Summary:

- The iPhone 16 launch was Apple’s big opportunity to prove it can win this AI era, but instead achieved the opposite, with the leadership gap between Apple and competitors widening.

- Apple trades at a ludicrously expensive valuation, while other exemplary Magnificent 7 stocks offer much better risk-reward.

- Although Apple recently made a key move that may not yield immediate benefits, but could pay off handsomely several years later as the AI revolution progresses onto the next phase.

Vadym Plysiuk

Apple (NASDAQ:AAPL) finally launched the iPhone 16 line-up earlier this month, and will release iOS 18.1 next month, marking the beginning of the ‘Apple Intelligence’ era. However, the bulls may be getting ahead of themselves by expecting an iPhone super-cycle to unfold over the next 6-12 months, given that early indicators are already pointing to an underwhelming sales cycle, and several key AI features are missing from the launch. Although Apple is also making some key moves that leverage its existing competitive advantages over rivals, paving the way to new forms of AI devices. AAPL remains a ‘hold’ for now.

In the previous article, we extensively discussed Apple’s AI monetization opportunities, both on the hardware and software side. We also covered how Wall Street may be getting too optimistic around the stock, and that AAPL should not be trading at a more expensive valuation than the king of AI, Nvidia (NVDA).

Since then, the stock has become even more expensive, while iPhone sales prospects have certainly not gotten any better.

Apple’s valuation remains a big issue

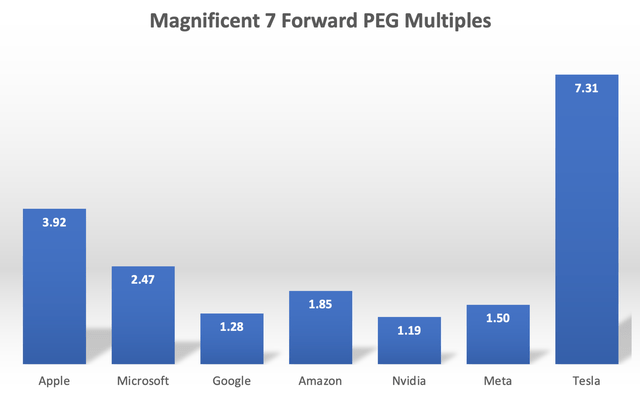

Back in July, AAPL was trading at around 35x forward earnings. Though, the Forward Price-Earnings-Growth (Forward PEG) ratio offers a much more comprehensive assessment of Apple’s valuation, as it adjusts the Forward PE multiple by the anticipated earnings growth rate. A few months ago following the WWDC event, the market estimated that Apple’s EPS FWD Long-Term Growth (3-5Y CAGR) is 10.39%, resulting in a Forward PEG multiple of 3.33x.

This EPS growth projection has since declined to 8.63%, while the stock still trades at a Forward PE of 34x, leading to the Forward PEG multiple to jump to a staggering 3.92x.

The outlook for the upcoming iPhone sales cycle barely justifies this lofty valuation.

Don’t expect an iPhone super-cycle

The telecommunication providers remain vital distribution channels for Apple, as consumers commonly purchase new phones through bundled subscription offerings. Hence, insights from these telecom companies can offer leading indicators into the iPhone sales cycle, though the indications have been rather mixed this time round.

Mike Sievert, the President and CEO at T-Mobile, sounded rather upbeat in a recent interview with CNBC:

The first week was better than last year. Not only good but better than last. People are buying pros, max, they are buying up the food chain and buying at a greater rate. What’s interesting is we may see this is better than last year to a greater extent as I have a feeling the cycle will be lengthened a little, as the AI features don’t come out for a little while. So that word-of-mouth of seeing apple intelligence on your phone and telling other people is still in front of us

On the other hand, the CEO of AT&T, John Stankey, offered a more gloomier outlook:

My intuition is this isn’t going to be what I call a major cycle as we have seen with the 5G, 4G dynamics and volumes. It’s going to be meaningful, but I would be surprised if it hits that level.

…

I was looking at the offers in our industry that popped up after the announcement, they looked similar to last year, so I’m not expecting this thing is going to go crazy

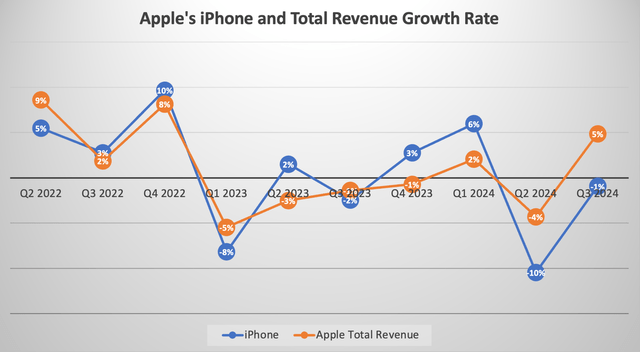

The iPhone makes up around half of Apple’s total revenue base, and its muted sales growth over the past several quarters has subsequently weighed on the entire company’s top-line.

