Summary:

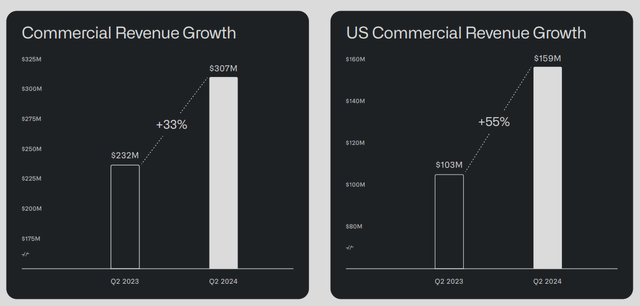

- Palantir is overvalued based on traditional metrics, with a P/E ratio of ~240 and a P/S ratio of ~40.

- Three DCF scenarios show Palantir’s current stock price is unjustified unless it achieves a revenue CAGR of 35.5% over eight years.

- Even optimistic AI market growth rates indicate a 14% overvaluation, suggesting the stock is expensive but holds unique long-term potential.

Michael Vi/iStock Editorial via Getty Images

Palantir Technologies (NYSE:PLTR) is a well-known participant in the data analytics and artificial intelligence fields. Since the company is selling at high multiples of its earnings and sales, it is currently seen as costly by many standard valuation methods. In spite of this, the business’s core competencies are still robust, and it has a strong revenue base, good gross margins, and significant room to develop in the artificial intelligence and data analytics industries.

To comprehend Palantir’s current valuation, we’ll investigate three scenarios based on various growth projections using Discounted Cash Flow (DCF) calculations.

Current Valuation

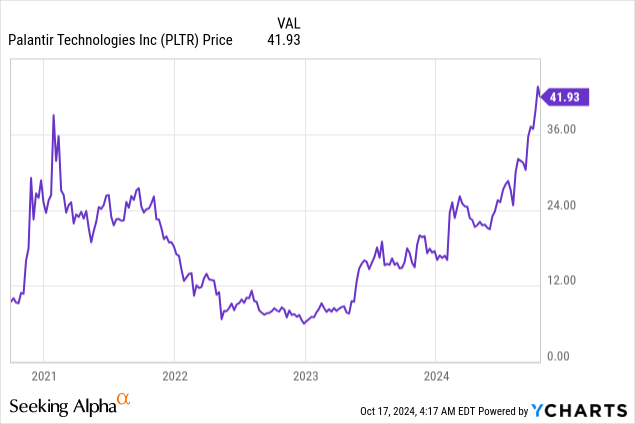

The recent spike in Palantir’s stock price is indicative of excitement regarding the company’s long-term AI prospects.

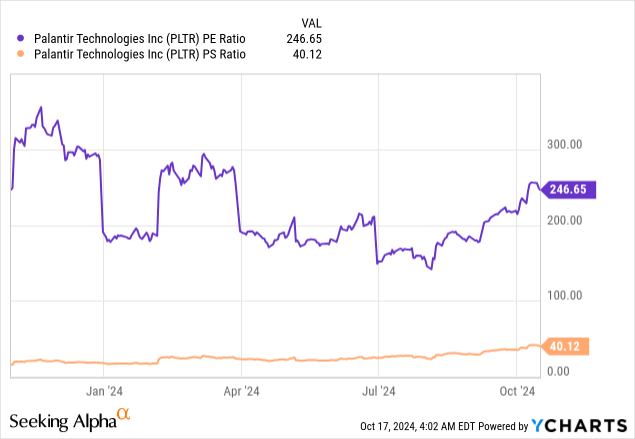

As a result of this massive performance, the price-to-earnings (PE) and price-to-sales (PS) ratios have also increased, or have been that high since the IPO in 2020, indicating that the expectations for the company are enormous.

Seeking Alpha’s Valuation Grade is therefore justifiably at an F, since other valuation methods come to a similar conclusion.

