Summary:

- Mastercard Incorporated’s share price delivered strong results on an absolute basis, but there is a catch.

- MA is not priced at the stratospheric levels from 2020-21 period, but that doesn’t mean that the stock is attractive.

- To justify the current share price, investors will have to be comfortable with way too optimistic assumptions about the future.

- The gap between the company’s free cash flow yield and the yield on 10-year Treasures is yet another major red flag for future returns.

alicat

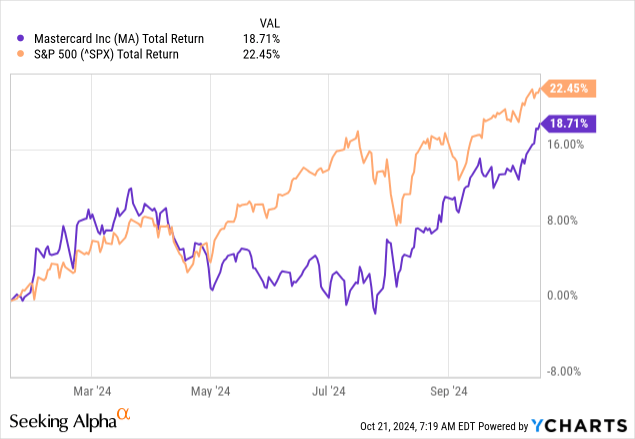

It seems that 2024 could be yet another good year for Mastercard Incorporated (NYSE:MA) shareholders.

Although the stock is underperforming the S&P 500 (SP500) on a year-to-date basis, a nearly 19% total return in just 10 months could easily be classified as short-term success. But before we jump to conclusions, we should take notice of the very uneven performance of MA over the period.

At one point in August 2024, the stock was in negative territory year-to-date, while the S&P 500 was up nearly 15%. Then in just a few months, MA skyrocketed and has almost closed the gap with the equity index.

The reason for MA’s vastly different performance since early August when compared to the first half of the year does not appear to be related to the company’s specific events. The second quarter results were reported around that time, but there wasn’t anything specific to justify such a large difference in share price performance.

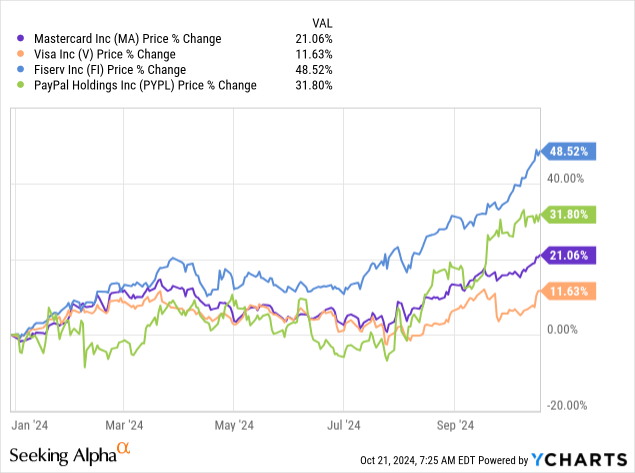

As we see on the graph below, however, shares of all major payment companies have been on a steep up-trend since early August, which is a clear indication that there are industry-wide tailwinds at play here.

Another important observation is that MA and Visa (V) significantly underperformed their smaller peers — Fiserv (FI) and PayPal (PYPL). Fiserv has been my long-time favorite within the sector and I also recently became bullish on PayPal, while I have been keeping ratings on both Visa and Mastercard at Hold.

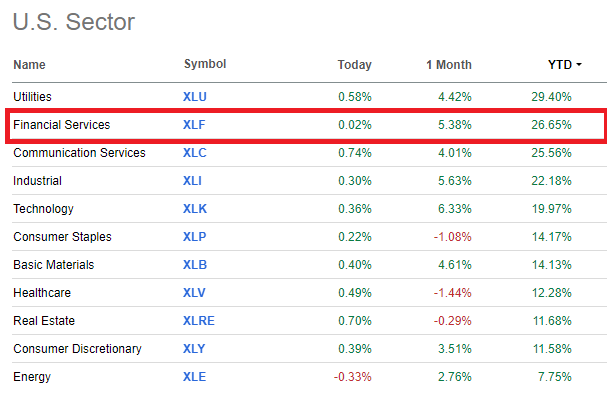

With all that in mind, we should not forget that so far 2024 has been an exceptionally strong year for equities and Financial Services stocks in general, which has been a massive tailwind on Mastercard’s back.

