Summary:

- Microsoft’s current valuation requires a revenue CAGR of 20% over the next 8 years, maintaining margins and free cash flow conversion at current levels.

- In a Bear-Case scenario, Microsoft is overvalued by 38%, while in a Bull-Case scenario, it could be undervalued by 9%.

- Achieving the necessary growth rates seems challenging, given Microsoft’s already dominant market positions in key segments like Productivity, Cloud, and Gaming.

Jean-Luc Ichard

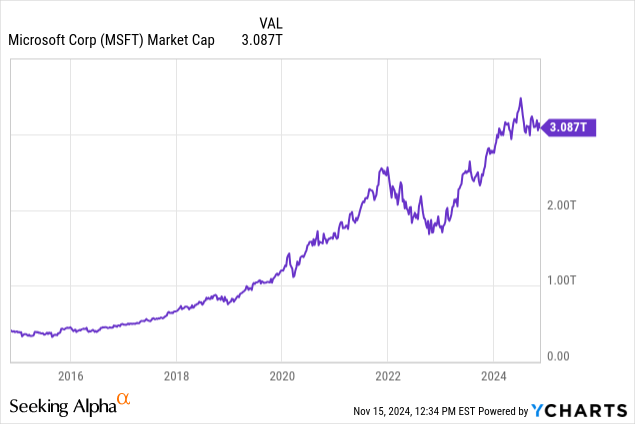

Microsoft is (NASDAQ:MSFT) currently trading at a valuation of almost $3.1 trillion, making it the 3rd biggest stock after Apple (AAPL) and Nvidia (NVDA).

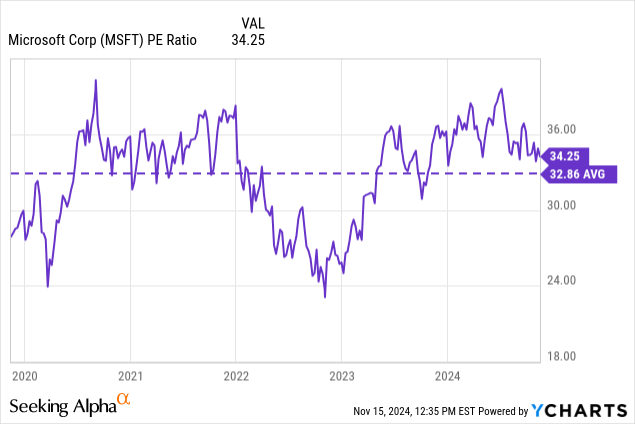

When looking at traditional valuation, like the PE ratio for example, the company also looks pretty expensive. With currently having a PE of 34.5 compared to their own 5 year average of 32.9 and the S&P 500’s current PE of 30.4.

In this article we will first discover what growth the market is currently expecting from Microsoft to then break it down on the different business segments and analyse if the current market cap is justified or not.

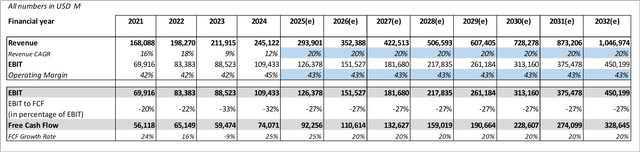

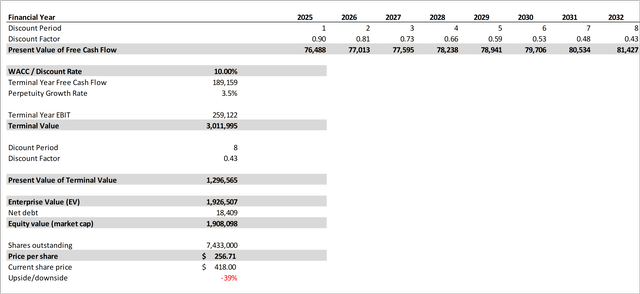

Required Growth

If we consider that the current profitability – in form of the EBIT margin – stays consistent at the average EBIT margin of 43% of the last four years, we need a few additional assumptions to calculate the required growth rates.

- Free Cash Flow Conversion: I averaged out the last four years and used a EBIT to FCF ratio of 73% to calculate the free cash flow for the following years.

- WACC: Here I used MSFT’s current WACC of 10%.

- Perpetuity Growth Rate: 3.5% seems fitting when considering that after 8 years the company should still grow through their cloud and AI segment.

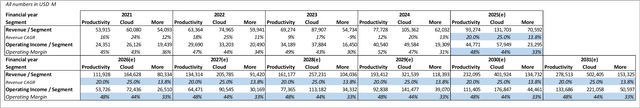

Microsoft’s Required Growth (own assumptions; seekingalpha.com) Microsoft’s Required Growth (own assumptions; seekingalpha.com)

The current valuation of Microsoft therefore requires a revenue CAGR of 20% for the next 8 years to be justifiable. Keep in mind that this also requires MSFT to keep margins and free cash flow conversion at certain levels. Now we will take a look what this means for the different segments and how achievable this seems for Microsoft.

