Summary:

- MARA, the largest publicly traded Bitcoin miner, is pursuing BTC Yield and increasing BTC per share, following MicroStrategy’s lead.

- MARA has potential additional revenue streams through products like 2PIC and MARAFW. These are like a pick and shovels play to Bitcoin mining.

- Risks include potential lack of product market fit for tech solutions, reliance on BTC price fluctuations, and focus on hashrate growth over BTC acquisition.

eclipse_images/E+ via Getty Images

MARA, formerly Marathon Digital (NASDAQ:MARA) before they rebranded the company, is the biggest publicly traded Bitcoin miner by hashrate. MARA’s latest actions suggest it is pursuing BTC Yield, a KPI pioneered by MicroStrategy (MSTR), to increase BTC per share.

I have written about BTC as a treasury reserve asset in the past. Today, my position is quite simple: increasing BTC per share is accretive and a form of generating value for shareholders. Almost all of my assets are invested in either BTC or equities which have the ability to increase BTC per share. The increase of BTC per share is termed “BTC Yield” by MicroStrategy. Because MSTR pioneered the concept of BTC treasury reserves, I will use this term to describe this new corporate finance strategy.

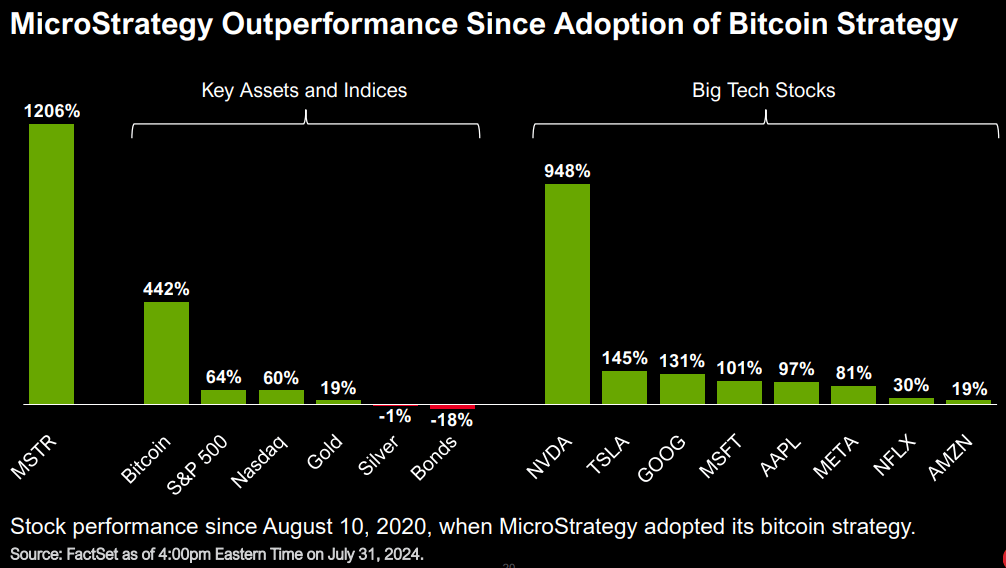

The reality is that companies on this path tend to outperform. MSTR is the best example of this. It is a mediocre software business which prioritized BTC Yield and here are the results after a few years:

MSTR Outperformance (MicroStrategy)

It seems like MARA is now aggressively pursuing BTC yield because it is a Bitcoin miner that is also purchasing BTC via securities issuances. MARA did an offering of $250 million of senior convertible notes but this was heavily oversubscribed so they closed the round with $300 million. Most of the money was used to purchase BTC, which has now caused MARA’s BTC holdings to swell to over 25,000 BTC.

This is the first high profile example I have seen of a Bitcoin miner also purchasing BTC. After all, miners are automatically receiving their revenues in BTC directly from the Bitcoin block reward. They even have to sell the BTC they have mined to cover the cost of power, maintenance, and administrative overhead. Many miners do hold the BTC they have mined, but to actually raise more money to buy more BTC from the market, while also mining it, is unheard of to me. Personally, I really like it.

