Summary:

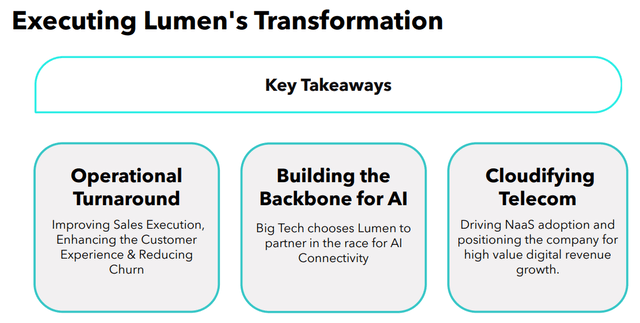

- Lumen Technologies is executing a successful transformation, focusing on AI exposure and partnerships with tech giants.

- The Q3 earnings release catalyzed a mid-November rally, highlighting Lumen’s $8 billion in Private Connectivity Fabric sales, primarily with hyper-scalers.

- Lumen’s fair share price is $9.71, offering a 39% upside, driven by AI growth and strategic resource allocation despite Wall Street’s pessimism.

- High leverage and potential economic downturns pose risks, but Lumen’s AI momentum and management’s clear vision support long-term success.

PM Images

Introduction

I have mixed feelings about my September ‘Strong buy’ recommendation on Lumen Technologies (NYSE:LUMN). On the one hand, the stock achieved my target price of slightly below $10 by mid-November. It was a solid rally because the stock traded at $7.22 when I shared this recommendation. On the other hand, the stock was unable to stay above this psychological level for longer, and it currently trades approximately at the same level as it did in late September. There are strong fundamental reasons why I reiterate the ‘Strong buy’ recommendation. The company successfully executes on its transformation plans, the AI exposure is expanding, and the stock is very attractively valued.

Fundamental analysis

The Q3 earnings release was the big catalyst that helped the stock to rally by mid-November. I prefer not to dive deep into numbers because they might be misleading. It is widely known that Lumen experiences a big transformation by pivoting its focus towards growth opportunities with higher potential. Therefore, the fact that Lumen’s revenue decreased by 11.5% year-over-year is misleading. Investors should better focus on positive developments around transformation.

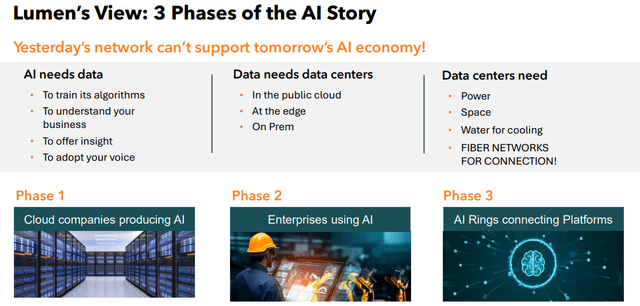

The AI industry is experiencing robust headwinds, and expanding its AI exposure is one of the core goals of Lumen’s transformation. During the earnings call, the management emphasized the high importance of AI-related revenue in the company’s turnaround. Therefore, it will be more useful for investors to look at the recent dynamics of AI-related revenue.

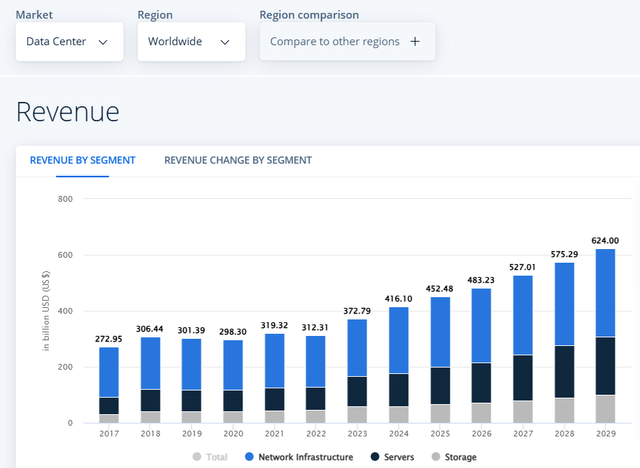

According to the management, the company has already secured $8 billion in Private Connectivity Fabric (‘PCF’) sales so far. Out of them, $3 billion were added during Q3 2024. All deals are primarily with hyper-scalers like Microsoft, Meta, Amazon, and Google. The fact that the largest and most technologically advanced companies in the world select Lumen as their trusted partner for AI connectivity says a lot about the reliability of Lumen’s services. The management says that the company benefits from the current aggressive data center buildout. Tailwinds for the data center industry are expected to remain robust for the next several years. Statista forecasts that the industry will deliver an 8.45% CAGR by 2029.

The management has split the AI revolution into three phases, which are outlined above. Kate Johnson, the CEO, is confident that Lumen is well-equipped to benefit during all three phases of the AI revolution. I tend to agree with the CEO because Lumen boasts a vast fiber network, which is unlikely to be replicated since it requires not only massive capital expenditure but also deep expertise.

Aforementioned partnerships with the leading AI companies help in building Lumen’s competitive edge. This is important not only from the recognition perspective, but from the practical as well. These companies are hyper-scalers with vast financial resources that are willing to be at the forefront of the AI era. Such a situation is a solid ground for Lumen to expand its partnerships with tech giants.

