Summary:

- Mastercard is one of the big two major card network providers and has a solid position in multiple markets.

- The company reported strong financial results for the fourth quarter of 2022, as it beat both revenue and earnings estimates for growth.

- Mastercard is poised to benefit from the growth in open banking and has connections with over 3,000 banks and financial institutions across 18 markets.

- I forecast its innovative “Pay by Bank” solution will continue to grow rapidly and focus on SMB partnerships will also pay off positively.

- Mastercard has experienced strong growth in its cross border payment volume as travel continues to have a strong multi-year rebound.

jbk_photography

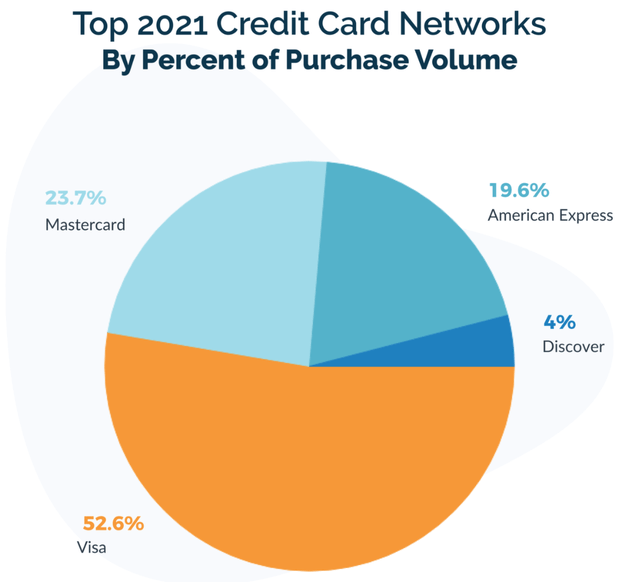

Mastercard (NYSE:MA) is one of the big two credit card networks which had a 23.7% market share, just behind Visa which has a 52.6% market share according to 2021 data (which was the latest I could find). Despite not being the “leading” card network Mastercard was cited as the leader in certain smaller markets such as Sweden (70% market share), Netherlands (88% share) etc. In addition, the global payments market is forecast to reach $3.1 trillion by 2031, thus there is plenty of meat on the bone for two giants like Visa and Mastercard. Mastercard also has unique advantages such as its innovative “Pay by Bank” technology and many exclusive partnerships with major banks. Mastercard has also continued to produce strong financial results in the fourth quarter as it beat both top and bottom-line growth estimates, despite a tough economic backdrop. In this post, I’m going to break down the recent earnings of Mastercard, reveal its tailwinds and its valuation via my advanced model, let’s dive in.

Visa Mastercard Market share (SEC filings, Upgraded Points)

Stable Financials

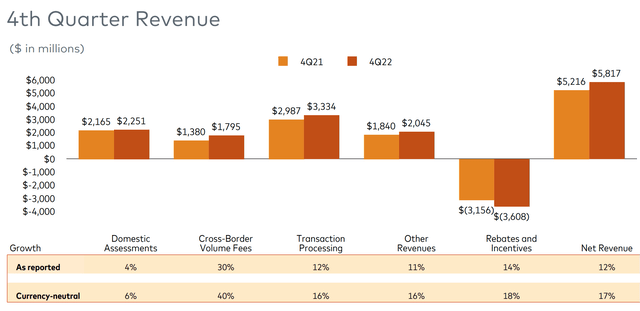

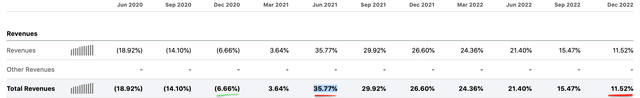

Mastercard reported strong financial results for the fourth quarter of 2022. Net revenue was $5.82 billion, which beat analyst expectations by $23.8 million and increased by 11.52% year over year. Its revenue growth rate was slightly slower than the prior quarter’s growth rate of 15.47%, 21.4% in (Q3,22), and its fastest growth rate of 35.77% year over year (Q2,21). This trend is expected as the consumer slowed down spending due to high inflation, rising interest rate, and “recessionary” environment. Interestingly enough it’s not just about the cold hard numbers, which impact this growth. I believe the fearful news cycle regarding a “cost of living crisis” can cause consumers to lower spending, even before the technical fact of a “recession” has occurred. Many companies also raise prices in advance due to “expected inflation”, which is a phenomenon, Fed Chairman Jerome Powell warned about in his speech at Jackson Hole in 2022. A positive for Mastercard is I discovered a similar declining growth rate for its main competitor Visa (V). This is an extra data point that backs up my thesis about this being an overarching macroeconomic issue.

