Summary:

- Bitcoin miners like MARA are leveraging convertible bonds to increase BTC holdings, injecting stock volatility and achieving high BTC Yields.

- MARA’s BTC holdings and operations make it undervalued, with 53% of its market cap in BTC.

- The convertible bonds strategy has driven a 47.6% YTD BTC Yield, yet the market hasn’t fully recognized this value.

- MARA’s approach and asset value make it a strong buy, offering significant upside potential at current levels.

halbergman

There’s a lot of really interesting things going on in Bitcoin (BTC-USD). BTC recently crossed $100,000 per coin and $2 trillion market cap, hitting a new milestone that has been in the making for almost 16 years.

The corporate adoption of Bitcoin as a strategic treasury asset is also beginning to take off. There is even the suggestion that the US might put BTC on its balance sheet. In this article, I’ll focus on a very interesting development in corporate BTC acquisitions— Bitcoin miners that are raising capital to buy BTC. MARA (NASDAQ:MARA), the world’s largest publicly traded miner by hashrate, is really leading the way in this front.

Raise Capital To Buy Bitcoin – Strategy Overview

I’ve covered the general strategy of raising money to buy BTC in several different articles. It is as follows:

-

Buy BTC with cash you have.

-

Issue shares to buy BTC.

-

Borrow money to buy BTC.

-

All of this increases the equity’s exposure to BTC, a highly volatile asset. This makes the stock super volatile. If it hasn’t happened already, get option markets on the equity.

-

Once a high implied volatility is reflected by the option markets, issue convertible bonds at very low-interest rates to buy BTC.

The 5th step is essentially the company selling its own volatility to rapidly grow BTC per share, since a convertible bond has a call option embedded within it. Everything leading up to step 5 is about increasing BTC exposure so that BTC’s volatility can be injected and infused into the stock. If all goes well, the stock will have an >100 IV with a vibrant options market. This allows convertible bonds to be issued at near 0% interest rates.

Convertible bonds offer many benefits for growing BTC per share:

-

Selling volatility, so you are monetizing something other than your equity and debt

-

Issuing equity at above the market price, based on the conversion premium

-

Minimal interest expenses to service the debt, and in some cases zero expenses

-

Tap into a gigantic market of convertible bonds traders. Their trading activities (delta hedging, gamma scalping) also increase price discovery and volumes in your stock

-

You can immediately take the proceeds to buy BTC, announce a BTC Yield that same day, and then raise more money at a much higher frequency than for anything else

-

The acquisitions of BTC have the effect of cornering the supply and driving up the price of BTC, which makes your BTC more valuable

Why Bitcoin Miners Can Do This Really Well

If you look back at the steps above, you’ll notice injecting volatility into the stock is vital to successfully executing the strategy. Most stocks take a while to get there because they have an operating business which is not volatile. They need a lot of BTC to really inject volatility.

Bitcoin miners are already very volatile because their entire business model centers around BTC. A mining operation is much like a call option on BTC, where the strike price is the cost to mine 1 BTC. Many miners also hold on to the BTC they mine, which gives the balance sheet some higher-than-average BTC exposure. Most miners have over 100 IVs.

Therefore, miners can issue convertibles at near 0% rates, and MARA has done this a few times this year. Each time, the company spent most of the money on BTC. The company has 40,435 BTC as of 10 December and a YTD BTC Yield of 47.6%. This means that for every 1 BTC you held via MARA shares on 1 January 2024, you now held 1.476 BTC from those same shares.

