Summary:

- Lumen Technologies stock saw a significant 5-day move, sparking speculation of small-cap rotation, successful turnaround, or a potential acquisition.

- New CEO Kate Johnson has successfully reduced debt, improved debt maturity profile, and initiated partnerships with Microsoft and Corning.

- The investment thesis on LUMN stock includes turnaround potential, small-cap rotation strategy, and asset play with possible acquisition, with a fair value of $5-$6 per share.

John M Lund Photography Inc

Lumen Technologies stock – Some historic moves

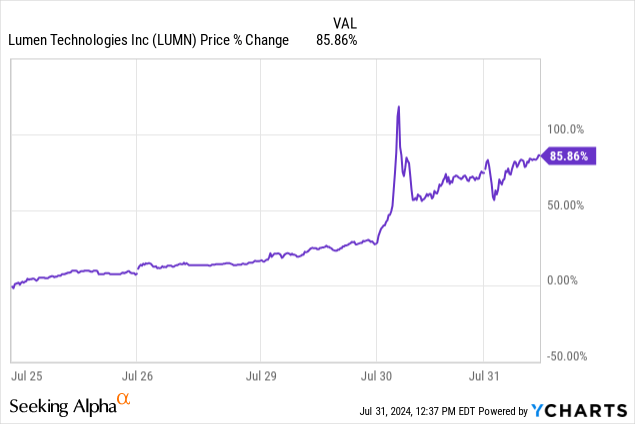

The recent 5-day move in Lumen Technologies, Inc. (NYSE:LUMN) has set off some alarm bells. This could be something as benign as a small-cap rotation hunting for some of the most undervalued stocks. It could also indicate a turnaround being executed successfully or inklings of an acquisition afoot now that rate cuts are on the horizon. Any of these could be possibilities.

This is the third time I have covered the stock. The first can be found here:

Lumen Technologies: Few Things Go To Zero.

And the second here:

Lumen Technologies: Don’t Get Too Excited Yet.

In the case of Lumen, if you are just entering the backstory at this point, the company was priced near $1 a share as recent as a month ago. A combination of one of the biggest fiber networks ever assembled in Level 3 communications, which were merged with Century Link in 2017 to later become known as “Lumen.”

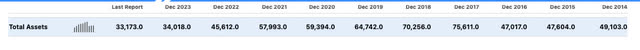

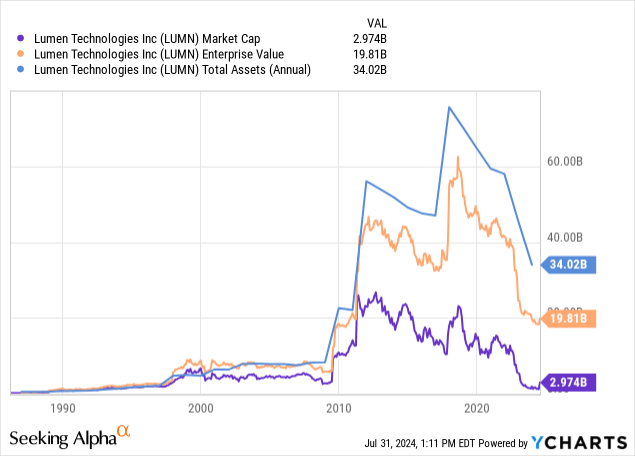

Why this play was initially so interesting to me was that they commanded far more assets than their market cap via all the leverage in the deal:

