Summary:

- Luminar Technologies’ Q2 results showed a 22% sequential revenue decline, along with more large losses and cash burn.

- The company’s share count continues to surge due to a variety of items, and the balance sheet needs further help.

- A new debt deal was announced to help push back some maturities, but it is very costly in the near term.

Paul Bradbury/OJO Images via Getty Images

Investing in new technology companies can be very frustrating. A lot of times, there seems to be a great future ahead, but things don’t always work out on time. A good example of this is automotive technology company Luminar Technologies, Inc. (NASDAQ:LAZR). The LIDAR firm has continually missed growth targets for its large revenue ramp, sending shares crashing in recent years. After the bell on Tuesday, the company announced the latest delay in its plans, along with weak Q2 results, and provided a major financing update.

Previous coverage on the name:

A few months ago, I discussed how pressure was rising for Luminar, especially after Q1 revenues were not good. The company’s large losses and resulting cash burn were putting a strain on its balance sheet, which I said needed to be addressed in a major way. Investors were also being diluted heavily over time, through a combination of stock payments to employees and management, an equity sales program, and Luminar using shares to pay its vendors.

Luminar shares have risen two cents since my prior article, which actually is better than the couple of percent decline we’ve seen in the S&P 500. Of course, this is just a small recovery that puts the name still down almost 37% since I went to a sell rating. After soaring into the low $40s back in late 2020, Luminar shares closed Tuesday at just $1.41 per share.

The Q2 report:

Tuesday afternoon, Lumen reported second quarter results after the market closed. For the fourth straight quarter, the company missed analyst revenue estimates, coming in at just $16.45 million, nearly $4 million below the street. Management stated in the press release that the Q2 result was “consistent with guidance for revenue to potentially be lower QoQ”, but a 22% sequential decline seems a lot weaker than that.

The biggest problem currently is that Luminar continues to lose giant sums of money. The cost of sales was nearly $2 for every dollar of revenue, and GAAP operating losses of $127 million (including $6.26 million of restructuring expenses) were several times the company’s revenue figure. The company burned through another $78 million of cash in the period, yet management said most of its key milestones are on track to be met or beat in 2024.

Unfortunately, due to the revenue result for Q2 and a slower than expected vehicle series production ramp, management updated its yearly guidance as seen below. As a point of reference, the company finished the second quarter with $211.3 million in cash and marketable securities, along with a $50 million line of credit executed in Q1’24 that has not been drawn upon.

-

Revenue: With a slower anticipated series production ramp, Luminar is shifting its outlook for a revenue run-rate in the mid-$30 million range from 2H’24 to now in FY’25.

-

Cash & Liquidity: Due to the announced capital structure actions, Luminar is increasing its guidance for YE’24 Cash & Liquidity from >$150 million to >$240 million, which still includes the $50 million line of credit obtained in Q1’24 that remains undrawn.

-

Q3’24 Revenue: Luminar expects Q3’24 revenue to be in line with to modestly higher versus Q2’24, as a QoQ increase in series production volume is offset by a QoQ decrease in revenue from a non-series production customer for a contract expected to be renegotiated.

Going into Tuesday, analysts were expecting almost $30 million in Q3 revenue, so this latest guidance seemingly falls well short of that. Back in late 2022, analysts were expecting about $769 million in revenue from the company in 2025, and that number stood at just $222 million as of Tuesday. With this latest mid $30 million run-rate timeline being pushed back, the street is going to cut future revenue estimates even more.

Some needed, but costly, new funds:

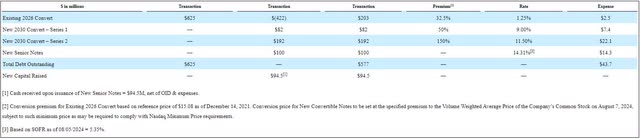

With continued cash burn putting pressure on the balance sheet, Luminar was likely to need funds sooner rather than later. An announcement on that came on Tuesday, with the company exchanging some of its 2026 notes for new debt maturing in 2030, along with a new series of notes due by 2028 at the latest. In the graphic below, you can see the key details.

Luminar Debt Transaction (Company Press Release)

The good news here is that Luminar cut the face value of its total debt by nearly $50 million, along with pushing out the maturity of a few hundred million by a number of years. It also brought in some fresh capital that will help it get through the next couple of quarters. The bad news is that the debts here are extremely costly, with the company’s annual coupon interest expense going from less than $8 million to more than $43 million based on the current SOFR.

One of the key problems for investors over time has been the significant dilution I referred to above. While we don’t have an updated share count just yet, the company issued another $4.4 million in stock to vendors in Q2 and raised over $18 million through its equity sales program. The share count used for the loss calculation in Q2 was up by almost 30 million to 454 million as compared to Q1.

A look at the valuation here:

As of Tuesday’s close, shares were trading at about 2.7 times their expected 2025 revenue, although the actual valuation is a bit higher when you include more potential dilution coming. A comparable name like advanced driver assistance system company, Mobileye Global Inc. (MBLY), goes for a little less than 5.5 times its projected 2025 revenues. Mobileye doesn’t offer the same projected amount of revenue growth (on a percentage basis), but it does have a very strong balance sheet and decent free cash flow.

Going into Tuesday, the average analyst price target on Luminar was $4.61, implying tremendous upside from current levels, but that was down another 4 cents from my previous article. The street is banking on the company actually converting its large order book into sales, which could eventually make this company worth a few billion dollars if all goes right. The average target though was just under $30 about three years ago, showing how continued problems with execution have resulted in the bear camp taking over.

Final thoughts / recommendation:

Luminar’s debt transaction on Tuesday may have helped the company’s long-term future, but the Q2 results showed more troubles in the short term. Another sizable revenue miss was reported, and the company pushed back its revenue growth plan. Large losses and cash burn are continuing, and while things could improve eventually, there will be more struggles first.

Until this company gets its act together, I am going to continue to rate the stock as a sell. While analyst revenue estimates have been slashed over the last 2 years, they now are set to go another leg lower. The debt deal helps out in the long run, but it is very expensive, and the balance sheet still could use more help. With significant dilution already occurring over time, I can’t get on board here until things really start to improve.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.