Summary:

- LAZR’s share price weakness presents an attractive entry point for investors, as the focus on overall EV production has overshadowed LAZR’s strong execution.

- LAZR has achieved key milestones for FY23, including production ramp-up with Volvo and passing initial production audits, indicating its ability to execute.

- Although the order book fell short of the original target, LAZR has outperformed on a like-for-like basis, and its cash flow situation is expected to improve with upcoming production and a new credit line.

gremlin

Investment action

I recommended a buy rating for Luminar Technologies (NASDAQ:LAZR) when I wrote about it the last time, as execution was on point and the business was working well towards its FY30 targets, notably with the cash position potentially improving. Based on my current outlook and analysis, I recommend a buy rating. I believe the near-term share price weakness is due to investors being overly focused on the headline EV production weakness and not giving credit to LAZR execution so far. Based on the progression so far, I think LAZR is on track to achieve its FY30 targets, which has a lot of upside.

Review

The LAZR share price continues to remain weak, which I believe continues to present an attractive entry point to investors. My assessment of why the share price has not reflected its long-term potential is that investors’ focus seems to be on near-term electric vehicle [EV] sales growth. Based on the S&P Global Mobility February 2024 light vehicle production forecast, global volumes are expected to decline -0.4% y/y in 2024 or lower, with global production of EVs and hybrids revised downward. My thoughts are that many investors continue to take a risk-off approach to any names that are involved in the EV space. However, this weakness does not have a direct impact on all businesses in the space, in particular for LAZR. There is a continued ramp-up of production with Volvo for LAZR, which I believe should serve as a solid revenue tailwind in 2024. If well executed, it could potentially lead to more deals.

Hence, the focus cycles back to whether LAZR can execute, and again, my view is that LAZR can. Looking at the milestones planned for FY23, LAZR has done very well against them. Firstly, on product and technology execution, LAZR has accomplished a great feat, in which it managed to: (1) automate its facility in Mexico (position the business for high volume production); (2) meet automaker SOP requirements (ensure output will be in line with expectations); (3) complete software requirements for automaker programs; (4) enter the Iris+ C phase; and (5) develop a next-gen lidar prototype. The latter three points point to positive developments in product design. In addition, for the current rate production audit for EX90, LAZR managed to pass the initial test in 2023, which is a positive development that brings LAZR one step closer to commercial production. The next update (which I see as a major catalyst) is for LAZR to finish the final run at a rate test at a higher rate with more strict standards for measuring quality and yields. Management appears confident on this front, as they expect to begin shipping for volume production in 2024 for the EX90. Based on the execution so far, I believe LAZR should have no issues passing the final test. I also like to remind readers of the fact that LAZR won another deal for the Polestar in November (Polestar 4), which I believe is an encouraging sign for its next generation lidar. This really shows that LAZR’s products are being evaluated and recognized by industry players.

Secondly, regarding the goal of growing its order book, although it was $200 million short, I thought it was good enough for them to achieve $800 million of orders ($1 billion was the target). Although it could be argued that they actually surpassed their $1 billion target if not for the change in order book methodology (now using third-party volume estimates and more conservative take rate assumptions), which basically drove order book down by ~$400 million. On a like-for-like basis, LAZR actually saw its order book grow by $1.2 billion (20% above target). Importantly, management mentioned that the updated order book is ~$3.8 billion, which still provides strong visibility into growth.

Touching on cash flows, 4Q23 FCF saw -$54 million, which was more than the guided range of -$40 million to -$35 million. This translates into a run-rate FCF burn rate of $220 million. With the current cash position of ~$290 million, firstly, this indicates that LAZR can at least last another year of operations. Secondly, remember that LAZR is expected to start production in FY24, so that additional revenue should help with improving the cash position. Thirdly, LAZR has recently obtained a new credit line that should provide it with additional capital (if needed) to operate for the next 2 years. Overall, cash position improvement could be better, but I think the achievement on the execution side of things triumphs over the slight weakness here.

Valuation

Author’s work

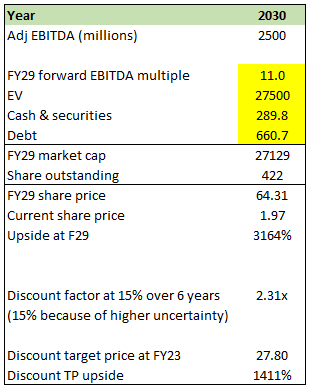

The way I value LAZR has not changed, and I don’t see a reason to change as LAZR continues to execute well and I believe it can achieve its FY30 targets. What I have updated is the capital structure of LAZR, the discount rate (I raised my discount rate to incorporate the higher uncertainty given the cash position situation), and the current share price.

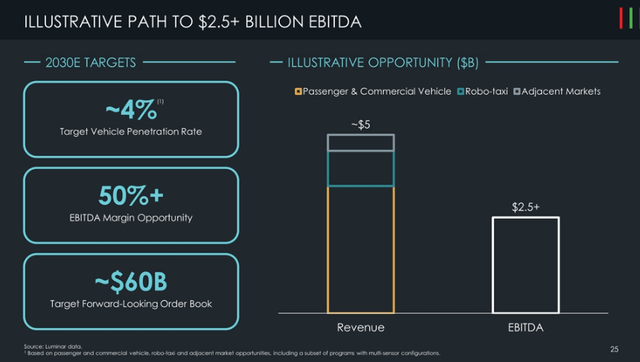

For the benefit of new readers, the way I valued LAZR was by using management’s FY30 EBITDA target as a key guide to how much the share price is worth if LAZR continues to execute. The problem is what valuation multiple to attach, and the way I work around this is by attaching the same multiple that the S&P index trades at historically, with the idea that LAZR should trade at least in line with the market or possibly higher given the large addressable market and growth potential. The S&P index has historically traded at 11x forward EBITDA, and attaching this to the LAZR FY30 EBITDA guide, this translates to a potential share price of $64 in FY30, or $27.80 after discounting back to FY24.

Risk

The key risk is still execution, which I have mentioned previously, in that any signs of misexeuction would be bad for the stock price given that investors are tracking how well management can execute towards the FY30 target. The secondary risk is LAZR’s balance sheet. As it approaches commercial production, it might not have a lot more cash than expected, which could trigger LAZR to take on more debt (if needed). If the order book does not translate to revenue for any reason, LAZR could be on the hook for potential credit risk.

Final thoughts

My recommendation is still a buy rating for LAZR despite near-term share price weakness. My take is that the weakness is attributed to investor focus on overall EV production rather than LAZR’s specific execution. On execution, LAZR has met or exceeded key milestones for FY23, including production ramp-up with Volvo, passing initial production audits, and securing a new lidar deal with Polestar. While the order book fell short of the original target, it was due to the revision of calculation methodology, which on a like-for-like basis, LAZR has outperformed its target. Cash flow burn is a concern, but upcoming production and a new credit line should improve the situation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.