Summary:

- Mastercard is a core holding within my dividend growth portfolio.

- The payment processor topped the analyst consensus for net revenue and adjusted diluted EPS for the first quarter.

- Mastercard’s profitability and minimal debt load make it a financial fortress.

- Shares of the payment processor could be priced 12% below fair value.

- Mastercard could be poised for 45% cumulative total returns by the end of 2026.

A woman at a restaurant pays with her card. SouthWorks/iStock via Getty Images

As part of my dividend growth investing strategy, there are plenty of factors that I take into consideration. Robust business models, rapid growth prospects, exceptional balance sheets, and proven dividend growth track records are all factors that I like to see from prospective investments.

It is relatively rare, however, to find businesses that can check off all of these boxes. That is why I dare to say that any company that can do so earns the designation of being a world-beater.

One such business that I believe fits these requirements is Mastercard (NYSE:MA) (NEOE:MA:CA). When I last covered the payment processor with a buy rating in January, I liked its reputation for being a top-notch wealth compounder. The company’s future growth prospects were also solid. MA’s balance sheet was A-rated. Finally, shares were somewhat discounted.

Today, I’m reiterating my buy rating on MA after taking another look at it. The company posted a double beat on net revenue and adjusted diluted EPS with its first-quarter results, which were shared on May 1. MA is also benefiting from shifting consumer trends within the broader economy. Another plus is that the company’s financial health is vigorous. Lastly, shares remain attractively valued.

Mastercard Keeps Chugging Along

Mastercard Q1 2024 Earnings Press Release

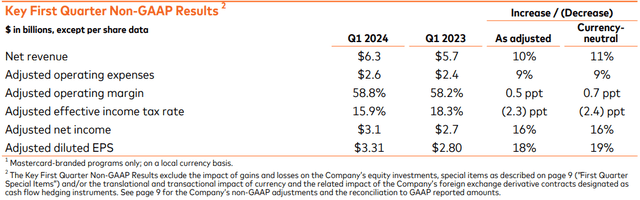

True to form for a business I deem to be wonderful, MA put up another impressive quarter for shareholders last month.

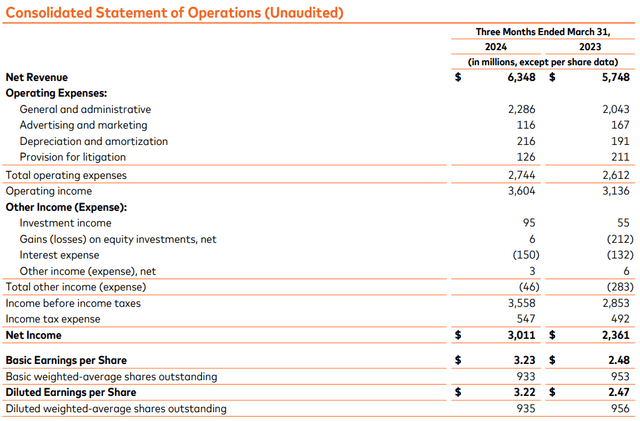

The company’s net revenue surged 10.4% higher over the year-ago period to $6.3 billion in the first quarter that ended March 31. For perspective, that was better than Seeking Alpha’s analyst consensus by $10 million.

What was behind the company’s double-digit topline growth rate for the first quarter?

As a leading payment processor, MA has benefited from a virtuous cycle for quite a while now. Those who know the company well know that I mean cardholder base growth.

MA has billions of cardholders with trillions of dollars of annual purchasing power. This represents too attractive of an economic opportunity for many merchants to pass up. So, quarter after quarter and year after year, the number of merchants who accept MA’s payment network keeps growing.

The more merchants who accept the company’s payment network, the more willing consumers are to open an MA credit/debit card with issuing financial institutions. This explains how the company’s total cardholder base grew by 8.3% to nearly 3.4 billion as of March 31, 2024.

This cardholder base growth combined with an inflationary global economy and relatively steady consumer spending pushed gross dollar volumes 10% higher year-over-year during the first quarter.

