Summary:

- Lumen Technologies’ stock surged 350% since our initial buy rating but lacks fundamental operational improvements, prompting a downgrade to “Hold” from “Buy.”

- Despite increased fiber revenue, Lumen’s mass market and N.A. Enterprise segments show declining legacy product revenues, questioning the effectiveness of their turnaround strategy.

- Recent AI-driven business opportunities boosted stock prices, but details are unclear, and skepticism remains about the long-term viability and cost structure.

- With $18 billion in debt and no tangible turnaround success, the current risk/reward ratio is unattractive; we sold our LUMN position.

imaginima

Lumen Technologies (NYSE:LUMN) is a telecommunications company that has seen impressive growth in its stock price after seeing multi-decade lows in the last year. Since the company’s stock price has seen an impressive upward correction, without a fundamental improvement in its operations of similar dimensions, the company now is not as attractive.

Our Previous Articles

In the second half of 2023, we published two articles with buy ratings for LUMN, at its multi-decade lows. Since our first buy rating, the stock price has returned a massive 350%. Since our last article, where we reiterated our buy rating following a dip caused by a controversial debt agreement, the stock price has returned over 425%.

Our first article was named “Lumen: Favorable Risk/Reward“, while the second was named “Lumen: Still A Cautious Buy (…)” in both articles we made the case for a buy rating for LUMN, mentioning the favourable risk/reward ratio at the low prices and the probability of a successful turnaround.

Evidently, we were right with our assessment, with the stock returning over 350% in a year since our first article on LUMN. We now want to revisit this company and make the case for a rating downgrade, caused by the changed risk/reward due to the increased stock price.

Lumen’s Operations

Since our previous article, where we reviewed Lumen’s Q3 2023 release, we now have 3 quarters of earnings to review and showcase the company’s current operations.

The company has reported operations in three main segments. North American Enterprise, Business Wholesale and Mass Markets. Within N.A. Enterprise, the company differentiates between their products based on their growth profiles “Grow”, “Nurture” and “Harvest”.

Mass Markets

Within their Mass Markets, Lumen’s turnaround efforts concentrated on increasing the share of more future-proof fiber revenue, while managing its declining legacy broadband business for cash. The company has invested billions into adding more fiber locations. Since their Q3 2023 release up until their Q2 2024 release, the company reported following on their Mass Market segment:

- A decrease in total broadband revenue of ~7.5% to $691m.

- An increase in fiber revenue of ~11.7% to $181m.

- A decrease in legacy broadband revenue of ~12.8% to $510m.

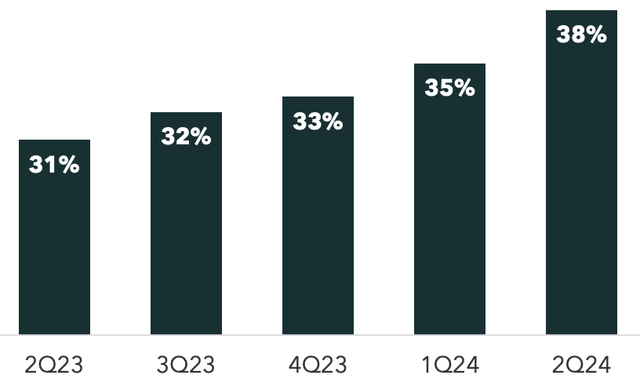

Lumen’s Fiber Contribution To Total Broadband (Lumen Q2 2024 Release)

While the company has managed to slowly increase the contribution from its growing fiber products to its total broadband revenue, as shown above, the company’s mass market segment still shows negative growth and will likely continue to do so in the coming quarters, since the company’s legacy products still contribute a large majority to its total broadband revenue.

With the company spending hundreds of millions a year to add hundreds of thousands of fiber locations but at the same time struggling to strongly increase customer penetration for those locations, a continued investment into fiber seems, in our opinion, questionable at best. A vast majority of the CAPEX spent on fiber enablement seems to be spent on locations that will not materialise into paying customers. Compared to Q3 2023, the company failed to increase their penetration noticeably from 25%.

