Summary:

- The ongoing automotive strike by the United Auto Workers poses a threat to the profitability of GM, Ford, and Stellantis in the electric vehicle market.

- The Big 3 automakers are already struggling with high costs in producing EVs, and adding significant labor costs from the strike may hinder their ability to compete with Tesla effectively.

- The strike could result in higher prices for EVs produced by traditional automakers, potentially deterring consumers from switching to electric and slowing down progress towards sustainability goals.

- The only one benefitting from the strike is Tesla.

jetcityimage

I’m fully in support of workers securing fair compensation for their contributions. However, the current automotive strike by The United Auto Workers (“UAW”) presents a double-edged sword for the United Auto Workers and for the “Big 3” also known as General Motors (GM), Ford (F), and Stellantis (STLA). The auto strike, much like Damocles’ sword, hangs over their collective heads ready to end their dreams of becoming profitable in the Electric Vehicle (“EV”) space. A sword that can hurt the UAW, GM, F and STLA but probably only benefits Tesla, Inc. (NASDAQ:TSLA).

GM, Ford, and Stellantis have been gearing up for a full-scale shift to electric vehicles over the last five years, complaining of high costs the whole way. It has been tough for these companies because they’re bleeding a substantial amount of money on every EV they produce whereas their old combustion engines are still profitable.

Without government regulations and upstarts like TSLA, I believe they would have delayed this transition if they could have. Now that they need to accelerate the production of EVs, they find themselves mired in a strike with the UAW. Each company has approached the future a little differently, so let’s take a look at how this impacts the auto industry.

General Motors

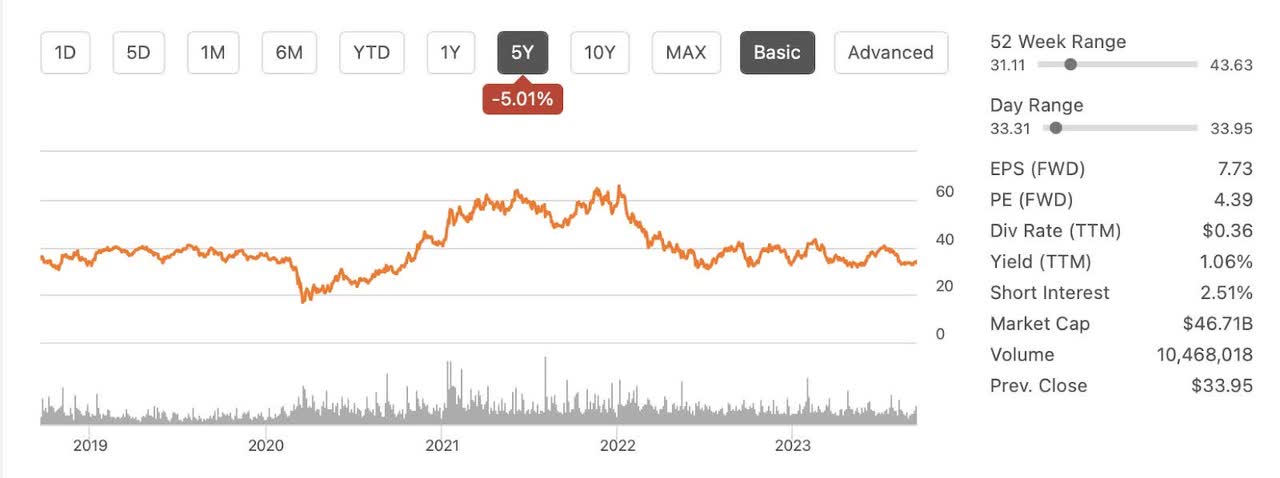

GM 5 Year Chart (Seeking Alpha)

GM’s commitment to making electric vehicles is impressive. They continue to reach production targets of EV’s in the U.S. but in their most recent earnings call they also highlighted the need to reduce costs.