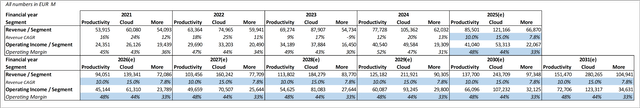

Productivity and Business Processes

I will just shortly describe what the company is doing in each of the segments, as this was already explained in my last MSFT article. This segment contains Office & Dynamics products as well as the LinkedIn social media platform.

The whole business productivity software market is expected to grow at a CAGR of 15.9% p.a. until 2032. The growth of LinkedIn was very impressive over the last few years. They managed to achieve a stunning growth rate of 40% p.a. over the last 12 years and 25% p.a. for the latest five years. The global market of social networking is expect to grow at a CAGR of 17% p.a. per year for the next years.

The company’s move to cloud-based solutions and recurring revenue models serves as the foundation for this segment’s growth. Notably, LinkedIn’s performance keeps supporting this market sector with good engagement metrics and significant user growth. According to management’s projections, this division should see consistent revenue growth driven by the growing use of AI technologies integrated into Office products (like Copilot).

Even while Microsoft dominates the productivity software industry, Google Workspace and other SaaS suppliers pose a serious threat. Nonetheless, Microsoft has a competitive moat because to its vast ecosystem and ongoing advancements in automation and generative AI. The company’s leadership in this field is further cemented by its strong business connections and notable integration capabilities throughout its portfolio.

As the growth expectations are of LinkedIn and the productivity software are pretty similar we can assume the following growth rates for the whole segment to consider a Bear- and Bull-Case scenario:

Bear: 10% p.a.

Bull: 20% p.a.

Intelligent Cloud

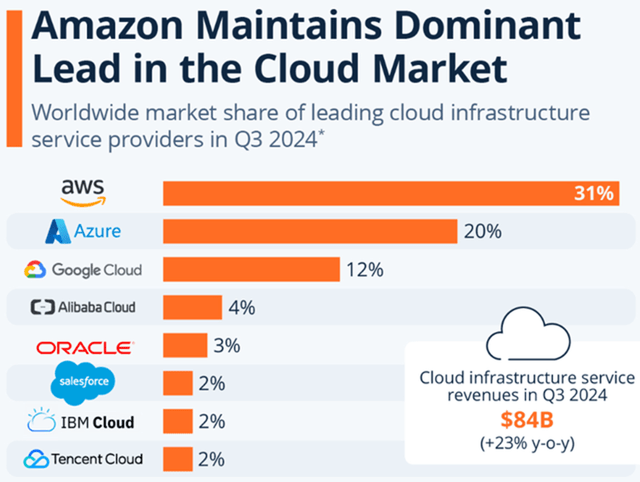

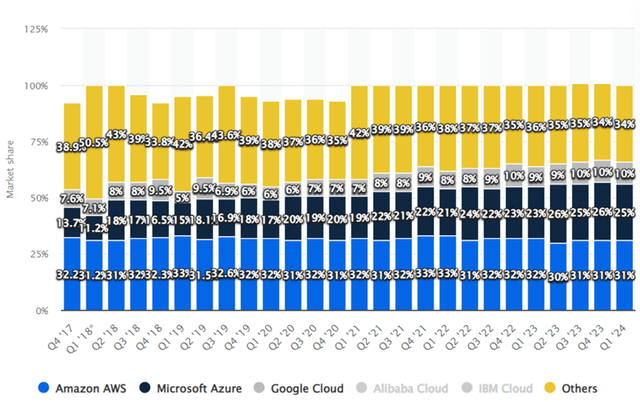

The company is currently holding 20% to 25% market share in the cloud market according to statista. This is also growing consistently over the last few years.

Cloud Market Share by Provider Q3/24 (statista.com) Cloud Infrastructure Services Vendor Market Share Worldwide (statista.com)

Because of its robust infrastructure-as-a-service (IaaS) and platform-as-a-service (PAAS) capabilities, Azure is well-positioned to benefit from the anticipated large growth of the cloud computing market over the next ten years. Microsoft has been able to expand its cloud offering and draw in business clients looking for cutting-edge, scalable solutions by including AI-powered tools and collaborations (such as OpenAI integrations).

The company’s emphasis on integrating AI into Azure is a calculated move to take advantage of the growing need for cutting-edge cloud capabilities. Management’s optimistic assessment of AI services as a growth lever was emphasized in recent earnings calls, which hinted to a possible acceleration of revenue growth.

Experts are currently predicting the following market growth rates for the cloud market:

| Research Firm | Expectation p.a. | Time Frame |

| Mordor Intelligence | 16.4% | 2024 – 2029 |

| Grand View Research | 21.2% | 2024 – 2030 |

| Markets and Markets | 15.1% | 2024 – 2028 |

| Fortune Business Insights | 16.5% | 2024 – 2032 |

| Acumen Research | 17.8% | 2023 – 2032 |

| Statista | 18.5% | 2024 – 2029 |

The average of these assumptions of 17.6% p.a., if we now assume that MSFT loses market share in the Bear-Case and wins market share over Amazon (AMZN) and Google (GOOG, GOOGL) we can assume the following growth rates:

Bear: 15% p.a.

