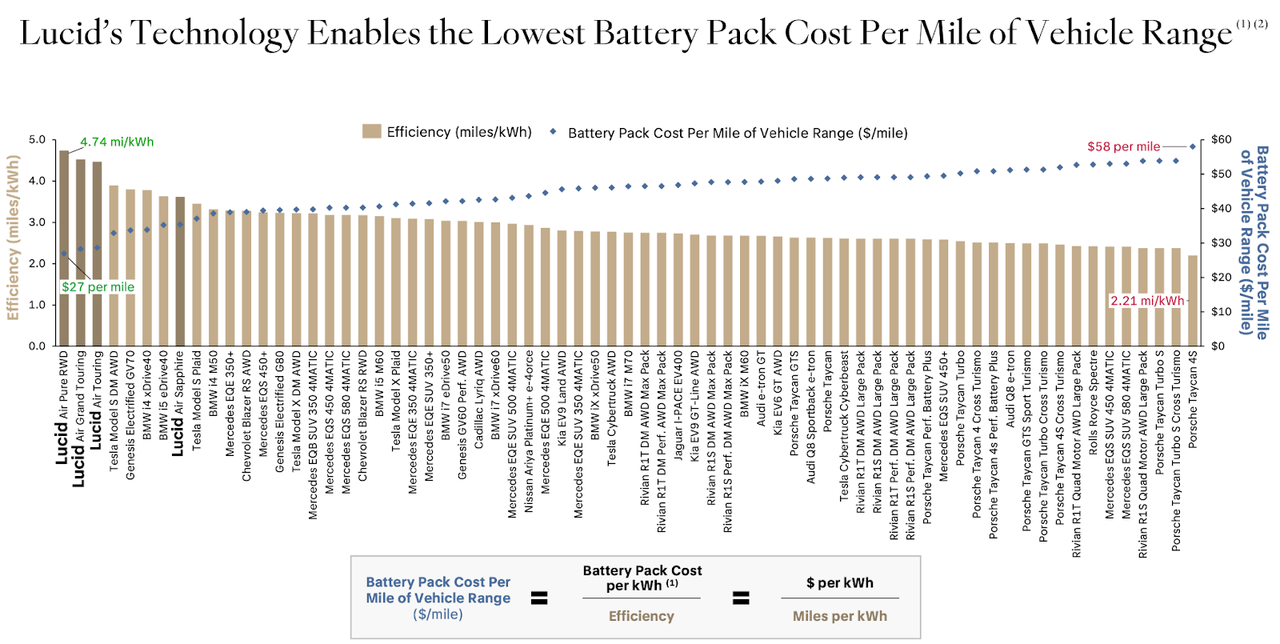

The biggest metric I use every time I evaluate a company is to evaluate its product. Whether the product provides a solution, or is made thoughtfully and offers an alternative solution that’s competitive with the current “meta”, I value these companies very highly. That’s why out of dozens of EV start-ups, I chose Lucid (NASDAQ:LCID) and Rivian (RIVN) as my winners. They provide vehicles that either fit a new niche or have superior technologies that outperform the competition. The Lucid Air has the most efficient conversion of energy out of all EVs, allowing it to reach 516 miles of range on the Touring model.

lucid technology superiority in EV (Lucid)

The rest of the product is no slack either, it has a fast acceleration and comfortable ride, earning itself a 10/10 on Car and Driver. The product is great, and often performs better compared to similar vehicles from companies like Tesla, Porsche, and Mercedes. So, why am I downgrading the company?

The Gravity Won’t Save Lucid

As I said in my last article, the Gravity will be a great vehicle that competes neck and neck with model X and other luxury SUVs. However, that’s the problem, luxury. When it comes to luxury, our criteria has to change. Naturally, the potential customers are a much smaller size, and they often are more picky about brand images. Even though Lucid might be the better choice than Mercedes on paper, a lot of consumers will still buy Mercedes just for its superior brand. The future of Gravity might look very similar to the current Lucid Air- a very wonderfully made vehicle that’s struggling to find demand.

As for Lucid’s specialty in powertrain and power efficiency, hybrid vehicles will provide the solution at a much cheaper price range that will make much more sense for the middle-class consumers. As we can see, Lucid is in a very awkward spot where it does not provide the exclusivity for the upper-class, nor the best solution for the middle-class consumers. Currently, the audience that I think the car appeals the most to is the middle-class shoppers who are also EV enthusiasts. So yes, Lucid has the best technology- for EVs. If we keep aside the fact that the vehicle runs on electricity, there are not many more appeals that will provide a solution to its customers.