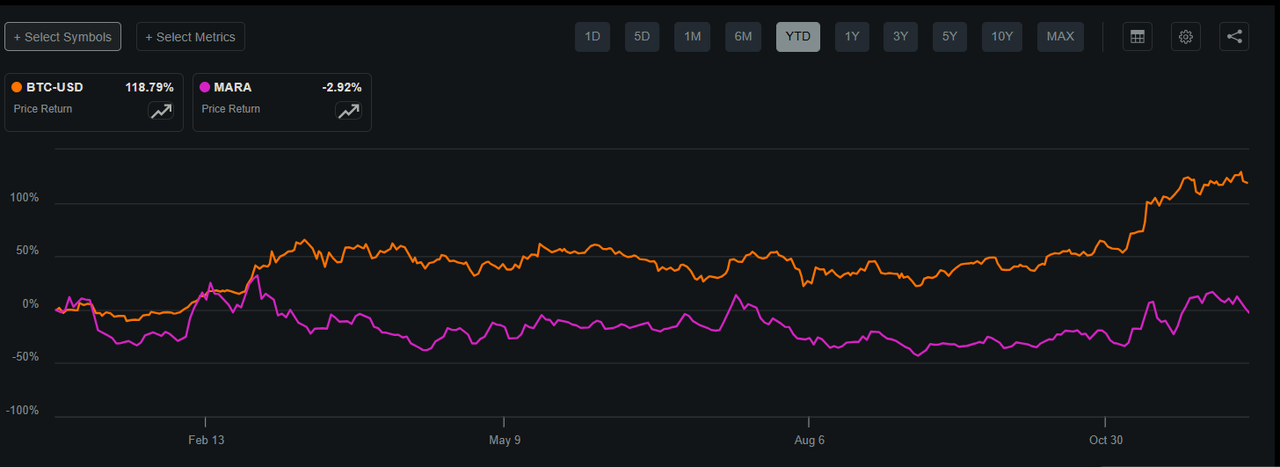

MARA Looks Pretty Cheap

Because BTC is up 118% YTD, a BTC Yield of 47.6% would mean that the value contained within a share should have increased around 165% (I am simply adding the BTC Yield and the BTC performance, but this would be an overestimate if MARA bought the BTC throughout the year at higher price points, which it did). The fact that the stock hasn’t moved much this year suggests that an extreme repricing could be in store.

BTC and MARA YTD (Seeking Alpha)

Here’s another way to see it. Anyone can clearly see that this is an operating business plus a large stash of BTC. These two components are required to get a fair value of the company. The 40,435 BTC at $96,000 per coin is $3.88 billion. MARA’s market cap right now is $7.34 billion at a $22.80 share price. This means that 53% of the company’s value is BTC. For every dollar of MARA stock you buy, you are getting 53 cents of BTC. The operating business makes up the remaining 47 cents of that dollar, and it has a value of $3.46 billion.

Let’s do some quick math.