Bull: 25% p.a.

More Personal Computing

This segment is composed of Windows, Gaming, Search and News Advertising and Devices. To speed things up in this very complex segment I think the following expectations seem suitable:

| Windows | Gaming | Ads | Devices | |

| Bear p.a. | 5% | 10% | 10% | 5% |

| Market p.a. | 8.0% | 13.1% | 15.5% | 8.0% |

| Bull p.a. | 10% | 15% | 20% | 10% |

| Weighting (as of Q4/24) | 37% | 35% | 20% | 8% |

A cooling PC market and macroeconomic slowdowns have affected Windows OEM income, but the gaming industry shows promise. Microsoft is in a better position to take a bigger chunk of the gaming industry because to the recent focus on cloud gaming and content acquisition, which is best illustrated by the Activision Blizzard transaction.

Microsoft has guided that this market will increase modestly, mostly due to ongoing investments in gaming and premium services like Game Pass.

With the weighting of the different segments within the More Personal Computing segment, we get the following growth rates according to the above stated rates per segment:

Bear: 7.8% p.a.

Bull: 13.8% p.a.

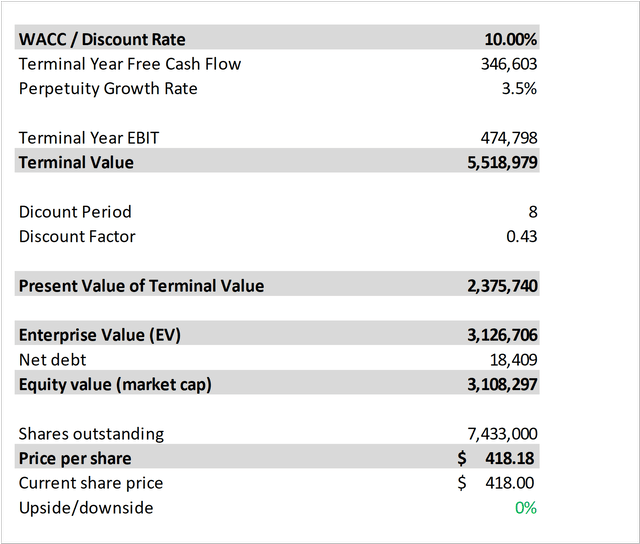

We will now jump in two additional Discounted Cash Flow Analysis to see where the fair value for each of the scenarios is currently located.

Valuation With Expected Growth Rates

Bear Case

Microsoft Discounted Cash Flow Analysis BEAR Case (I) (own assumptions)

Microsoft Discounted Cash Flow Analysis BEAR Case (II) (own assumptions)

Within our Bear-Case we get a fair value share price of $256, indicating that the company is currently overvalued by a whopping 39%. However keep in mind that this scenarios also anticipates growth rates below the market in every single market segment of Microsoft.

Bull-Case

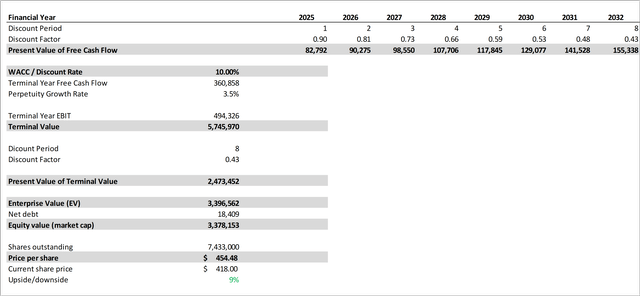

Microsoft Discounted Cash Flow Analysis BULL Case (II) (own assumptions) Microsoft Discounted Cash Flow Analysis BULL Case (II) (own assumptions)

Through our Bull-Case scenario we get a fair value share price of $454, meaning that the company could be undervalued by 9%. Just like the Bear case was the pessimistic scenarios, the growth rates stated here are very optimistic and consider growth above the general market rate for the next 8 years.

Conclusion

We get a valuation gap of -39% to 9% from our Discounted Cash Flow Analyses. The current valuation and market cap of Microsoft seems justified, if the company achieves a revenue CAGR of 20% p.a. for the next 8 years and also manages to keep the margins and free cash flow conversion at today’s levels.

According to our Bull-Case this seems only achievable when the company is growing above the market rates of the segments that MSFT is operating in. This poses risks as growing above the market rate always means to also grow market share in said markets. When considering that Microsoft is already the market leader in the Productivity and Business Processes segment and 2nd place in Cloud and Gaming, this seems like a very challenging venture for the company. Due to the very high quality, good diversification and the outstanding position in the key markets AI and Cloud, I “only” currently rate the company a ‘Hold’ despite the current overvaluation. Investors might want to take some gains in this position and use the funds elsewhere.

What’s Your Perspective? Let’s Discuss!

Thank you for reading my analysis! I’d love to hear your ideas and points of view – whether you agree, disagree, or have your own take on the stock. Let’s start a discussion in the comments! I welcome any helpful arguments and ideas that can help us better comprehend this topic. Thanks!

~ Fabian – FF

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.