Summary:

- Mastercard has consistently delivered impressive returns to shareholders, outperforming tech-focused indices.

- The global shift towards electronic payment methods presents growth opportunities for Mastercard.

- Technical analysis suggests a potential breakout for Mastercard’s stock price, indicating further momentum in the future.

jbk_photography

In the rapidly evolving world of payment processing, Mastercard Incorporated (NYSE:MA) stands out as a frontrunner, consistently delivering impressive returns to its shareholders. While other indices, known for their tech-centric composition, have showcased strong returns over recent years, Mastercard has managed to surpass these figures, indicating not just a robust past performance but also hinting at a sustained momentum in the future. The global shift towards electronic payment methods is evident in developed economies and is gradually becoming prevalent in emerging markets. Mastercard’s significant influence in this sector is evident from its vast portfolio of credit/debit cards, rivaling only a few industry giants. This article delves into the technical examination of Mastercard’s stock price, aiming to discern its future trajectory and identify potential investment avenues. Notably, the stock price hovers around a pivotal breakout point, poised for additional momentum.

Mastercard’s Dominance in the Digital Payment Era

Mastercard has consistently rewarded its shareholders with significant returns. While the Nasdaq Composite index, known for its tech concentration, has almost doubled in the past five years, there exist stocks that have outpaced even this impressive figure. Among the top-performing entities, Mastercard stands out, delivering total returns of over 90% to its shareholders during the same timeframe. What makes this feat even more intriguing is the likelihood of the company continuing this trend of outperformance.

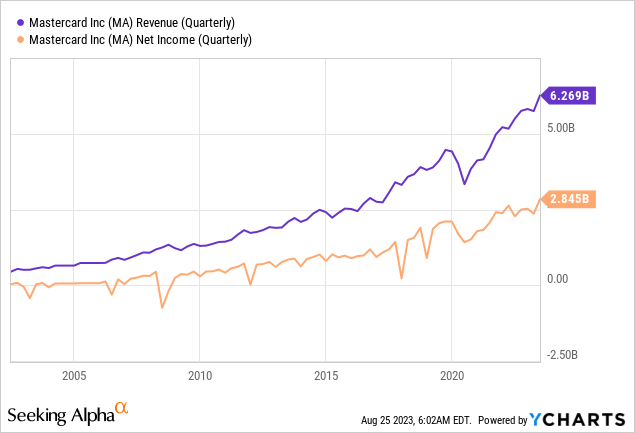

In economically advanced nations, the mode of payment has steadily shifted to debit cards, credit cards, and digital wallets, particularly for online transactions. As emerging economies evolve, the adoption rate of these payment methods is expected to rise further. Mastercard’s Q2 report showcased a notable 14% YoY increase in net revenue, reaching $6.269 billion, as shown in the chart below. Additionally, the quarterly net income stands at $2.845 billion. A review of Mastercard’s financial history reveals a consistent upward trend in profitability over the past decades. This sustained growth in earnings suggests a potential for even greater profits in the future.

Mastercard’s non-GAAP diluted EPS witnessed a 12.9% increment YoY in the second quarter, settling at $2.89. Moreover, Mastercard’s increasing global acceptance promises a bright future. Analysts project its adjusted diluted EPS to grow by 17.5% annually over the next half-decade. When juxtaposed against the credit services industry’s average projection of 14.3%, Mastercard holds an edge.

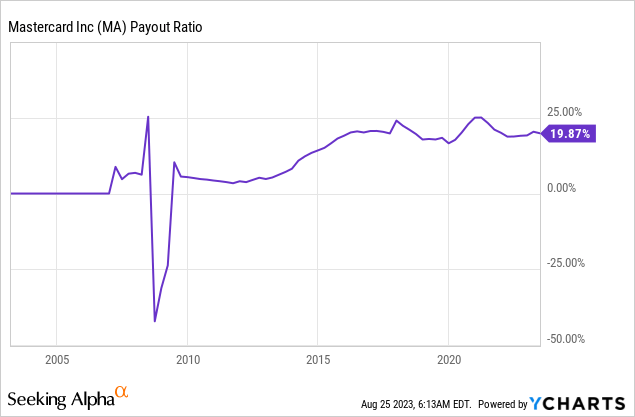

Though Mastercard’s dividend yield of 0.57% may not seem particularly enticing, dividend-focused investors shouldn’t overlook it, especially if they don’t intend to depend on dividends for at least another decade. With a dividend payout ratio of 19.87% and the current quarterly dividend per share at $0.57, Mastercard is well-positioned to capitalize on growth avenues, fortify its financials, and persist with its share buyback initiatives.