Mary Barra, the CEO of GM, outlined the vision of limiting the future cost of transitioning to electric vehicles (EVs):

“We now expect capital spending in 2023 to be in the $11 billion to $12 billion range, which is about a billion less than the high end of our prior guidance, and we are working on more reductions.”

This claim demonstrates GM’s commitment to efficient financial management and cost control in their EV endeavors.

Barra further reinforces GM’s strong commitment to growing their share of the EV market by noting

“In the EV market, we achieved our target to produce 50,000 electric vehicles in North America in the first half. About 80% were the Chevrolet Bolt EV.”

GM’s tangible progress in EV production can be attributed to the success of the Chevrolet Bolt EV.

This continued expansion indicates GM’s commitment to scaling up their electric vehicle infrastructure, which is pivotal for their future plans in the EV space. The customer demand for EV’s continues to rise and Barra provided a clear and optimistic outlook for GM’s future in the electric vehicle market, showcasing their financial prudence, production achievements, infrastructure expansion, and growing customer demand. However, none of these will materialize as long as the UAW strike goes on and future costs remain undefined.

Ford

Ford 5 Year Chart (Seeking Alpha)

In Ford’s case, their CFO, John Lawler, highlighted the problem of costs as well, commenting that:

“We now expect Ford Blue to deliver full-year EBIT of about $8 billion. We expect higher volumes and stronger mix and more than offset any potential pricing headwind for Model E to report an EBIT loss of around $4.5 billion, largely reflecting the present pricing environment, disciplined investment in new products and capacity, and other costs.”

Ford Blue for those that don’t know is Ford’s lineup of combustion based lineup of cars and trucks. Basically, profits from cars that use gas more than makes up for the losses of selling electric vehicles. As the market for combustion cars shrinks, this creates a damned if you do, damned if you don’t for Ford, with no real options but to march forward into the great unknown.

Ford will have to invest substantially in EVs to bring costs down and be competitive in the EV space. Any increase in wages for United Auto Workers could include battery techs and everyone involved in manufacturing electric vehicles. The strike could win more money and more benefits for workers in the short term but end up crippling the future ability of the company to compete in the electric vehicle segment. Since we are looking at a major transition to manufacturing electric vehicles competitively, this appears to be a lose-lose situation for Ford.

Stellantis

5 Year Stellantis Chart (Seeking Alpha)

Stellantis CEO, Carlos Tavares also highlighted the prohibitive cost concerns of manufacturing EVs in U.S. and European markets earlier this year, saying, “we need to accelerate the cost reduction on that technology to make it more affordable.” The cost increases that would result from the wage and benefit increases desired by the UAW might not be sustainable for Stellantis, which has demonstrated that it will close factories and adjust to capacity needs.

Perhaps these comments and concerns regarding costs are merely a negotiating tactic engineered by the big three to help them end the strike favorably on their terms. Or perhaps legacy costs and high wages will prohibit the big three from truly competing with the $870 billion dollar titan in the electric vehicle industry, Tesla.