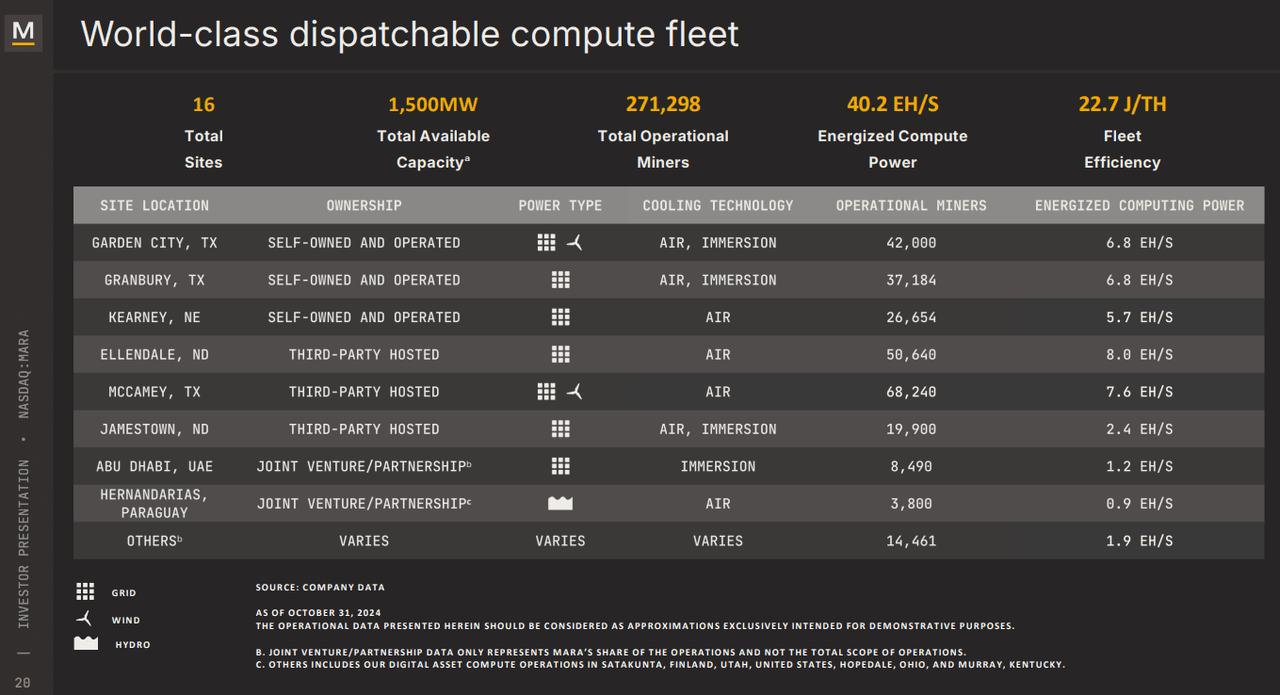

MARA has an average fleet efficiency of 22.7 J/Th as of Q3. It also has 50 Eh/s as of 10 December. Miners will install the newest models, so I expect the average fleet efficiency to be slightly more efficient by 10 December (the Q3 presentation reports 40.3 Eh/s). Note that a higher fleet efficiency means a lower J/Th number.

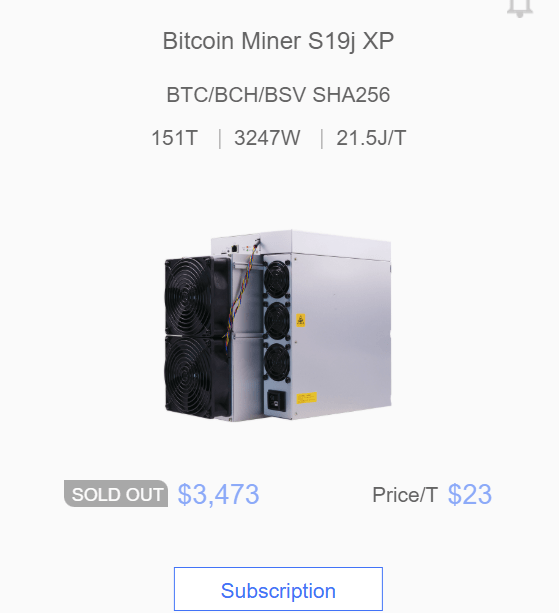

On Bitmain’s website, the S19J XP miners are 21.5 J/Th efficiency with a price per terahash of $23. Because MARA’s average fleet efficiency will be roughly 21.5 J/Th, we can assume that it is all S19j XP machines.

S19j XP (Bitmain)

Given these numbers, the ASICs alone required to generate 50 Eh/S is worth $1.15 billion (23 $/T x 50,000,000 T = $1.15 billion; 1 exahash is 1 million terahashes).

So the operating business which is worth $3.46 billion (after we removed the BTC holdings from the MARA market cap) also contains $1.15 billion worth of machines. This isn’t even counting the fact that all the machines are currently installed and running with all the proper servicing protocols in place. It also doesn’t count the actual sites, power infrastructure, and human capital that must accompany a mining operation for the machines to generate hashrate and mine BTC. MARA has 1500 MW of available capacity and owns much of these assets outright.

Is all of that worth only $2.3 billion? Let us say that it is worth $2.3 billion, despite the fact that some data center REITs with 3000 MW in total across their sites (and minimal ownership of computing machines) can trade for tens of billions of dollars.

Please remember that we still haven’t even counted the future income generated by turning these machines on. 50 Eh/s is 6.5% of the Bitcoin network’s total hashrate of 765 Eh/s. Bitcoin miners collectively earn a 3.125 BTC block subsidy per block per 10 minutes (we are not even counting network transaction fees). This is 4320 blocks, 13,500 BTC per month. A 6.5% share of that is 877.5 BTC, or $84.2 million at $96,000 per coin. So $84.2 million per month is the lower bound revenue estimate.

