Summary:

- Broadcom entered the hybrid cloud market with their VMware acquisition.

- Second quarter FY 2024 results beat estimates, with revenue growth driven by Artificial Intelligence and VMware.

- Although the stock sells at a premium valuation, there is still potential upside for long-term investors.

Sundry Photography

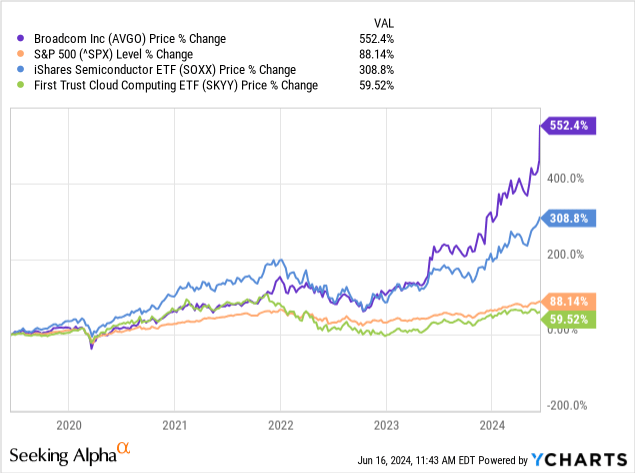

When I last discussed Broadcom Inc. (NASDAQ:AVGO), the company was coming off a quarter that displeased investors. The stock dropped 7% after releasing its first-quarter fiscal year (“FY”) earnings. I recommended buying the company because it is a huge potential beneficiary of the proliferation of Artificial Intelligence (“AI”). Since that recommendation, the stock rose 24.22%, compared to the S&P 500 Index (SPX) increasing 4%.

Broadcom recently reported its second quarter FY results that beat analysts’ revenue estimates by around 4% and non-GAAP (Generally Accepted Accounting Principles) earnings-per-share (“EPS”) estimates by 1%. Management also raised its annual revenue guidance. Generally, a guidance raise signals management’s confidence in future growth. The company’s most significant growth drivers during the quarter were AI demand and VMware (hybrid computing), which are both tremendous reasons to invest in this stock.

This article will discuss Broadcom’s VMware opportunity, review second-quarter earnings, examine the company’s risks and valuation, and give reasons for maintaining the stock’s buy rating.

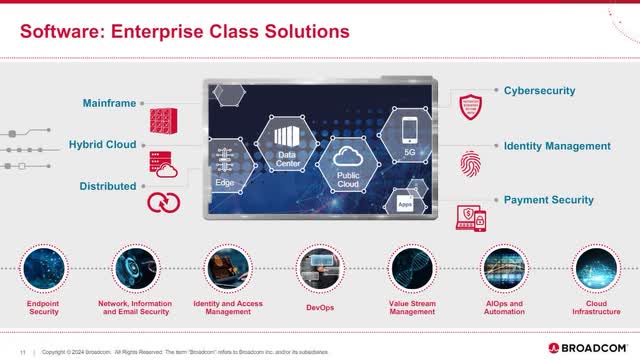

The importance of the VMware acquisition

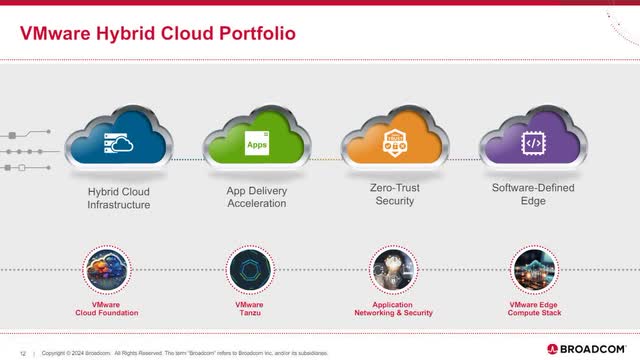

Broadcom closed its acquisition of VMware in November 2023. Management acquired VMware for its broad set of tools for private and hybrid clouds. Chief Executive Officer (“CEO”) Hock Tan said on the second quarter FY 2024 earnings call (emphasis added), “Since we acquired VMware, we have modernized the product SKUs from over 8,000 disparate SKUs to four core product offerings and simplified the go-to-market flow, eliminating a huge amount of channel conflicts.”