Wholesale

The company’s wholesale business hasn’t been a focus for the company. Since Q3 2023 up until Q2 2024, the wholesale segment reported a 4.7% revenue decrease to $723m. The management does not talk much about their wholesale segment. Since the segment shows a gradual decline and appears to be managed for cash, we will conclude our review of this segment here, highlighting a gradual decline.

N.A. Enterprise

Arguably the company’s most important segment is its North American Enterprise segment. It is the most volatile segment of the company and also its most talked about. Because the company slightly adjusted their reporting segments, some of the numbers are sourced from Lumen’s Q2 2024 Trending Schedule. Since their Q3 2023 release up until their Q2 2024 release, the company reported the following on their N.A. Enterprise segment:

- A decrease in total N.A. Enterprise revenue of ~5.5% to $1.76b.

- An increase in “Grow” revenue of ~1.7% to $761m.

- A decrease in “Nurture” revenue of ~12.4% to $524m.

- A decrease in “Harvest” revenue of ~10.6% to $286m.

These numbers paint a similar picture to how their turnaround strategy works out in their mass market segment. Arguably, the result in the N.A. Enterprise segment is even worse, where their “Grow” products only manage to slightly grow, while they report large decreases in their legacy products.

Even though their “Grow” products already make up close to 50% of their total N.A. Enterprise revenue, the growth is not nearly enough to offset the decline in other segments. Combined with the fact that most of the company’s investment and focus is probably spent on their “Grow” segment, the returns on that investment make a long-term viability questionable.

Expenses

With total operating revenue decreasing ~10.2% to $3.27b from their Q3 2023 release up until the Q2 2024 release, the company managed to only decrease their total operating expenses by ~8.3% to $3.13b. This dynamic further underlines the fact that the turnaround cannot be called a success yet, with operating margins declining alongside revenue.

Even though the company already had several rounds of lay-offs and multiple divestitures, for the turnaround to be deemed a success, operating margins need to increase in the coming quarters.

With the company not cutting costs accordingly and investments in growth having questionable returns so far, we are cautiously expecting a clearer picture regarding the company’s expenses in the next quarters.

Recent News

At least some of the company’s increased stock price over the last few months can probably be attributed to news from the company that it “has secured $5 billion in new business” from AI demand, with “another $7 billion in sales opportunities”. After the announcement on 5th August, the company’s stock price shot up from $2.59 to $5 the next day.

We believe this move to be largely exaggerated, due to the lack of details on this news. It is unclear what the timeframe for the potential $12b in new sales is, and how the cost-structure to realise these sales looks like. The company did not adjust their 2024 outlook in their Q2 release from 6th August, and also did not release an updated outlook since.

We continue to be sceptical on the details of these sales and the optimism it caused with investors, especially with “AI Demand” being a driver of this potential new business.

Valuation

We believe there is still no tangible evidence of their turnaround being a success yet. We believe the value of the company solely rests on turnaround efforts becoming a long-term success for the company’s operations.

Without strong returns from the company’s turnaround offers, bankruptcy for Lumen is still a real threat, with over $18b in debt on the balance sheet.

At current prices we do not believe the risk/reward ratio to be attractive for the company, we will revisit this thought after closely watching the company’s future news and/or a decrease in price to a market cap of around $2b, meaning a share price of roughly $2 per share.

This would also roughly match an EV/EBITDA of roughly 5, slightly higher than it was when we described LUMN’s share as a favourable “option” on the company’s turnaround in our very first article.

We do not ever give sell-ratings on stocks, so we are only downgrading LUMN to “Hold” from “Buy”. However, we will mention that we already completely sold out of our LUMN position and currently do not hold any position on LUMN.

What To Look Out For

We will continue to closely monitor the company’s news. We are specifically looking forward to more clarification regarding the new AI driven business opportunities and other information in the future. The company’s Q3 2024 release is scheduled for 5th November 2024.

Besides general news, we are also closely watching out for a potential change in strategy, given the lack of convincing returns from the company’s investments into growth products and the comparatively slow decrease in operating expenses.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is purely educational. Do your own research. Any communication from this account is not to be taken as investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.