Seeking Alpha

With supportive macroeconomic conditions likely to come under pressure in 2025, investors should be cautious when buying MA at current levels. On top of all that, it appears that the stock is becoming too richly priced, with more and more optimistic scenarios about the future being priced-in the stock.

Taking Significant Risks

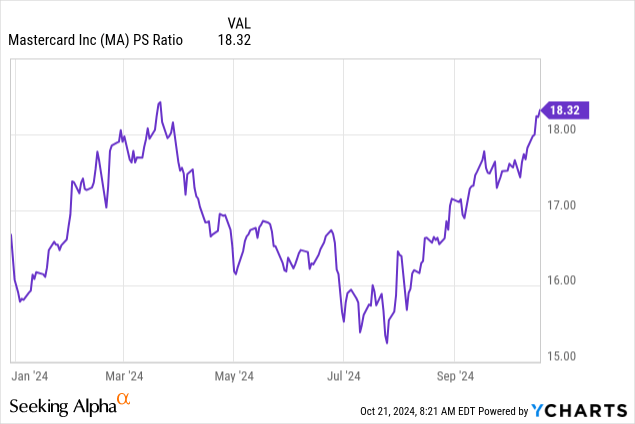

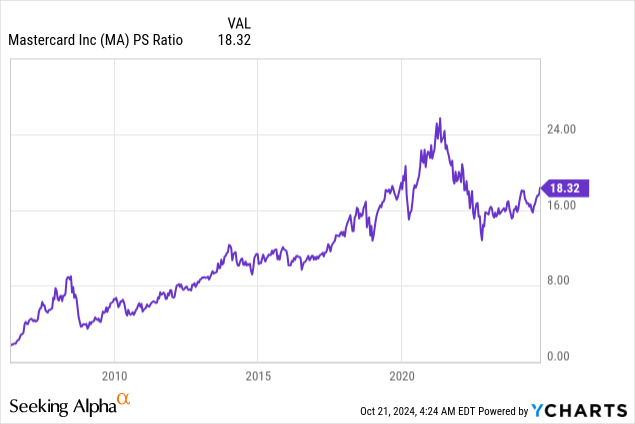

As we could see on the graph below, the uptrend in MA’s share price since early August has not been driven by better-than-expected business fundamentals but rather by expectations about the future. Thus, the company’s shares are now trading at more than 18 times sales, compared to slightly above 15 a few months ago.

Such wild fluctuations are rarely a good sign for the sustainability of recent shareholder returns and although the current P/S multiple is well-below the exuberant levels of the 2020-21 period, they are by no means comforting for long-term investors.

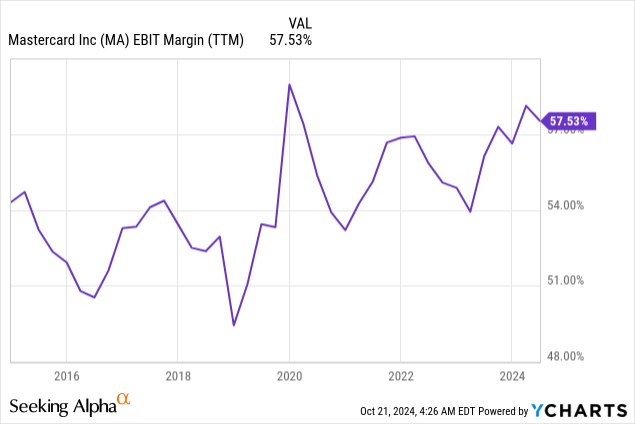

To an extent, this could be justified by Mastercard’s record-high operating margins, which come as a direct result of the higher economies of scale recently as growth accelerated and by the sharp recovery of cross-border volume fees.