Broadcom Second Quarter FY 2024 Investor Presentation

Before we get into VMware’s products, we must first understand the definition of a hybrid cloud. Alphabet Inc. (GOOGL)(GOOG) defines a hybrid cloud on its Google Cloud website:

A hybrid cloud is a mixed computing environment where applications are run using a combination of computing, storage, and services in different environments-public clouds and private clouds, including on-premises data centers or “edge” locations. Hybrid cloud computing approaches are widespread because almost no one today relies entirely on a single public cloud.

In other words, a company can use different private and public clouds for different purposes. For instance, private clouds may be better suited for storing protected data. Public clouds may be better suited for data crunching that requires massive compute resources. Some clouds have specific AI or analytics resources that companies can’t find elsewhere. Which cloud a company uses has many competing concerns, including costs. Hybrid computing allows companies to choose different clouds depending on their needs for a specific period. So, there are a few good reasons hybrid clouds are becoming popular. According to Statista, the hybrid cloud market was $85 billion in 2021, and it forecasts the market to grow at a compound annual growth rate of 20.6% to $262 billion in 2027.

VMware Cloud Foundation can build and manage hybrid cloud environments and extend on-prem infrastructure into the public cloud.

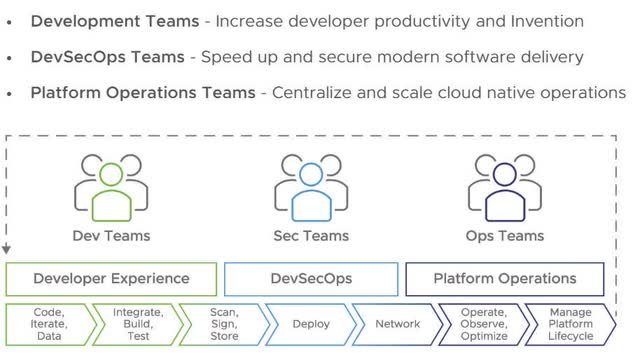

VMware Tanzu is a DevSecOps platform for building, deploying, and managing cloud-native applications across various cloud environments (private, public, hybrid). If you have not heard of DevSecOps, my article on GitLab Inc. (GTLB) defines the term. Although GitLab and Tanzu sound like both applications do similar things, the apps are complementary rather than competitive. The following image comes from a website describing Tanzu.

The company uses Zero Trust to secure workloads, applications, data, networks, devices, and users.

VMware also enables edge computing. Edge computing is servers or devices that process data locally at the “edge” of a company’s network. One example of edge computing is self-driving cars, which have onboard computers that process data on the vehicle. Other applications might be servers in factories or power generation sites. Broadcom has a massive existing customer base that could use VMware’s solutions.

The company is changing VMware’s business from a licensing to a subscription model as part of its integration efforts. CEO Hock Tan said on the company’s second-quarter earnings call:

We are making good progress in transitioning all VMware products to a subscription licensing model. And since closing the deal, we have actually signed up close to 3,000 of our largest 10,000 customers to enable them to build a self-service virtual private cloud on-prem. Each of these customers typically sign up to a multi-year contract, which we normalize into an annual measure known as Annualized Booking Value, or ABV. This metric, ABV for VMware products, accelerated from $1.2 billion in Q1 to $1.9 billion in Q2. For reference, for the consolidated Broadcom software portfolio, ABV grew from $1.9 billion in Q1 to $2.8 billion over the same period in Q2.