Switched transaction volumes were up 13% over the year-ago period to reach nearly 44 billion in the first quarter. Aside from cardholder base growth, there was another intriguing and underrated factor behind MA’s switched transaction volume growth.

CFO Sachin Mehra noted this in his remarks at the Bernstein Strategic Decisions Conference late last month. He pointed out how the evolution of the economy has been a catalyst for MA.

Specifically, how the COVID-19 pandemic accelerated trends like Uber Eats. The added second transaction by Uber Eats to the merchant in question is adding gross dollar volume and transactions to MA’s network.

Another example that he noted was the shift from cable subscriptions to often multiple streaming subscription services. Subscriptions with multiple streaming services are adding to that switched transaction volume. Since MA receives fixed cents for each transaction it completes, these shifts in consumer spending are also helping to drive net revenue higher.

Finally, cross-border volume climbed higher by 18% year-over-year for the first quarter. Just as I noted in my prior article, the ability of consumers to travel was restricted for a couple of years at the height of the COVID-19 pandemic.

This is time that those people will never get back, so they are doing those bucket-list trips now instead of several years ago as they originally planned. That explains why cross-border volume growth keeps growing at a robust rate.

Turning my attention to the bottom line, MA’s adjusted diluted EPS rose by 18.2% over the year-ago period to $3.31 during the first quarter. For what it’s worth, that was $0.07 ahead of Seeking Alpha’s analyst consensus.

Due to careful cost management, MA’s total operating expenses grew by just 5.1% year-over-year to $2.7 billion in the first quarter. This led to a 210 basis point expansion in the non-GAAP net profit margin to 48.7% for the quarter. Coupled with a 2.2% reduction in the diluted share count, this is how adjusted diluted EPS growth significantly outpaced net revenue growth during the quarter.

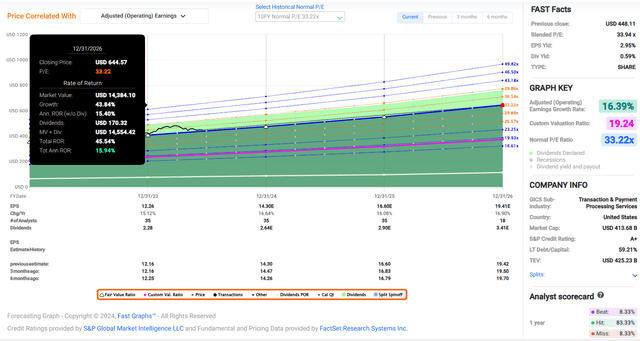

The analyst consensus for MA remains promising for the foreseeable future as well. Thanks to continued cardholder base growth and the aforementioned favorable shifts in consumer spending patterns, adjusted diluted EPS growth for the remainder of 2024 should remain in the mid-teens. The FAST Graphs analyst consensus anticipates that adjusted diluted EPS will rise by 16.6% to $14.30 this year (on 35 estimates).

For 2025, another 16.1% growth in adjusted diluted EPS to $16.60 is currently projected (on 35 estimates). In 2026, adjusted diluted EPS is anticipated to increase by an additional 16.9% to $19.41 (on 18 estimates).

Mastercard Q1 2024 Earnings Press Release

Transitioning to MA’s financial health, the company’s outlook is also healthy. MA had $8 billion in net debt as of March 31, 2024 (cash and cash equivalents plus investments minus short-term debt and long-term debt). Annualizing the $3.9 billion in EBITDA in the first quarter, that would be a net debt to EBITDA ratio of just 0.5.

This means that MA’s net debt load is very manageable for its size and scale as a business. That is what supports the company’s A+ credit rating from S&P on a stable outlook per The Dividend Kings’ Zen Research Terminal (unless otherwise hyperlinked or sourced, all info in this subhead was according to Mastercard’s Q1 2024 Earnings Press Release and Mastercard’s Q1 2024 Operational Performance Data).

