Summary:

- Lumen Technologies trading volume surged in July, with stock price starting at $1.00 and to around $6.70 in after-hours trade after posting results.

- Lumen secured $5 billion in AI-related new business and $7 billion in sales opportunities, leading to its impressive increase in stock price.

- Lumen’s partnership with Corning for fiber network expansion will support business growth and increased free cash flow forecast for 2024; this may lead to debt rating upgrade and improved growth.

shulz

At the end of July, trading volume in shares of Lumen Technologies (NYSE:LUMN) surged into the hundreds of millions. Buyers accumulated LUMN stock throughout the last month, starting at around $1.00. In the absence of any news, the stock earned a seven-day winning streak alert on July 19. By July 30, Lumen finally announced a major agreement with Corning (GLW).

Lumen would allocate 10% of Corning’s global fiber capacity for each of the next two years. This would facilitate Lumen’s building of a new network to interconnect artificial intelligence-enabled data centers.

On August 5, 2024, Lumen secured new business worth $5 billion. It attributed the major demand for connectivity fueled by AI to the spike in deals. Additionally, the firm may secure another $7 billion in sales opportunities.

On the day of the second quarter earnings report, LUMN stock traded up by 93% to close at $5.00. The stock nearly tripled in return since I last provided coverage in the company in May 2024. The stock traded at around $6.85 after the market closed in response to the Q2 earnings report.

Pre-Earnings Business Updates

On August 1, 2024, Lumen announced a supply agreement with Corning, whereby Corning will provide a substantial supply of next-generation optical cable. Markets responded enthusiastically to the news, since Lumen significantly increased its capacity to key cloud data centers. Markets are willing to pay a premium for companies that stay ahead of their competition. AI has heavy workloads and uses high bandwidth applications since it involves massive amounts of data.

Lumen CEO Kate Johnson said that the partnership with Corning sets it as a preferred partner. As a result, customers must deal with Lumen to secure the supply of this next-generation fiber network.

Corning said that the increased fiber capacity would enable Lumen to fit two to four times the amount of fiber into its existing conduit. In the second quarter, Corning posted net sales from optical communications increasing by 4.0% Y/Y and up by 20% Q/Q. However, GLW stock slumped after Corning issued its outlook, which disappointed investors.

Second-Quarter Results

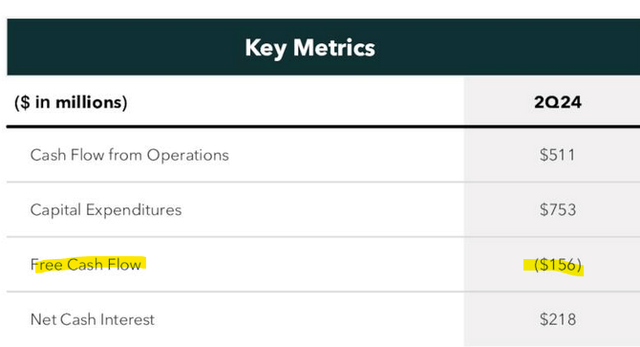

In Q2, Lumen posted a $0.13 a share non-GAAP loss, after revenue fell by 10.7% Y/Y to $3.27 billion. Cash flow from operations improved to $511 million, compared to a $100 million decline the year before.

Seeking Alpha

Investors are looking beyond the quarterly results by reacting to the outlook for the year.

Full-Year Outlook

Lumen shares rallied in after-hours trade after the firm sharply increased its free cash flow forecast for the full year of 2024. As indicated in bold below, FCF is up to $1.2 billion.

|

Metric |

Current Outlook |

Previous Outlook |

|

Adjusted EBITDA |

$3.9 to $4.0 billion |

$4.1 to $4.3 billion |

|

Free Cash Flow |

$1.0 to $1.2 billion |

$100 to $300 million |

|

Net Cash Interest |

$1.15 to $1.25 billion |

$1.25 to $1.35 billion |

|

Capital Expenditures |

$3.1 to $3.3 billion |

$2.7 to $2.9 billion |

|

Cash Income Taxes/(Refund) |

($200) to ($300) million |

($200) to ($300) million |

Lumen expects net cash provided from operating activities in the range of $4.1 billion to $4.5 billion for the year. Lumen noted in a footnote that the outlook excludes the effects of Special Items, goodwill impairments, and future changes in its operating or capital allocation plans. The forecast also includes a $700 million tax refund that the firm received during Q1/2024.