According to the numbers above, VMware’s ABV grew 58.3% sequentially, compared to the consolidated Broadcom software portfolio’s 47.4% sequential growth. Management is also driving the costs down and hopes to move VMware’s operating margins close to the rest of Broadcom’s software portfolio by FY 2025.

VMware can potentially drive significant revenue growth and profits for Broadcom, especially if it builds complementary products to its networking and storage solutions and AI chips.

The company’s second quarter FY 2024 revenue

Broadcom grew its second-quarter revenue by 43% year-over-year to $12.5 billion. However, most of this growth was a result of acquiring VMware. Organic growth was only 12% year-over-year, with most of the growth coming from AI revenue, which was up 280% year-on-year to $3.1 billion, more than compensating for cyclical weakness in other areas of the semiconductor business. Once the Federal Reserve lowers interest rates and the economy rebounds, revenue in some stagnant areas of Broadcom’s business should rebound. The company reports revenue in the following two segments:

1. Infrastructure software

Broadcom Second Quarter FY 2024 Investor Presentation

Broadcom’s software segment generated $5.3 billion or 42% of total revenue, up 175% over the previous year’s comparable quarter. VMware revenue grew 28.6% year-over-year to reach $2.7 billion.

Broadcom could encounter numerous problems as it attempts to digest the VMware acquisition. The article will discuss a few of the potential downsides of the acquisition in the risk section. However, management is pleased with the integration of VMware so far, despite the integration risks, and it is accelerating the growth of this new acquisition.

2. Semiconductor solutions

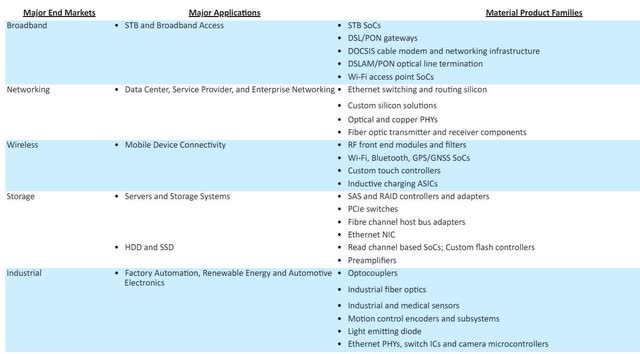

The semiconductor solutions segment consists of various products in many end markets. The company’s FY 2023 10-K lists the most significant end markets and products in the following image.

Currently, the networking end market makes up 53% of semiconductor revenue and drives most revenue growth. In the second quarter, networking revenue grew 44% year-over-year to $3.8 billion. CEO Hock Tan said the following about networking revenue growth on the second quarter earnings call:

[Networking revenue was] driven by strong demand from hyperscalers for both AI networking and custom accelerators. It’s interesting to note that as AI data center clusters continue to deploy, our revenue mix has been shifting towards an increasing proportion of networking.

Whenever management discusses “custom silicon” or “custom accelerators,” it refers to the company’s custom AI chips, also called ASICs (Application-Specific Integrated Circuits).

When you see management talk about AI networking, it’s a reference to the company’s Ethernet switching, PCI (Peripheral Component Interconnect) Express switches, NICs (Network Interface Controllers), DSPs (Data Signal Processors), optical lasers, and PIN diodes (used in fiber optic network cards and switches). Broadcom uses all of the above for connecting AI data center clusters together. CEO Tan said during the earnings call:

Seven of the largest eight AI clusters in deployment today use Broadcom Ethernet solutions. Next year, we expect all mega-scale GPU deployments to be on Ethernet. We expect the strength in AI to continue, and because of that, we now expect networking revenue to grow 40% year-on-year compared to our prior guidance of over 35% growth.

