Summary:

- Buying businesses with secular growth tailwinds tends to yield impressive results over the long haul.

- Mastercard posted solid net revenue and non-GAAP EPS growth in the third quarter.

- The company’s healthy financial position earns it an A+ credit rating from S&P on a stable outlook.

- Shares of Mastercard could be 11% discounted relative to fair value.

- Just as it has in the past 10 years, the payment processor could be set up to crush the S&P in the next 10 years.

A woman shops online while at a cafe. andresr/E+ via Getty Images

As a younger investor, I statistically have five decades or maybe even more ahead of me. That is why, as I am set to enter my late 20s (27 in April), my appreciation for compounders is continuing to grow.

What do I mean by “compounders?” I am referring to businesses with wide competitive moats and powerful growth catalysts that are on their side (e.g., e-commerce, digital advertising, etc.).

The payments processing giant, Mastercard (NYSE:MA), is one such business that is a core holding within my individual stock portfolio of 99 holdings. The company accounts for 1.6% of my portfolio by value.

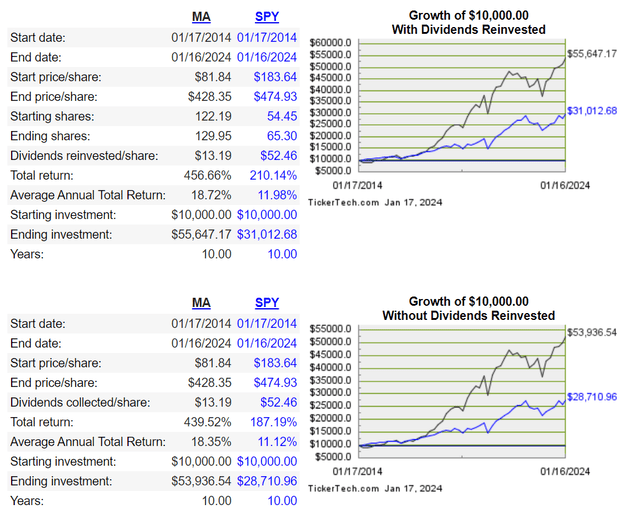

The results of an investment in Mastercard 10 years ago speak for themselves. A $10,000 investment would now be worth nearly $56,000 with dividends reinvested – – good enough for an 18.7% compound annual growth rate. That blew away the $31,000 that the same investment amount in the SPDR S&P 500 ETF Trust (SPY) would be valued at today with dividends reinvested – – a 12% CAGR.

As I will detail as this article progresses, I believe similar outperformance margins can persist in the years to come. This is why I am initiating a buy rating on Mastercard here in Seeking Alpha. Without further ado, let’s dig into the company’s fundamentals and valuation.

Dividend Kings Zen Research Terminal

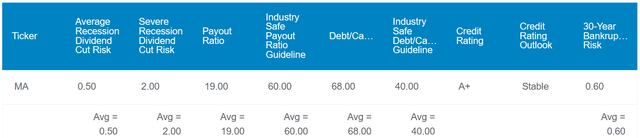

Since it is less than half of the S&P 500’s (SP500) 1.5% yield, Mastercard’s 0.6% dividend yield isn’t going to appeal to everybody. Since everybody has different life circumstances (i.e., age, risk tolerance, and investment objectives), that’s okay.

But for my money, Mastercard is a business that I want to own more of over time. The company’s 19% EPS payout ratio is significantly less than the industry-safe guideline put forth by rating agencies. This arguably compensates for the 68% debt-to-capital ratio being above the 40% that rating agencies prefer.

That’s why S&P still awards Mastercard an A+ credit rating on a stable outlook. This means the probability of the payment processor defaulting on its debt in the next 30 years is just 0.6%. Put another way, if 167 30-year scenarios could be simulated, Mastercard would go out of business in just one of them based on probabilities.

Accordingly, the estimated chance of the company cutting its dividend in the next average recession is merely 0.5%. In a severe recession, that risk is still low at just 2%.

Dividend Kings Zen Research Terminal

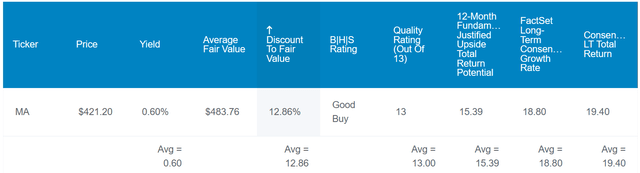

Despite its exceptional quality, shares of Mastercard look to be underappreciated by the market. Based on the historical P/E ratio and dividend yield, the payment processor could be worth $484 a share. Against the $430 share price (as of January 17, 2024), this suggests shares are 11% undervalued.

If Mastercard can meet the growth consensus and return to fair value, here are the total returns that it could produce in the coming 10 years:

- 0.6% yield + 18.8% FactSet Research annual growth consensus + 1.2% annual valuation multiple upside = 20.6% annual total return potential or a 551% 10-year cumulative total return versus the 8.6% annual total return potential of the S&P or a 128% 10-year cumulative total return

Another Strong Quarter From A World-Beating Business

With over 3 billion cards on its network as of September 30, Mastercard is the second-biggest publicly traded payment processor behind Visa (V). The Purchase, New York-based payment processor’s network completes hundreds of millions of transactions daily in over 210 countries and territories throughout the world (details sourced from Mastercard’s Q3 2023 Earnings Press Release).

