Summary:

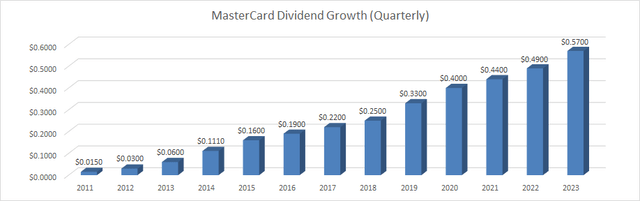

- Mastercard Incorporated’s dividend has gone up nearly 40 folds since 2011.

- Yield on Cost is often looked down as a metric, but betting on past winners is not a bad idea.

- Mastercard has plenty of room to continue rewarding investors with strong dividend increases.

TARIK KIZILKAYA

As I’ve written in the past, one of the best things about writing on Seeking Alpha is being able to look up past articles and see how our recommendations turned out. No one gets it right all the time, and I am no different. But, let’s count only the winners, okay? I wrote this article on Mastercard Incorporated’s (NYSE:MA) dividend growth potential back in 2013 just when the company had announced a massive and third consecutive dividend increase while also announcing a 10:1 stock split. And boy has the stock delivered since then in both capital and dividend returns. Please note, although the stock has performed magnificently over the years and earnings are expected to continue growing, the focus of this article will be on its dividend growth.

Over the years, I’ve drifted away from both writing about and owning Mastercard stock. This is partly due to never seeing the stock on sale for long, but mostly due to the fact that I’ve held shares in American Express, Inc. (AXP) for a long time and been fairly satisfied with the returns. I try my best to not own two very similar stocks. For example, although I’ve admired PepsiCo, Inc. (PEP) as a company and stock, I made a bet on The Coca-Cola Company (KO) instead and stuck with it for decades.

Anyway, back to the point, towards the end of 2022, Mastercard announced its 11th consecutive annual dividend increase. How has Mastercard performed when it comes to dividend growth since my coverage almost 10 years ago? Let’s find out.

In short, the dividend has grown by a ridiculous factor of 38 since 2011 and more than 5 folds since my 2013 article. In January 2011, Mastercard stock was trading at about $22 while paying an annual dividend of 6 cents per share, which worked out to a paltry yield of about 0.30%. Fast-forward 12 years, Mastercard is now paying an annual dividend of $2.28/share while the stock is trading at about $375, which works out to a current yield of 0.60%. But the yield on cost for someone who bought in 2011 at $22 has reached an astonishing 10.36%. Huh, you think?

Mastercard DG (Compiled by author, with data from Seeking Alpha)

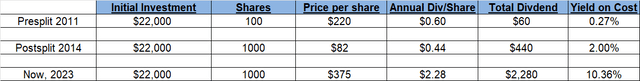

If that math appeared a bit complicated, don’t worry. The table below aims to simplify it.

- The first row: Let’s say someone bought 100 shares of Mastercard in 2011 before the company announced its first dividend increase in 2012. The stock was trading at around $220 back then (pre-split) and that meant an initial investment of $22,000 for an initial yield of 0.27%.

- The second row: It is now 2014. Mastercard’s stock price has gone up almost 4 folds to $820 and the annual dividend has reached $4.40/share thanks to generous dividend increases. Mastercard then announces a 10:1 stock split. By this time, the yield on cost had grown to a more respectable 2%.

- The third row: This is the real now, May 2023. Mastercard’s stock price has more than quadrupled since 2014 and the dividend has grown more than 5 folds. The yield on cost for that initial investment of $22,000 has now grown to 10.36% even though the current yield on the stock is a measly 0.60%.

Mastercard Yield on Cost (Author)

Okay, the dividend has indeed grown impressively, but how strong is the dividend coverage? What if the company has been paying more than it can afford just to keep the dividend growth intact? Let’s find out.

Frequent readers of my article know I prefer using Free Cash Flow (“FCF”) over Earnings Per Share (“EPS”) as FCF represents a company’s raw ability to generate cash from its day-to-day business.

- Shares outstanding: 947.63 million.

- Quarterly dividend per share: 57 cents.

- FCF needed to cover quarterly dividends: $540 million (947.63 million shares times 57 cents).

- Mastercard’s average quarterly FCF over the last 5 years: $1.955 billion.

- Payout ratio using quarterly FCF metric: 27.62% (540 million divided by $1.955 billion).

- So strong is Mastercard’s FCF that even the lowest quarterly FCF in the last 5 years (March 2019) at $1.17 billion covers the current dividend commitment at least two times over. Even in the disastrous COVID year of 2020 when many companies saw depressing FCF, Mastercard generated an average quarterly FCF of 1.63 billion.

- Finally, based on forward EPS estimate of $12.28, Mastercard has a payout ratio of 18.50% ($2.28 annual dividend per share divided by $12.28).

What about future returns?

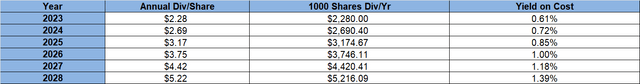

I don’t think Mastercard can match its past 10 years in terms of returns from both capital and dividend perspectives. However, given the current 5-year average dividend growth rate of 18%, it is not hard to see them maintain the same for the next 5 years too, especially given the room they seem to have as established above. The yield on cost once again more than doubles in a 5-year time span.

Mastercard Extrapolation (Author)

Mastercard also continues reducing its shares count gradually, as the shares outstanding has gone down nearly 10% in the last 5 years.

Conclusion

I’ve always used Yield on Cost as one of the hindsight metrics to evaluate my investments. Some say, “YoC is nothing but patting yourself on the back, and it offers nothing forward-looking”. That may be right, quantitatively speaking, but qualitative aspects (history) should mean something as well. Betting on a winning stock again is not a bad idea. And in this case, Mastercard has the quantitative factors in its favor as well.

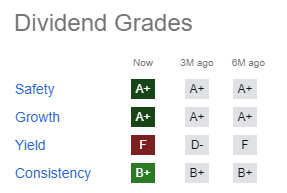

It is no surprise that Seeking Alpha’s quant rating gives Mastercard glowing grades on Dividend Safety, Dividend Growth, and Consistency while rating the yield an F. The yield is an F undoubtedly if you look only at the current yield, but the dividend growth has been so powerful so far and still has enormous room for improvement that the current yield does not matter as much as the other three factors in this case.

Do not be your own enemy and turn down perfectly fine long-term dividend growth stocks just because the current yield is low. And I did not even get into the capital appreciation potential of quality companies like Mastercard. That’s for another day, another time. Adios.

Mastercard Dividend Grade (Seekingalpha.com)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AXP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.