The above statement suggests that Hock Tan believes customers are changing their preference toward Ethernet for AI networking and moving away from NVIDIA Corporation’s (NVDA) InfiniBand networking product, potentially benefiting Broadcom because it is a dominant player in the Ethernet space. Additionally, it has some of the most highly advanced networking switches in the Tomahawk 5 and Jericho3 AI. A Broadcom press release states:

“The benchmark for AI networking is reducing the time and effort it takes to complete the training and inference of large-scale AI models,” said Ram Velaga, senior vice president and general manager, Core Switching Group, Broadcom. “Jericho3-AI delivers significant reduction in job completion time compared to any other alternative in the market.”

When management talks about custom accelerators and AI networking in a positive light, the company is likely doing well, as those areas are the company’s most significant growth drivers.

Wireless is the next largest end market, which accounts for 22% of semiconductor revenue. The wireless market was in a downturn in 2023 and stabilized in the fourth quarter of 2023. Apple is Broadcom’s largest wireless customer, with a massive deal between the two companies in 2023. The fact that Apple’s iPhone sales have been poor lately hasn’t helped Broadcom’s wireless sales. It only grew wireless revenue by 2% over the previous year’s comparable quarter to $1.6 billion. Don’t expect wireless to improve much this year. Management maintained its earlier guidance of flat revenue year-over-year guidance in FY 2024. Hock Tan commented, “This trend is wholly consistent with our continued engagement with our North American customer [Apple], which is deep, strategic, and multiyear and represents all of our wireless business.” Only when iPhone sales bounce back will investors see more growth in wireless.

Server storage was 11% of semiconductor revenue in the second quarter. The server storage market collapsed in 2023. However, some analysts project the storage market to recover in 2024. The company’s second-quarter server storage revenue declined 27% over the previous year’s comparable quarter to $824 million. Hock Tan discussed the server storage market on the earnings call:

We believe though, Q2 was the bottom in server storage. And based on updated demand forecast and bookings, we expect a modest recovery in the second half of the year. And accordingly, we forecast fiscal ’24 server storage revenue to decline around the 20% range year-on-year.

Broadband was 10% of the second quarter’s total revenue. Broadcom’s second-quarter Broadband revenue dropped 39% over the previous year’s comparable quarter to $730 million. Don’t expect a quick recovery in this end market. CEO Tan said:

Broadband remains weak on the continued pause in telco and service provider spending. We expect Broadcom to bottom in the second half of the year with a recovery in 2025. Accordingly, we are revising our outlook for fiscal ’24 broadband revenue to be down high 30s year-on-year from our prior guidance for a decline of just over 30% year-on-year.

In the second quarter, industrial revenue was 3% of total revenue and declined 10% over the previous year’s comparable quarter to $234 million. Expect the industrial market to worsen. Management forecasted industrial to drop a double-digit percentage over the last year’s second quarter, down from prior guidance for a high single-digit decline.

CEO Hock Tan said, “Non-AI semiconductor revenue has bottomed in Q2 and is likely to recover modestly for the second half of fiscal ’24.” Non-AI revenue is Broadband, Wireless, Industrial, and Storage, collectively. His updated FY 2024 AI revenue forecast from its networking end market is higher than the previous first quarter FY 2024 forecast of “35% of semiconductor revenue at over $10 billion.” He didn’t give the exact percentage of AI revenue he expected but raised total guidance for the semiconductor segment from “over $10 billion” to “over $11 billion.” Some analysts may complain that all of Broadcom’s semiconductor growth comes from AI and that the rest of the semiconductor business contributes nothing. However, while that may have been a valid observation recently, the rest of the semiconductor segment should rebound over the next year. If its forecasts come to fruition, the company should be firing on all cylinders sometime in FY 2025.

Additional fundamentals

On the second quarter earnings call, Chief Financial Officer (“CFO”) Kirsten Spears presented most of the company’s profitability metrics as non-GAAP. With the recent acquisition of VMware, the company has many amortizations, restructuring, and acquisition-related costs that make it challenging to compare GAAP numbers from period to period.

