Summary:

- Luminar Technologies has seen shares drop almost 79% in the past year due to revenue misses, large losses, and cash burn.

- Q1 results showed decent revenue growth but missed top line estimates for the third quarter in a row.

- Despite potential, Luminar has not executed to date and may need more capital to fund their growth plan.

BeritK

Over the last year, one of the worst-performing stocks in the market has been automotive technology company Luminar Technologies, Inc. (NASDAQ:LAZR). The LIDAR firm has seen its shares drop almost 79% in the past twelve months as it has continued to miss revenue growth targets while recording large losses and cash burn. While the company continues to detail a potentially promising future, pressure is rising for this management team to finally execute its ambitious growth plan.

Why I was bearish earlier this year:

I turned negative on Luminar back in March after the company announced a large revenue miss for its fiscal Q4 period. A $22 million sales quarter missed street estimates by more than $5 million, and guidance for later this year implied that full year numbers wouldn’t be as strong as hoped. The initial production ramp of the Volvo EX90 had been delayed, pushing back Luminar’s sensor sales revenue surge. I also continued to worry about major ongoing dilution that was piling up quarter after quarter.

Between falling revenue estimates and increasing stress on the balance sheet, shares have dropped more than 35% since I last covered the name. This is despite the fact that a lot of tech names, especially those focusing on artificial intelligence, have been soaring to new highs. Luminar sees itself as a potential key there in the auto sector, not only trying to make vehicles safer, but providing a potentially necessary backbone for truly autonomous vehicles in the future.

Q1 results have not turned the tide:

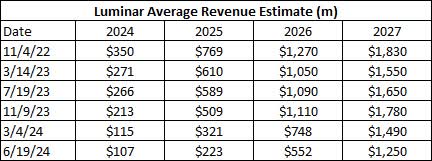

Back in early May, Luminar reported its fiscal Q1 results, and they did little to spark enthusiasm for the stock. While revenues jumped more than 44% over the prior year period, they slightly missed street estimates, the third quarterly miss in a row. Management reiterated its revenue forecast for a mid $30 million run rate in the second half of the year, but analysts seem a little skeptical. In the table below, you can see how revenue estimates for this year and the next three continue to come down significantly.

Luminar Revenue Estimates (Seeking Alpha)

With such a small revenue base, Luminar has actually been reporting negative gross margin dollars. While things are improving and expenses are coming down, the operating loss in Q1 of more than $125 million was roughly six times the amount of revenue generated. Losses should come down as revenues ramp and cost savings efforts pay off, but this is a scary income statement to look at currently.

The reason why investors have so much hope for Luminar in the future is its potential revenue backlog. The company in its Q1 shareholder letter mentioned a $3.8 billion order book, of which only 2% is expected to be converted to sales this year. That percentage is forecast to accelerate next year, as Luminar stated there are more than 25 commercial programs to follow after the EX90 launch. Management stated that it expects to ship five times more LIDARs in the second half of this year than in its prior 10 years combined. Timing of course remains a main issue, especially on the electric vehicle side, as we’ve seen a number of automakers face numerous delays in their production plans and cut back on EV investments in the near term.

Balance sheet needs some help:

Luminar finished last year with about $290 million in cash and investments on the balance sheet. The company also has $625 million of principal debt, but it doesn’t mature until late 2026. This debt could eventually be converted to equity, but the initial conversion price on the deal was almost $20 a share, more than 13 times what shares trade at currently.

This year, the company expects to burn another large amount of cash. As detailed in the above shareholder letter, total cash and liquidity are expected to finish 2024 above $150 million, but that includes the $50 million credit line that was obtained earlier this year. This cash burn pace would likely lead to some financial troubles sometime next year if some decent improvement is not shown rather soon.

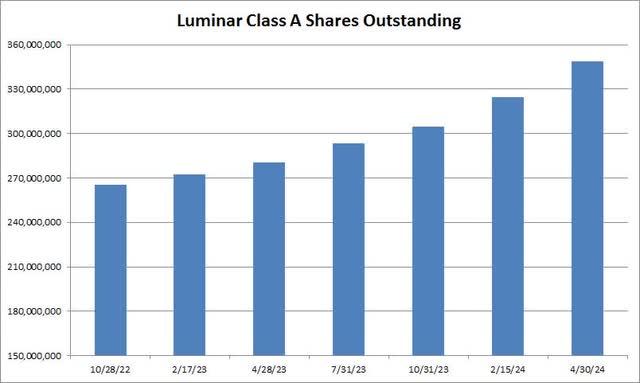

I stated previously that an equity raise here would certainly help, although it becomes more painful as shares continue to decline. The market cap here as of Tuesday’s close was less than $650 million, so a raise of even $100 million would be a large chunk of dilution to swallow. This is on top of the ongoing dilution from stock-based compensation and vendor payments already being seen. As the chart below shows, the Class A share count has already risen by more than 33% in about 18 months.

Luminar Shares Outstanding (Company Filings)

Valuation hasn’t really improved:

When I last covered Luminar, shares were trading at about three times their expected 2025 revenue. The actual valuation is a bit higher when you include more potential dilution coming, and that’s not even counting an equity raise. A comparable name like advanced driver assistance system company Mobileye Global Inc. (MBLY), went for a little less than 8.3 times its projected 2025 revenues. Mobileye doesn’t offer the same amount of revenue growth (on a percentage basis), but it does have a very strong balance sheet and decent free cash flow. Because I previously had a hold rating on Luminar below two times sales, I downgraded shares to a sell at nearly three times back in March.

Even with Luminar shares dropping considerably since my previous article, the name still goes for almost 2.9 times the expected 2025 sales. Mobileye has also seen its valuation come down by about a tenth of a point on price to sales since then. However, Luminar has seen its 2025 revenue estimate average come down by more than 30% over the past three months, while Mobileye’s sales estimate average is down just 2.6% over that time.

Going into Thursday, the average analyst price target on Luminar was $4.65, implying tremendous upside from current levels. The street is banking on the company actually converting that large order book into sales, which could eventually make this company worth a few billion dollars if all goes right. The average target though was just under $30 three years ago, showing how continued problems with execution have resulted in the bear camp taking over.

Final thoughts/recommendation:

As the Luminar revenue growth story has taken longer to play out than expected, shares have cratered over the past year. While the start of production for the Volvo EX90 will help sensor sales in the back half of this year, revenue estimates for Luminar continue to come down. The company is also reporting large losses, which is leading to a significant cash burn that needs to be addressed in the coming quarters.

Until there is some significant progress made here, I have to continue my sell recommendation. An equity offering could result in meaningful dilution, and a reverse split could be another negative catalyst if shares were to fall below a dollar. Should we finally start to see revenue estimates level off and the company makes a move to bolster its balance sheet, we can then talk about a new rating for this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.