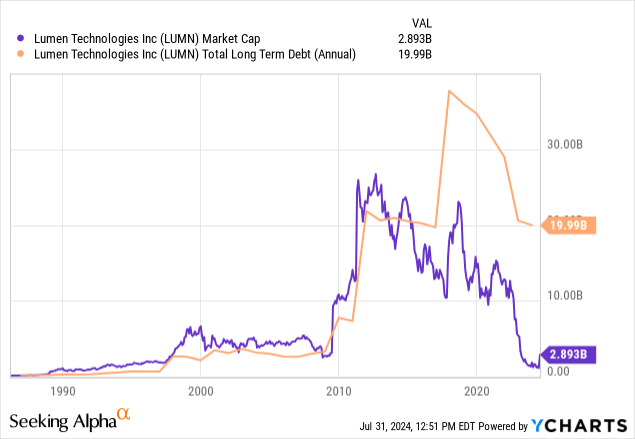

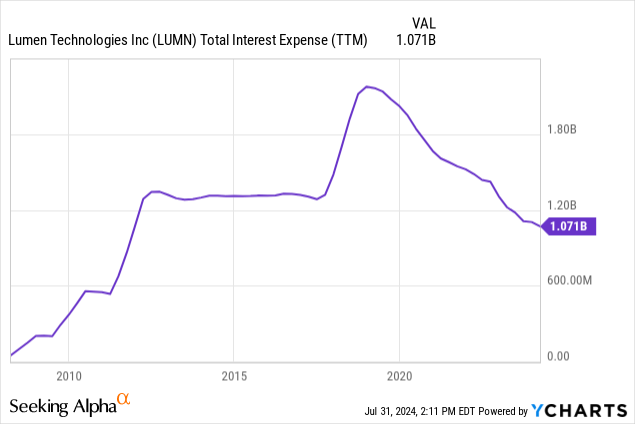

This huge debt pile initially started in excess of$30 Billion USD. Through asset sales around the globe, the melting ice cube of a company has managed to get debt down to near pre-merger levels, which became an emergency after rate hikes started in 2022. Having to roll over massive amounts of debt from the Zirp era into this normalized one would have crushed the company under the weight of interest payments.

Enter new CEO Kate Johnson and exit old CEO Jeff Storey. Kate was the previous president of Microsoft U.S., in charge of a sales department of $45 billion for Microsoft (MSFT). She was tasked with the turnaround after Storey was nudged out. The first task was to tackle debt and restructure the complex credit stack of the company.

To those who track the bond market and those who are familiar with private credit, we are realizing that lenders these days would rather not take over an asset. They are willing to extend and negotiate like never before. This was the first win in a sense for Johnson after helping to restructure a large chunk of near-term maturing debt (emphasis added):

Debt Maturity Profile Following Consummation of TSA TransactionsLumen’s near-term debt maturity profile has significantly improved, with the amount of maturities outstanding for 2025 to 2026 reduced from approximately $2.1 billion to approximately $600 million and total maturities outstanding for 2027 reduced from approximately $9.5 billion to approximately $800 million.

Through 2027, this was a $10.2 Billion swing in required debt paydowns. This bought the company more time to either turn around and refinance when rates become more favorable, or possibly make the company more attractive for acquisition. This would be knowing that the acquiring company may be able to assume a lot of the debt for lower than market rates that they could get for such a merger. Most importantly, it creates time to think and execute.

Percent off high

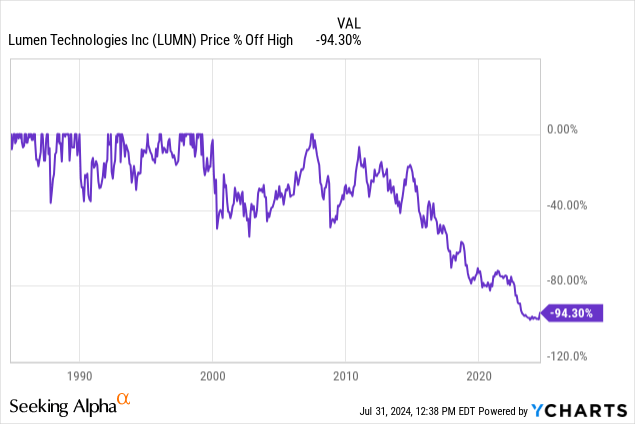

Even after this more than doubling from near $1 a share, the stock is still down -94.4%. I still believe the best angle to consider this company is an asset play with accumulated depreciation and amortization being deducted from gross assets not being a fair representation of the true market value of the fiber network they command.

This is a small cap with a large cap footprint.

This is easily observed by comparing market cap vs. enterprise value vs. total assets.

