Summary:

- Lumen Technologies is experiencing a share price surge driven by AI technology demands, despite a decline in third-quarter revenue and EBITDA.

- The company’s operating cash flow surged to $3.6 billion, driven by deferred revenue from AI-related sales, leading to $1.3 billion in free cash flow.

- Lumen has restructured debt, reducing long-term debt to $18.6 billion, and engaged in a tender offer to address near-term maturities.

- I am holding onto my shares and 2028 notes, expecting Lumen to become a sustainable free cash flow generator.

Ramberg/iStock via Getty Images

Introduction

Lumen Technologies (NYSE:LUMN) is a telecommunications company experiencing a share price surge due to the demands associated with AI technology. Back in September, I wrote about the company’s latest debt exchange offer. Prior to the debt exchange, some Lumen Technologies debt was trading at 20% yields despite the initial share rally. Now, Lumen has made a tender offer on the small amount of near term debt coming due. While the company’s debt has rallied, I’m planning to hold my near-term debt to maturity and not participate in the tender offer.

FINRA

Lumen Technology Earnings Results

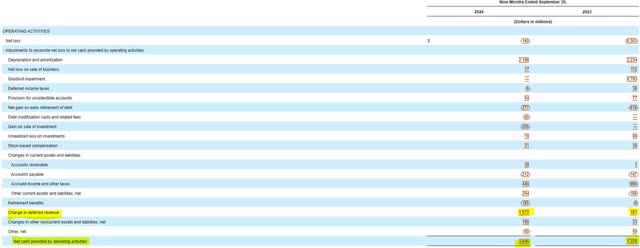

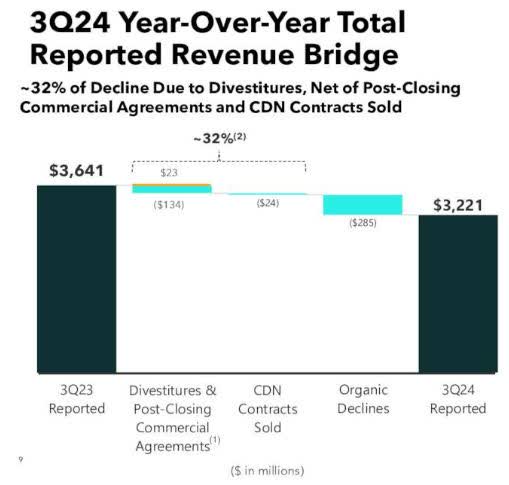

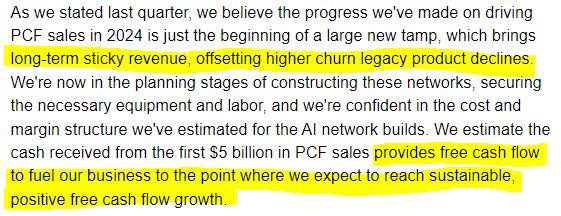

When taking a surface level examination of Lumen Technology’s third quarter earnings, investors may think that the company’s earnings are mismatched against their stock performance. Lumen’s third quarter revenue declined by more than $400 million to $3.2 billion compared to the same quarter a year ago. While one third of the sales decline was associated with divestitures, the other two-thirds, or $285 million, was associated with organic declines to the business.

