Summary:

- I am lowering my rating on Lumen Technologies, Inc. from buy to sell due to the recent 400% price surge, which, I believe, is unsustainable.

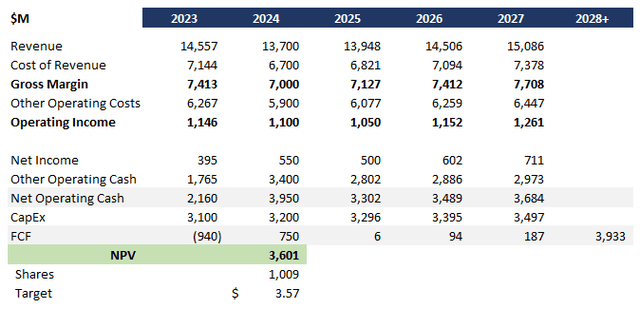

- My updated DCF analysis, considering lower-end management guidance and a 7.9% discount rate, yields a price target of $3.57, indicating a 32% downside.

- The AI market’s overvaluation and unrealistic growth expectations do not support Lumen’s current price, despite potential from data centers and fiber business.

quantic69

I am updating my ongoing analysis on Lumen Technologies, Inc. (NYSE:LUMN) in light of the rapid price increase. I had previously rated Lumen a buy for the following reasons:

- Low-end of management guidance run through a discounted cash flow, or DCF, analysis supported 17% upside on price

- Value of telecom assists exceeded the market cap by at least $1 billion

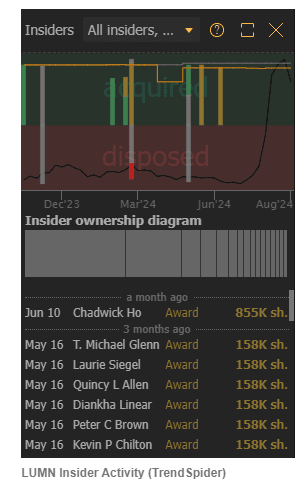

- Insiders were aggressively purchasing the stock

- Downside risks were well mitigated by management levers to keep the stock above $1 and the value of assets.

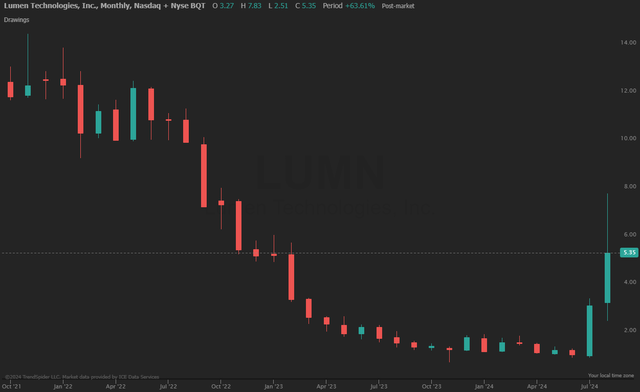

Since then, Lumen is up close to 400% while the S&P 500 (SP500) has been flat.

LUMN Price Trend (Trend Spider)

I’ve been bullish on Lumen since Q1, and could never have anticipated 400% upside when I set my price target at 20% upside. I do believe the business has a strong future and will return to growth, but I do not believe it can grow enough to support the current price while also overcoming its declining legacy business.

Based on the data center contracts announcement and Q2 earnings, I have more than doubled my price target from $1.22 to $3.57, but this is 32% downside from today’s pricing. The opportunity to enter has passed, and it is a great time to capture the gains and move somewhere else.

There is compelling macro data to suggest that the AI boom can’t support valuations at this level. This is balanced against a strong growth case that I do not believe supports the current price but does protect the company from falling back to the $1 level. There is also potential from the growth of the data center business and the growing fiber business, but it would be a leap of faith to imply it could support valuations at the current level.

With the above in mind, I lower my rating from buy to sell on Lumen Technologies.

Valuation

I updated my DCF analysis for Lumen with the following assumptions:

- Lower-end of management guidance as core businesses continue to decline.

- 7.9% discount rate using estimated WACC now that the risk of delisting has been mitigated.

- 3% revenue and cost growth, both near-term and long-term, assuming no margin expansion and slightly behind the overall industry CAGR.

This analysis yields a price target of $3.57, a 32% downside from today’s pricing. However, it is up from my previous price target of $1.22, driven by clarity around data center contracts and revenue potential.

LUMN DCF (Data: SA; Analysis: Mike Dion)

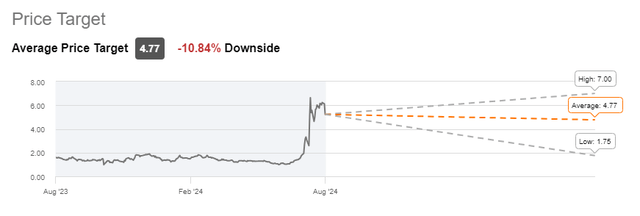

Wall Street has also raised its price target following the data center announcements. They are slightly more aggressive than me at a target of $4.77, although my target is well within range.

LUMN Wall Street Rating (Seeking Alpha)

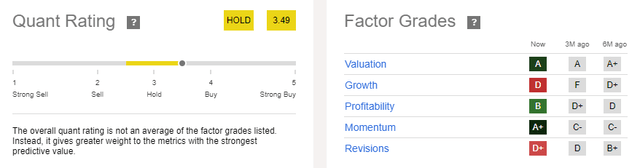

The quant rating suggests a hold, almost a buy. I believe this is overweight due to the recent stock momentum, rising almost 400% in two months.

