Summary:

- Luminar Technologies, Inc. continues to face delays in revenue growth due to production issues with Volvo, falling short of quarterly revenue targets.

- Despite struggles, the Luminar Semiconductor unit shows promise with over 100 customers and $100+ million in external lifetime orders.

- The company raised $100 million in capital and extended debt maturities, but faces challenges with high interest rates and the need for additional funding to reach profitability.

- Luminar Technologies stock has fallen to a fraction of the nearly $4 billion order boo.

Rasica

Following acknowledgement of a general customers push-out of Lidar demand by 1 to 2 years, Luminar Technologies, Inc. (NASDAQ:LAZR) has plunged to new lows. The company remains full speed ahead on Lidar development and in production mode now despite the stock weakness. My investment thesis remains ultra-Bullish on the stock despite the disappointing scenario playing out right now.

Source: Finviz

Struggling To Launch

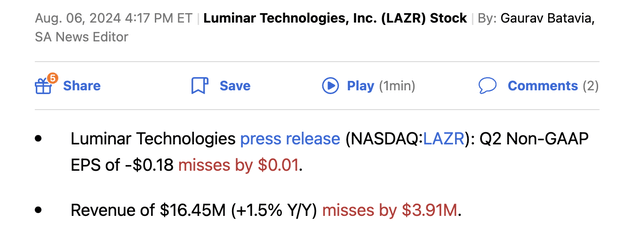

Luminar reported the following disappointing Q2 ’24 results, with revenue growth failing to materialize as forecast:

The launch of the Volvo EX90 vehicle with Lidar installed was supposed to push Luminar towards $35 million in quarterly revenues in the 2H of the year. Volvo initially delayed the launch until Q2, and now the company has reported a slower ramp up in production than expected.

Luminar still expects big business from Volvo with the South Carolina factory built with a capacity of 150,000 vehicles per year in combination with the S60 sedan, but the company won’t hit the $35 million quarterly revenue target until next year. Management did provide some interesting views on the rest of the business, including the Luminar Semiconductor unit.

On the Q2 ’24 earnings call, CEO Austin Russell seemed to make multiple indications of a stronger business than on the surface, as follows (emphasis added):

Luminar Semiconductor Inc., which what it was calling LSI, now has over 100 unique customers, including top technology companies, defense contractors, aerospace businesses, among others, with our chip technologies live everywhere from satellites to GPUs right now. As a result of this success, we’ve now achieved an estimated external lifetime commercial program value in the nine figures from our internal forecast and breakeven status on the business.

The CEO appears to suggest the Luminar Semiconductor unit has over 100 customers with $100+ million in external lifetime orders for a business not really factored into the stock valuation. Heck, Luminar has listed nearly $4 billion in order backlog and that hasn’t helped the stock either.

Luminar only reported Q2 revenue of $16.5 million and guided to Q3 revenues in the similar range. While this is far above zero, the Lidar company still isn’t at the hundreds of millions in annual revenues expected by now.

Regardless, Luminar is still working with Mercedes-Benz Group AG (OTCPK:MBGAF), Polestar Automotive Holding UK PLC (PNSY) and Nissan Motor Co. (OTCPK:NSANY) to advance various levels of full self-driving (“FSD”) technologies along with a software and insurance business. The main issue is the market’s lack of confidence in the Lidar companies due to the sales struggles and Tesla (TSLA) constantly suggesting full self-driving can occur without Lidar sensors.

The investment story hasn’t changed, with the CEO continuing to highlight the opportunity as follows:

And you see the pipeline not only with our close to $4 billion order book, but the 20 vehicle lines that we’re launching over the next few years.

The Volvo SOP was supposed to give the market more confidence in the business. Volvo is still set to ramp up US production by year-end and start China production as well. Luminar gets ~$1,000 per vehicle, so a production ramp will dramatically boost revenues rapidly and some indication existed for the ramp to occur by Q4.

Crucial Capital Update

Luminar made a big deal to address the outstanding convertible debt and raise additional capital. The stock plunged despite the company extending existing debt to 2030 and raising an additional $100 million in capital with senior notes and taking a $148 million discount off ~$422 million of the 2026 convertible debt.

The Lidar company has a target for ~$240 million in capital at year-end now, up from a prior estimates of $150 million, to push the company through 2026 where the business will be much stronger. The biggest issue is some possible requirements to raise an additional $100 million in capital to reach profitability and the additional interest expenses going forward.

Of course, the debt conversion came at a cost of much higher interest rates. The 2026 Convert had an interest rate of 1.25% and the 2030 Converts have interest rates of 9.0% and 11.5% while the new Senior Notes have a whopping effective interest rate of 14.3%.

The new capital gives Luminar some more time to right the ship and get other vehicle models into production, along with the Volvo EX90 reaching volume ramps towards year-end. The Lidar company will hopefully be able to raise additional capital in the future at more attractive rates.

The stock is now under $1, so the biggest risk to the story is the capital crunch while the stock price is beaten up. The Lidar company has to materially improve revenues before the market will regain confidence in the large order book and additional business opportunities.

Takeaway

The key investor takeaway is that Luminar Technologies, Inc. is an appealing stock, trading at a fraction of the massive order book. The market no longer has confidence in the business providing the opportunity when the view is the darkest. Naturally, risk exists the Lidar company will constantly struggle to turn the order book into revenues and the stock will only sink lower on the higher interest expenses hangover.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LAZR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start August, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.