Mastercard’s Dominance in the Digital Payment Era

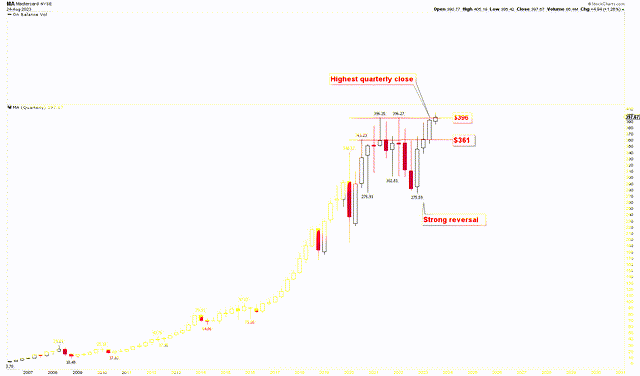

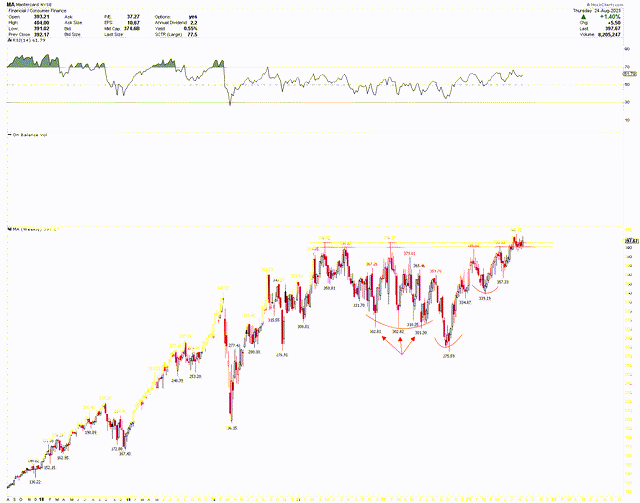

The long-term trajectory for Mastercard looks very promising, as evidenced by the attached quarterly chart. The stock price has consistently demonstrated a robust bullish trend. Notably, the dip in 2022 paved the way for upcoming surges, highlighted by the prominent reversal candle in 2022’s final quarter. This particular candle suggests potential market momentum in the upcoming periods. Moreover, the 2023 second-quarter candle closed exceptionally strong, marking the highest quarterly close ever recorded, hinting at possible future price increases. Currently, the price is navigating the challenge of breaking through upper levels. A quarterly closure surpassing $396 could herald the onset of another price surge.

Mastercard Quarterly Chart (StockCharts.com)

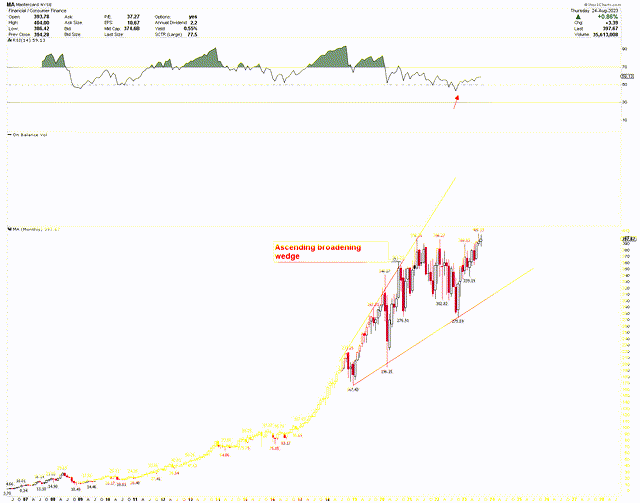

Delving deeper into Mastercard’s positive trajectory, the monthly chart showcases an ascending broadening wedge from 2018 to 2023. This wedge underscores the market’s volatility and the potential for price escalation. This wedge’s critical lows are $167.43, $196.15, and $275.59. A definitive monthly reversal candle characterized the most recent dip to $275.59, suggesting continued bullish momentum. Further price increases are also expected, with the RSI rebounding from the 50 mark.

Mastercard Monthly Chart (StockCharts.com)

The bullish pattern under discussion is also evident in the shorter-term chart below. Here, the appearance of an inverted head and shoulders pattern stands out as a powerful bullish signal. The pattern’s head touches the low of $275.59. The left shoulder showcases a triple bottom at $302.81, $302.82, and $301.30, while the right shoulder reaches a low of $339.19. The pattern’s neckline ranges between $390 to $400, with the current price oscillating in this bracket, poised to break through. Persistent consolidation in this area signals market fortitude and a high probability of an upward breakout. It’s noteworthy that despite the price’s high-level fluctuations, the RSI continues to trend upward.

Mastercard Weekly Chart (StockCharts.com)

Mastercard is at a pivotal trading juncture, seemingly on the cusp of a significant upward breakout. For investors, this resistance zone presents a prime buying opportunity, especially considering the strong indications provided by the inverted head and shoulders pattern.

Market Risk

Mastercard’s growth is intricately tied to the economic health of both developed and developing countries. Economic downturns or uncertainties in critical markets can negatively impact Mastercard’s standing. Furthermore, due to its widespread global operations, Mastercard’s revenue is sensitive to currency shifts. A persistently strong U.S. dollar or unforeseen exchange rate changes can distort their financial reports.

The 2018-2023 ascending broadening wedge in the monthly chart highlights potential market unpredictability. This volatility can give rise to unforeseen stock movements, making the stock vulnerable to abrupt declines. Given the stock’s current status, poised for a potential breakout, there are associated risks. If the stock fails to break through key resistance points, its upward momentum may falter. Observing key markers, like the $396 benchmark, is critically important.

Bottom Line

As a critical player in the payment processing industry, Mastercard demonstrates a promising and resilient trajectory. Not only has it outperformed notable indices, but it also showcases a potent blend of technical strength coupled with solid fundamentals. The shift towards electronic payments globally augments Mastercard’s potential growth, and its vast portfolio of credit/debit cards further substantiates its market prowess. Even while facing global challenges and the subsequent financial repercussions, the company’s financial metrics point to a largely positive trend. The technical analysis highlights its ongoing bullish momentum, signaling optimism for short-term traders and long-term investors. However, as with any global entity, Mastercard is not devoid of risks, especially those stemming from broader economic fluctuations and currency dynamics. Investors must be aware of these factors when making decisions. Investors can purchase Mastercard at its present value and consider increasing their holdings should a correction arise. A quarterly closing surpassing $400 could trigger a robust Mastercard performance surge.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.