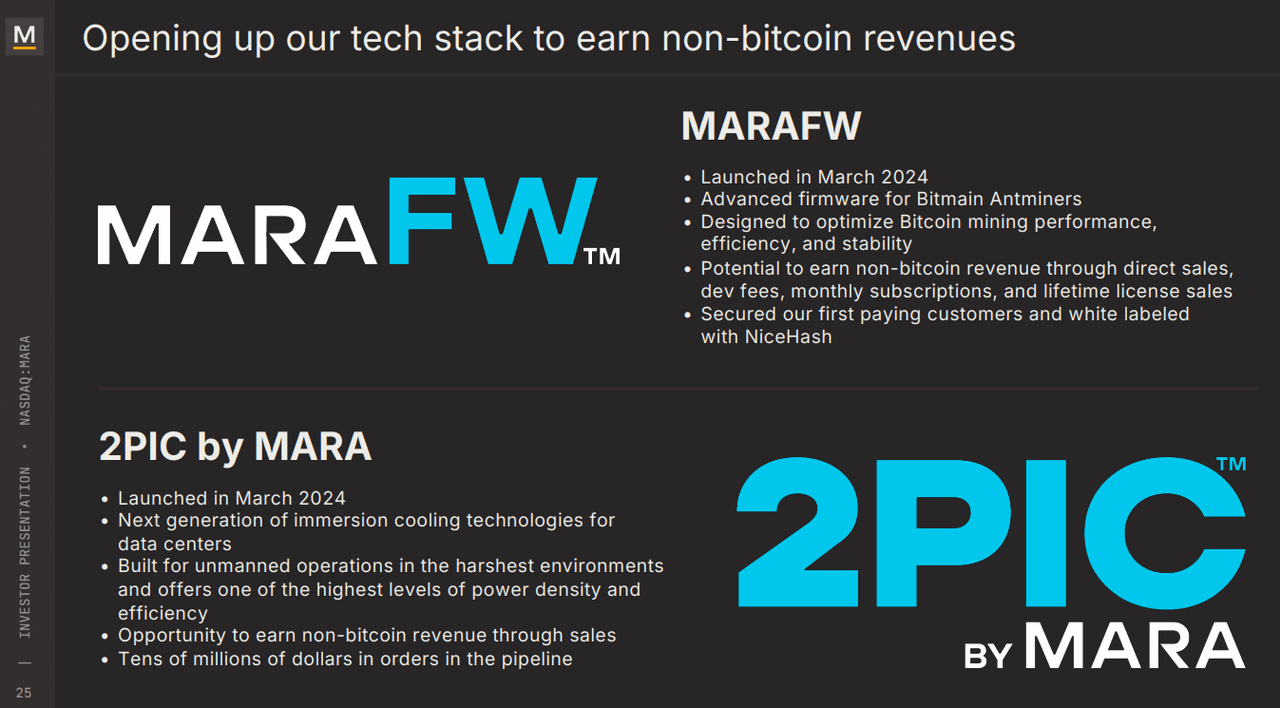

We also must remember that the mining operation isn’t even the only operating business segment. MARA sells special firmware and 2-phase immersion cooling (2PIC) technology.

2PIC has tens of millions of dollars in orders in the pipeline. 2PIC works for Bitcoin mining and for AI GPUs. This is a pure pick and shovels play on AI data centers. MARAFW, which is only for mining, also has its own paying customers.

An investor is probably getting a lot of free things at the current share price and market cap.

There’s a third way to see this opportunity. And it is the simplest.

Amongst all the miners, MARA’s BTC holdings occupy the highest percentage of its market cap.

