Summary:

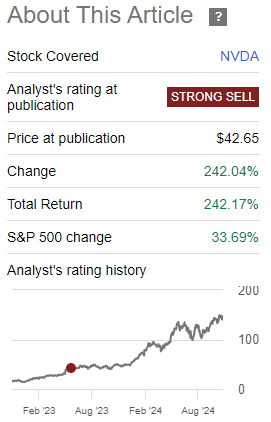

- Nvidia Corporation’s stock has surged 242% due to exceeding growth and profitability expectations.

- To justify its $3.6 trillion valuation, Nvidia needs a revenue CAGR above 30% p.a. over the next eight years, maintaining current margins and cash flow conversion.

- When considering the market growth rates of NVDA’s underlying business segments, the company currently seems fairly valued.

vzphotos

First things first, as you have to own up to your mistakes: From my latest article on Nvidia Corporation (NASDAQ:NVDA, NEOE:NVDA:CA) in July 2023 the company has returned a stunning 242%. Back then, I rated the company a Sell, as valuations were then implying that the company needed to massively increase profitability and also simultaneously grow at a revenue growth rate of 50% p.a. for 8 years. From there on, I wasn’t covering and screening the company anymore.

My Latest Rating on Nvidia (seekingalpha.com)

Now 1.5 years later, we know that the company even exceeded my “optimistic” expectations, and managed to grow above 100% for two years and also dramatically increased their profit margins.

Historical Metrics NVIDIA (nvidia.com)

This definitely justified a big increase in stock price. The question now is if the rise was too optimistic. To answer this question, we will first analyze what growth is required for the next 8 years to justify the $3.6 trillion valuation to then take a look at Nvidia’s different business segments and answer if the required growth rate seems achievable.

Required Growth

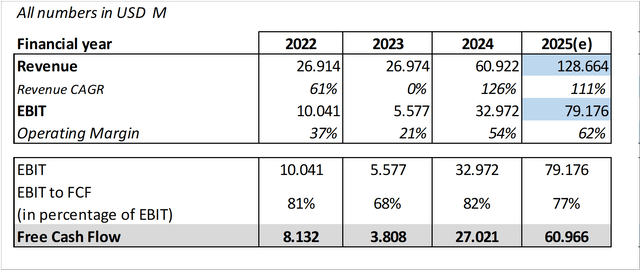

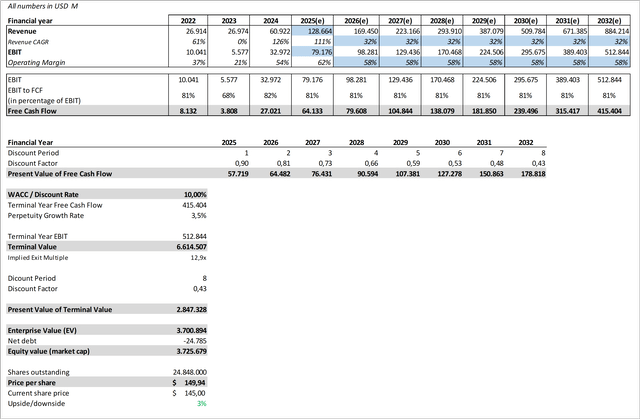

For our analysis, we first assume that Nvidia is managing to achieve the guidance for their Q4/2025, resulting in a revenue of ~$129 billion and an EBIT of ~$79 billion for FY2025. This also gives us an EBIT margin of 62% for 2025. From there on, I assumed the following to create a Discounted Cash Flow Analysis:

- EBIT Margin: The margins can be seen above and range from 21% to 62%. I think it is reasonable to assume that they will achieve the higher end of this range. Therefore, I averaged out the last two years and used a constant margin of 58% for the analysis.

- Free Cash Flow Conversion: Nvidia achieved the following EBIT to FCF conversion rates: 2022: 81%2023: 68%2024: 82% 2023 seems to be a clear outlier here. That’s why I assumed that the company manages to get the high end of these conversion rates and therefore 82% for the next 8 years.

- WACC: Here I used NVDA’s current WACC of 10%.

- Perpetuity Growth Rate: 3.5% seems fitting for a high-quality and high-growth company like Nvidia.

Required Growth For NVIDIA (own assumptions)

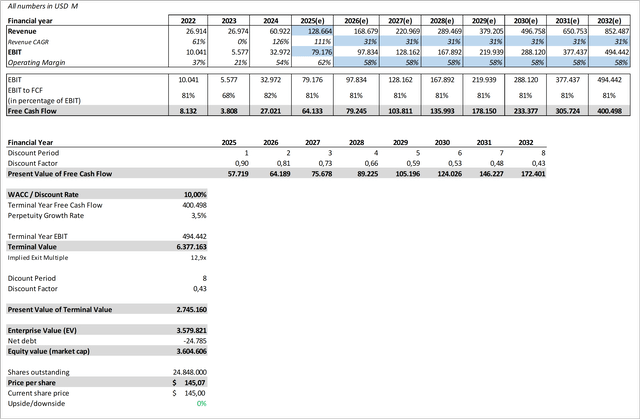

Therefore, a revenue CAGR of 31% over the next eight years is necessary to justify the current price. Remember that NVDA must maintain margins and free cash flow conversion at current levels to achieve this. We’ll now examine the implications for the various segments and how feasible this appears to be for the company.