Earnings Presentation

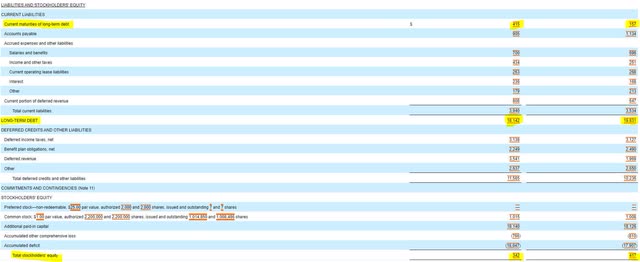

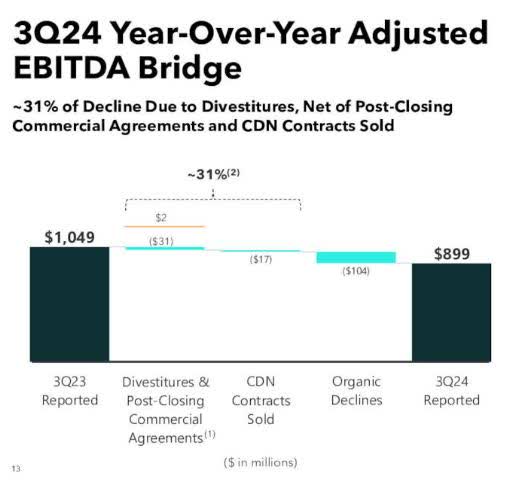

From an EBITDA standpoint, Lumen saw similar trends. Third quarter EBITDA fell from $1 billion to $899 million compared to the same period a year ago. 31% of the EBITDA decline was associated with divestitures, with the remaining $104 million due to organic declines. Lumen has generated a net loss of $140 million through the first three quarters of 2024 as the company’s interest expense was greater than its operating income and led to the net loss.

Earnings Presentation

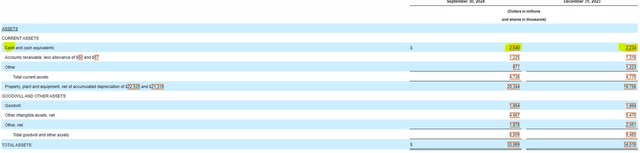

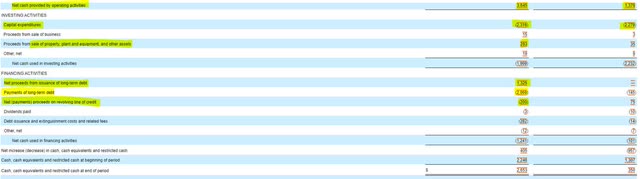

Lumen’s balance sheet has had a couple of positive developments during 2024. First, the company’s cash balance has grown from $2.2 to $2.6 billion. The cash balance combined with $738 million of borrowing capacity under Lumen’s revolving credit facilities gives the company more than $3.3 billion in liquidity. Thanks to Lumen’s efforts to restructure debt, long-term debt has dropped from nearly $20 billion to $18.6 billion (when including current maturities). Shareholder equity has dropped from $417 million to $342 million.

Cash Flow—The Key to Lumen Technology’s Future

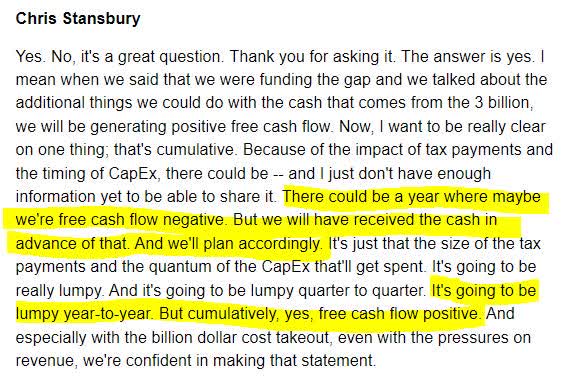

While Lumen Technology’s declines in sales and earnings tell a part of the story, the cash flow statement shows a broader picture about what is happening. Lumen’s operating cash flow has surged from $1.4 billion to more than $3.6 billion due to the growth in deferred revenue and changes in accrued income and taxes. The deferred revenue is related to the large sales that Lumen announced related to AI that it has already cash proceeds from.

The sales deals being announced by Lumen require upfront payments that will amortize over several years. According to management during the conference call, the current sales are sufficient to build a bridge to sustainable free cash flow even if the trend is a little lumpy. The surge in operating cash flow has allowed Lumen to grow free cash flow to $1.3 billion so far this year. The company’s free cash flow growth has allowed Lumen to extinguish debt and make the recent tender offer.

Earnings Call Transcript Earnings Call Transcript SEC 10-Q

The Debt Outlook

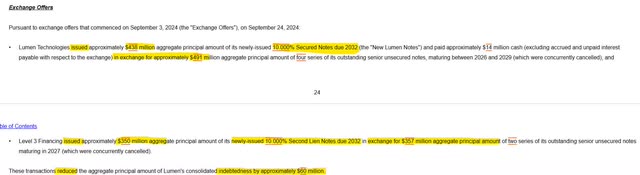

During the third quarter, Lumen engaged in another exchange offer, where $788 million in two separate 10% coupon secured notes due in 2032 were issued in exchange for $848 million in various unsecured notes. The result of the debt exchange left Lumen not facing significant maturity until 2028 when $1 billion of debt is due. Over the next three years, the company has a combined less than $1 billion debt maturing.