PLTR Valuation Grade (seekingalpha.com)

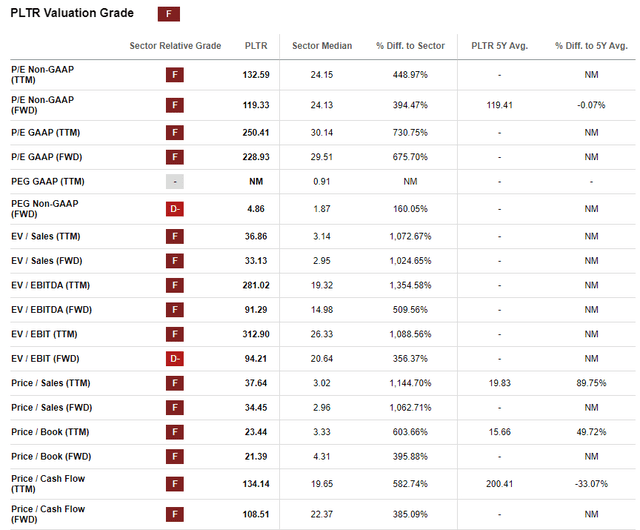

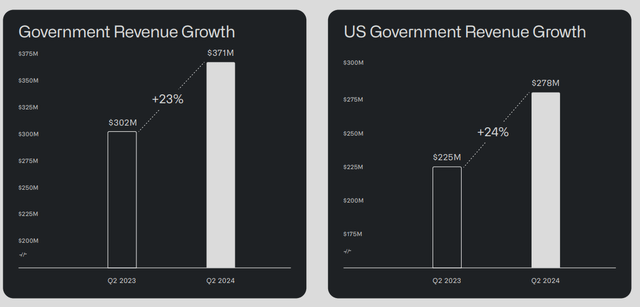

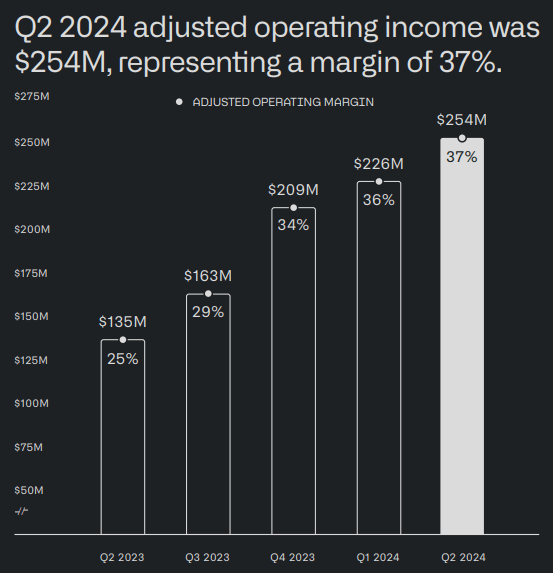

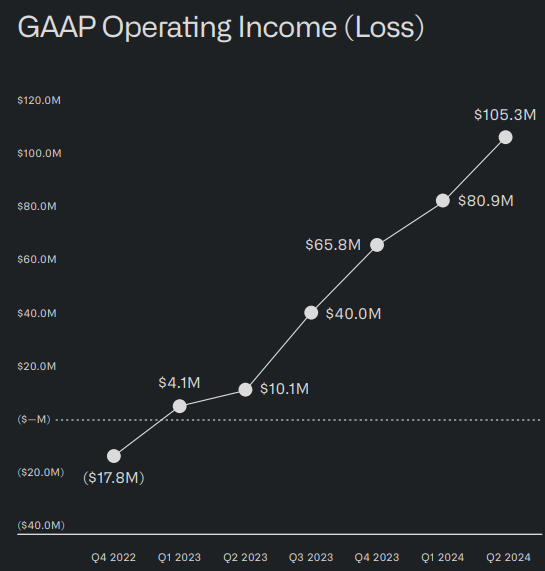

Taking a look at the latest earnings, there are however many positive things and developments one has to acknowledge. They are increasingly focusing more on the promising commercial segment and less on the sluggish government one, all while increasingly improving profitability.

Palantir Commercial Revenue Growth (Palantir Q2 Earnings) Palantir Government Revenue Growth (Palantir Q2 Earnings) Palantir Profitability (Palantir Q2 Earnings ) Palantir Quarterly Operating Income (Palantir Q2 Earnings )

A ~240(!) PE and ~40(!) PS ratio nevertheless seems completely out of touch with everything the stock currently has to offer. Still, the company is currently trading at these prices, meaning some market participants think that the current price is justified.

To make sense of the current valuation and get a better understanding of potential requirements for additional upside, I conducted three different DCFs with different growth projections.

