Summary:

- My initial Buy recommendation for Lumen Technologies, Inc. has been my most successful to date, with the stock soaring nearly 400% since January.

- The reasons for this optimism are rooted in management’s successful execution of its turnaround plan.

- Management has pledged to deliver further cost efficiencies soon, and recent developments in expanding AI exposure appear extremely promising.

- Valuation analysis indicates that it’s still not too late to invest in this major winner.

Andrii Yalanskyi/iStock via Getty Images

Introduction

A Buy-rated article on Lumen Technologies, Inc. (NYSE:LUMN) was one of my first ones here at Seeking Alpha. It is definitely my best recommendation so far as an SA Author, since the stock has soared by almost 400% since January 2024.

In January, the stock was significantly undervalued, with a Price/Sales ratio of approximately 0.1. This substantial discount was largely due to the considerable uncertainty surrounding the viability of the management’s turnaround efforts. Now, more than nine months later, I am pleased to share my updated perspective on the company’s performance and other critical developments.

Although still a work in progress, turnaround results in 2024 are hopeful, providing additional confidence that the management can achieve its goals. The positive EBITDA trend continues, and the company’s leaders commit to achieving more cost efficiency. In addition to tight cost management, LUMN is actively taking advantage of the positive AI trends, winning several important new multibillion-dollar contracts to increase AI connectivity. With a whopping 400% up from mid-January, there is still a lot of upside left. I am making LUMN a “Strong Buy” from “Buy” due to increasing confidence in the new management.

Fundamental analysis

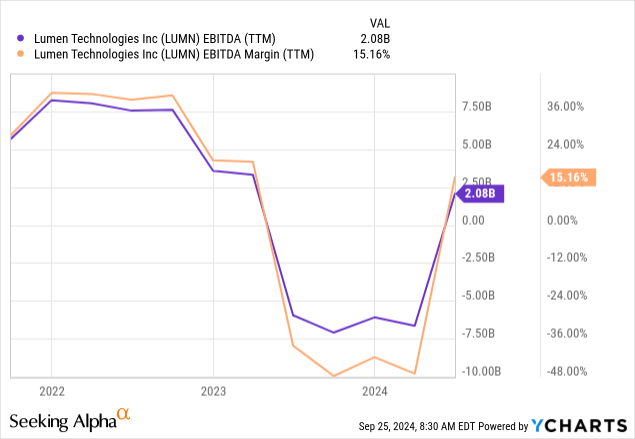

When I analyze turnaround stocks like LUMN, a sharp spike in profitability is something that I am looking for. Lumen’s EBITDA has bounced on a TTM basis in 2024, which indicates that turnaround goes well so far.

This is the number one positive factor for me, as it indicates that the management is moving in the right direction in terms of optimizing costs. According to the Q2 earnings call transcript, Lumen is on track to achieve $1 billion in cost savings by 2027 through strategic infrastructure simplification. This includes unifying its network and simplifying its product portfolio, which will enhance operational efficiency and customer experience. Therefore, we can expect the positive EBITDA trend to continue in upcoming quarters.

Apart from focusing on cost efficiency, the management is also striving to improve the company’s AI exposure. The company is building critical infrastructure to serve as the backbone for AI applications, which is expected to drive significant growth over the coming decades. The AI market is expected to observe a 36.6% CAGR by 2030, according to Grand View Research.

Lumen has already established itself as an AI network service provider of choice, negotiating more than $5 billion in strategic partnerships and opening doors to nearly $7 billion more opportunities. Those collaborations with tech giants such as Microsoft highlight Lumen’s place in the AI ecosystem. Its exclusive fiber network and digital platform distinguish the company, enabling it to excel in these marquee collaborations.

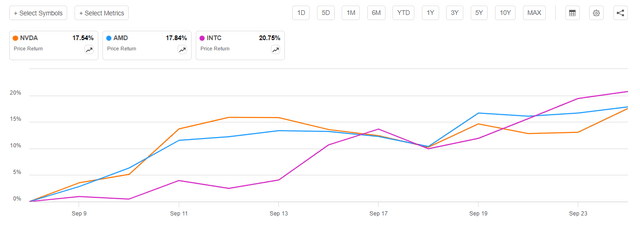

Recent developments suggest that strong AI tailwinds are still in place. Stocks of the three major AI chips players, including NVIDIA (NVDA), Advanced Micro Devices (AMD), and Intel (INTC) have rallied notably over the last three weeks. Moreover, Nvidia’s CEO recently shared information that the sales launch of a brand-new Blackwell family of AI accelerators is approaching. Additionally, Nvidia’s CEO recently announced that the sales launch of the new Blackwell family of AI accelerators is on the horizon and the “demand for it is so great.”