Fund and insider buys

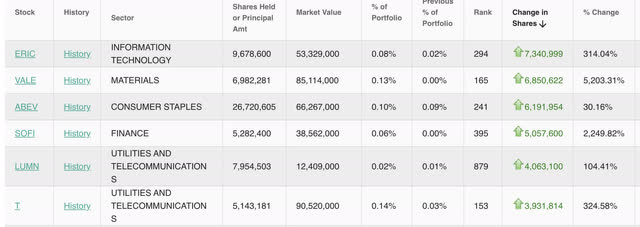

Renaissance MRQ :13 F

Whalewsidom Renaissance technologies 13 F

When looking for a bounce, quant funds like the late Jim Simmons’ Renaissance 13 F are a good place to look. This is purely a fund based on mathematics and anticipatory momentum. Lumen was in the most recent filing top 5 for share increase.

Recent insider buys

A great Peter Lynch quote to remember:

Insiders sell for many reasons but buy for only one.

The 3-month buy-to-sell ratio for the insider roster is 5.2 to 1.

The 12-month buy-to-sell ratio is 4.5 to 1.

Insider buying cannot create a thesis, but the already high buy-to-sell ratio has increased between the 12 to 3-month period.

Recent news

Here was the first piece of news to spike the stock courtesy of Seeking Alpha:

Lumen Technologies (LUMN) has forged a strategic deal with Microsoft (MSFT) to support digital transformation and drive AI initiatives across its organization.

Lumen (LUMN) has launched an enterprise-wide transformation to simplify and optimize its operations. As part of the partnership, the telecommunications company will migrate and modernize its workloads to Microsoft Azure, use Microsoft Entra solutions to safeguard access and prevent identity attacks, and partner with Microsoft to create and deliver new telecom industry-specific solutions.

This element alone is expected to improve Lumen’s (LUMN) cash flow by more than $20M over the next 12 months, while also elevating the company’s customer experience.

The second came from Corning (GLW) incorporated’s Q2 report:

Corning and Lumen Technologies reach an agreement to reserve 10% of Corning’s global fiber capacity for each of the next two years to interconnect AI-enabled data centers

While I can’t say for sure that these catalysts are truly what is spiking the buys, this is the buzz circulating online for investment catalysts. While the Microsoft deal is relatively small, it shows some synergies that may be anticipated to increase over time between the two companies, with Kate Johnson being uniquely positioned to open this line of communication.

The Corning report indicates that Corning believes Lumen will have the financial capacity to pull off a 10% absorption of the company’s fiber capacity. This strongly suggests that the company sees demand for interconnecting AI data centers, and the viewpoint is reciprocated by Corning.

For a company that was once considered dead in the water, the AI acronym, a Fab 7 deal, and possible fiber expansion versus sloughing are very intriguing revelations.

LUMN stock – Investment thesis and relations to rate cuts

1. Turnaround

The turnaround story believing the company can return to positive free cash flow and possibly reinstate a dividend is certainly one of the thesis’.

This is a company that at one point was producing over $4 in free cash flow per share and easily paying a $1 a share dividend.

The company is much smaller now after selling assets to pay down debt, let’s compare the 2

In 2019, with about 2 X the assets that the company currently has, they were able to generate about $3 a share in free cash flow. Now, with a tad more than half that number of assets, eventually getting to $1.25 a share in free cash flow is not out of the question based on the assets and a similar ROA to 2019. With the stock hovering around $2.5 a share, that would be a free cash flow yield of 50%. We don’t have to be quants to realize that would make this a remarkable deal.

2. Small-cap rotation

With rate cuts on the horizon, a simple small-cap rotation could also be the reason for the recent share price run-up. One of my screens, if I was running a small-cap fund, would be to look for small caps that used to be mid or large caps. Bottom fishing is an easily understandable strategy. As long as there is no massive share dilution and some semblance of profitability, betting on multiple “fallen angel” small caps could be akin to venture capital investment.

This is certainly a strategy that I use for a portion of my funds, I see it as a much less risky proposition than getting involved in private equity funds. Lumen, Legget & Platt (LEG), and VF Corporation (VFC) are all fallen angels that I’m taking shots at right now.

