Summary:

- Luminar Technologies’ stock has crashed and is trading at a fraction of its 2020 price.

- The company has a significant long-term debt burden that may pose challenges in the future, hence the new “asset light” approach.

- Luminar recently announced a deal with Volvo, which could lead to a rise in revenue and potentially improve its cash flow.

gremlin

Luminar Technologies (NASDAQ:LAZR) was one of the highest valuation stocks when the EV hype was at its peak. The stock has crashed back down to earth and is close to all-time lows. This is happening at a time when the company is finally about to bring an actual product out to market. Given that LAZR stock is trading at a fraction of its price in 2020 is now a good time to enter?

Introduction and the Basics of LiDAR

According to the company’s 10-K, Luminar Technologies is a manufacturer and developer of LiDAR sensors specifically for the automotive industry. In simple terms, LiDAR stands for “Light Detection and Ranging” and is a remote sensing technology that works by emitting laser light and measuring its bounces to get an accurate “map” of the environment.

While used for a variety of research purposes, LiDAR’s most promising application is in near-autonomous and full autonomous vehicles. It is one of the primary sensors used for this purpose and is one of the key technologies to achieve autonomous vehicles in the future.

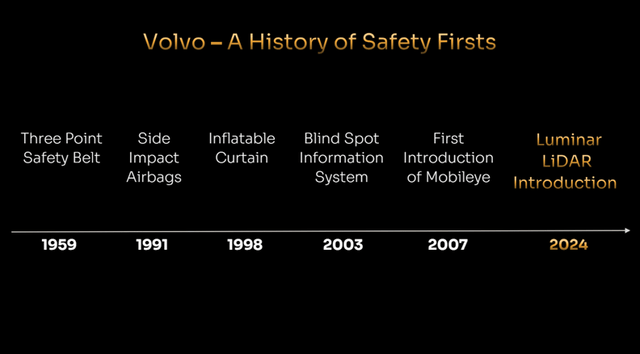

In the near-term, LiDAR can be used to improve the safety of a vehicle by improving object pre-collision warning. It can also be used to improve upon the current generation of advanced driver assistance systems (“ADAS”). For example, the new upcoming Volvo EX90 will make full use of this technology from Luminar making the latter one of the first companies to bring LiDAR technology to the consumer market. It is also important to point out that according to the company’s 10-K.

Historically, we have also faced competition from Tier 1 suppliers that have pursued various LiDAR investments or partnerships; however, many of these efforts have abated over the past year, and a number of Tier 1 suppliers have exited or abandoned their LiDAR development effort

As I will discuss with the Volvo partnership later in this article, this puts Luminar at a competitive advantage as it is among the first movers with this technology.

Investor Presentation (Luminar)

Looking Luminar’s Balance Sheet

For high-flying growth stocks like Luminar Technologies, it is important to examine the company’s balance sheet. We do this to judge the overall liquidity and financial stability of the firm, as high-flying growth companies tend to operate unprofitably and burn cash for many years. Therefore, this is a way of examining just exactly how much runway the company has to execute on its vision.

Luminar Technologies has cash and short-term investments worth $289.8 million. This is against the company’s massive long-term debt burden of $615.4 million. The company also has capital leases of $35.1 million, which can be viewed as a form of long-term debt for manufacturing companies. Adding these together gives a total of $650.5 million. The company’s total assets of $512.4 million do not fully cover its debt burden.

Looking at the company’s long-term debt, virtually all of it is from a single issuance of Convertible Senior Notes done through a private placement. The interest rate on this debt issuance is very low at only 1.25%, which would explain the company’s low interest expense of only $11 million. Simply looking at the numbers may lead you to believe that the company has sufficient cash to cover its interest expense.

However, this may not be true for the long term, as these notes will mature in December 2026. If Luminar needs to refinance it would most certainly have to do so at much higher interest rates because of two factors i) these bonds were issued in December 2021 when interest rates were still low and ii) these bonds have a convertible option for shares at a strike price of $19.98.

Now, for sure, the company can issue another convertible note to refinance this one and get a lower interest rate due to the conversion premium. However, LAZR stock is a lot lower now compared to what it was in 2021. During that time, LAZR stock traded at the $14 to $16 price range. Currently, the stock is priced at $1.68 and is in danger of approaching penny stock territory. Issuing a convertible note in this period of stock underperformance would result in massive dilution for shareholders.

In connection with the offering of the Convertible Senior Notes, the Company entered into privately negotiated capped call option transactions with certain counterparties (the “Capped Calls”). The Capped Calls each have an initial strike price of approximately $19.98 per share

In terms of short-term liquidity, the company has a current ratio of 4.18x and a quick ratio of 3.83x. These are measures to judge whether or not Luminar Technologies can meet its short-term obligations. Given that these values are higher than one shows that Luminar at least has sufficient liquidity in the short term to fund its immediate obligations.

Of major concern and a key risk for me is the fact that Luminar has burned through a lot of cash over the past two years. In 2023, it had a negative $247.3 million cash flow from operations. In 2022 and 2021 this number was negative $208.2 million and $148.4 million, respectively. The rate of the company’s cash burn has been increasing in recent years and if it continues at the current pace, the company’s $289.8 million only allows it one more year of runway. Luckily, there has been few good news for the company that can address some of these concerns.