Cost To Mine

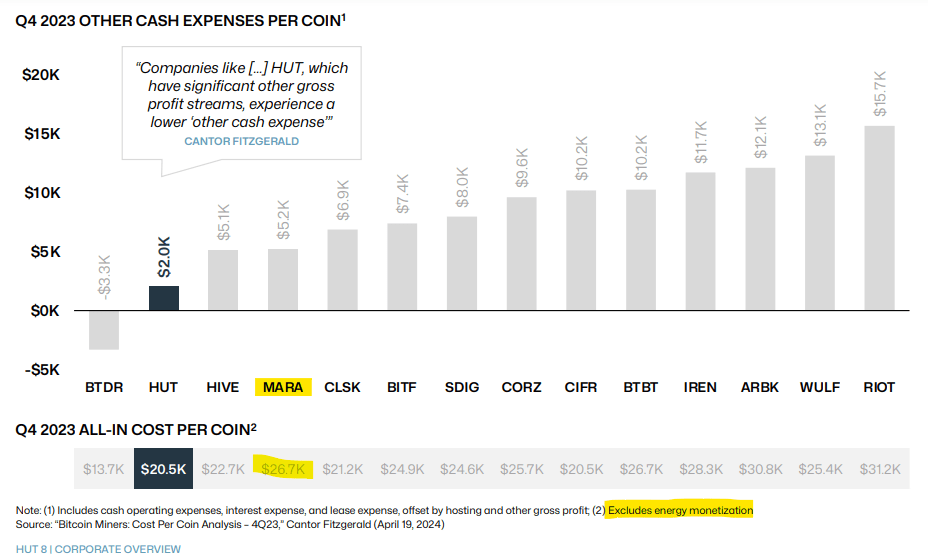

MARA is mostly covered in that its cost per BTC isn’t that high compared to other miners. Here is a chart from Hut8 (HUT) investor presentation about the cost per coin. MARA is definitely on the lower end of cash expenses, though it is on the higher end when it comes to all-in cost, which excludes energy monetization.

Cost per coin (Hut8)

This study from CryptoRank roughly confirms HUT’s numbers regarding MARA. In terms of free market competition, a cost per coin under $30,000 means a 50% profit margin given a BTC price of $60,000. Now, these are pre-halving numbers. After the halving, MARA would be a lot closer to breaking even.

Only A Few More Questions Remain

As I have covered in a sobering analysis of Bitcoin miners, mining is probably the most perfectly competitive industry in history. Thus, it is bad to be a shareholder here because basic economics shows that perfect competition results in 0 economic profits. The “alpha” for miners then becomes whether they are able to monetize other things which function in parallel to the mining activity they do. I gave a few examples of this in the article:

The differentiator between miners as corporate entities and not only as mining operations will come from a few places:

Does the miner hold some of the mined BTC? If so, then it needs to be valued based on those balance sheet assets as well. At that point, the business is really two businesses: a BTC holding company and a mining operation.

Does the miner derive revenue outside of just mining BTC? Astute observers may note that some miners have received money from government entities for their assistance in stabilizing the local grid. That is additional revenue which should flow to the shareholders. There are also other external revenues, such as merge mining, which even less people are aware of.

I also mentioned that some miners are transitioning their infrastructure to support AI and HPC. These forms of computing offer much higher revenue but do not have the flexible load benefit of mining.

MARA is doing a lot of things right here. It is creating additional revenue which exists in parallel to mining while also holding onto the BTC it mines. In fact, it is doing even more on this second front because it is actively raising capital to purchase more BTC.

Let’s talk about additional revenues first. There are several exciting things, which you can see on the MARA tech suite website, but here I will only cover the two I view as having strong potential for outsized revenue generation.

These two are basically the pick and shovels to the mining gold rush (or Bitcoin rush).

The first is 2PIC, which stands for “2-Phase Immersion Cooling.” Without getting into the deep technical details: mining generates a lot of heat for machines, and immersing machines in special cooling fluid is a way to enhance performance and lower the long term maintenance costs of a mining rig. Immersion cooling actually works for all kinds of computers, including GPU clusters which are used in AI. 2PIC is a special kind of superior immersion solution pioneered by MARA.

I have witnessed the MARA team pitch 2PIC at multiple Bitcoin and mining related conferences in the last few months. Reception has been extremely positive. If MARA is able to sell their specialized solution to other miners, then they’d effectively be selling the tools to better mining profitability, generating more income in the mining space without actually mining more. The best thing about 2PIC is that it works for HPC too. It is pick and shovels for the rush to both Bitcoin mining and AI.

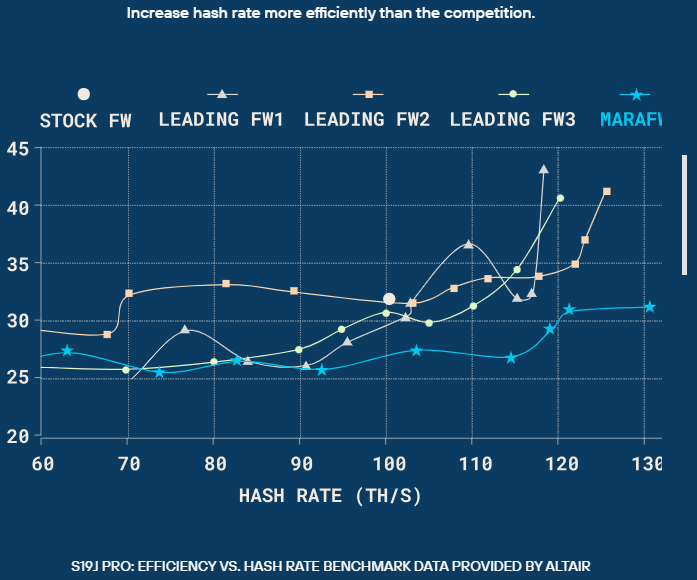

The second is MARAFW, which stands for “MARA Firmware.” Mining firmware is usually installed on mining machines to support autotuning and overclocking. Without getting into the deep technical details: these two things increase the hashrate output of a machine. If something normally consumes 20 watts for 1 terahash (ie. “20 J/Th efficiency”) and has a normal output of 100 terahashes per second (ie. “hashrate of 100 Th/s”), then overclocking and autotuning could boost the machine to 165 Th/s at an average efficiency of 23 J/Th. MARAFW is a proprietary firmware developed by MARA which increases the hashrate without decreasing efficiency.