Fair Value Has Surpassed $500 A Share

Despite the exceptional first-quarter results, shares of MA are up just 3% since my last article. That is well behind the 13% returns posted by the S&P 500 (SP500) index during that time. Along with my rising fair value estimate, this has created a compelling buying opportunity in my view.

The company’s current-year P/E ratio of 31.5 is modestly below the 10-year normal P/E ratio of 33.2 per FAST Graphs. Moving forward, I believe that a reversion to the 10-year normal P/E ratio is likely to happen.

This is because a look at MA’s future growth outlook relative to the past demonstrates that its growth prospects are intact. The company’s 16.4% annual growth prospects for the next few years are in line with the 10-year average of 16.6%.

After the current week comes to a close in a few days, the calendar year 2024 will be 48% complete. That leaves another 52% of this year ahead and 48% of 2025 over the next 12 months. This is how I’m accounting for the respective 2024 and 2025 adjusted diluted EPS forecasts of $14.30 and $16.60. That gives me a 12-month forward adjusted diluted EPS input of $15.41.

Applying this fair value multiple to the above earnings input, I get a fair value of $511 a share. Compared to the $450 share price (as of June 19, 2024), this equates to a 12% discount to fair value. If MA matches the growth consensus and returns to fair value, it could produce 45% cumulative total returns through 2026.

Mid-Teens Dividend Growth Can Keep Up A While Longer

MA’s 0.6% forward dividend yield clocks in well below the financial sector median forward yield of 3.7%. This is why Seeking Alpha’s Quant System grades it an F for forward dividend yield.

Looking beyond this low starting income, MA shines enough in other areas for me to like it quite a bit.

For one, the company’s payout has grown at a brisk rate in the past five years. MA’s five-year compound annual growth rate for its dividend is 16.2%. That’s nearly triple the financial sector median of 6.3%. This is enough to earn an A grade from the Quant System for this metric.

I also fully expect this level of dividend growth to persist for at least the next several years. This is because MA is slated to pay $2.64 in dividends per share in 2024. Against the $14.30 in adjusted diluted EPS predicted for this year, that would be an 18.5% payout ratio.

For context, that’s well below the 60% payout ratio that rating agencies desire from the industry per the Zen Research Terminal. This gives MA plenty of flexibility to grow its payout as fast as adjusted diluted EPS in the years ahead. Since 16%+ annual adjusted diluted EPS is the forecast for the next few years, this is guiding my expectation for mid-teens annual dividend growth.

That should allow MA to build on its 12-year dividend growth streak, which is better than the financial sector median of 2.2 years. This explains the B+ grade for overall dividend consistency from the Quant System.

Risks To Consider

MA is a business that’s executing well, but there are still risks to the investment thesis. Since no new risks were addressed in the most recent 10-Q Filing, I will be reiterating some risks from prior articles.

Although merchants have had their disputes with MA over the years, the payment network is widely trusted. For the company’s success to continue, this must remain the case. If MA experienced any widespread cyber breaches of its IT networks, this could compromise stakeholder data. That could undermine the company’s reputation and also result in significant litigation being brought against it.

Earlier this month, there was news that MA and Visa’s (V) $30 billion settlement proposal related to swipe fees may be rejected by a federal judge. This was going to be a deal with merchants to reduce swipe fees for three years and cap rates for five years.

If that does indeed turn out to be rejected, the two payment giants may have to go back to the negotiation table with merchants. If any additional concessions are made to merchants to resolve this lengthy dispute, that could weigh on MA’s profit margins.

Summary: A Low-Risk, High-Growth Business For A Discount

Comprising 1.4% of my portfolio, MA is my 24th-biggest holding. In all honesty, this company has everything that I look for from a dividend growth stock.

As I alluded to earlier, MA has a great business model. Cardholder growth and evolving consumer spending habits are on their side. The balance sheet is A-rated. Dividend growth has been off the charts.

The cherry on top is that the valuation looks to also be favorable right now. MA is trading at a double-digit discount to my fair value estimate and has 15%+ annual total return potential through 2026. That’s why I plan on upping my stake in MA by 25% within the next couple of weeks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA, V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.