Summary:

- Luminar Technologies’ stock has fallen nearly 98% from its 2020 peak due to missed revenue targets, large losses, and significant cash burn.

- Q3 revenues were $15.5 million, missing estimates by over $3.5 million, and this marked the fifth consecutive quarter of revenue shortfalls.

- Despite cost-cutting efforts, LAZR’s cash burn remains high, with ongoing dilution coming from stock-based compensation and equity sales.

Kelvin Murray/DigitalVision via Getty Images

Over the last couple of years, one of the worst-performing stocks in the market has been automotive technology company Luminar Technologies, Inc. (NASDAQ:LAZR). The LIDAR firm has seen its shares drop nearly 98% from its late 2020 peak as it has constantly missed revenue growth targets while also reporting large losses and cash burn. Luminar recently reported its Q3 results, and the numbers continue to show significant troubles.

Previous coverage of the name

It was back in August that I most recently covered the name, at which point investors had received another revenue disappointment. Despite dramatically reduced analyst estimates, management couldn’t give an optimistic revenue forecast, and the balance sheet was continuing to weaken. While a capital infusion and debt swap was going to help, it was rather costly, and the company’s share count has been soaring over time.

Luminar shares have risen two cents since my prior article, and that’s after setting a new multi-year low in recent months. The small gain here has lagged the S&P 500’s more than 13% gain by a significant margin, as US markets have recently rallied to new highs. Since I went to a sell rating on the name, the stock price has been cut nearly in half, while the S&P 500 has recorded a gain of more than 17%.

Looking at Q3 results

For the quarter, revenues came in at $15.5 million, down almost 9% over the prior year period, and badly missing street estimates by more than $3.5 million. This was the fifth straight quarter where the top line has missed expectations, despite the street constantly cutting its estimates. Four of those misses have been at least $2.6 million each, which is rather large on a percentage basis when you consider the reported numbers here.

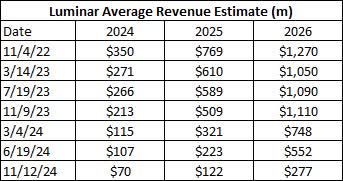

Management has called for Q4 revenues to grow “moderately” over Q3 levels, but the street was looking for over $23 million going into the latest report. While dramatic growth is expected to come in 2025, prior revenue goals have been abandoned. As the table below shows, street revenue estimates have recently hit new low points, with another $414 million plus in cuts for this cumulative three-year period just over the past five months alone.

Luminar Revenue Estimates (Seeking Alpha)

Financial struggles ongoing

Management’s cost-cutting plans are ongoing, but this is still a company that’s deep in the red. The company lost around $105 million in Q3 when excluding impairments and restructuring costs. That’s a more than $15 million sequential improvement, but it’s still several times the amount of revenue that is coming in here. Losses should improve throughout 2025, but Luminar really needs to get its top line going to make the income statement look much better.

Perhaps the biggest issue currently remains cash burn. The company burned over $58 million in Q3, and while that was better than Q2, the share count is surging due to stock-based compensation, an ongoing equity sales program, and paying vendors with stock. Management expects to sell more stock in Q4, and finish the year with $230 million to $240 million of cash. That’s down from its previous $240 million end of year forecast.

Total liquidity at the end of September was over $430 million, but that figure included both a $50 million line of credit as well as $182 million remaining on the equity sales program. With a market cap of just $570 million as of Tuesday’s close, the share count could soar a lot more if that sales plan is fully tapped. Management also stated on the conference call that a reverse split could be coming soon, as the stock trading under $1 for an extended period of time could risk its exchange listing.

The current valuation picture

As of Tuesday’s close, shares were trading at about 4.7 times their expected 2025 revenue, although the actual valuation is a bit higher when you include more potential dilution coming. A comparable name like advanced driver assistance system company, Mobileye Global Inc. (MBLY), goes for a little less than 6.8 times its projected 2025 revenues. Mobileye doesn’t offer the same projected amount of revenue growth (on a percentage basis), but it does have a very strong balance sheet and decent free cash flow.

Going into Tuesday, the average analyst price target on Luminar was $2.04, implying tremendous upside from current levels, but that number has been more than halved since my previous article. The street is banking on the company actually converting its large order book into sales, which could eventually make this company worth a few billion dollars if all goes right. The average target though was just under $30 about three years ago, showing how continued problems with execution have resulted in the bear camp taking over.

Final thoughts and recommendation

Luminar’s revenue struggles continued in Q3, with the company missing street estimates for the fifth straight quarter. While management can continue to talk about better days ahead, revenue estimates continue to be slashed. Cost-cutting efforts are starting to bear some fruit, but are nowhere near where they need to be, and cash burn remains a major problem.

Until this company gets its act together, I am going to continue to rate the stock as a sell. Dilution is piling up by the quarter, and many of the names I’ve covered on this site don’t do well when they have to reverse split their shares. Perhaps if the growth story plays out in 2025 I can look at my rating again, but there are just too many negatives here at the moment for my liking.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.