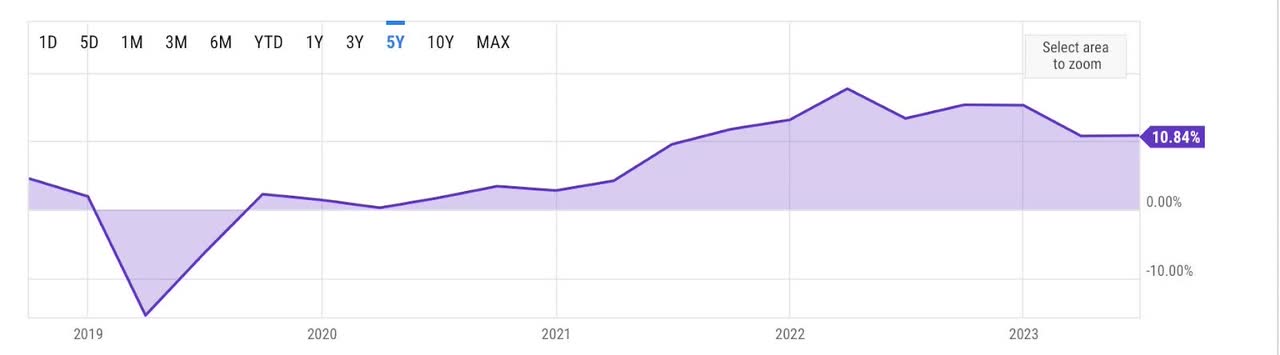

Now, contrast that with Tesla. They’ve managed to slash their prices while still raking in roughly 10% profit margins on every EV they sell.

Quarterly Profit Margin Tesla (Yahoo Charts)

So, if the Big 3 struggled to compete on price before for EVs, tacking on an extra 20% to 40% in labor costs won’t do them any favors. With Tesla cutting prices to capture current market share, the Big 3 will have a lot of catching up to do.

In my opinion, this is why the UAW has the Big 3 over a barrel. If they want to catch TSLA in U.S. EV sales, they need to start now. The longer the delay the worse it will get which could force a poor agreement. With current executive salaries in the multi million dollar range and huge profits over the last few years, the optics of a prolonged strike are not good. I believe this will eventually force an agreement and an end to the strike.

I am going to be very interested in the negotiations and the final agreement. A major “victory” by the Big 3 will be a step back for labor in the U.S.

However, A UAW “victory” may end up leading to non-competitive American car manufacturers. This would become a pyrrhic victory if costs of EVs become too high for GM, F, and STLA, to be competitive. The consumers will not have to bear the costs because they will have other options. Eventually, this could lead to fewer and fewer jobs at the Big 3.

The traditional automakers are in a tough situation that puts a strain on their future profit margins, as EVs require significant investments in research, development, and infrastructure. They’re essentially losing money on each electric vehicle sold, given their hefty initial investments. Although profit may be on the horizon for GM, F, and STLA, Tesla is already profitable.

I may currently believe that TSLA is overvalued based on fundamentals and that CEO Elon Musk needs to do better, which I wrote about in an article you can read here. But I also believe that Tesla is giant steps ahead of the big 3 regarding EV production and technology.

-

Tesla’s Competitive Advantage: Tesla, an EV pioneer, stands out as a notable exception. They have not only managed to produce EVs efficiently but have also reduced prices, all while maintaining healthy profit margins. This competitive edge stems from their years of experience in EV manufacturing, vertical integration, and innovation in battery technology. This allows Tesla to price their EVs competitively, even as the traditional automakers struggle.

-

Labor Costs and Future Competitiveness: The UAW’s success in securing favorable labor agreements for its members is commendable. However, in the context of the ongoing industry transformation, it raises questions about the long-term competitiveness of the Big 3. Adding significant labor costs to the already challenging financial equation of producing EVs may hinder their ability to compete with Tesla effectively.

-

Impact on Industry and Consumers: The ripple effect of these developments could result in higher prices for EVs produced by traditional automakers, potentially deterring consumers from making the switch to electric. This, in turn, could slow down the industry’s overall progress towards reducing greenhouse gas emissions and achieving sustainability goals.

Final Thoughts

While I believe that advocating for workers’ rights is an important right in America; I also believe it is crucial that negotiations are in good faith and consider the broader industry dynamics. A one-sided UAW victory may inadvertently contribute to future job losses. Making traditional automakers less competitive in the EV market will mean they can’t sell as many electric vehicles. This could potentially benefit companies like Tesla, which have already established a strong foothold in this evolving landscape and do not have to negotiate with the UAW.

Balancing the interests of workers, the industry, and consumers will be a challenging task for the Big 3 if they want to compete in the electric vehicles market. They have to resolve this strike relatively quickly so that they can add production capacity. However, they have to do it in such a manner that lets them sell future EVs at a profit. At this point, I can only say that Tesla is the main winner of this strike. As always, please do your own due diligence prior to buying any positions. Thank you for reading and good luck investing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.