Support from the Public Investment Fund

The market for Lucid in America is small, but there is still a chance of impact abroad. In the first quarter, Lucid generated $172.7 million, which is only an increase from $149.4 million a year ago. This was much better than the $154 million predicted by Wall Street. However, out of this, about $51 million came from the Saudi Arabia government. While this proves the extent of support PIF pours into the company, it brings in further questions regarding the demand of the vehicle.

“Excluding Saudi sales, first quarter revenues were down 19% year over year (YOY)” -Future Fund Active ETF co-founder Gary Black

This reminds me of BYD, a Chinese EV company that was able to gain customers and sales because of the strong Chinese-government support. However, the extent the Saudi Arabia government can do remains to be seen as a result of its relatively small population. For reference, there are around 313,000 millionaires in Saudi Arabia who, in my opinion, can comfortably afford a Lucid. This is nothing compared to the 3 million annual sales last year by BYD.

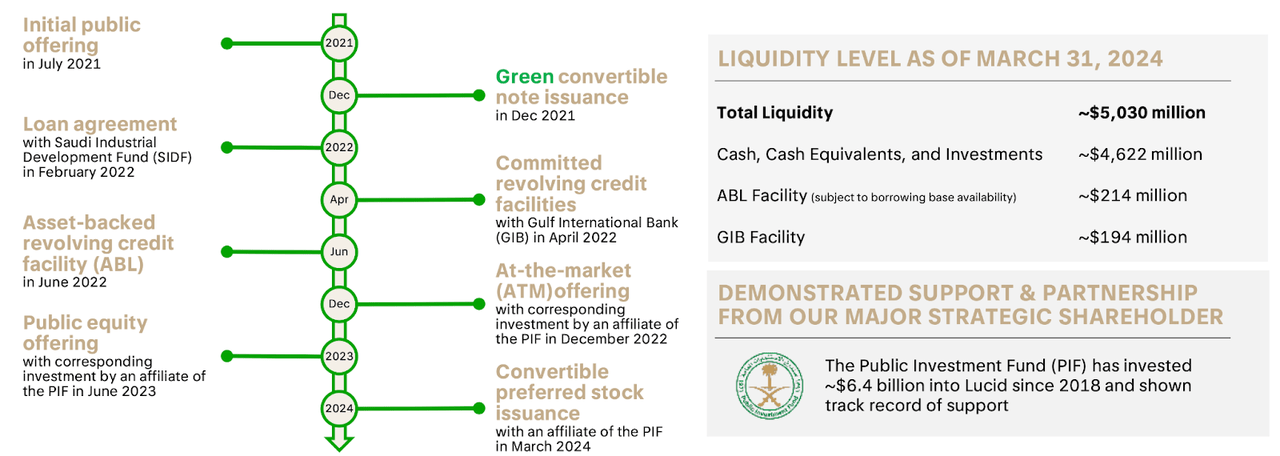

The situation is a bit tense, but for the time being, the PIF will continue supporting Lucid, as evidenced by its recent $1 billion investment in March 2024, making it total to around $6.4 billion in capital invested since 2018.

As of March 31, 2024, Lucid has approximately $5.03 in liquid assets. This, in Lucid’s words, is enough to last until the second quarter of 2025, or after the start of production of the Gravity.

The Saving Grace

The most positive part of Lucid, ironically, is that it is owned 60% by the PIF already. This leaves me strong hopes of a total buy-out as opposed to the Saudi pulling back on their investment. Saudi Arabia has shown deep investment into its Green Finance Framework, and Lucid is likely a big part of its plan for the future, as evidenced by the heavy investments. If Lucid fails to find traction abroad and goes bankrupt, the PIF may just buy the whole company, now has only a $6.1 billion market cap and even less than what PIF has already invested. The company’s superior technology patent will still play a strong role in the country’s future development, and capital will be more focused on just serving the country itself.

Bottom line is, Lucid faces a really competitive market where its branding fails to make it very desirable in the luxury market. In addition, its long range and power-train speciality is not a moat as hybrid cars can achieve the same result at a lower cost. Even though Lucid is only planning on only producing 9,000 vehicles as cost-saving measure this year, I am still doubtful Lucid will find the demand it needs in this market situation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.