Discounted Cash Flow Analysis

Main Assumptions

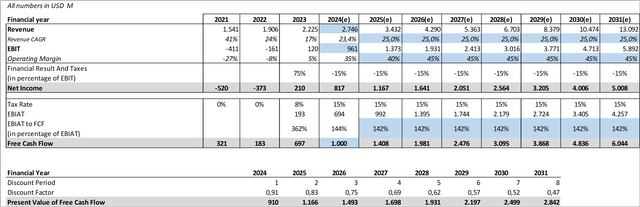

I took the following main assumptions for our DCFs:

-

- EBIT-Margin: Palantir is currently guiding a revenue of ~$2.75 billion and EBIT of ~ $0.97 billion for 2024, translating into an EBIT margin of 35%. From there on I assumed the following margins, to adjust for an improvement in profitability.

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| EBIT | 35% | 40% | 45% | 45% | 45% | 45% | 45% | 45% |

- Tax Rate: For the future tax rate I assumed 15%.

- Free Cash Flow Conversion: Palantir is also expecting free cash flow in the range of $0.8 billion to $1.0 billion. To get a suitable FCF conversion rate I used the high end of this guidance, the above-mentioned EBIT guidance and the tax rate, to calculate the EBIAT to FCF conversion of 142%.

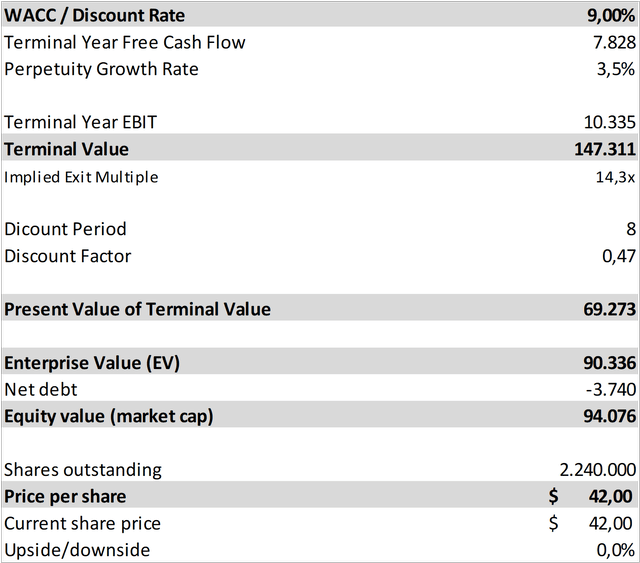

- WACC: Here I used 9%, which is right around Palantir’s current WACC.

- Perpetuity Growth Rate: Here I used a conservative 3.5%.

Historical Growth Rates

In the first scenario, we assume that Palantir is continuing to grow at historical growth rates. Their 3y-revenue CAGR (TTM) is currently at 23%. For some additional upside, I used 25% revenue growth rate in the first scenario.

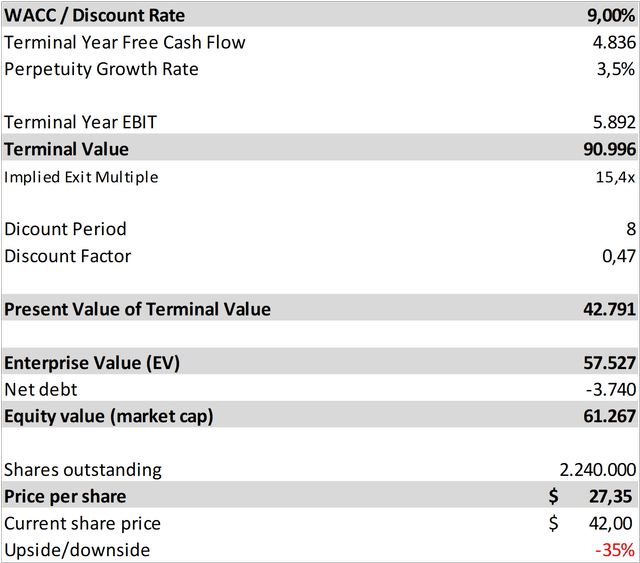

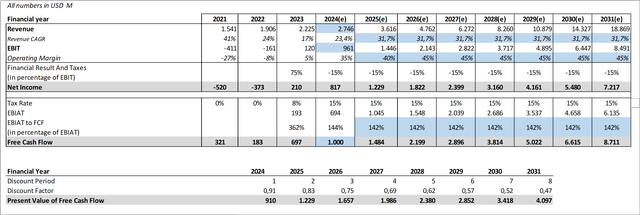

Palantir Discounted Cash Flow Analysis I – Historical Growth Rates (own assumptions; seekingalpha.com) Palantir Discounted Cash Flow Analysis II – Historical Growth Rates (own assumptions; seekingalpha.com)

In this scenario, we get a fair value share price of $27, meaning that the current share price of $42, gives us an overvaluation of 35%.

