Summary:

- Despite previous skepticism, MARA Holdings’ stock has held up well post-halving, prompting a reevaluation of its potential pathways to profitability.

- Marathon’s Q3 2024 earnings preview shows growth in Bitcoin mining operations, but the company remains unprofitable on a gross income level.

- Key to profitability: reducing costs through vertical integration and exploring new revenue sources, including a potential pivot to AI data centers.

- Given the strides in cost management and AI opportunities, I am shifting to a speculative “Buy” rating for Marathon Digital.

da-kuk

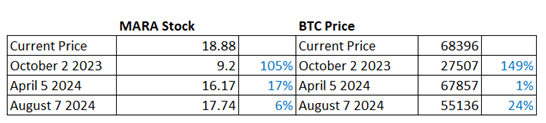

I’ve written previous articles on MARA Holdings (NASDAQ:MARA) where I made the argument that direct Bitcoin ownership may be a better investment. This has panned well 2 out of the 3 times I have suggested it, making it a win in my book.

However the fact of the matter is despite the drop in revenue due to the halving event, we have not seen a subsequent massive drop in MARA stock price. The company’s stock has held up way better than I expected causing me to have a second look. I believe the company has certain interesting pathways it can go from here.

Articles (Seeking Alpha)

Author’s Calculations (Seeking Alpha)

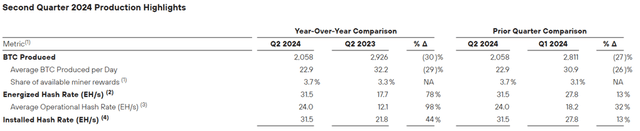

Q3 2024 Earnings Preview

In the latest update on Marathon’s Bitcoin mining operations, the company has shown growth in its operations. Its energized hash rate, a number used to calculate a miner’s efficiency, has reached 36.9 EH/s. This was a 5% increase from the month of August and substantial growth from the 31.5 EH/s reported last Q2 2024. The company mined 705 Bitcoins in September, 673 Bitcoins in August, and 692 Bitcoin in July. This makes the rough total for Q3 2024 about 2070 Bitcoins mined. This was slightly higher than the 2058 Bitcoins mined in Q2 2024.

The summary of these monthly results reflects what mining activity would look like post the April 2024 halving event. In other words, this gives us investors the idea that Marathon should be minting roughly about 2000 Bitcoins growing at a steady rate as it continuous to expand its production capabilities. According to management, the company is on track to hit its target of 50 EH/s by the end of 2024.

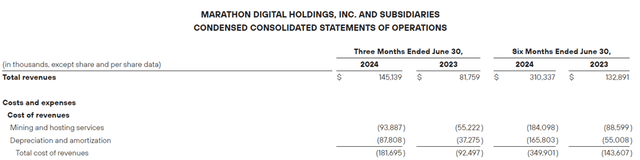

However, what is most concerning to me as an investor, is the fact that Marathon is not profitable on a Gross Income level for its Bitcoin operations. This was something I discussed in a lot of detail in my previous articles on the company. As a growth investor, I’ve become rather forgiving of technology companies reporting and sustaining negative Net Income for long periods of time. This is of course with the understanding that the company will eventually hit a certain scale, allowing profitability.

This scaling could be challenging though for Marathon Digital which loses money for every Bitcoin mined. For this article, though, I would like to play “Devil’s Advocate” and highlight the path to profitability for the company. These are the things in particular I would take note of in the company’s upcoming Q3 2024 earnings.

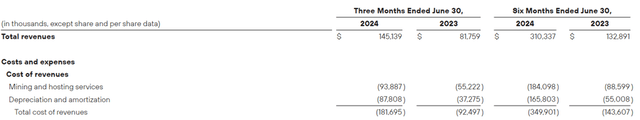

Marathon Financials (Investor Relations)

Marathon’s Path to Profitability

There are really only two ways for Marathon to reach profitability on a Gross Profit level, and that is either increase Revenue or/and decrease its costs. On the Revenue side, simply continuing to increase the company’s hash rate i.e. mining more Bitcoins would not lead it to profitability. This is because on the Gross Profit level, increasing Marathon’s hash rate without decreasing the cost per coin mined simply means that Marathon continues to lose every Bitcoin mined.

