Summary:

- Luminar’s Q2 results show the delayed path to mass production with Volvo, reducing revenue forecast from $250M to $74M in 12 months.

- The company’s financial situation remains dire, with negative margin, reliance on equity sales, and high cash spending.

- Debt renegotiation provides temporary relief, but the future holds significant dilution for equity investors and a continued need for equity sales.

pixelfit/E+ via Getty Images

Luminar Technologies (NASDAQ:LAZR) has reported its Q2 results, and the path that was going to enable Luminar via its primary customer, AB Volvo (OTCPK:VOLAF), to bring mass production and billions in revenue was again delayed. The company pushed the timeline to produce $35M per quarter into 2025 instead of the second half of 2024. The revenue forecast for 2024 has gone from $250M to $74M in the last 12 months, illustrating that Luminar’s demand, despite a so-called order book measured in billions, proved unsupported, hinting that the future forecast will continue to be altered. Luminar, along with its other competitors, focused primarily on consumer auto ADAS, has become a casualty of shifting market trends and OEM delays caused by technological and budgetary constraints.

Financially, the quarterly revenue of $16.5M with a negative margin of 64% has no positive effect on the company’s conditions. Luminar cannot currently service its debt from the income statement, as it obtains its cash from the sale of equity and has spent the cash from the 2026 convertible note of $625M.

In 2023, the company sold over $80M worth of equity; in the first part of 2024, the total was $39M. As my article will illustrate, the sale of equity will only intensify based on unchanging income statement conditions and changes in the financial structure of Luminar’s debt.

Luminar is the largest spender of cash among the LIDAR group; in the first half of 2024, the company spent $158M, with an annualized run rate for the operating cash flow of $316M. By the end of Q2, Luminar had only $161M in cash and access to $50M in line of credit, giving it $211M. Not enough to secure its business for the rest of the year. While the company started a new ATM program of $150M in March of 2024, and at the end of Q2, it still had $138M available for sale, the cash situation for Luminar places the company at risk of running out of money, especially with the 2026 maturity of its debt.

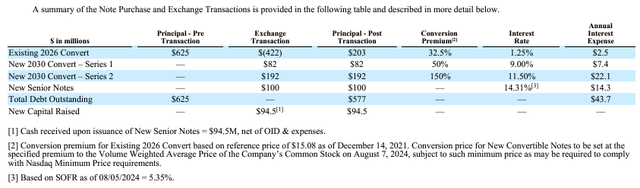

Therefore, the news that the company managed to renegotiate its debt was undoubtedly the most exciting part of the second quarter announcements. The company achieved an exchange of $422M of the convertible debt at 1.25% out of the mentioned $625M into two-tier, second-lien loans totaling $274M, receiving a discount of $148M. However, with 9% interest on the $82M portion and 11.5% on the $192M portion, the maintenance of this amount will require $29.5M annually for the next 5.3 years, or $156M for the life of the loan. If the amount remained as an original convertible, the interest payable would have been $12M. Hence, the interest payable on new convertible loans compensates for the discount given by the debt investors. The benefit of the delay achieved by Luminar will be paid with interest, which will be paid with equity at the cost of dilution to the current shareholders. The transaction details are below, as filed with the SEC on August 6th.

A summary of Note Purchase and Exchange Transactions (Luminar Technologies, SEC filing)

In addition, the company received the first lien loan of $100M at 14.31%, which matures in 2028 and has an annual interest payment of $14.3M. The new capital raised was $94.5M after the original issue discount and fees. This debt is not convertible.

The transaction gave Luminar $94.5M in cash, reduced the debt from $625M to $577M, and pushed the maturity of $274M into 2030. The company added $100M in debt maturing in 2028. The price paid was $213M in interest, versus $17M in interest for the 2026 convertible. The interest will be paid with cash from the sale of equity until gross profit is available to cover it, and the first year of 2025 and part of 2024 will be covered with a $50M in equity sold based on filing from August 8th as an extension of the current ATM.

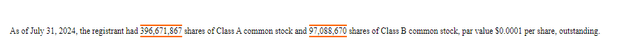

Pragmatically speaking, Luminar has bought time for a large chunk of its debt, but for equity investors, the future holds a lot of dilution with the sale of equity at a low price. For example, with the current price below $1, the $50M extension will likely be sold below it, and the remaining ATM, which needs to support operating cash flow, will have a similar price. I can see that in 2024, that will likely add 150M shares to the existing 369M class A and 97M class B shares outstanding as per the 10-Q filing on August 6th to arrive at the $240M targeted by the company at the end of this year.

