Summary:

- Lumen Technologies, Inc.’s stock surged on deals with Corning and Microsoft, but these are supplier and partner deals, not major customer agreements.

- Despite investing in fiber network capacity for AI traffic, Lumen’s financials remain weak with ongoing revenue declines and high debt levels.

- Lumen’s recent rally is unwarranted, and investors should be cautious as the company is unlikely to see significant sales growth or positive cash flows.

filistimlyanin/iStock via Getty Images

Over the last week or so, Lumen Technologies, Inc. (NYSE:LUMN) has exploded higher to levels the $1 stock hadn’t seen in a couple of years. The telecom network provider has burst higher on some apparent excitement over partners and agreements with technology providers, though the excitement appears highly misguided. My investment thesis remains ultra-bearish on the stock following the big rally above $4.

Unwarranted Rally

The best case for the massive surge by Lumen has been the combination news of a deal for acquiring fiber from Corning Incorporated (GLW) and partnering with Microsoft Corporation (MSFT) on cloud and network usage. In both cases, these companies are suppliers and partners, not necessarily big customers of Lumen.

The deal with Corning involves Lumen reserving 10% of Corning’s global fiber capacity for the next two years. These fibers interconnect AI-enabled data centers where demand is surging, allowing Lumen to double the U.S. intercity fiber miles to increase the capacity needed by major cloud data centers like those owned by Microsoft.

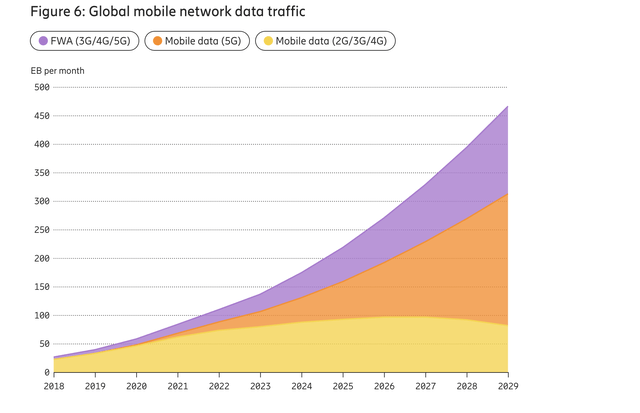

Ericsson has a mobility report highlighting how wireless data traffic has soared to sub-50 EBs per month to triple the rates currently. The total is headed to 466 EB per month in 2029.

The problem with Lumen for years now is that data usage has been soaring from higher Internet traffic due to growing wireless traffic from 5G and FWA deployments. The network company already claims the largest ultra-low-loss intercity fiber network in the U.S. Lumen spent $3.1 billion on capex last year, and revenues dipped 12% during the March quarter, with the majority of the dip due to organic sales declines.

Lumen gaining access to purchase the fiber network materials from Corning isn’t the same as customers being willing to pay a premium price for access to the updated fiber network enhanced for AI traffic. The telecom company is forecast to continue reporting ~5% dips in revenue through 2025 due to customers generally only moving to higher capacity networks at the same cost as prior networks.

The company is partnering with Microsoft in a combination of where Lumen helps Microsoft with network access for growing AI demand and Microsoft provides Lumen with Azure cloud services. Again, this is a partner/supplier deal and not a situation where Lumen has announced any details on Microsoft being a major customer. The press release even suggests Microsoft is helping invest in the AI network, while the only financial details provided were Lumen saving a measly $20 million in cash flow by utilizing Azure.

Weak Financials

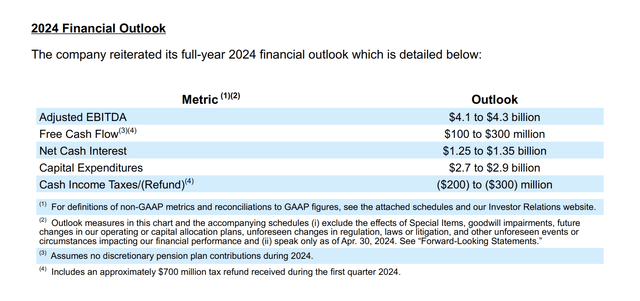

When Lumen last offered updated guidance on April 30, the company was still guiding towards only slightly positive cash flows for the year. Lumen was already planning on spending an estimated $2.8 billion on capex for 2024 with the expectations for 5% revenue declines going forward.

Source: Lumen Q1’24 earnings release

The telecom had to recently re-negotiate debt to obtain access to additional liquidity of $2.3 billion. Lumen has a net debt balance topping $17 billion and is currently spending $1.3 billion on Internet expenses annually, while cash flows are precariously low when including an ~$700 million tax refund.

The company will report Q2 ’24 results on August 6. Lumen won’t be able to provide a positive outlook based on AI when the supply agreement with Corning was just signed and networks take time to build. Plus, the supply agreement was for a 2-year period, possibly suggesting Lumen can’t even access the fiber network materials needed now.

Lumen provided no indication of any infection point in network demand over the coming months when reporting Q1 results. The company reiterated 2024 expectations and generative AI boosted network demand started over 18 months ago, so our view is very skeptical of Lumen suddenly seeing AI demand lead to material sales growth.

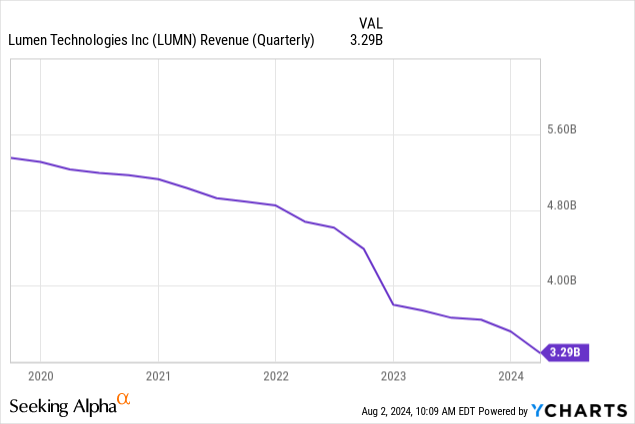

The more likely outcome is the telecom investing in the network in a desperate attempt to maintain sales. Lumen continues to lose legacy revenues at an alarming rate. In fact, since the launch of generative AI in late 2022, the telecom network company has seen the following revenue trends only worsen, partly due to divestitures.

If anything, sales have only weakened further. Investors have no reason to get so excited about a turnaround in growth when no signal existed in the recent financials or any of the supplier and partner deals.

Takeaway

The key investor takeaway is that investors must take the big recent gains in Lumen and run. The big rally is unwarranted, and the company is likely to remain in a position of declining sales and struggling to generate positive cash flows.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start August, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.