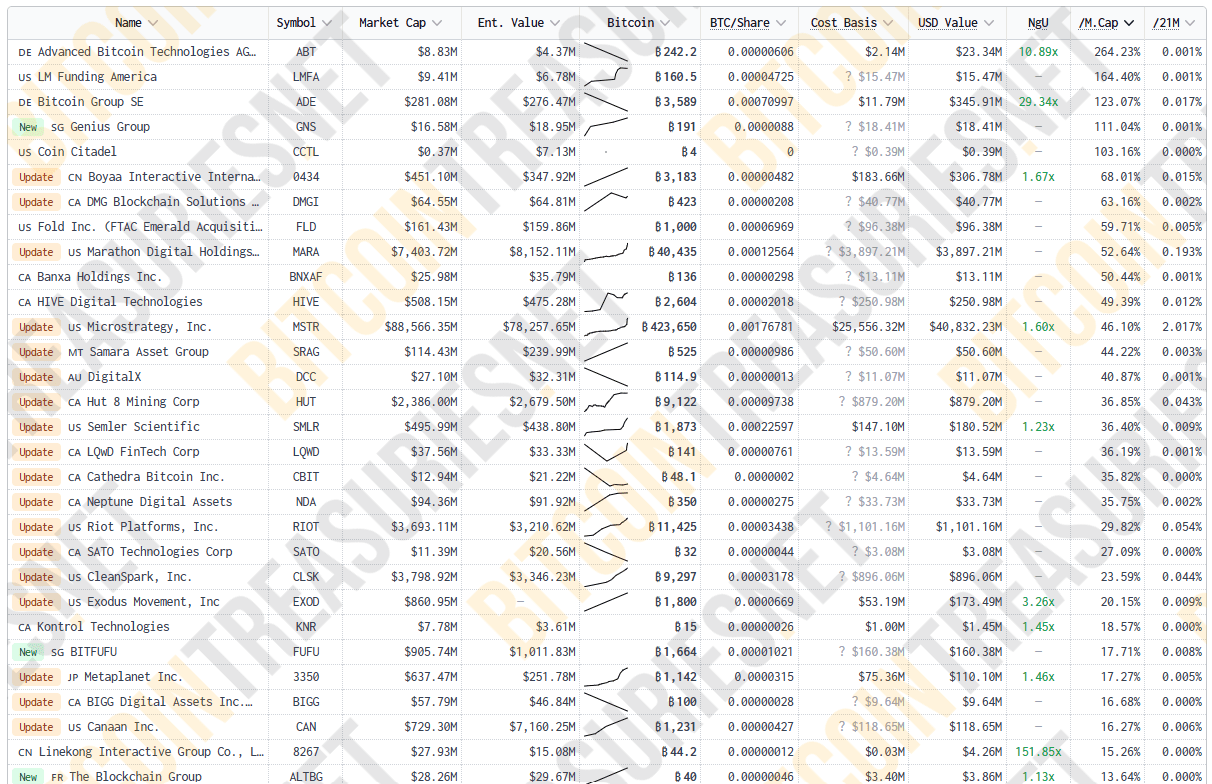

At this point, MARA’s premium to its BTC holdings is even smaller than MicroStrategy’s premium to its own BTC holdings. And unlike MicroStrategy, MARA’s operating business has a positive income based on GAAP accounting. Here is the list of companies with Bitcoin treasuries, sorted by their BTC as a percentage of their market:

Bitcoin Treasuries (Bitcointreasuries.net)

When you look at it this way, MARA is literally the cheapest miner. And it is fascinating that it has the most BTC and highest BTC Yield by a long shot.

Risks

The main risk with MARA is that the convertible bonds strategy doesn’t work out. This can happen if there’s a prolonged pullback in MARA’s price. The bondholders will not opt to convert their bonds to shares, and MARA may be forced to sell off assets to pay the principal. It is also during such a time that refinancing the bonds could prove difficult, leaving asset sales to be the only course of action. This risk could materialize if BTC crashes. This company is of course a bet on BTC. Anyone who cannot accept that risk need not consider MARA for investment.

The other key risk is that MARA still seems to be very committed to increasing hashrate. I dislike this. Mining is largely a losing game in all commodities. Gold miners don’t outperform gold and silver miners don’t outperform silver. Bitcoin is the most unforgiving and zero-sum commodity there is, thanks to its absolute scarcity and its global accessibility. Bitcoin miners have no moat in mining. Their moat is in their access to power infrastructure, which can be repurposed to serve AI use cases. Recently, we are seeing that their other moat is the volatility of their equity, which can be efficiently monetized via convertible bonds.

In general, my view is that MARA can and should divest their miners over time and buy BTC with the proceeds to further increase BTC per share. Dumping the depreciating ASICs and focusing on acquiring BTC would be better for the long term. It is unlikely that any ASIC will generate more BTC over time via mining than by being sold for some BTC on the spot.

Conclusion

The company is executing the convertible bonds strategy with great results. Yet, the market has been seemingly unresponsive to these enormous BTC Yield numbers that MARA has been putting up. On a multiple to BTC holdings basis, MARA is the cheapest Bitcoin miner out there. A simple sum of parts analysis shows that there is a lot of value here.

MARA is a Strong Buy at these levels.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, FBTC, MSTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

May initiate a Long position in MARA in 72 hours.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.