The company reported non-GAAP gross margins of 76.2%, up 60 basis points (‘bps”) from the previous year’s second quarter. Non-GAAP operating expenses were $2.4 billion, and R&D was $1.5 billion. Broadcom’s CFO, Kirsten Spears, attributed the increase mainly to the acquisition of VMware. Operating income on a non-GAAP basis was $7.1 billion, up 32% year-over-year from $5.4 billion. The second quarter FY 2024 non-GAAP operating margin was 57%, down 500 bps year-over-year. When excluding expenses associated with integrating VMware into Broadcom’s existing operations, operating income of $7.4 billion increased 36% year-over-year, with a 59% operating margin.

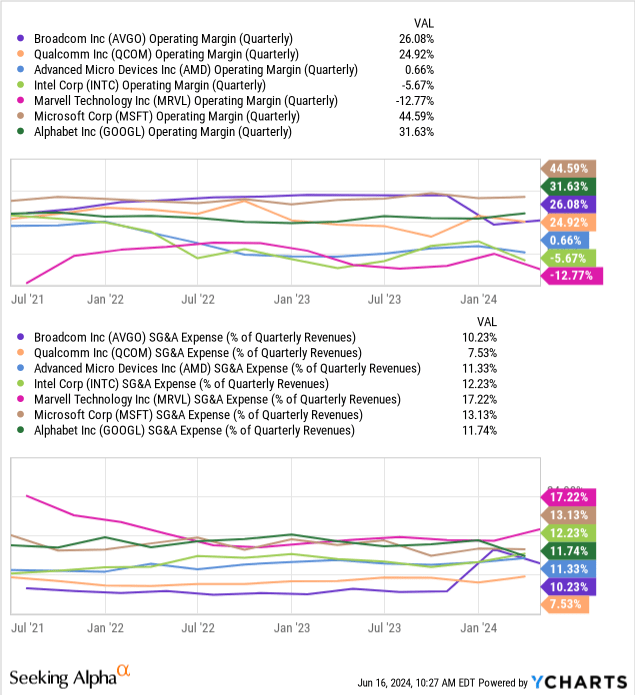

Broadcom is one of the most well-run companies in the tech industry. Before purchasing VMware, it had one of the highest GAAP operating margins among hardware manufacturers (except NVIDIA) and software/cloud companies. Its GAAP operating margins were routinely around as high as Microsoft’s. For instance, the company’s second quarter FY 2023 GAAP operating margin was 45.9%. Broadcom accomplished that feat by having one of the lowest Selling, General & Administrative Expenses (SG&A) as a percentage of revenue in the software, cloud, and hardware industry. For instance, the company’s second quarter FY 2023 GAAP SG&A as a percentage of revenue was 5%. This quarter, post-acquisition, its SG&A has ballooned to 10.23%, still lower than most of the industry but higher than its figures before the acquisition. Its GAAP Operating margin was 26.08% this quarter. The rise of GAAP SG&A and operating margin was mainly due to the integration of VMware.

CEO Hock Tan has a history of running a lean company and doesn’t invest much in Sales or G&A. Investors are hoping that company management will cut the fat out of VMware and bring VMware’s operating margins up to the rest of the software segment’s operating margins. If Broadcom does restore its operating margins to prior levels, it will happen over time, as integrating companies as large as VMware may be difficult.

Second quarter FY 2024 adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which omits $149 million of depreciation, was $7.4 billion or 60% of revenue, compared to the second quarter FY 2023 adjusted EBITDA of $5.7 billion or 65% of revenue. The company didn’t explain the slight EBITDA margin decline, but it likely is due to increased operating costs in integrating VMware. All-in-all, Broadcom lost some profitability year-over-year.

The Semiconductor Solutions segment’s non-GAAP gross margins were around 67%, a decrease of 370 bps from the previous year’s comparable quarter. The CFO said this decrease was primarily a result of “a higher mix of custom AI accelerators.” This segment’s operating expenses were $868 million, an increase of 4% over the previous year’s comparable quarter. The CFO attributed the rising operating expenses to increased R&D (research and development) costs. Semiconductor operating margins of 55% were down 400 bps from the previous year’s second-quarter results.