Marathon Financials (Investor Relations) Marathon Financials (Investor Relations)

In Q2 2024, the company reported a total cost of revenues of $181.7 million. Given that the company mined 2058 Bitcoins in Q2 2024, this implies a total cost per coin of $88,287 ($181.7 million divided by 2058 Bitcoin mined) in Q2 2024. This is a metric I would calculate when looking at Marathon’s upcoming Q3 2024 earnings. This high number is quite concerning as Bitcoin has not breached the $80,000 mark thus far this year.

In Q2 2024, the company reported total revenues of $145.1 million. However, of the total amount of $78.6 million was mark-to-market revenue from the increase in the average price of bitcoin. Removing this amount and the small amount of revenue generated from providing hosting services gives us about $57.8 million in Revenue from direct mining. Dividing this amount by 2058 Bitcoins mined gives us a price of $28,104. Considering the massive Bitcoin rally since then, I would not be surprised to see Marathon report improved Revenues for the quarter. Note though that the current price of Bitcoin is roughly $68,000 which is still below the implied cost to mine, thus not ensuring the company’s profitability.

Cost-Cutting Measures and Other Revenue Sources

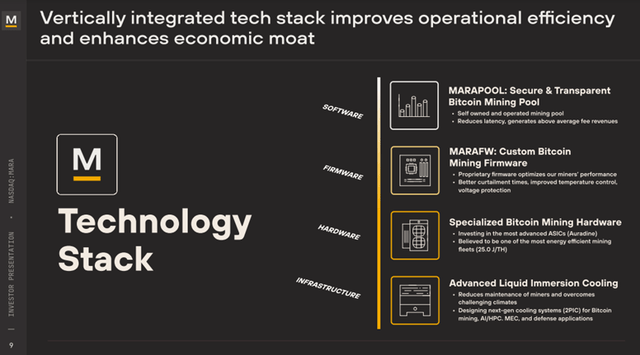

Marathon’s management seems to be aware of the issue and has begun vertically integrating its operations. Initially, the company pursued an asset-light strategy by relying on third parties in order to expand rapidly. Once acquired, these owned sites can be operated more efficiently using the company’s vertical stack. For instance, Marathon is in the process of converting its Granbury data center from air-cooled to MARA’s immersion containers. Being majority vertically should reduce the company’s cost of Bitcoin mined. This is something we should look out for in the coming quarters.

Investor Presentation (Marathon Digital)

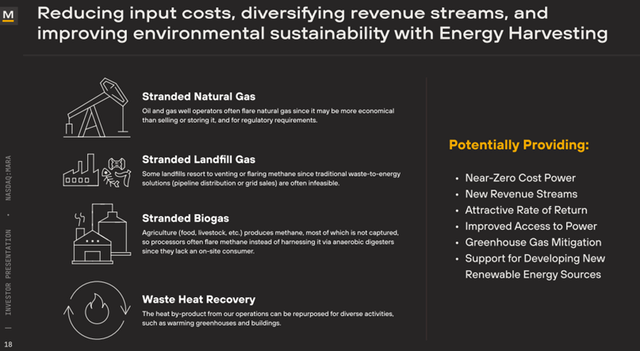

In terms of revenue, Marathon has been exploring alternative sources of Revenue to boost its profitability. Many of the proposals though are merely ancillary, and I don’t expect these to move the needle much. These proposals range from using the heat generated by Bitcoin mining to using the excess methane from landfills to power operations. Some of these projects are already ongoing. For example, the company is already re-selling recycled heat to 11,000 residents in a small town in Finland.

These projects, though while good PR due to its environmental benefit, are simply too small to significantly impact Marathon’s top-line revenues. For example, the data center in Finland that sells recycled heat is only 2MW, while the landfill methane gas Bitcoin data center is only 280kW. This is but a tiny size of the company’s 760MW of mining capacity. The company has also started mining the cryptocurrency Kaspa which has a higher profit margin than Bitcoin. As well as leveraging its balance sheet to borrow $300 million in order to buy more Bitcoin.

