Summary:

- Apple stock is still up over 22% in the past year, outperforming the S&P 500, despite Apple Bears saying it’s too expensive.

- Despite that, the company’s expensive valuation is increasingly more challenging to justify due to a slowdown in iPhone growth cadence. The question is whether the market has priced in these challenges.

- Apple’s execution is still formidable, outperforming peers in critical markets such as China and the US. As such, it’s hard to bet against Apple’s ability to outperform expectations.

- I argue why AAPL has a tactical buy signal, although the long-term backdrop is still bearish. Therefore, investors with little or no exposure can consider capitalizing on its recent bottom to buy AAPL.

Scott Olson

Apple Inc. (NASDAQ:AAPL) investors have faced a challenging three to four months since AAPL topped out in mid-July 2023. However, Apple Bears should be careful about claiming victory just yet, as AAPL is still up more than 22% over the past year on a total return basis. It outperformed the S&P 500’s (SPX) (SPY) 19% total return over the same period, suggesting a bearish view on AAPL hasn’t been on point.

I last updated AAPL holders in early September, as the company prepared to launch its iPhone 15. I maintained my caution in AAPL even as investors were assessed to have rotated back into the stock. However, the subsequent broad market pullback also impacted buying sentiments in AAPL, as the initial buying surge faded. Despite that, I assessed increasingly constructive buying sentiments since then, suggesting it’s timely to reassess whether the current levels are apt for buyers to add exposure, following its recent earnings release.

AAPL’s expensive valuation (rated “F” by Seeking Alpha Quant) is likely increasingly challenging to justify, given a marked slowdown in iPhone growth tailwinds. Accordingly, Apple reported a mixed fiscal fourth quarter or FQ4’23 earnings scorecard. While its growth in the US seems to have stabilized, its growth has stalled in China as revenue fell 2.5%, suggesting Apple wasn’t immune to the macroeconomic headwinds in China. Despite that, management stressed that Apple outperformed its peers in China, corroborated by Counterpoint Research, as “the overall smartphone market in China declined by 3% in CQ3.” Notwithstanding the outperformance, I believe AAPL’s growth premium suggests the market needs more confidence in a faster growth cadence to justify its valuation.

Apple Bears would likely point out that the significant slowdown in Mac revenue was disappointing, as it fell 33.8% YoY. However, management clarified that the comparison with last year’s metric needs to be considered in the correct context. Accordingly, management stressed that the ongoing “challenging market conditions” exacerbated the relatively poor performance, as last year’s “record” performance was boosted by “demand recapture” from earlier supply chain disruptions.

Digitimes’s recent reporting suggests that the demand signals in the notebook supply chain are mixed. However, the launch of Apple’s M3 chips powering the Mac could drive a more meaningful recovery in 2024. While it isn’t targeted at M2 chip users, investors should pay close attention to the interest from M1 chip users, as “the upgrade will result in a noticeable performance boost.”

Investors are likely assessing Apple’s ability to outperform Wall Street’s estimates in its December quarter (FQ1’24), as it’s Apple’s most crucial calendar quarter. The iPhone upgrade cycle (nearly 50% of Apple’s revenue base) faced challenges in CQ3. However, Apple still outperformed the US market’s smartphone decline. In addition, the figures were primarily based on Apple’s performance before its iPhone 15 series launch. As such, we will likely only be able to assess iPhone 15’s performance when Apple reports its first fiscal quarter release early next year.

Despite that, the market was likely disappointed with Apple’s guidance, as it expects flat sales in the December quarter, underperforming analysts’ estimates. As such, Apple’s near-term performance is still affected by its most successful hardware product. Although Apple’s services segment delivered a 16% YoY growth in FQ4, it accounted for only about 25% of Apple’s FQ4 revenue base. As a result, challenges in Apple’s iPhone category are still expected to dominate investors’ skepticism about how AAPL’s growth premium can still be justified.

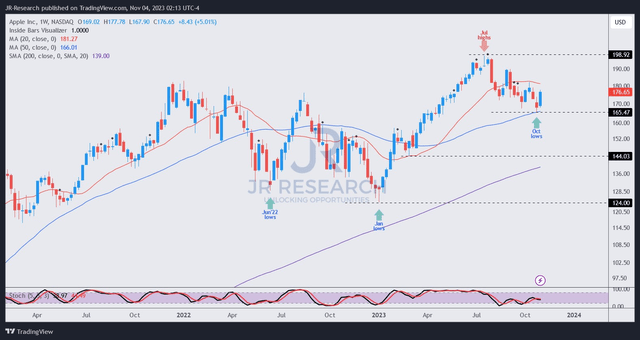

AAPL price chart (weekly) (TradingView)

Notwithstanding the relatively mixed demand signals across Apple’s key revenue segments, I believe investors have already anticipated these headwinds.

Accordingly, AAPL buyers have attempted to bottom out at its October lows, in line with its 50-week moving average or MA (blue line). However, AAPL has a long-term bearish signal at its July 2023 high ($200 level), which is expected to be its long-term top for a while.

As such, I see a tactical opportunity to go long on AAPL, as the Tim Cook-led company has proved its execution prowess against its peers, notwithstanding its high valuation.

The market seems confident in AAPL’s ability to deliver the goods in an increasingly challenging macroeconomic environment. However, if you choose to add, I urge investors to avoid adding close to AAPL’s $200 zone to improve their risk/reward. Also, if AAPL fails to hold its October 2023 lows ($165 level), a further breakdown toward its early March 2023 lows ($145 level) must be expected.

Rating: Upgraded to Cautious Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

See the additional disclosure section below for important notes accompanying the Speculative/Cautious Buy rating presented. Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. Our cautious/speculative ratings carry a higher risk profile. They are only intended for sophisticated investors/traders. We urge new or inexperienced investors to avoid relying on such ratings. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified. Moreover, investors must exercise prudence and devise appropriate risk management strategies, such as pre-defined stop-loss/profit-taking targets, within a suitable risk exposure.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!