The chart below shows MARAFW’s competitiveness against other firmwares. Note that the lower blue line signals that the energy per hash isn’t going higher, which means the machines using MARAFW are more efficient as they are pushed to higher hashrates.

MARAFW (MARA)

Firmware is generally monetized by giving some of the hashrate on the machine to the firmware developer. For instance, if your 100 Th/s was increased to 150 Th/s, then maybe 10 Th/s will be sent to mine BTC that ultimately accrues to the firmware developer’s wallet.

Given the obvious competitiveness of MARAFW, there’s a case to be made that this could be another revenue driver for shareholders.

Buying Bitcoin: Massively Bullish

MARA is now buying BTC with money raised from capital markets. Recently, it used $249 million of the $300 million convertible debt offering to purchase BTC for their treasury. They are clearly using the MicroStrategy playbook, where they are selling shares which are trading at a premium to the BTC they hold and sweeping these proceeds into BTC.

This strategy can be taken one step further by issuing convertible debt against the equity of a leveraged BTC balance sheet. I describe this in detail in my article about corporate adoption of BTC treasuries. The higher implied volatility, thanks to leveraged BTC, causes the interest rate on convertible debt to be extremely low. In this case, MARA is borrowing at 2.125%, while the risk free rate is roughly twice as large. In short, companies can sell the volatility of their own “Bitcoinized” capital structure and sweep funds into buying BTC, and they can always sell this volatility because they have the power to issue their own shares.

The result of buying BTC with capital raises is that it directly increases BTC per share and is therefore accretive from the perspective of someone who is looking to increase the number of BTC they own. Relative to all the public miners, MARA is pretty well-placed to do this because they could likely hold onto nearly all the BTC they mine while using the cash flows from 2PIC, MARAFW, Slipstream, and hosting to pay for their self-mining expenses. (To be clear, this isn’t the case right now, but this situation may emerge if their tech suite gains more traction).

Another accretive move, though I doubt they will do this, is to actually sell some of their mining machines for BTC. Machines tend to degrade over time and are outclassed by newer models. Mining itself isn’t a good game to be in long term due to how competitive it is. BTC acquisition is a better game, and it is also what MARA is signaling with these moves.

Overall, MARA will trade like a leveraged version of BTC. Now that it has 25,000 BTC plus debt, its equity is somewhat leveraged BTC. Mining itself approximates a call option on BTC, where the strike price is the cost to mine a single coin. Finally, the auxiliary products which MARA is offering are also optionality on the long term adoption of Bitcoin and Bitcoin mining. Lastly, BTC per share is expected to grow over time.

Risks

I think there are many risks to MARA, and this is largely why I have not taken the position yet. First, I don’t know if they will hold that BTC forever. I remember that MARA was selling its holdings back in 2021 during the bear market while MSTR was buying. Selling low is poor capital management, even if they probably had little choice at the time. Mining is a business with bad margins, and I think many publicly traded miners want to show an increase in hashrate even though this is value destructive in the long run.

If I were a shareholder, I would generally be more comfortable with miners purchasing more BTC instead of more machines and power agreements. The latter creates unnecessary risk. I look at the management’s statements on earnings calls and it just seems like they want to grow the hashrate. When I see that MARA has also started mining Kaspa, it just indicates that hashrate growth and doing actual mining remains a big and frankly unproductive focus at MARA. Kaspa as a crypto asset is, by all indications, a short term thing. It cannot compete with BTC as money and it cannot compete with Ethereum as a smart contract platform.

Another major risk is that the tech solutions do not find good product market fit. This would be very value destructive because MARA would have invested a lot time into building these without getting a return for it. It would have been better to just buy BTC with that money.

Overall I’m not completely convinced that it would be possible to mine BTC and also raise money to buy it for the long term. The only way this could work is if the other cash flows from selling 2PIC and MARAFW can actually cover the electric costs of mining and the interest expenses on these capital raises. We’ll have to wait and see.

The last risk is of course the intimate connection to Bitcoin. Any negative price action on BTC will probably be reflected on MARA, and with some higher beta too.

Conclusion

Overall, I rate this stock a Hold, on the fringe of a speculative buy. I think it is fairly valued given the risks. I want to see more certainty that there is a buffer of non-mining cash flows which can support the mining operation and service debt. I want to see the numbers for ancillary product lines once they have been battle tested on the market. Tagging on BTC acquisition is exciting but it’s more about being able to hold through the thick and thin.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.