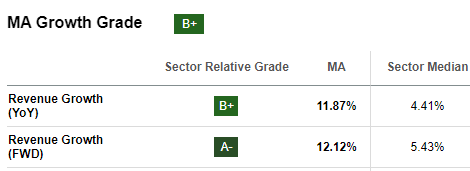

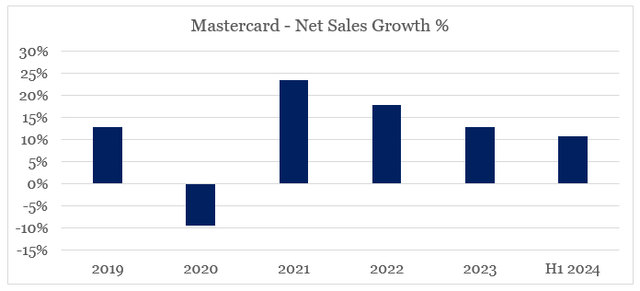

Sell-side analysts still expect MA’s topline growth to accelerate, but as we could see from the graph below, the annual growth rate has been trending down. This is as overseas expansion and value-added services have a diminishing effect on the company’s topline figure.

Seeking Alpha prepared by the author, using data from SEC Filings

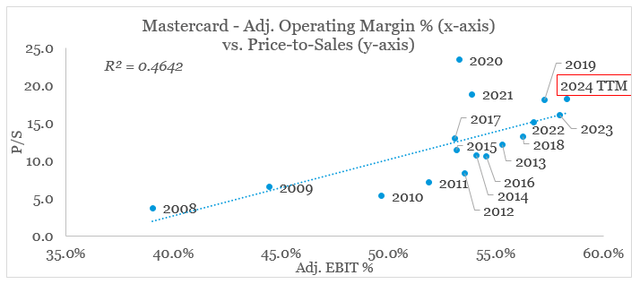

Moreover, Mastercard’s current sales multiple is also above the long-term trend-line that is formed between the company’s annual EBIT margins and the corresponding P/S multiple since 2008.

prepared by the author, using data from SEC Filings and Seeking Alpha

Although MA does not appear to be overvalued to the extent that it was back in 2020 and 2021 (see the graph above), it appears that the market is confident that margins will continue improving and then sustained at these levels over the long-run.

The main problem with MA share price is that even if this turns out to be true, future returns would depend more heavily on topline revenue and earnings growth rather than multiple repricing based on higher margins.

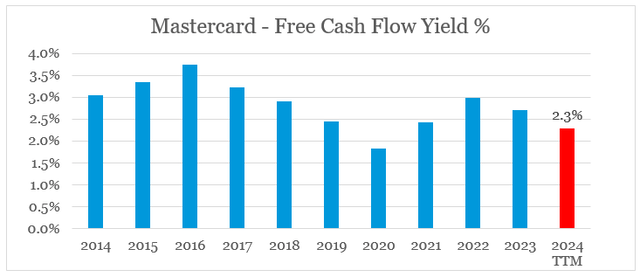

On a free cash flow basis, things look even worse with MA now trading at a free cash flow yield of just 2.3%, which is the second lowest after 2020.

prepared by the author, using data from SEC Filings and Seeking Alpha

The reason this is even worse than the 2020 period, is twofold:

- firstly, we had a temporary drop in Mastercard’s cash flow in FY 2020 which is not the case now;

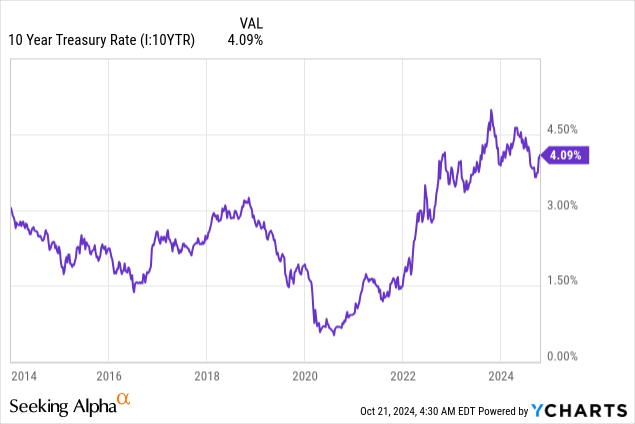

- secondly, 10-year Treasury yields (US10Y) were at record low levels back in 2020, which resulted in a positive gap with Mastercard’s record low free cash flow yield at the time. Currently, the opposite is true, with bond yields hovering above 4% and Mastercard’s stock trading at roughly half that.

Conclusion

Although 2024 will likely go down in history as a good year for Mastercard Incorporated shareholders on an absolute basis, the performance gap with the market and other peers in the electronic payments space is concerning. Even worse, MA currently trades at levels that in my view are unsustainable beyond the very near-term. Lastly, the gap between the company’s free cash flow yield and the 10-Treasury yield is a major red flag that MA’s future returns will be under pressure.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.