AI Market Rates

I this scenario, we assume that Palantir manages to exceed historical growth rates and grows at the anticipated growth rate of the whole AI market. As this is very hard to predict, I consulted several sources for a suitable growth rate:

| Markets and Markets | 35.7% p.a. |

| Statista | 28.5% p.a. |

| Grand View Research | 36.6% p.a. |

| Fortune Business Insight | 20.4% p.a. |

| Forbes | 37.3% p.a. |

All are looking at a time frame of 2024 to 2030/2031. The average of these five sources gives us an average revenue CAGR of 31.7% p.a. With this, we get the following DCF.

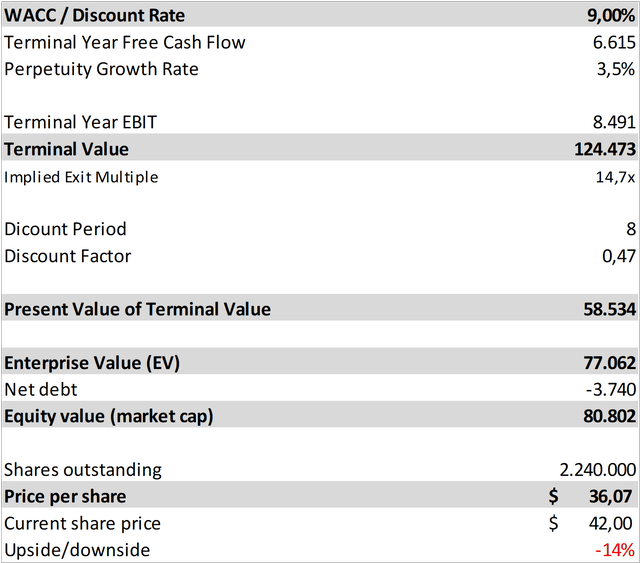

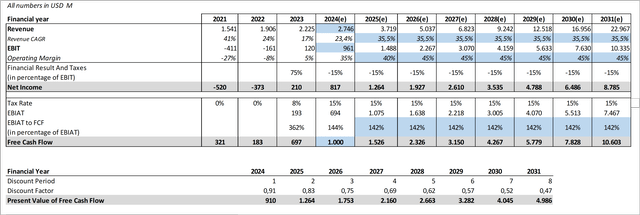

Palantir Discounted Cash Flow Analysis I – AI Market Growth Rates (own assumptions; seekingalpha.com) Palantir Discounted Cash Flow Analysis II – AI Market Growth Rates (own assumptions; seekingalpha.com)

These rather optimistic growth rates leave us with a fair value share price of $36, meaning that the company is still overvalued by 14% in this scenario.

Required Growth Rates for Fair-Value

In the last scenario, we are exploring what growth rates would be necessary over the next 8 years to justify the current valuation.

Palantir Discounted Cash Flow Analysis I – Required Growth Rates for Fair-Value (own assumptions; seekingalpha.com) Palantir Discounted Cash Flow Analysis II – Required Growth Rates for Fair-Value (own assumptions; seekingalpha.com)

According to this DCF, Palantir needs a revenue CAGR of at least 35.5% for the next 8 years to justify the current valuation.

Conclusion

Palantir seems to be very expensive when looking at several different valuation methods. Even when factoring in growth rates ~26% above the historical growth rates (31.7%=AI market rate), we still get an overvaluation of 14%. We, in fact, need at least an increase of 42% to a revenue CAGR of 35.5% p.a. to justify the current stock price.

Even with this valuation, I’m currently “only” trimming my position by at least 50%. My position is currently ~300+% in the green, so realizing a few gains won’t hurt. I’m planning to hold the remaining position, since Palantir is, in my opinion despite the valuation, a very compelling and a once-in-a-lifetime opportunity for a unique market position in AI and data analytics. I also think that a growth rate between historical and AI market rates seems feasible for Palantir, if we factor in their latest commercial growth rate of 33%. This is why I currently rate the company a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.