Nexus Research, data compiled from company filings

Following the introduction of Apple Intelligence, there was initial optimism around the potential for an iPhone super-cycle in FY2025. Although expectations have since subdued as Apple has revealed which Apple Intelligence features that were showcased during the Worldwide Developers Conference 2024 (WWDC’24) will actually become available as part of iOS 18.1.

I think if you look at the street numbers right now for fiscal ’25, looking for iPhone growth of 5%, 6%, it’s been basically flat the last couple years.

– Gene Munster, Managing Partner at Deepwater Asset Management

Perhaps the biggest disappointment is the absence of the advanced, generative AI-powered capabilities of Siri that got many people excited following June’s WWDC.

Meanwhile, Google’s (GOOG) conversational ‘Gemini Live’ is already available to Android users that are also Gemini Advanced subscribers, for $20 per month.

Android is undoubtedly way ahead of iOS in terms of AI capabilities. While Apple promises to roll out more AI features over the next year that Google already offers through its own mobile operating system, it does raise the risks of the iPhone-maker losing market share to other smartphone-makers in the era of AI. This is not to say that loyal iPhone users will switch to an Android phone for AI, but that the new, younger generation of smartphone-buyers could potentially opt for Android-powered mobile devices.

In fact, realizing just how behind it is in this AI race, the Cupertino-based giant did not raise prices for iPhone 16 this year, as the availability of more advanced AI experiences through Android-powered Samsung devices, as well as other Chinese smartphone-makers, seems to be undermining Apple’s pricing power.

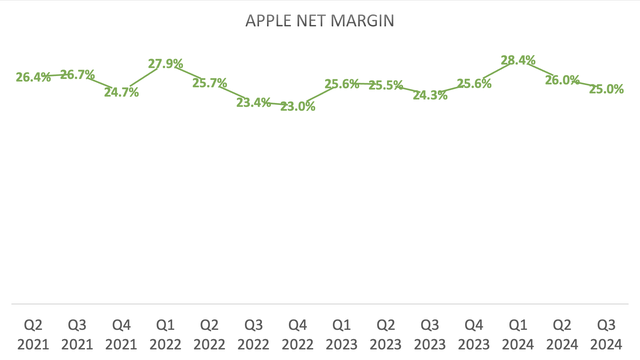

Now amid its endeavor to catch up in the AI race, CEO Tim Cook signaled on the last earnings call that they will continue increasing R&D investments to innovate around Artificial Intelligence and Machine Learning. Although if Apple continues to remain a few steps behind competitors in this AI race, it could continue to undermine its ability to pass on these costs to consumers through price hikes.

Nexus Research, data compiled from company filings

Apple has been able to sustain a net margin of mid-to-high 20s-percentages over the last several years, although rising AI costs coupled with static product prices could indeed result in profit margin compression going forward.

Bull case for Apple

In spite of Apple being clearly behind Google in the AI race, Apple certainly has competitive advantages of its own to leverage.

Arguably the biggest reason for Apple’s inclusion in the Magnificent 7 league is its extensive installed base, which boasts over 2.2 billion active devices (including iPhones, MacBooks, iMacs, Apple Watches, etc.). The Apple ecosystem will serve as a key gateway for over a billion consumers to experience generative AI.

Now despite the risk of new smartphone buyers potentially opting for Android-devices given its more advanced AI experiences, it is unlikely that loyal, existing iPhone users will switch over just because Apple is slower at rolling out AI features, so its existing installed base is likely to remain intact, and should eventually upgrade over the coming years to an AI phone.

Apple’s greater opportunity to capitalize on the AI revolution lies in upselling its existing iPhone user base towards buying more AI-enabled hardware devices, but more importantly, more software services.

Indeed, the AI era gives Apple the opportunity to sell new forms of generative AI-powered services, and augment current subscription offerings like Apple Fitness+ and Apple Arcade.

In fact, there are expectations that Apple will start charging users for more advanced AI assistant features, similar to how OpenAI and Google charge around $20/month for exceedingly powerful AI capabilities.

These opportunities collectively could offer new avenues for Apple Services revenue growth, which contributes around 20-30% to the top-line, and remains a high-margin segment driving overall profitability.

But it’s not just the Services side that opens new doors for Apple to optimally capitalize on the AI boom.

For over a decade, Apple has successfully built up a portfolio of custom silicon that powers each of its devices, from iPhones to iMacs to AirPods. This has enabled it to masterfully curate a richer cross-device experience, becoming a key aspect of its cross-selling strategy to encourage consumers to increasingly rely on Apple for all forms of hardware needs. As the AI race evolves, this is certainly an advantage that Apple will strive to leverage over rivals Google and Microsoft (MSFT).

In fact, Apple has been doubling down on this self-reliance strategy by also striving to design its own modems that enable the cellular capabilities of devices like iPhones and Apple Watches, thereby striving to cut out Qualcomm from its supply chain.