Lumen’s FCF expectations sharply lower bankruptcy risks. At the end of the quarter, the firm had $18.41 billion in long-term debt, compared to $1.495 billion in cash and cash equivalents. Expect the firm to lower its debt levels in the next several quarters.

Expect Debt Rating Upgrade

In March, S&P Global downgraded Lumen’s debt from ‘CC’ to ‘SD.’ The firm is demonstrating a transformative performance, heightened by securing $5 billion in AI-related new business and another $7 billion in sales opportunities. Expect the ratings agency to upgrade Lumen’s debt rating in response to recent business developments and the revised outlook.

LUMN Stock Score

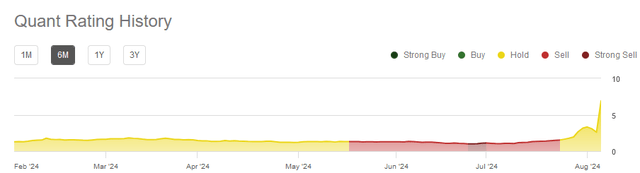

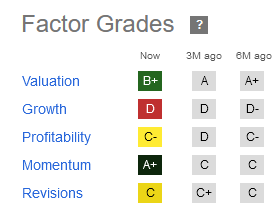

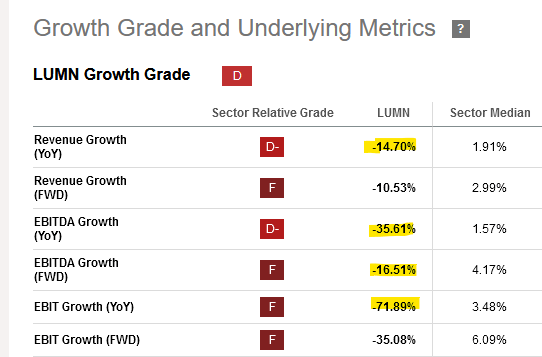

Seeking Alpha raised its rating on LUMN stock on July 24, 2024, to a ‘Hold.’ The stock’s continued positive momentum, rising profitability, improving growth, and analyst EPS revisions will raise the company’s factor grades.

Seeking Alpha

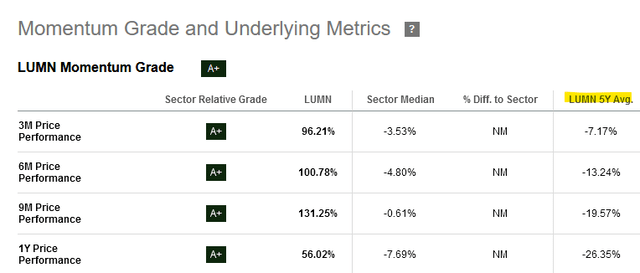

Below, LUMN stock has the strongest score on momentum.

Seeking Alpha

The stock’s strong performance suggests a good chance that the momentum score will stay at an A+.

Seeking Alpha

Above: LUMN stock outperformed the S&P 500 in the last year.

Below, the five–year average return is still negative. CEO Johnson will need to build its growth on the AI economy to reward its long-term investors.

Seeking Alpha

Your Takeaway

From a stock performance perspective, Lumen will share the spotlight with AST SpaceMobile (ASTS) recently and Celestica (CLS) over the last two years. While the positive catalysts differ compared to Lumen, markets are rewarding shareholders who waited a long time for its turnaround.

In the weeks and months ahead, Lumen will update investors with contract wins arising from its active discussions with customers. The firm needs to solidify $7 billion in additional revenue to justify the recent stock rally. If it raises its adjusted EBITDA guidance for the year, the growth grade will improve.

Seeking Alpha

Contract negotiations may take longer than expected. Investors should expect Lumen to start realizing earnings early next year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Please [+]Follow me for coverage on deeply discounted stocks. Click on the “follow” button beside my name. Get do-it-yourself tips and tricks for free here:

- Subscribe to the Free DIY Tier to get a preview of the subscription. Read dozens of articles. This is completely separate from the alerts you get when following me.

- The Basic tier is the second level.

- The Full Service is for readers who want it all, want a helping hand in the markets, and want to chat in the forum with like-minded do-it-yourself investors.