Investor Presentation (Marathon Digital)

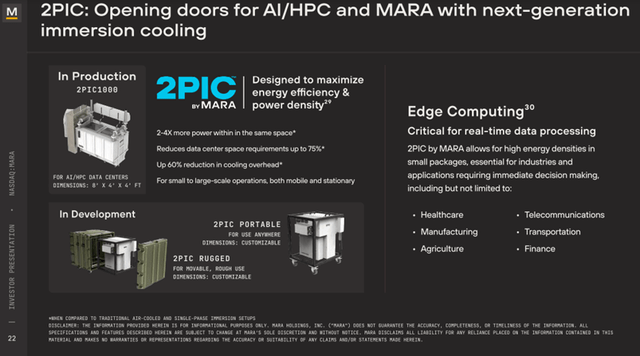

However, by far the most interesting avenue that Marathon could pursue is a pivot to AI. The demand for data centers is set to grow rapidly in the near future, driven primarily by AI computing. Estimates from the Federal Energy Regulatory Commission indicate that data centers will need up to 35 GW of power as early as 2030, a significant portion of all power generated in the US. According to a Reuters article, due to a lack of supply of reliable electricity, technology companies have begun pursuing energy assets held by bitcoin miners. It wouldn’t be a surprise to me to see more collaboration or deals between Bitcoin miners and technology companies for data centers.

Furthermore, Marathon has made specific moves towards this pivot. For instance, the company has recently appointed AI experts Janet George and Barbara Humpton to its board. The company’s technology and know-how in the field of power efficiency could provide a competitive advantage. Specifically, the company’s MARA 2PIC700 Two-Phase Immersion Cooling System can be used for AI data centers as well. Simply put, the technology allows up to 2-4x more power within the same space by rapidly cooling the hardware used in data centers. A lot of power is used to cool data systems, and “running too hot” creates inefficiencies. According to the company’s press release about this system;

Compared to current alternatives, MARA 2PIC700 enables two to four times the power density and can reduce the space requirements for a data center by up to 75%. It can operate in temperatures ranging from minus 20 degrees Celsius to 50 degrees Celsius and is built for remote management. As a result, the system can enable data centers to be built and operated in remote or harsh climates that were previously inaccessible. For Bitcoin mining specifically, MARA 2PIC700 enables ASIC miners to be overclocked by 60-100% and can enable up to a 60% reduction in cooling costs, even under the most extreme conditions.

Investor Presentation (Marathon Digital)

It will be interesting to see in the coming quarters whether or not Marathon could make any inroads in the AI/High-performance computing industry. I would keep an eye out for any deals made by the company and other Bitcoin miners in this space. I believe, if successful, this could prove to be a real game-changer for the company.

Conclusion

In previous articles, I believed that investors were better off owning Bitcoin or a Bitcoin ETF over Bitcoin miners like Marathon Digital. This was a theme that played out pretty well I think as mentioned above. However, I am changing my tune a bit as management seems to be making strides towards decreasing costs and increasing revenues. In particular, I am excited about the company’s foray into AI data centers using its cooling technology. Finally, the halving event that I first wrote about in October 2023 last year has already come and gone, so the decreased mining output is already “baked in” the current price of Marathon’s stock.

In terms of valuation, based on the last 10-Q the company has roughly $375.3 million in long-term liabilities and about $256 million in Cash. The company also recently raised $300 million in Convertible Senior Notes, which it used to purchase $249 million worth of Bitcoin. Based on the latest September update, has about 26,842 BTC. At Bitcoin’s current price of $68,396, the company’s Bitcoin assets plus its cash minus its debt is $1.416 billion.

At Marathon’s current stock price, its market cap is about $5.560 billion. In other words, you are paying about 3.9x asset value per share. This is a reasonable valuation compared to the 3.4x median Price to Book value. Note: that I’ve used this valuation method as Marathon is not profitable on a Gross Income level and a good chunk of its Revenue comes from mark-to-market gains on the increased price of Bitcoin. Also, the vast majority of its hardware assets on its books (i.e. mining rigs) have a very short useful life.

I’ve been debating on whether to rate Marathon as a “Hold” or as a “Buy”. Ultimately, it comes down to what you believe about the future of the company. I am switching gears to a very speculative “Buy rating” as I think the company has many paths to be successful moving forward. I am particularly interested in the application of its technology to the AI industry.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MARA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.