Luminar Technologies Kicks Off its Growth

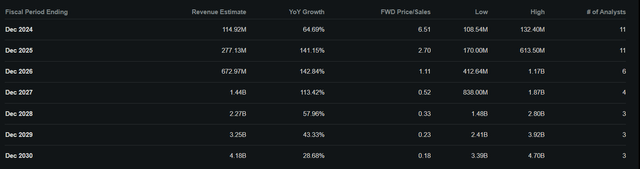

Luminar Technologies recently announced that it will start delivering LiDAR sensors for the Volvo EX90 (VOLV-B). This will be the first time a car intended for end consumers will feature and standardize this technology. This will kick-start a massive rise in the company’s revenue, as the total order book is $4 billion to Volvo and other partners such as Mercedes-Benz (MBG) and Polestar (PSNYW).

More importantly, it is almost like a sign of approval that Luminar can produce high-quality, automotive-grade LiDAR sensors. Volvo has a track record of safety, being among the first to adopt many safety-focused innovations. Luminar has passed two key Run at Rate industrialization milestones for Volvo, demonstrating its capabilities for producing at scale. Management expects to ship “multiple times more product in the second half of 2024 than it has in the prior 10 years”. This is only bound to accelerate from here as self-driving cars come closer to reality. According to Founder and CEO, Austin Russell

The past 10 years of Luminar have all been leading up to this historic moment, and proving what many thought would never be possible. We’ve officially launched in mass production for the first global consumer vehicle with LiDAR, and as standard equipment. …We expect this to kick off a domino effect of dozens of awarded commercial program launches with Luminar, drive economies of scale up and cost down, and unlock mass consumer visibility

Volvo Adopts LiDAR (Investor Presentation)

Luminar Adopts an Asset Light Approach

I believe that the start of the Volvo shipments should alleviate some of the cashflow concerns of the company. As Luminar starts to receive and recognize revenue from the deal, something to watch out for is whether or not the company’s cash flow from operations turns positive. Watching the earnings release for the latter half of 2024 will be key.

However, there still remains the issue of the company’s capital structure. In order to expand, the company will need capital, and it already carries a heavy burden of debt. Luckily, Luminar management is well aware of this and has begun to transition the business into having an “asset light” approach.

The company is laying off 140 employees, or 20% of its workforce, and will rely more on its contract manufacturing partners. Primarily, the company will lean on Taiwanese contract manufacturing firm TPK Holding, which has committed to an “exclusive relationship” with Luminar. This will allow the company to rapidly scale production without heavy capital outlays, something its current balance sheet has difficulty handling. According to management, this restructuring should reduce operating costs by $50 million to $65 million per year.

LAZR adopts Asset Light (Investor Presentation)

Conclusion

The global LiDAR market is expected to grow at a rapid rate of 19.9% CAGR to 2029. It is currently estimated to be $2.57 trillion in 2024. By 2029 the forecast is that it could reach $6.38 trillion. I believe there is a lot of value to be captured in this market by a company like Luminar Technologies, which is a leader in LiDAR technology. As mentioned earlier, apart from Volvo, Luminar has a strong relationship with Daimler, owner of Mercedes-Benz.

As one of the first companies to potentially bring LiDAR technology out of R&D and into global production with this Volvo deal, the company could have a first-mover advantage. I am hopeful that if the Volvo and future Mercedes-Benz LiDAR-enabled models are successful, it will open up business with other OEMs.

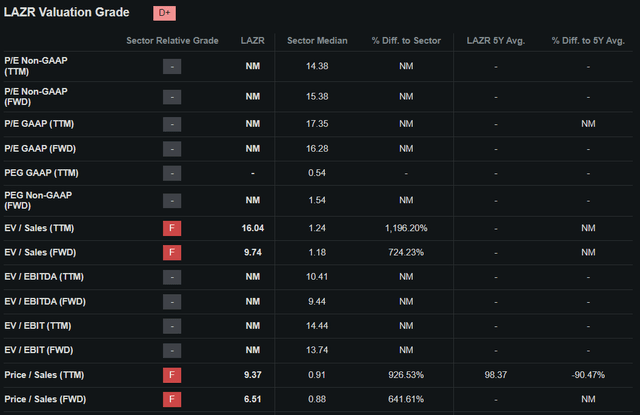

In terms of valuation, based on Seeking Alpha’s quant rankings, it gets a grade of D+. This is not a surprise, as most disruptive hyper-growth stocks tend to be overvalued. This is especially true for a company like Luminar which has had no meaningful revenue and negative income.

However, as noted by the company, prior to the Volvo EX90, most of its sales were primarily for R&D projects. This will be the first time we will see the product in the hands of actual consumers, and it could mean an acceleration of revenue from here. Analysts estimate that the company could have revenues of $672.9 million by 2026 giving it a forward 2026 Price to Sales ratio of 1.11x. I believe that this could be higher assuming Luminar closes additional deals with other manufacturers and/or the market for LiDAR/autonomous vehicles accelerates.

Valuation (Seeking Alpha) Valuation (Seeking Alpha)

The company is now trading at a Market cap of $748.56 million, which is near its all-time low. While I am not sure the stock will head lower from here, I think the company might be worth a speculative buy at these levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LAZR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.