Mastercard Q3 2023 Earnings Press Release

Time after time, Mastercard has delivered for its shareholders. The third quarter represented the 12th consecutive quarter that the company posted a double-beat according to a glance at Earnings News on Seeking Alpha.

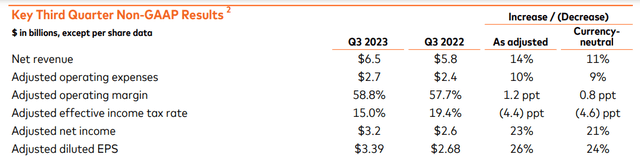

Mastercard’s net revenue surged 13.5% higher year-over-year to $6.5 billion during the third quarter. That topped the analyst consensus by approximately $6 million.

Mastercard’s performance was robust across the board, which is what carried it to this topline outperformance in the third quarter. Growth in the company’s payment network and a healthy consumer allowed for 11% gross dollar volume growth for the third quarter.

After years of the COVID-19 pandemic impacting international travel, there has been a profound recovery as consumers are eager to return to traveling. This was evidenced by a 21% growth rate in cross-border volume during the quarter.

Finally, Mastercard’s switched transactions were up by 15% in the third quarter. Given steady global consumer spending and growth in the cards on its payment network, this makes sense.

Mastercard’s adjusted diluted EPS climbed 26.5% higher year-over-year to $3.39 for the third quarter. For context, that exceeded the analyst consensus by $0.18. Aside from a higher net revenue base, this phenomenal adjusted diluted EPS growth was driven by a 390 basis point expansion in non-GAAP net profit margin to 49%. That is how adjusted diluted EPS growth far outpaced net revenue growth during the quarter.

Previewing the company’s fourth quarter results scheduled to be reported on January 31, growth should remain solid. In his opening remarks during Mastercard’s Q3 2023 earnings call, CFO Sachin Mehra noted that he expects net revenue to grow at a low double-digit rate on a currency-neutral basis, not including acquisition activity. This seems to jive with the analyst net revenue consensus of $6.48 billion for the fourth quarter – – an 11.4% topline growth consensus versus the $5.82 billion in Q4 2022.

For additional context, analysts expect that the company will put up $3.08 in adjusted diluted EPS in the fourth quarter. Even if the company merely matches these expectations rather than exceeding them, that would represent a still impressive 16.2% year-over-year growth rate.

Seeing as Mastercard consistently tends to outperform expectations, it’s likely that it will continue on this momentum to close out its 2023. That’s why I expect the company will top expectations once again in the fourth quarter. This is also the driving force for why I believe that analysts are right in projecting that Mastercard can produce mid- to high-teens annual earnings growth for the foreseeable future.

Mastercard also remains a financial fortress. The company’s interest coverage ratio through the first nine months of 2023 (accounting for interest expenses less investment income) was 43.6. For a company whose earnings only decreased one year in the last 20 years per FAST Graphs, this is an unbelievable interest coverage ratio. Even if earnings were to dip by 17% as they did in 2020, Mastercard’s risk of financial insolvency in the foreseeable future is rather close to zero.

Amazing Dividend Growth Lies Ahead

To be sure, Mastercard isn’t a play on immediate income. Instead, it is about where the dividend is heading. In just the last five years, the quarterly dividend per share has soared 100% higher to the current rate of $0.66. I am confident that this dividend can double again in the next five years and likely in the subsequent five-year period.

The reason for my optimism has to do with Mastercard’s monstrous free cash flow. The company produced $7.6 billion in free cash flow through the first three quarters of 2023. Compared to the $1.6 billion in dividends paid during that time, this equates to a 21.5% free cash flow payout ratio (page 11 of 86 of Mastercard’s 10-Q filing).

Simply put, there is tons of upside in the payout moving forward. Outsized earnings and free cash flow growth in the medium term can power dividend growth in the teens. As the company’s growth eventually slows and investment opportunities lessen, a slower growth rate can be offset by more capital being diverted to the dividend and an expanding payout ratio.

Risks To Consider

Mastercard’s fundamentals are remarkable, but it faces risks just like any other company.

As a highly profitable business, Mastercard has attracted its fair share of attention from detractors. If regulators in key markets passed legislation that was upheld by courts, that could damage the dazzling profit margins of the company.

Another risk to Mastercard is the potential for major cyberattacks to penetrate the company’s IT network. If this happened, sensitive customer data could be compromised and the company’s reputation/fundamentals could be harmed. Mastercard could also be vulnerable to substantial litigation as part of the fallout.

In a massive and growing global payments industry, Mastercard also has plenty of competitors that are gunning for its spot in the global payments oligopoly. If the company can’t continue to meet the needs of merchants and consumers with its services, it could risk losing market share to competitors.

Summary: Mastercard Is A Holding I’d Like To Add To In 2024

Mastercard isn’t the cheapest stock in my coverage universe. But for its quality, I would argue that it is compelling here. After all, Mastercard is an A-rated business with sizable growth/dividend growth prospects.

These all-around sound fundamentals are why I believe the forward P/E ratio of 30 can be justified. Few businesses can command the valuation multiple that Mastercard does, but that’s because so few deserve it as much as the payment processor.

That’s why I am starting coverage with a buy rating and tentatively plan on adding later this year (when I reenter the markets after a pause to build liquidity).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA, V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.