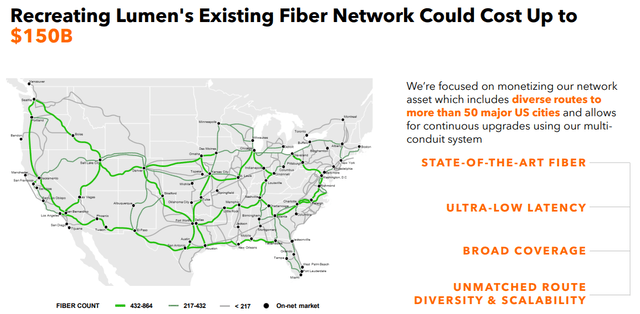

What is crucial is that Lumen’s moat is strong. According to the above slide from the latest presentation for investors, recreating Lumen’s existing fiber network could cost up to $150 billion. This substantial barrier to entry underscores the unique value of Lumen’s infrastructure, which is nearly impossible for competitors to replicate without significant investment and time. This expansive network is not only integral to powering Lumen’s current operations but also will function as a critical enabler of the AI economy – a durable source of competitive advantage.

As the appetite for high-capacity, low-latency connectivity increases, Lumen’s existing network will be a key asset in gaining market share and driving long-term revenue growth. This large moat means the company will continue to be a central player in telecommunications for years to come.

For a highly leveraged company, the Federal Reserve’s recent decision to cut interest rates is a positive development. Lower interest rates mean that a highly leveraged company could restructure the balance sheet. Lower interest rates help the company to refinance existing debt at reduced interest expenses. According to LUMN’s P&L its TTM interest expense is $1.25 billion, indicating room to reduce costs.

Valuation analysis

Back in January, the stock traded with an unbelievably low Price/Sales ratio of around 0.1. That is an extremely low level. Therefore, despite the stock price soaring by around 400% since my first call, the TTM P/S ratio is still extremely low at around 0.52. A 1.76 Price to Cash flow ratio also suggests that significant undervaluation is still in place.

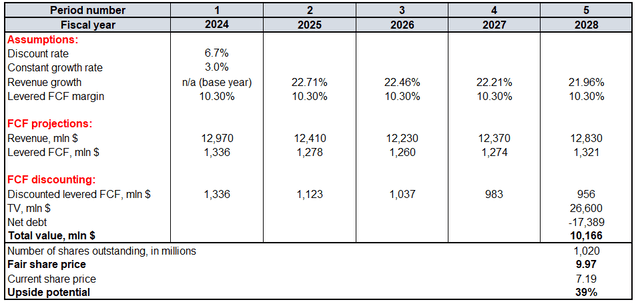

Building a DCF model will help in determining the fair share price. Lumen’s cost of equity is the discount rate, which is 6.7%. Due to favorable AI trends, the constant growth rate to calculate terminal value (“TV”) is 3%. Revenue projections for the next five years are from consensus. LUMN’s TTM levered FCF margin is 10.3%. Due to the company’s substantial indebtedness, I expect no improvements in the metric over the next five years. According to Seeking Alpha, there are 1.02 billion shares outstanding. I typically disregard net debt, as it constitutes an insignificant portion of the balance sheets for the companies I usually analyze. However, LUMN’s net debt significantly exceeds its market capitalization, making it impossible to overlook in the DCF analysis.

As we see, the solid upside potential is still there. My fair share price estimation for LUMN is $10, which is almost 40% higher than the current share price. With that being said, I find current valuation attractive.

Mitigating factors

Although I am hopeful about the company’s potential for a turnaround, it is far from being over. A fundamental turnaround, especially for a company with $33 billion in total assets, is a long and bumpy road. While the new management’s actions have been prudent thus far, their tenure at LUMN has been relatively brief, leaving considerable uncertainty about their ability to successfully execute the turnaround plans.

Making the balance sheet healthier and less leveraged should be the cornerstone of the management’s turnaround actions. I believe the company’s current high level of debt does not pose a significant credit risk. Still, I should stress that high leverage may represent a financial risk to the business because it limits Lumen’s ability to raise further finance in the event of a good investment opportunity arising. A balance sheet heavily filled with debt will probably not leave a company much lending room to raise additional finance on the debt markets. This will result in the company wanting to pass up on good investment opportunities due to a lack of financing. In a fast-paced technology field, a business must be financially flexible to be able to keep up with the technology.

The stock is also sometimes attacked by short sellers. There is a notable 7.33% short interest. Over the last month, the stock also suffered from short ideas released by Hedgeye and Kerrisdale Capital. On the other hand, despite pressure from short sellers, the stock still gained almost 16% over the last month.

Conclusion

Even with a 400% increase in value from the time I wrote the thesis, LUMN remains seriously undervalued. Management is making great strides to increase LUMN’s AI exposure. LUMN’s fiber network is one that is extremely unlikely to be replicated. EBITDA trends are strong, and management has committed to achieving further cost efficiencies. With much more certainty now that management can continue to execute its turnaround than at the beginning of 2024, I am upgrading LUMN to a “Strong Buy.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUMN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.