Summary:

- Luminar Technologies reported disappointing Q4 revenues, missing Street estimates by over $5 million.

- Analysts have slashed their revenue estimates for the company, pushing the potential growth story further out into the future.

- Luminar’s cash burn rate and increasing share count contribute to concerns about the company’s financial health and valuation.

Cecilie_Arcurs

Back in November, I covered the promising potential future of automotive technology company Luminar Technologies (NASDAQ:LAZR). The company boasted a large potential order book and was getting ready to see its revenue growth really take off. Unfortunately, the company’s Q4 report was very disappointing, so the story here will take much longer to play out.

Last week on February 27th, Luminar reported just over $22 million in Q4 revenues when it reported its quarterly results. While that number was basically double what was seen in the year ago period, it badly missed street estimates by more than $5 million. The company’s revenue picture fell short of expectations last year due to the delayed launch of the Volvo EX 90, as well as a shift in manufacturing capacity and engineering resources for industrializing its Iris and Iris+ platforms.

The company has spent a lot of money to build out its production base for when automotive and commercial partners are ready for their launches. The revenue miss in Q4 also led to a larger than expected loss, as management couldn’t quite reduce costs in tandem. The one bright spot was that quarterly cash burn came down to $53.6 million in Q4, a more than $7 million improvement sequentially and about $26 million year over year. The company’s goals for 2024 can be seen below.

Luminar 2024 Plans (Q4 Shareholder Letter)

Luminar’s biggest strength may also be its biggest risk. There are those who are skeptics of LIDAR, like Tesla (TSLA) CEO Elon Musk who believes there are better ways to autonomy currently. New technologies take time to develop, as we’ve seen with Luminar’s delays to date. The company’s initial sales surge is based on Volvo, which isn’t one of the major electric vehicle players right now. The EX90 that Luminar constantly talks about is a premium vehicle, starting at more than $75,000, so we’re not yet talking about a mass market EV like the Tesla Model 3 or Y.

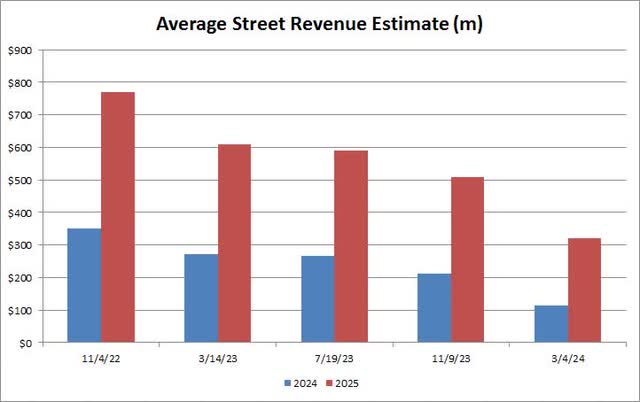

I mentioned in my previous article that the company has continued to miss street expectations, leading analysts to slash their revenue estimates. That trend continued last week, which is part of the reason why I’m cutting my rating on shares today. Management expects to achieve a quarterly run rate of revenue in the mid-$30M range following its expected start of production and ramp with Volvo in the second half of 2024. Unfortunately, street analysts were looking for over $185 million in revenues this year, so estimates have continued to drop as seen in the chart below.

Luminar Revenue Estimates (Seeking Alpha)

In the last 16 months, the average cumulative revenue estimate for 2024 through 2027 has dropped from $4.220 billion to $2.674 billion. This still assumes that the top line at least doubles in 2025, 2026, and 2027. While the company boasts an order book of $3.8 billion, that number is useless if you can’t eventually book those sales.

Management expected to finish last year with more than $300 million in total liquidity. As it turned out, Luminar ended the year with a little less than $290 million, and it has recently taken out a $50 million credit line. While cash burn rates came down throughout the year, the company still burned through almost $270 million last year. Another equity raise here wouldn’t be a surprise, although it will be more painful as shares have dropped.

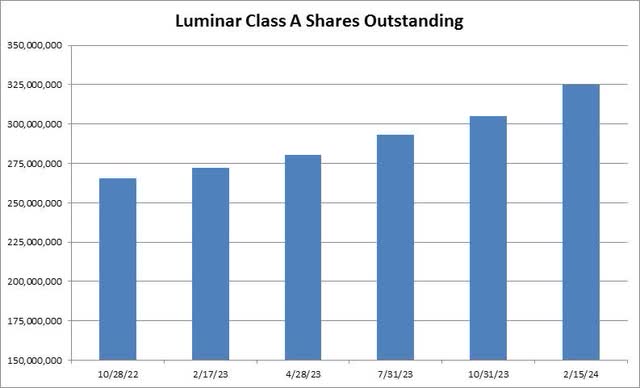

This cash burn over time has combined with a few other items to send the company’s Class A (trading stock) shares outstanding much higher as seen below. Last year, over $207 million was reported on the cash flow statement for stock based compensation, and the company reported another nearly $51 million in stock payments to vendors in lieu of cash. The Class A share count is up over 19.3% in just the past twelve months, with more dilution coming.

Luminar Shares Outstanding (Company Filings)

Beyond the revenue disappointment, the other reason I’m downgrading shares today is valuation. Since my previous article, Luminar shares have dropped 29% compared to a 16% rise for the S&P 500. However, because revenue estimates have come down much more, the price to sales based on expected revenues for 2025 has shot up from less than 1.9 times to about 3.0 times. A comparable name like advanced driver assistance system company Mobileye (MBLY), goes for less than 8.3 times its projected 2025 revenues, but Mobileye’s number is down about two-tenths since November.

Mobileye doesn’t offer the same amount of revenue growth (on a percentage basis), but it does have a very strong balance sheet and decent free cash flow. Even so, I can’t pay up for Luminar shares after another major revenue disappointment, which is why I am downgrading to a sell today. For me to upgrade back to a hold or even consider a buy, I need to see some of this revenue growth actually come to fruition. I also would like to see another equity raise here to bolster the balance sheet to get through this growth phase.

I am going to wait another couple of quarters to see how the 2024 story plays out before examining my rating again. Previously, I had a hold rating on Luminar shares at 1.9 times sales, and that was before the latest major disappointment. Should Mobileye shares return to around that level or even a little more of a discount, depending on the timing as it relates to the revenue ramp, I would consider upgrading to a hold. However, until Luminar starts to show a bit more progress and gets its financial house in order, I wouldn’t be willing to buy until we get towards that 1 to 1.5 times sales valuation.

In the end, Luminar has announced another sizable sales disappointment, leading me to downgrade the stock to a sell today. Revenues for this year are expected to fall well short of previous expectations, which has pushed the company’s valuation to an unreasonable level. With the balance sheet probably needing some help and the share count continuing to surge, management has a lot more to prove now and the growth story will take longer to play out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.