Summary:

- Luminar Technologies, Inc.’s Q3 results were mixed, with product revenue growth but a significant decline in services revenue, leading to a hold rating.

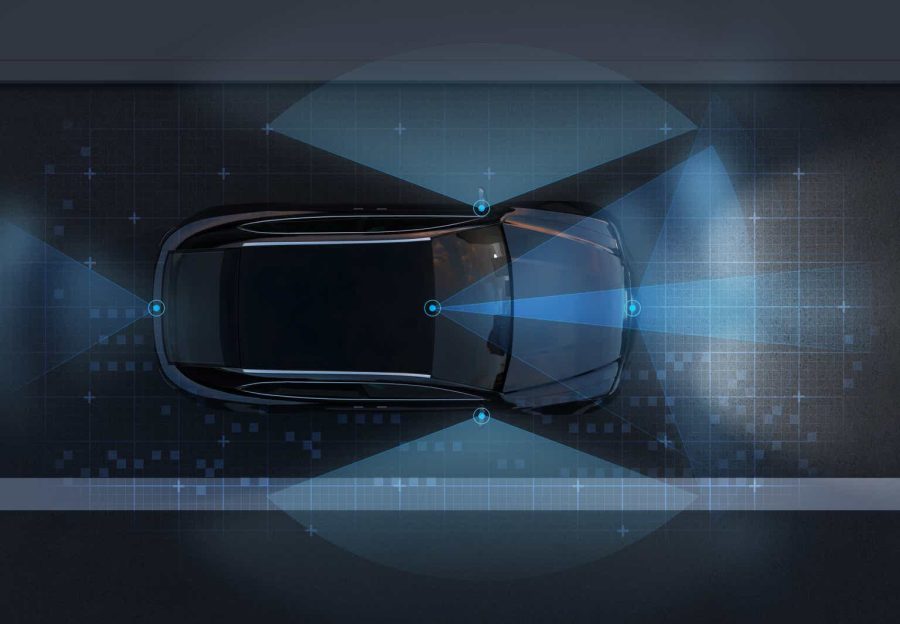

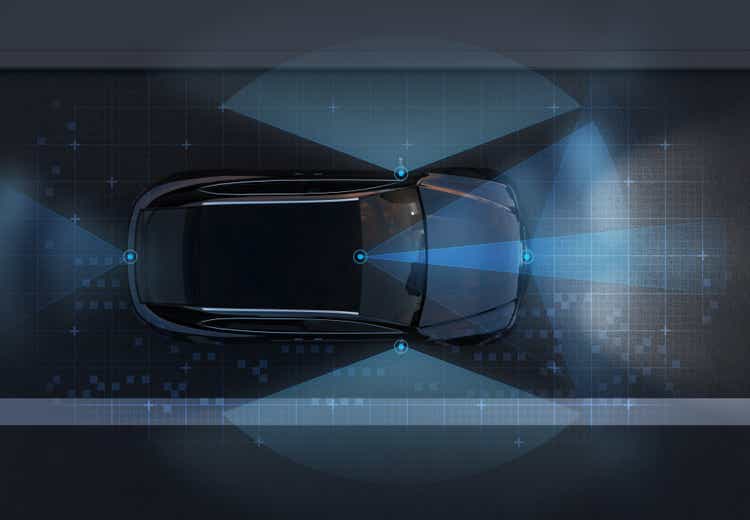

- Luminar has strong partnerships with top auto manufacturers, but demand for its LiDAR technology is still in its infancy.

- Financially, LAZR has substantial cash reserves but also significant debt, and share dilution remains a concern for future capital needs.

- I remain cautious and will monitor the company’s progress in cost-cutting and demand growth before considering a buy rating.

Chesky_W

Introduction

Luminar Technologies, Inc. (NASDAQ:LAZR) recently reported Q3 results, which came in mixed, in my opinion, with slight improvements from a year ago. I wanted to take a look at the numbers in more detail and give some comments on where I stand in terms of the company’s prospects. If the company manages to survive and be the leader in this technology by partnering with more auto OEMs, I can see the company turning itself around and making decent profits eventually. However, I don’t think we are going to see this happening very soon. I am initiating a hold rating.

Q3 Results

The company’s sales came in at $15.49m, -8.7% y/y, and missed analysts’ estimates by $3.57m. Non-GAAP loss per share came in at -$0.16, which was in line with analysts’ estimates.

Looking a little deeper into the numbers, revenues from products came in at $12.6m, up 18% from the same period last year, while the Services segment is the one dragging down the company’s performance with $2.8m vs. $6.2m last year, a 55% decline.