The infrastructure software segment’s second quarter FY 2024 non-GAAP gross margin was 88%, down 400 bps from the previous year’s second-quarter results. Second-quarter FY 2024 operating expenses were $1.5 billion, a substantial rise from the prior year’s second-quarter operating expenses of $361 million. The segment’s second quarter FY 2024 operating margin was 60%, down from the previous year’s comparable quarter operating margin of 73%. If you exclude the expenses of acquiring VMware, the operating margin for the infrastructure software segment would be 64%.

The company’s free cash flow (“FCF”) was also down. CFO Kirsten Spears said the following on the earnings call (emphasis added):

Free cash flow in the quarter was $4.4 billion and represented 36% of revenues. Excluding cash used for restructuring and integration of $830 million, free cash flows of $5.3 billion were up 18% year-on-year and represented 42% of revenue. Free cash flow as a percentage of revenue has declined from 2023 due to higher cash interest expense from debt related to the VMware acquisition and higher cash taxes due to a higher mix of US income and the delay in the reenactment of Section 174.

Section 174 of the Internal Revenue Code refers to the amortization of research and experimental expenditures. According to KBKG:

Section 174 was originally enacted in 1954 and allowed businesses to deduct 100% of expenses for research and development in the year they were incurred. The aim of this legislation was to incentivize businesses to pursue R&E opportunities that improve performance, product development, and other business processes.

A law that took effect in December 2021 changed Section 174 rules for how businesses account for research and development, negatively impacting businesses. Today, there is a movement to repeal the law that changed section 174, and the commentary by the company’s CFO means that there is some hiccup in getting section 174 restored to its original version. Broadcom will also need to pay down its debt to lower its interest expense and help restore its FCF margins to the previous levels over time.

Risks

One of the primary risks that investors should monitor is how well the company integrates VMware. Competitors like Nutanix, Inc. (NTNX) are already looking to gain new customers, as VMware clients may stop doing business with the company. Some of the reasons VMware may lose customers include higher prices, losing channel partners, systems companies like Dell Technologies Inc. (DELL), Hewlett Packard Enterprise Company (HPE), and Lenovo Group Limited (OTCPK:LNVGY)(OTCPK:LNVGF) reducing business with VMware, and possibly worse customer support.

Broadcom’s second quarter FY 2024 10-Q highlights integration concerns in its risk section, which states (emphasis added):

As part of our integration of the VMware business, we are focusing on VMware’s core business of creating private and hybrid cloud environments among large enterprises globally and divesting non-core assets. If VMware customers do not accept our business strategy, the investments we have made or may make to implement our strategy may be of no or limited value, we may lose customers, our financial results may be adversely affected and our stock price may suffer. Although we expect significant benefits to result from the VMware Merger, there can be no assurance that we will actually realize these benefits. Achieving these benefits will depend, in part, on our ability to integrate VMware’s business successfully and efficiently.

Additionally, the company used a significant amount of debt to finance the VMware acquisition. As soon as Broadcom closed the acquisition, Fitch Ratings downgraded the company’s Long-Term Issuer Default Rating and senior unsecured ratings from BBB to BBB-, one level above non-investment grade speculative (junk bonds). Right now, its outlook is stable. However, if the economy worsens, the company is at risk of its credit ratings changing from investment grade to a junk bond rating, which would result in an increased risk of default.

Its second quarter FY 2024 10-Q stated:

As of May 5, 2024, the aggregate indebtedness under our senior notes was $76,521 million [$76.521 billion]. During the two fiscal quarters ended May 5, 2024, we borrowed $30,390 million [$30.390 billion] in 2023 Term Loans to finance the VMware Merger, and we assumed $8,250 million [$8.250 billion] of VMware’s outstanding senior unsecured notes.