LUMN Quant Rating (Seeking Alpha)

AI Potential Has Been Overestimated

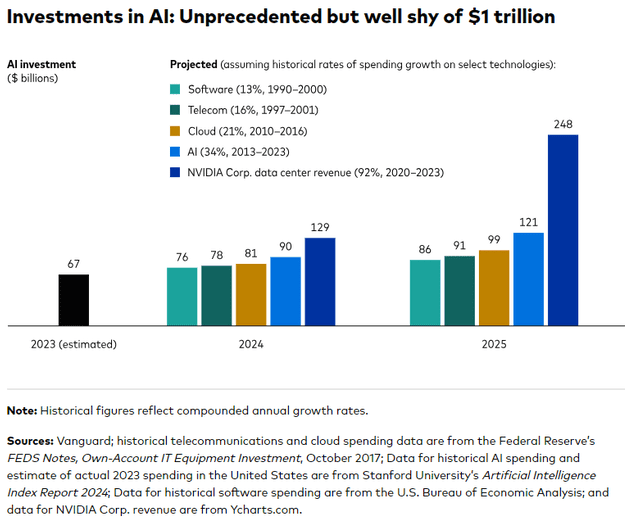

Looking at the macro data, I believe that the AI market isn’t large enough to support Lumen’s current valuation, and most AI companies are overvalued anyway. Current AI market caps would require AI to drive $1 trillion in value as soon as 2025. Even at historically large growth rates, the data does not support that this acceleration is possible.

AI Investment Estimate For 2025 (Vanguard)

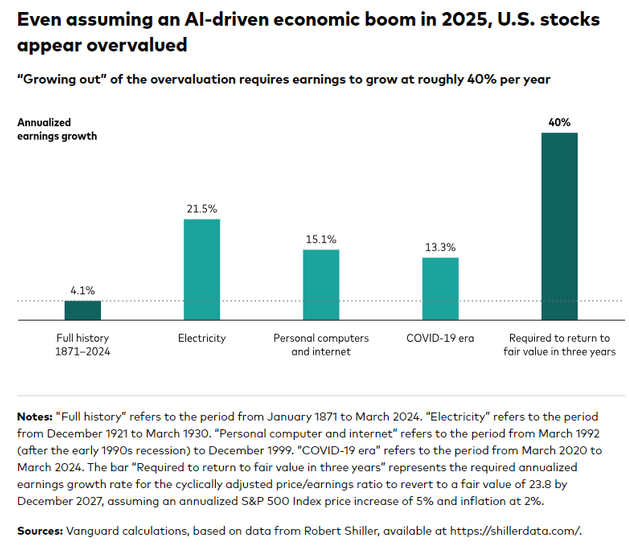

Earnings across the AI ecosystem would also have to grow at 40% for valuations to normalize. There is certainly a market, and it is certainly growing.

AI Expectations Versus Historical Tech Growth (Vanguard)

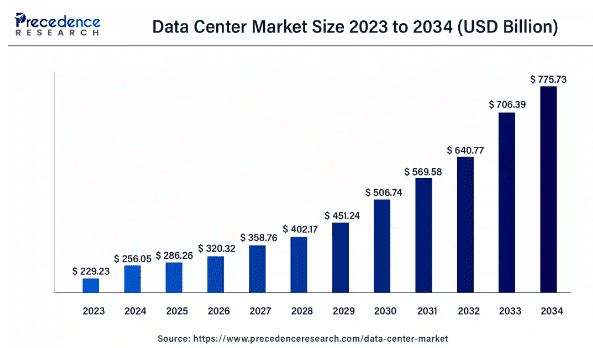

Considering this for my valuation, I pegged revenue potential from the data centers to the overall data center market, not AI-specific. This market is expected to grow at a CAGR of 11.7%, well below AI expectations but enough to support a price target in the mid-3s against the backdrop of declining copper businesses.

Data Center Market CAGR (Precedence Research)

Upside Potential

Upside potential would need to be sizeable to overcome the gap from my price target to current pricing. There are two upside drivers. The first is that estimates about the AI market are correct, and Lumen can ride that wave up similarly to companies like Nvidia.

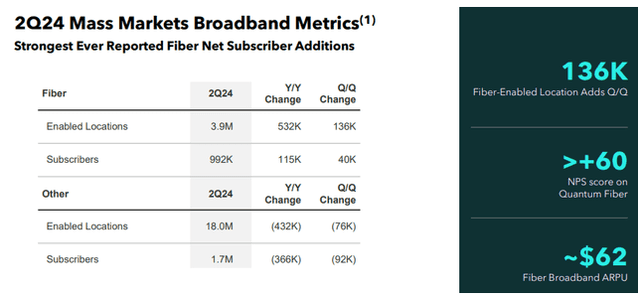

The second comes from the new fiber business that continues to set growth records. If this growth continues, fiber will overtake copper as the profitability driver and the relative impact of copper declines will soften. If the growth accelerates further or core business declines decelerate, there could be upside potential for the business.

2Q24 Metrics (LUMN Investor Relations)

It is also worth noting that there has not been an uptick in insider activity. Given the rapid rise in price, this is surprising, as insiders will usually cash in some share and option gains. This could suggest an upside view within the company.

LUMN Insider Activity (TrendSpider)

Verdict

Lumen Technologies has solid potential with two growth businesses and contracts in hand. This certainly supports my prior thesis that this is not a sub-$1 stock, but the market has now pushed the business well past a reasonable valuation.

The current price is more reflective of AI hype and investors looking for AI exposure, than the tactically commercialized opportunities Lumen has in front of it.

At a price target of $3.57, I lower my Lumen Technologies, Inc. rating from buy to sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.