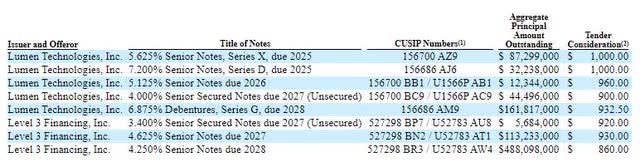

Last week, Lumen moved to address the small amount of near term maturities by making a tender offer on various notes due between 2025 and 2028. The tender offer pays par value for 2025 maturities, offers 96 cents on the dollar for the 2026 maturity, between 90 and 93 cents on the dollar for 2027 maturities, and 86 to 93.25 cents on the dollar for the 2028 maturities. The offer covers nearly $1 billion in maturities and would be a great use of free cash flow if holders of the various notes consent.

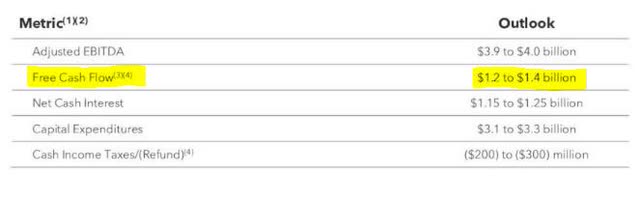

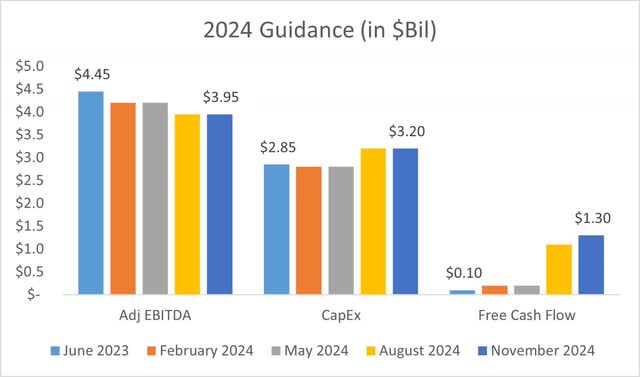

Guidance Outlook

Lumen Technologies also updated its 2024 guidance with some improvements. Management affirmed its $3.95 billion adjusted EBITDA and $3.2 billion capital expenditures targets. Free cash flow guidance was increased to $1.3 billion, a far improvement from $100 million provided back in February. The company’s 2025 guidance will be issued with the fourth quarter’s earnings in February, and I believe that guidance release will be more important than the earnings results.

Earnings Presentation Previous Quarters Guidance

Conclusion

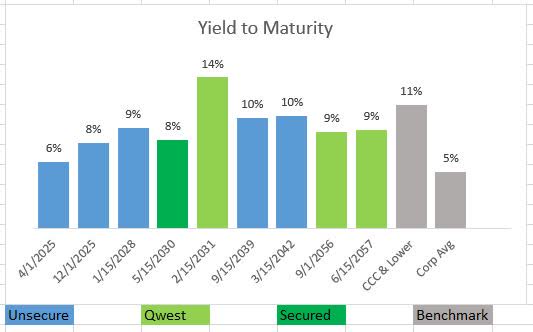

I am holding the 2028 notes that have received a tender offer and I will not be participating, despite the run-up in price. The bonds still hold a 10.5% return potential to maturity for January 2028. I’m also holding onto my shares. I’m not seeing a better opportunity to reallocate my investment. Lumen Technologies is about to turn into a sustainable free cash flow generating machine and will begin addressing high yielding secured debt once this tender offer has passed.

CUSIP: 156686AM9

Price: $90.32

Coupon: 6.875%

Yield to Maturity: 10.54%

Maturity Date: 1/15/2028

Credit Rating (Moody’s/S&P): Caa3/CCC-

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUMN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own Lumen debt maturing in 2028 and 2039.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.