Summary:

- Lumen Technologies nears $1 stock price level, facing investor doubt in potential turnaround.

- Debt restructuring and declining sales suppress equity value, making recovery gains unlikely.

- With unsustainable debt-to-equity ratio and falling sales, Lumen Technologies is not investible, facing delisting risk and lack of upside potential.

Aleksandr_Vorobev/iStock via Getty Images

Lumen Technologies Inc. (NYSE:LUMN) has neared (and shortly fallen below) the dreaded $1 stock price level as investors appear to lose hope that the over-leveraged Telco could pull off a major turnaround.

Lumen Technologies restructured its debt and postponed debt maturities in a deal with creditors in November 2024 in an attempt to buy the company time and focus on its restructuring. With that said, Lumen Technologies is confronted with so much debt that it is suppressing the remaining equity value.

With the business also stuck in restructuring and sales continuing to decline, I think that investors don’t have much to look forward to in terms of recovery gains.

Though I threw in my towel the last time I covered the Telco, it is hard to see a compelling upside case for Lumen Technologies. Sell.

My Rating History

My last stock classification on Lumen Technologies was Sell as I cut my losses after a major debt restructuring was agreed between the Telco and its creditors last year. Lumen Technologies continued to post a substantial decline in its sales in the first quarter and the leverage ratio does not seem to be sustainable.

I think that other Telco’s in the sector, particularly from a leverage point of view, offer a much better risk/reward relationship, with my favorite presently being AT&T.

Consistent Erosion Of Lumen Technology’s Sales Base

Lumen Technologies continues to see a falling sales, a reflection of asset divestments and a struggling core business that is not showing any serious signs of a turnaround.

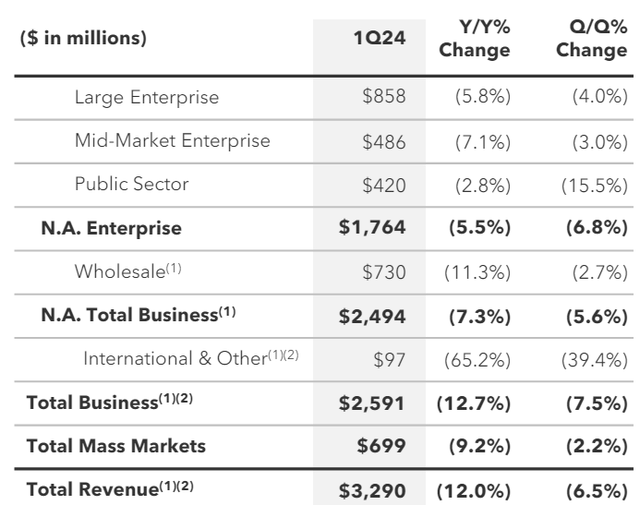

Lumen Technologies’ total sales decreased 12.0% YoY in 1Q24 to $3.3 billion. The Telco’s sales also decreased a whopping 6.5% on a QoQ basis which was also not particularly confidence-boosting.

Total Sales (Lumen Technologies)

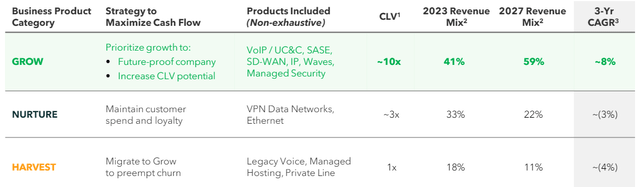

Obviously, Lumen Technologies is not a growth company and is presently restructuring its business. The Telco has identified certain core areas it sees as promising such as VoIP, software-defined networking technology and security.

However, even those areas are not growing particularly strongly. The most serious risk, however, does not come from Lumen Technologies’ shrinking sales base, but from its unsustainable debt-to-equity ratio.

Products to Strategize Cash Flow (Lumen Technologies)

Equity Value Suppressed By Excessive Debt

The core problem at Lumen Technologies is that the Telco has too much debt, and it is weighing heavily on the remaining equity.

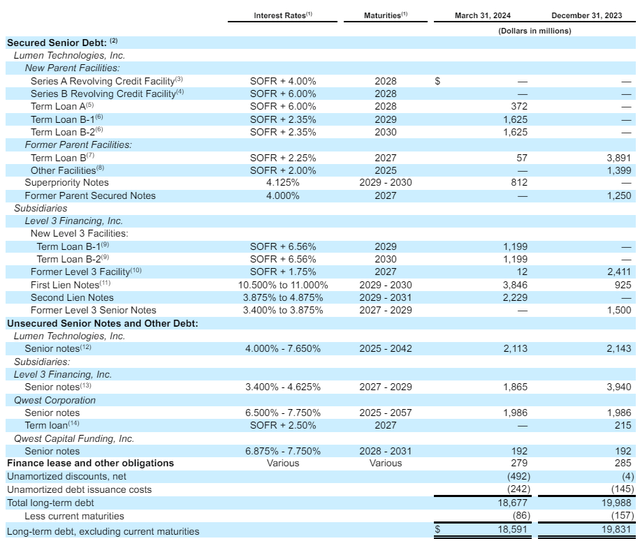

Lumen Technologies owes $18.6 billion in long-term debt which compares to an equity value of just $1.05 billion. This means that for every dollar in equity value, Lumen Technologies has $19 in long-term debt.