The management has a clear vision of how to capitalize on these favorable trends, which is also vital for the long-term success. Johnson’s clear vision of the AI revolution’s phases shows strong strategic foresight. This helps in planning and allocating resources properly in order to be well-prepared to capture positive external trends. As a result, the company currently works on streamlining its operations and there are apparent efforts to realign the business mix. Divestitures allow the company to reallocate resources, which results in a rather aggressive $3.2 billion expected full-year CapEx.

Valuation analysis

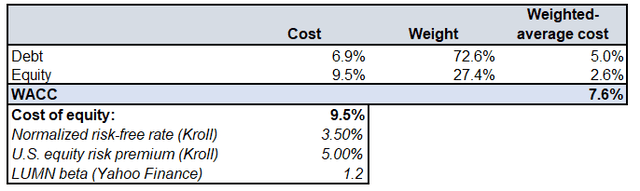

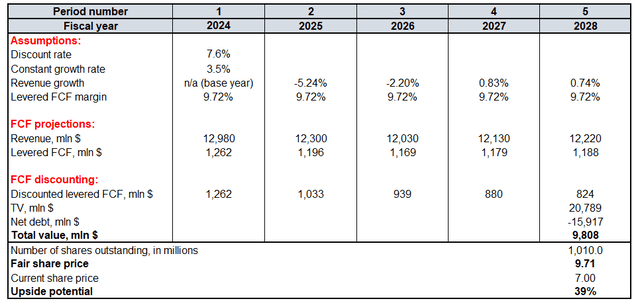

Building a DCF model will help in determining the fair share price. Lumen’s WACC is 7.6% due to the high weight of debt in the company’s total capital. The cost of debt was calculated through dividing the TTM finance expenses by the outstanding total debt.

I incorporate a moderately aggressive 3.5% constant growth rate to calculated LUMN’s terminal value (‘TV’) due to the company gaining AI exposure. Revenue projections for the next five years are from consensus. LUMN’s TTM levered FCF margin is 9.72%. Due to the company’s substantial indebtedness, I expect no improvements in the metric over the next five years.

According to Seeking Alpha, there are 1.01 billion shares outstanding. I typically disregard net debt, as it constitutes an insignificant portion of the balance sheets for the companies I usually analyze. However, LUMN’s net debt significantly exceeds its market capitalization, making it impossible to overlook in the DCF analysis.

Lumen’s fair share price is $9.71, which is around 39% higher compared to the current share price. Therefore, even considering LUMN’s substantial indebtedness, the stock is very attractively valued.

Mitigating factors

Executing such large and complex transformations is extremely challenging. The success here depends not only on the management’s excellence, but on external factors as well. A sudden economic downturn, or a potential credit crunch, might be a big headwind for LUMN to finalize its transformation as planned.

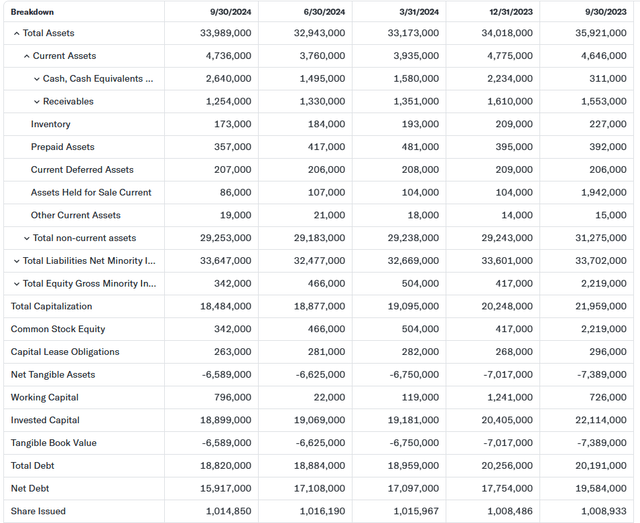

The significant decrease in Lumen’s net debt over the last five quarters indicates that the management did a great job. On the other hand, Lumen’s around $16 billion net debt is still significantly higher compared to the company’s $7 billion market cap. Such a high leverage ratio significantly limits Lumen’s financial flexibility, which might be a big headwind in case the data center demand suddenly cools down.

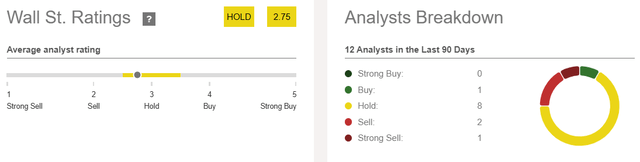

Wall Street analysts do not share my optimism. There is only one bullish rating out of twelve. I think that such pessimism is explained by Lumen’s extremely high leverage. While I believe that Lumen’s strong prospects in AI outweigh the significant indebtedness risk, the weak sentiment from Wall Street analysts might be a big headwind for the share price. On the other hand, analysts’ ratings are quite dynamic and new positive developments around AI revenues will highly likely make Wall Street more bullish.

Conclusion

Lumen successfully executes on its turnaround strategy by pivoting to more high-growth areas. The AI-related revenue is gaining momentum, and expanding partnerships with the largest data center players help LUMN to build its moat in the AI revolution. The management has a clear vision of how to capitalize on favorable trends, which helps in adequately allocating resources. The stock has a 39% upside potential, which means that LUMN is still a ‘Strong buy’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUMN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.