At the end of the second quarter, the company had only $9.81 billion in cash and cash equivalents. Its net debt was $64.21 billion, and the trailing 12-month EBITDA was $21.30 billion. Broadcom’s net debt-to-EBITDA ratio was 3.01, on the borderline of a risky debt situation. Additionally, the FCF that the company may otherwise use for growth initiatives, stock buybacks, or dividends is tied up. Instead, the company must use the FCF to pay down debt.

The current debt load also limits Broadcom’s ability to raise additional debt to fund growth, acquire other companies, increase working capital, or use the money for other purposes by making it more likely that lenders will institute stricter loan covenants, raise interest rates, and shorten maturities for future loans.

The 2023 Term Loans have floating interest rates, which expose Broadcom to interest rate risk. Broadcom’s interest payments on those Term Loans will increase if the Federal Reserve surprises the market by raising interest rates instead of lowering them.

The last risk I will briefly discuss in this article is competition, which is intensifying in Broadcom’s fast-growing AI business. The company’s networking and custom chip AI initiatives increasingly compete with NVIDIA solutions. Although you may hear that Broadcom’s management says that its custom AI chips don’t directly compete with NVIDIA’s off-the-shelf AI chips, NVIDIA also has initiatives to compete in custom AI chips. Although NVIDIA promotes customers using its InfiniBand networking product, it is also developing Ethernet products under the Spectrum-X brand.

Additionally, Broadcom has plenty of competition for its hardware solutions outside of NVIDIA. The company already competes against Marvell Technology, Inc. (MRVL) in networking. Competition is also increasing in the custom-made AI chips from a wide variety of players, from traditional chip manufacturers like Advanced Micro Devices, Inc. (AMD) to cloud players like Amazon.com, Inc. (AMZN), which created Inferentia AI chips for AWS, to AI startups like Groq and more. Many of these companies claim to have the fastest, most efficient, low latency chip. Broadcom will need to continue to invest substantial amounts to stay on the cutting edge of AI chips and networking.

Valuation

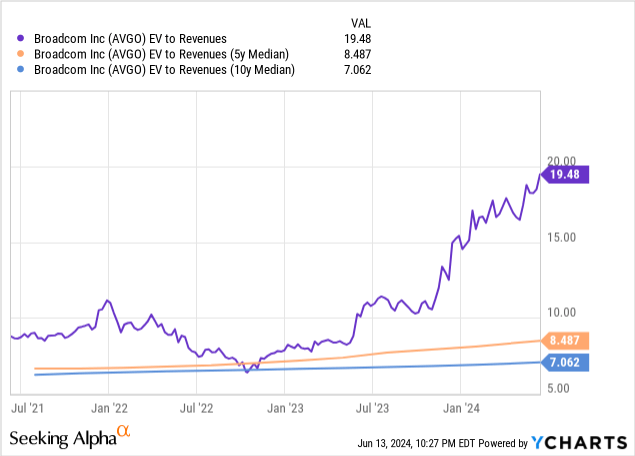

Broadcom sells at an EV-to-revenue of 19.48, well above its five- and ten-year median and the information technology (“IT”) sector’s EV-to-revenue of 3.21. Based on this valuation ratio and a few others, some may argue that the market grossly overvalues the stock. Seeking Alpha’s Quant grades the stock’s valuation an F.