The calculation changes for the worse if we were to take the Telco’s actual book value which as of March 31, 2024 was just $504 million. In this case, Lumen Technologies had, for every dollar in equity, a whopping $37 in long-term debt which is an unsustainable ratio by any stretch of the imagination.

Verizon Communications Inc. (VZ) has a (long-term) debt-to-equity ratio of 1.65x and AT&T Inc. (T) of 1.37x. These ratios are much healthier and just serve to show how out-of-whack Lumen Technologies’ debt ratios have become in the last year.

Long-Term Debt (Lumen Technologies)

Battling With The Key Psychological Level Of $1.00

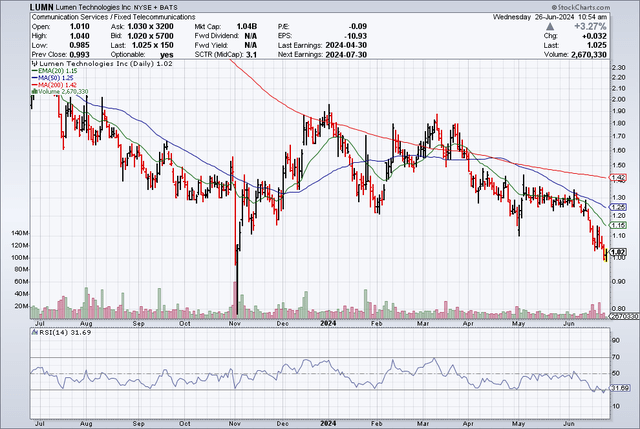

Lumen Technologies’ stock is fighting with the key psychological level of $1.00 as new going concern fears have weighed on the Telco’s stock price as of late.

Lumen Technologies’ stock crashed through both the 200-day and 50-day moving averages in March and April of 2024 and has grappled with the 20-day moving average (a less important marker of momentum strength) since May. Most recently, this moving average also has broken and the Telco’s stock is fast approaching the psychologically significant price level of $1.00.

A break of the $1.00 psychological barrier would probably also do more damage to investor sentiment as few serious investors buy a stock that is selling for such a low price.

Moving Averages (Stockcharts.com)

Lumen Technologies Is Not Investible

Lumen Technologies’ stock is selling for 0.07x this year’s sales while Verizon Communications is selling for 1.3x this year’s estimated sales and AT&T for 1.1x. Lumen Technologies’ sales multiple therefore indicates a distressed valuation. As opposed to Lumen Technologies, Verizon Communications and AT&T are producing positive Free Cash Flow and have much more sensible debt-to-equity ratios that are sustainable.

Lumen Technologies had about half a billion in book equity as of March 31, 2024 and 1 billion shares outstanding, so has a book value of only $0.50 per share. At $1.00 a share the Telco is thus valued at twice book value and my best guess is that the Telco will report another loss in 2Q24, so this book value is probably going to fall further.

In the best case, I could go along with a $0.50 per share book value for Lumen Technologies’ intrinsic value, but this, as I asserted, is likely a generous estimate. I don’t think that Lumen Technologies is presently investible, not with its debt profile and the uncertainty surrounding future losses, and would recommend investors to stay away.

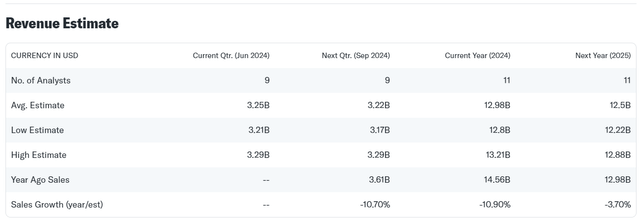

Revenue Estimate (Yahoo Finance)

Upside Risks For Lumen Technologies

Stock exchange rules require a delisting process to be initiated if a stock’s price trades below $1.00 for 30 consecutive days, meaning a delisting is a very real, short-term risk for Lumen Technologies. This risk, of course, comes in addition to leverage risks and the risk of running an unprofitable business.

On the flipside, 14% of Lumen Technologies’ float is shorted, so there is, hypothetically, the potential for a short squeeze in case the Telco were to report business improvements in one of the upcoming quarters. Overall, though, I think the risk/reward here is not compelling.

My Conclusion

It is hard to stay optimistic here when the stock price is telling investors in no uncertain terms that the company’s equity may not be worthy very much anymore.

Lumen Technologies’ sales base is eroding and the Telco lost a whopping 12% of its sales in the last year. Yes, some of it is due to the company’s asset divestments, but the business is hardly in good shape. The debt situation is quite bad, in my view, and the Telco’s leverage profile is not healthy at all.

With its restructuring ongoing, chances are that Lumen Technologies will continue to post losses, and chip away at the remaining equity value. Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.