Summary:

- Luminar Technologies, Inc. has reported record quarterly results and announced a SoP with a major Tier 1 auto, but the stock is trading at all-time lows.

- The company missed Q4 ’23 consensus estimates and faced delays in the launch of the Volvo EX90 vehicle with Lidar installed, reducing market trust.

- The stock trades sub-$2 with a market cap of only $750 million, while the order book is a massive $3.8 billion.

The Bold Bureau

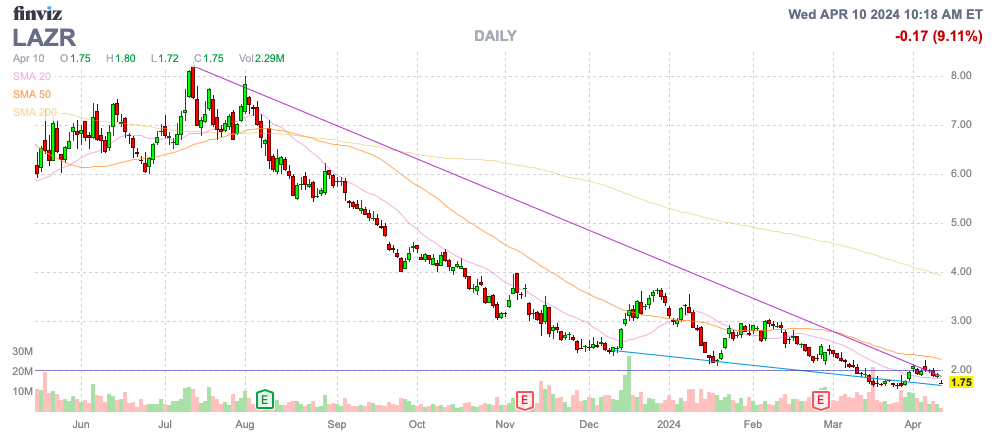

Luminar Technologies, Inc. (NASDAQ:LAZR) has faced a difficult period since going public via a SPAC, but the Lidar sensor company has made a lot of progress. The company recently reported record quarterly results and announced the SoP with a major Tier 1 auto, yet the stock now trades at the all-time lows. My investment thesis remains ultra-Bullish as the Lidar stock starts turning a large order book into actual sales.

Source: Finviz

Not Helping

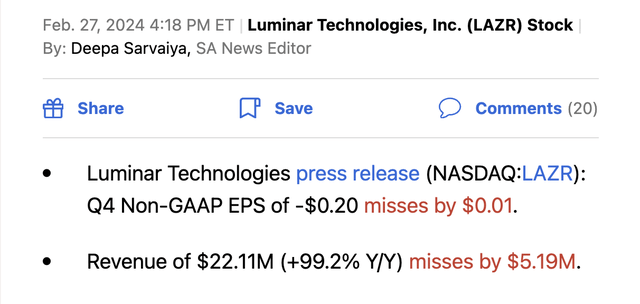

Luminar reported such an ugly Q4 ’23 compared to estimates that the market has appeared to give up on the stock. The company reported the following quarterly numbers:

The company did report that Q4 revenues surged 99% to $22 million, but Luminar missed consensus estimates by over $5 million. These numbers were even downgraded during Q3 due to the delay of the Volvo (OTCPK:VOLAF) EX90 vehicle launch with an Iris Lidar installed.

Luminar missed the targets due to some slower revenue recognition for an Iris+ development contract and partly due to shifting engineering work towards preparing the Iris Lidar for the start of production on the EX90. The vehicle was delayed at least 6 months due to some software issues at Volvo.

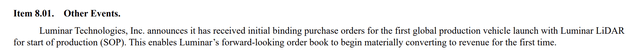

Either way, Luminar not hitting financial targets greatly reduced market trust and has caused investors to entirely ignore an order book of $3.8 billion now. Despite all the promises that SoP was around the corner, investors have thoroughly ignored this 8-K filing announcing the official launch of production, though the actual vehicle wasn’t listed in the SEC filing.

The market doesn’t trust the large forward order books of Lidar companies due to the time delay these orders take to turn into revenues and the lack of any projects actually moving to production until this Luminar deal. As anyone should know, pre-revenue, startup phase type companies always run into timing issues with launching new products, especially something as complex as a new vehicle with new technology.

The key is that once these production deals start, the volumes will roll in and new models will launch with Lidar sensors. Luminar finally has a production deal rolling.

Next Step

Luminar guided to a quarterly run rate in the mid-$30 million range in the 2H, equating to an annualized revenue run rate of $140 million. The number is a far cry from the estimates of where revenues would hit $500+ million in 2025 just going back to mid-2023 targets.

On the Q4 ’23 earnings call, CEO Austin Russell highlighted the exact situation facing Luminar right now (emphasis added):

…if you use the same kind of calculation that then our order book would be $100 billion or something at this point, which is that at that point, it just becomes irrelevant. We’re probably not even, probably still getting a fraction or not much credit at all today for even the order book that we have.

Over the few years of being public, Luminar has constantly highlighted how revenues were set to explode by 2030 as millions, upon millions of vehicles include Lidars for autonomous driving, or even for just advanced ADAS safety. The question hasn’t really been about if, but when, Lidar sensors are included in vehicles.

As the CEO correctly points out, the order book has become virtually worthless due to the stock market entirely ignoring the volumes, considering industry Lidar players constantly fail to hit financial targets and revenues are a small fraction of the order book. At some point, volumes will jump from the few thousand Lidar sensors currently sold each quarter now to millions in the future.

Luminar has a cash balance of nearly $290 million plus a $50 million credit line, so clearly the launch of a production program will vastly change the financial picture of the firm. The worst-case scenario would be the Lidar company needing to raise dilutive financing with the stock under $2 right now, considering the goal is to end the year with a liquidity position greater than $150 million.

The stock only has a market cap of $750 million after this dip, and the revenue run rate should hit $140 million by Q3. Luminar has started Lidar sensor production for the EX90 in Q1 and the Luminar Day on April 23 and the Q1 ’24 earnings report in early May should provide far more positive metrics on financial targets after the EX90 production program has been running for over a month.

Takeaway

The key investor takeaway is that Luminar Technologies, Inc. trades at the all-time lows, yet the business is in full production mode finally. Investors should use the weakness to load up on the stock, setting up for a big second half of the year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LAZR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.