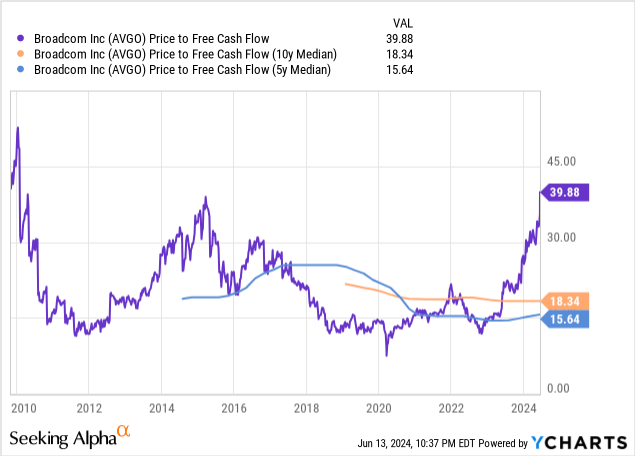

The company’s price-to-FCF (P/FCF) is 39.88, well above the five- and ten-year median P/FCF, signaling potential overvaluation. However, investors should remember that the costs of acquiring VMware have negatively impacted the company’s FCF growth. If Broadcom successfully integrates its recent acquisition and pays down its debt, the company should grow into its P/FCF valuation.

I often like to compare a company’s EPS year-over-year growth rate to the forward P/E rate one year out. If the two numbers match, I consider the stock fairly valued. Since Broadcom’s FY 2025 EPS growth rate of 24.66% nearly matches its one-year forward P/E ratio of 25.06, some might argue that the market fairly values the stock at current prices.

In my last article about the company, I said, “Broadcom has also grown its FCF at a rate of 15.75% over the last five years. Suppose the company can maintain that FCF growth rate over the next ten years; its intrinsic value would be $1502.99.” After the company reported second-quarter earnings, the stock price had zoomed by my previous intrinsic value estimate and reached $1678.99 on June 13. Let’s look at what the current stock price implies about the company’s FCF growth over the next ten years and examine whether that growth is feasible.

Reverse DCF

|

The second quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$18,461 |

| Terminal growth rate | 3% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 17.2% |

| Stock Price (June 13, 2024, closing price) | $1,678.99 |

| Terminal FCF value | $102.881 billion |

| Discounted Terminal Value | $495.475 billion |

| FCF margin | 43.31% |

Based on my assumptions about the discount and terminal growth rates, my latest reverse DCF calculation states that Broadcom needs to produce an FCF growth rate of 17.2% over the next ten years to justify its June 13, 2024 closing price. Some analysts forecast Broadcom’s FCF to grow at a compound annual growth rate (“CAGR”) of 23.14% over the next three years and reach an FCF margin of 51% by 2026. At least one analyst forecasts its revenue to grow at a 21.53% CAGR over the next five years.

If the company can maintain a 50% FCF margin over the next ten years, the company would only need to grow FCF by 15.3% to justify the June 13 closing price. Suppose the company can increase its FCF at a rate of 16% at a 50% FCF margin over the next ten years; the estimated intrinsic value would be $1,773.83, which is 5.6% over the June 13 closing price. At a 19% FCF growth rate at a 48% FCF margin, the estimated intrinsic stock value would be $2,123.90, which is 26.5% over the June 13 closing price. The point of these different scenarios is not to make an exact prediction of where the stock should trade but to show that if the company maintains a high rate of FCF growth and can restore and sustain FCF margins in the 48% to 50% range, it may still have upside, despite some thinking the market overvalues the stock.

Maintaining my buy rating on Broadcom

Broadcom has outperformed the overall market and the semiconductor and cloud markets over the last five years. Investing in Broadcom today involves believing that the company will continue to outperform.

This company has a history of finding lucrative markets that can grow over the long term. Its current growth engines are AI and hybrid computing, two markets with long-term secular tailwinds. A few of its other long-term investments, like Broadband, Wireless, Storage, and Industrial, have yet to kick into gear. However, management expects these markets to rebound by the end of FY 2025. Suppose those forecasts are accurate; expect the company to fire on all cylinders next fiscal year.

Broadcom just announced a 10-1 stock split that will go into effect on July 15. A stock split doesn’t impact the company’s fundamentals or market cap; however, it should make the stock more affordable for the retail investor. Although the stock price has increased significantly recently, and some may find it overvalued, it may deserve the premium. In my opinion, Broadcom still has potential upside over the next five to ten years. Therefore, I maintain my buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.