Now there is a two-fold advantage here if Apple succeeds at this complex endeavor.

The most obvious would be cost advantages over the long-term by not having to pay premium royalties to access Qualcomm’s industry-leading technology, which should help boost Apple’s bottom-line profitability.

But more excitingly, it could also grant Apple greater flexibility in designing new hardware products.

Down the road, there are plans for Apple to fold its modem design into a new wireless chip that handles Wi-Fi and Bluetooth access. That would create a single connectivity component, potentially improving reliability and battery life.

There’s also the possibility that Apple could one day combine all of this into the device’s main system on a chip, or SoC. That could further cut costs and save space inside the iPhone, allowing for more design choices.

– Mark Gurman, Bloomberg Technology

Beyond iPhones, the AI revolution is also expected to give rise to new form factors that enable richer generative AI experiences. So the fact that Apple is seeking to gain modem independence to open the doors to new hardware innovations is certainly a step in the right direction.

Although developing in-house modems is turning out to be much more complex than designing custom silicon, given the number of setbacks the company has faced over the years, which has pushed Apple to extend its agreement with Qualcomm till 2027.

Furthermore, even if Apple succeeds at developing its own modem, keep in mind that rivals Samsung and Huawei have already been using in-house modems for years, so there’s no first-mover advantage here for Apple.

Is Apple stock worth buying?

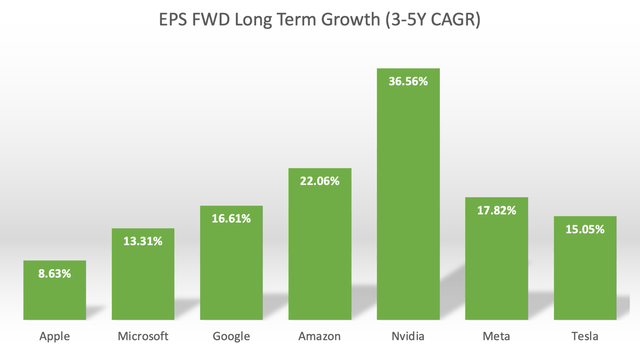

Earlier in the article, we mentioned how the EPS FWD Long-Term Growth (3-5Y CAGR) for Apple has been lowered from 10.39% to 8.63% amid diminishing expectations for an iPhone super-cycle. In fact, out of all the Magnificent 7 stocks, AAPL has the lowest projected EPS growth rate.

Nexus Research, data compiled from Seeking Alpha

Now using these expected EPS growth rates to determine the Forward PEG ratios reveals that Apple is one of the most expensive Mag 7 stocks, behind only Tesla (TSLA).

Nexus Research, data compiled from Seeking Alpha

For context, a Forward PEG ratio of 1x would imply that a stock is trading at roughly fair value, which few of the Mag 7 stocks are trading close to, including Nvidia, Google, and Meta Platforms (META). All three of these companies are way ahead in AI innovation and monetization, putting into question whether Apple can sustain such a premium valuation over the AI leaders.

After all, Apple is essentially playing catch up in an AI era initiated by Google’s innovation of the ‘Transformer’ architecture, which subsequently gave rise to generative AI models. It is of no surprise then that Google’s AI leadership is manifesting through the Android operating system, racing past iOS to offer more advanced generative AI experiences. In response to which, Apple is now having to spend heavily on R&D to catch up to a form of technology that Google has already mastered for many years now.

In fact, Google is so ahead of Apple in the AI race, that the Cupertino-based giant is even relying on Google Cloud’s TPUs to train its AI models. So while there are questions regarding the extent to which Apple will be able to capitalize on the AI revolution, Google is already winning big through its cloud segment. Truth to be told, Apple is paying rent in Google’s world.

Now that being said, there are of course valid reasons as to why the market has assigned such a low valuation multiple to GOOG, given the questions around the sustainability of its Search monopoly in this new era.

On the other hand, Apple typically commands an expensive valuation given its high-quality business that boasts a loyal installed base, which the company is constantly finding new, incremental ways to monetize. Moreover, the tech behemoth also possesses an enviable balance sheet with a large cash pile, which it deploys to reward its shareholders through share buybacks and dividend payouts.

Therefore, AAPL remains a great security for capital preservation, and long-term investors that have been holding the stock for years should certainly not be selling the stock simply because it is behind in the AI race. Slowly but surely, Apple will definitely see new revenue and profit growth opportunities in this AI era that will continue to benefit its long-term shareholders.

That being said, the 5yr average Forward PEG multiple of AAPL is 2.46x, which is roughly in-line with a level at which most safe-haven tech giants trade around. Hence, Apple’s current Forward PEG of 3.92x is still way too expensive, both relative to its historical valuation, as well as from a safe-haven perspective.

So for those investors that have fresh new capital to put to work and are looking for AI-growth exposure, Apple is not the ideal investment option at the moment. One should instead consider other Mag 7 stocks that are further ahead in the AI race, and are also trading at more reasonable valuations.

Apple stock remains a ‘hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.