Data Center

The global data center GPU market is expected by experts to grow at the following growth rates:

| Research Firm | Expectation p.a. | Time Frame |

| KBV Research | 31.8% | 2023 – 2030 |

| Grand View Research | 28.5% | 2024 – 2030 |

| Markets and Markets | 34.6% | 2023 – 2028 |

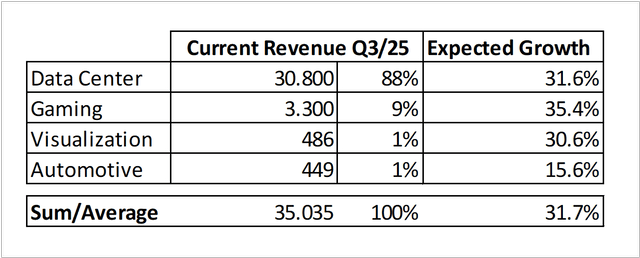

This gives us an average market growth rate of 31.6% p.a. for the next years. For context, NVIDA achieved a QoQ growth rate of 17% and a 112% YoY growth rate in their latest quarter.

Gaming and AI PC

For this segment, there aren’t that much research firms that are analyzing this market. Markets and Markets is expecting 28.8% p.a. until 2030 and TechInsights is very optimistic by expecting a growth rate of 42% p.a. until 2029. This would give us an average market growth rate in this segment of 35.4% p.a. Here, Nvidia achieved a growth rate of 15% YoY in Q3/25.

Professional Visualization

For the global visualization and 3D rendering market, Grand View Research is current expecting a growth rate of 30.6% p.a. for the time frame of 2023 to 2030. Their latest growth rate in this segment was 17% YoY.

Automotive and Robotics

Global Newswire expects the AI in Automotive Market to grow at a growth rate of 15.6% p.a. for the next 10 years. Here they preformed way better in the last quarter, as this segment grew with a whipping YoY rate of 72%.

Expected Growth Rates

With these growth rates, we get the following expected market growth rate for Nvidia’s business segments:

Expected Growth Rates For NVIDIA (market growth rates)

Assuming a growth rate of 31.7% p.a. and the above-mentioned other metrics (WACC, Perpetuity Growth Rate, EBIT and FCF Conversion) we get the following valuation for Nvidia.

Discounted Cash Flow Analysis (own assumptions)

With these predicted market growth rate, the company seems to currently even be undervalued 3%. Giving us a fair value share price of $150.

Risks To Consider

Despite Nvidia’s dominant position in AI and GPUs, investing in the company poses risks. The company’s market share may be eroded by fierce rivalry from rivals like Advanced Micro Devices (AMD) and Intel (INTC) or more important from new technologies like Quantum Computing (QUBT) for example.

Furthermore, because the semiconductor business is cyclical, NVIDIA is subject to changes in demand, which might result in overstock or pressure on prices.

Because of its reliance on significant businesses like artificial intelligence, it is susceptible to downturns in the economy or declines in consumer spending, as only 5 customers current make up around 50% of Nvidia’s revenue. I guess they could be Amazon (AMZN), Meta (META), Microsoft (MSFT) and Tesla (TSLA). Once their growth slows down, Nvidia will follow soon.

NVIDIA’s Customer Base (NVDA 10-Q Q2/25)

Revenues might be impacted by geopolitical conflicts that restrict access to significant markets, including trade restrictions between the United States and China.

Additionally, since the market is expecting growth rates >31% p.a., the company is vulnerable to steep corrections if growth slows or expectations aren’t fulfilled.

Conclusion

With the optimistic yet realistic assumptions we took, the company seems to currently be trading at the fair value range. This market cap therefore is justified, if the company manages to grow at the market rates of the segments it is operating in, which is a top-line growth rate of 31.7% p.a for the next eight years.

Considering the very high quality, exceptional market position in the AI space and Nvidia’s track record in growth and profitability expansion — especially in the past two years — the company could still be a compelling buy even after the recent run-up. Especially when considering that through our Discounted Cash Flow Analysis higher growth rates in the near future and therefore lower ones in 3–4 years automatically result in a higher valuation, as the cash flows aren’t discounted over that many years in this case. This seems likely when we compare Nvidia’s growth rates over the last two years to the expected market rates. That’s why I currently rate the company a “Buy” and I am monthly adding to the position in small installments. What’s Your Perspective? Let’s Discuss!

What’s Your Perspective? Let’s Discuss!

Thank you for reading my analysis! I’d love to hear your ideas and points of view — whether you agree, disagree, or have your unique take on the stock. Let’s start a discussion in the comments! I welcome any helpful arguments and ideas that can help us better comprehend this topic. Thanks!

~ Fabian – FF.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.