Looking at the company’s efficiency and profitability, gross loss came in at -90% vs -107% last year, so costs have come down slightly from a year ago, however, sequentially, it is slightly worse as gross loss came in at around -83% in Q2. The company’s net income came in at $0.06 due to a gain on extinguishment of debt of $147.3m.

Regarding the company’s financial position, LAZR currently has around $200m in cash, equivalents, and marketable securities against $539m in convertible and senior notes, which has been coming down slowly over time. Interest expense on that debt was around 9m for the quarter, however, is it worrisome? On paper, it looks like it cannot pay its debt obligations, but the company has plenty of cash to keep chugging along until, eventually, costs come down significantly, and if it continues to pay down the debt, it’s a bonus. Net loss has narrowed significantly since last year, so it means the company is progressing in the right direction.

Overall, the results weren’t bad or very good. The headline sales number isn’t as bad as it looks because product revenues have grown, but not as much as I would have liked. For services, there isn’t much room for further declines after this significant drop, so my only worry is the product service reverse course. Although the company’s debt pile isn’t particularly worrisome currently, if operations do not improve considerably, it is difficult to tell what is going to happen, especially if the company runs out of cash. On the announcement, the company’s share price skyrocketed by around 13%; however, people got time to digest the results, and now the company’s share price is up around 4% after-market. The company already had a good day before the market closed as its share price went up 16% for the day.

Comments on the Outlook

If everything goes well, and the company manages to turn a decent profit finally, I could see the company’s value increasing substantially. LAZR already has top auto manufacturers that use the company’s LiDAR technology, like Polestar Automotive Holding UK PLC (PSNY), Mercedes-Benz Group AG (OTCPK:MBGAF), Nissan Motor Co., Ltd. (OTCPK:NSANY), and AB Volvo (publ) (OTCPK:VOLAF), which means the opportunity for performance is there. It is all about the demand for such technology, which we can see is in its infancy.

So, it looks to me like the company has a demand issue. With time, this should change as more and more cars are being built with new technologies in mind, like LiDAR, to help us drive safer all around.

The demand for this technology is indeed increasing, as in the latest earnings call, the company announced that Volvo’s EX90 fully electric SUV features LAZR’s LiDAR technology and expects to meet all key deliverables for the global EX90 production ramp. Furthermore, a major Japanese automaker expanded its advanced development contract with the company. It is just a matter of time before the company sees some boost to its top-line growth.

Speaking of the top line, the company expects Q4 revenues to grow moderately compared to Q3 ’24, so there is nothing too exciting there yet. However, the demand for technology improvements in the future will most likely help the company stay afloat and even thrive if what it offers is indeed quality.

Looking at the next quarter’s efficiency and profitability, the company expects to see gross loss improve significantly, meaning we will see a continual decline in losses, which is good news for the long-term holders. The company’s cost-cutting actions are bearing fruit already, and we could see the company become GAAP profitable in a matter of a few quarters.

Additionally, the company will benefit from a range of different vehicles that are being sold worldwide. It is not locked into only the EV market, for example, which has seen some weakness recently. To offset this sluggish demand for EVs, hybrid vehicles, as well as ICEs, continue to perform rather well.

The company does face some stiff competition in this space, however. Velodyne Lidar is one of the pioneers in LiDAR technology, which offers a wide range of sensors for various applications, not limited to automotive, merged with Ouster, Inc. (OUST) and Innoviz Technologies Ltd. (INVZ), which also develops high-performance LiDAR sensors. Ouster, for example, already got its costs down enough to have a positive gross margin, and it also has a decent amount of cash on hand and about the same amount of debt. It is difficult to tell if all of these companies will be able to survive over the long run. Or if one will be far superior to the other, which will naturally win because no one will want to put an inferior product into their vehicle.

Share dilution is serious for a company like LAZR. To keep itself afloat with so little revenue, the company needs to come up with ways to get more capital. One way it has been down is to offer more shares to the public. It also seems to be accelerating in recent quarters, which is not ideal, however, if costs come down substantially, I could see this slowing down, too.

Investor Takeaway

The company’s share price is quite attractive right now if the widespread adoption of LiDAR technology takes place and the company begins to see an acceleration in revenues. I am not going to assign it a buy rating for now because I would like to see what kind of cost savings we are going to see in the next quarter. I would like to see the company’s demand for the sensor pick up significantly to the point where the costs are dwarfed by the sales.

As the world continues to advance car safety, we will see partial automation, or Level 2, and conditional automation, level 3, becoming a lot more popular. If Luminar Technologies, Inc.’s LiDAR product manages to compete and gain more partnerships with major auto OEMs, the future is bright for LAZR. However, I don’t think it is going to happen any time soon, which means I am going to remain on the sidelines for now. I will continue to monitor the progress and tune into the following quarters to see how well the company is doing in its restructuring plan.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.