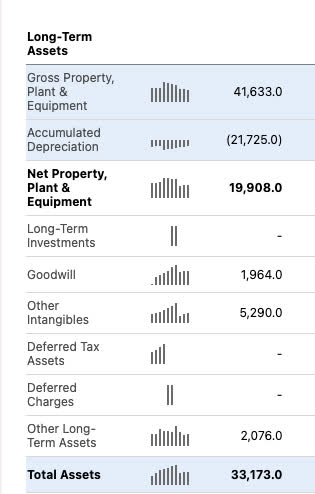

3. Asset play and possible acquisition

To me, this is the play that I adhere to with Lumen.

Seeking Alpha

The hard assets have a cost of $41.63 Billion, with accumulated depreciation of $21.725 Billion. If fiber assets have an inkling of being a hot commodity for enterprise-level data center connectivity, I wouldn’t object to even adding back the entire depreciation and then some to value the assets.

All numbers TTM in millions

Liabilities

- LT Debt = $18,312.

- Pensions = $2,457.

- Other non-current debt = $2,641.

- Current liabilities = $3,816.

- Total liabilities = $27,226.

Assets [for this I am only using gross PPE and ignoring any intangibles, goodwill, or other long-term assets].

- Gross PPE = $41,633.

- Gross PPE minus Total liabilities = $41,633 — $27,226 = $14,407.

- Divided by shares outstanding, 1,015 = $14,407/ 1,015 = $11.85/share.

In line with my previous assessment, the volatility of the company would entail at least a 50% discount, making the net asset value in my mind worth around $5.9 a share.

Let’s also keep in mind that more use cases for the assets could be uncovered with the AI and Data Center boom.

Interest rates dropping will magnify asset value in M&A due to a lower hurdle rate in IRR due diligence. Lower rates will also bring more possible suitors to the table and enhance negotiating power.

I am not saying that an acquisition is going to happen, all that I am saying is being taken out at $6 a share would not be a bad base case at all.

A bull case is a full recovery, and possibly snagging a stock that has the potential to generate a 50% or more free cash flow yield on your basis would be the greatest scenario of the mentioned 3.

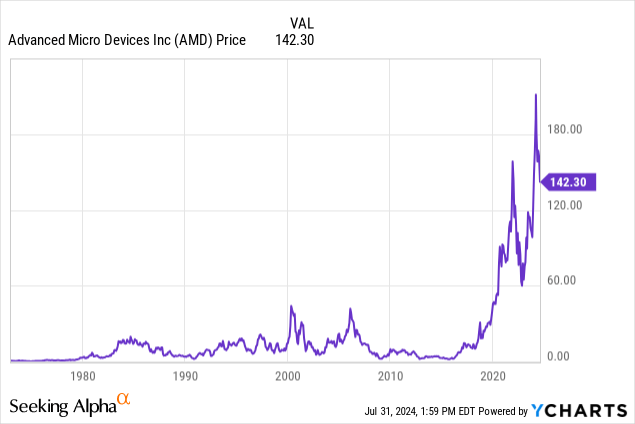

Let’s not forget that now hot stocks like Advanced Micro Devices (AMD) were left for dead not very long ago. Turnarounds and growth can happen with the right leadership, the right timing of economic catalysts [AI], and not a lot of capital moving into the stock when it’s trading at under $5 Billion.

Risks

Debt is a massive risk with this company, but the levels have been reduced significantly. CAPEX requirements TTM are still around $3 Billion, which exceeds cash from operations by about $2-$300 million USD. Luckily, the company has about $1.5 Billion in cash and short-term investments to fill gaps, but a bad year or two could see that exhausted and the company has to resort to drawing down credit facilities.

If the company does not increase cash from operations, then getting taken out in an acquisition may be the only positive outcome.

Interest expense remains around $1 Billion per annum vs. $3.7 Billion in EBITDA.

Summary

There are several bullish elements here. The debt extension, the beginning of Microsoft deals, which is what investors thought Kate Johnson would bring all along, and the 10% take-off of Corning’s fiber production suggests further growth plans for Lumen Technologies, Inc. beyond what the market anticipated.

Frankly, growth was looked at as a joke with this company as of recent, but these items may be changing the market’s mind. I still believe the fair value is about $5-$6 a share, with even more upside if you see the top-line tick up and rate cuts start to happen. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUMN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.