10-Q Share count Luminar Technologies (Luminar Technologies, SEC filing)

Further, the shareholders’ expectation now must include an equity cost center to service $41.5M in interest payments yearly beyond 2025 until the company can produce a gross profit from revenues. However, no revenues will come to the rescue until perhaps 2026. In addition, the $203M of the 2026 convertible remains with an annual interest payment of $2.5M, and solving its coming conversion will have a much more significant dilution than the original $20 per share.

My 2025 revenue forecast is only $140M, compared to analysts pooled by SA, whose average is estimated at $170M. Even if I improve the gross margin from negative 64% to 0% in 2024, it will not produce enough cash. In 2026, today’s forecast sees Luminar at $654M in revenue, making a $327M profit at a 50% gross margin, which would like to turn the operating cash flow positive but leave no money for interest payments. With the changing forecasts and unresolved $203M 2026 convertible debt, Luminar equity issuance, in my opinion, will intensify in the next two years.

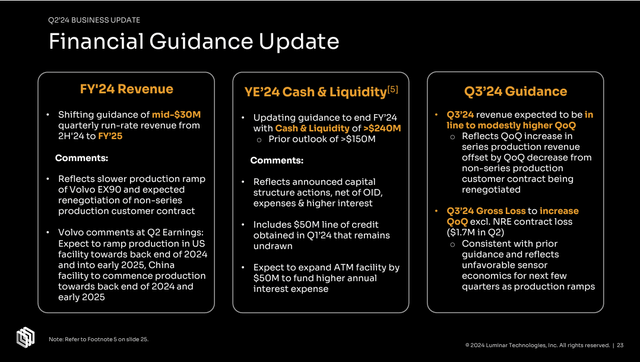

According to the CFO, Tom Fennimore, the company has a $240M end-of-the-year cash target for 2024. The slide below illustrates the inclusion of $94.5M and $50M of LOC. To summarize, $161M in Q2 plus $144.5M would total $306M. Then, there is an already mentioned extension of $50M for the interest payments. While not in the slide, the existing ATM program now has $131M left; the company must have sold an additional $7M of equity since June. To fund the run rate for the second part of the year, using what was spent in the first half, would require another $100M of equity to be sold unless, of course, operating cash flow would have been dramatically reduced, but as the slide notes, the losses are to increase in Q3 2024. In the coming quarters, I suspect the operating cash flow consumption will continue at the current rate.

Financial Guidance Update Q2 2024 (Luminar Technologies, Q2 Presentation)

Every company’s future hinges on its products and its ability to generate revenue. While Luminar’s financial exchange extends its loan obligations for most of its debt, the price paid in equity is becoming more significant now. The company’s revenue cycle has not improved; in fact, this year’s revenue is only $5M greater in the expectation than what has been achieved in 2023. The 2025 revenue forecast does not produce the necessary relief. The company expects gross margin to be positive in 2025. It seems to indicate profitability in 2026, but in my perspective, those are toll targets, and their achievement comes with more significant doubt based on experience in delivery to date.

The market observed the impact of the debt transition and sold the stock by a 37% drop in price the day after the announcements. While hopes for revenue to finally stop the cash hemorrhaging can be had, the reality does not produce a clear path, compounding the risk of the changing forecast in the revenue volume and the ability to achieve the necessary gross margin.

When the stock drops below $1, a reverse split (RS) is a clear possibility. Based on exchange requirements, it takes almost a year for it to happen, but RS as a risk can lower the stock price and make dilution even more dramatic.

I suspect Luminar will drop to the 50-cent level and eventually execute a reverse split, adding further selling pressure. After the reverse split, the company may sell equity to support operations in 2026 and possibly convert $203M of debt. Will 2026 revenues offset the $300M annual cash burn? Yes, there is a possibility that a 50% margin can create enough gross profit to neutralize the negative operating cash flow. There is an opportunity for cash flow to improve while the company reduces costs and curtails its high spending. However, the additional equity and future need for its issuance will continue until that point, which cannot stop the share depreciation. It is also very likely that the value depreciation only intensifies after a reverse split. Therefore, further equity sales will likely be needed beyond the additional $100M, which was already explained as still required even after recent changes, quoting CFO:

“During last quarter’s call, we estimated we would need approximately $200 million of additional capital to reach profitability. Half of this additional capital has been raised as part of this transaction. We have multiple alternatives to raise remaining $100 million, and we will do so in a thoughtful way that minimizes the ultimate dilution and economic impact to our company. In the meantime, we expect the additional capital raised in connection with this transaction to extend our liquidity runway from the end of 2025 to at least the end of 2026.”

With the evident depreciation spiral in place, I now rate Luminar as a strong sell, a downgrade from my sell recommendation published in May. I recommend monitoring the stock until the company reaches a point where the gross profit can begin to offset the need for equity sales. That will require a positive gross margin and a much larger revenue stream. In addition, a significant improvement in the consumption of operating cash flow reduction will be required.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OUST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.