Revenue growth rate (Income statement)

Another positive is Mastercard’s most recent growth rate is close to its pre-pandemic growth rate of 12.93% in 2019, thus it’s not “terrible”. If we take into account foreign exchange rate headwinds, revenue would have increased by 17% on a constant currency basis, which is solid. Breaking revenue down by segment, Domestic Assessments (volume-based transaction fees where both the merchant and cardholder country are the same), reported revenue of $2.251 billion and grew by 6% year over year (constant currency). Transaction processing revenue was $3.3 billion, which increased by a solid 16% on a constant currency basis. Rebates and incentives increased by 18% on a currency-neutral basis, due to increased volumes and new/renewed deals (which I will cover later).

Cross Border Strength

Cross-border volume fees were a stand-out performer with a blistering 40% (constant currency) revenue growth rate reported at $1.795 billion. Cross-border fees are the fees charged by card networks to merchants when a card from an international bank is used in a transaction. This can be done both via e-commerce (a Chinese citizen buying from a U.S. e-commerce website) and in person (via travel payments). Given Mastercard has seen a surge in cross-border payments in the recent quarter, I am going to assume this is mostly from travel-related activities, given the tepid e-commerce demand, (management also confirmed this). Travel was completely locked down in 2020, then in 2021/2022 this pent-up demand was released. As someone who used to run a popular travel website (pre-acquisition), I saw this massive increase in demand myself, with website traffic doubling over the past couple of years.

In Mastercard’s earnings call the company noted that Cross border travel had “continued to recover” and inbound travel was flat or up in “every region” relative to 2019. Interestingly enough, the company noted that in the first few weeks of January, cross-border travel is above 2019 levels. This increasing upward trend makes me believe that cross-border volumes will continue to show strength in 2023, despite headwinds from the macroeconomic environment. In addition, the elephant in the room (or should I say dragon) is China, which still offers plenty of room to have a major travel rebound. For context, China contributed just 1% of inbound cross-border travel volumes in 2019 for Mastercard. In the fourth quarter of 2022, this was ~0.20% and thus that has plenty of room for recovery. Outbound travel to China represented ~2% of outbound cross-border payment volumes in Q4,19 but in Q4,22 this was ~1%. On January 8th, 2023, China announced a reopening where passengers can travel without quarantine. Therefore this is a positive sign for Mastercard’s cross-border payments growth and recovery.

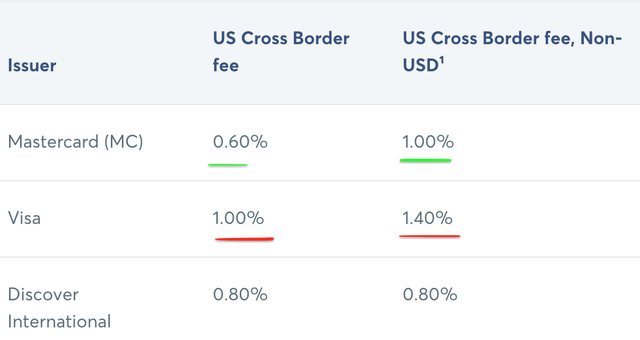

The ongoing Russia-Ukraine war is also impacting travel to those regions and surrounding areas. Therefore, when the Russia-Ukraine war ends, this will likely result in a rebound in travel (albeit) a slow one. In my post on Visa, I noted a similar growth trend in its cross-border volume. However, a positive for Mastercard is its cross-border fees are 0.6% (U.S) and 1% (non-U.S). This is lower than Visa at 1% and 1.4% respectively. Therefore Mastercard has positioned itself as a more cost-effective travel card and a popular review website labels the “top four travel debit cards” as all from the Mastercard brand with partners such as Chase.

Technology and Innovation

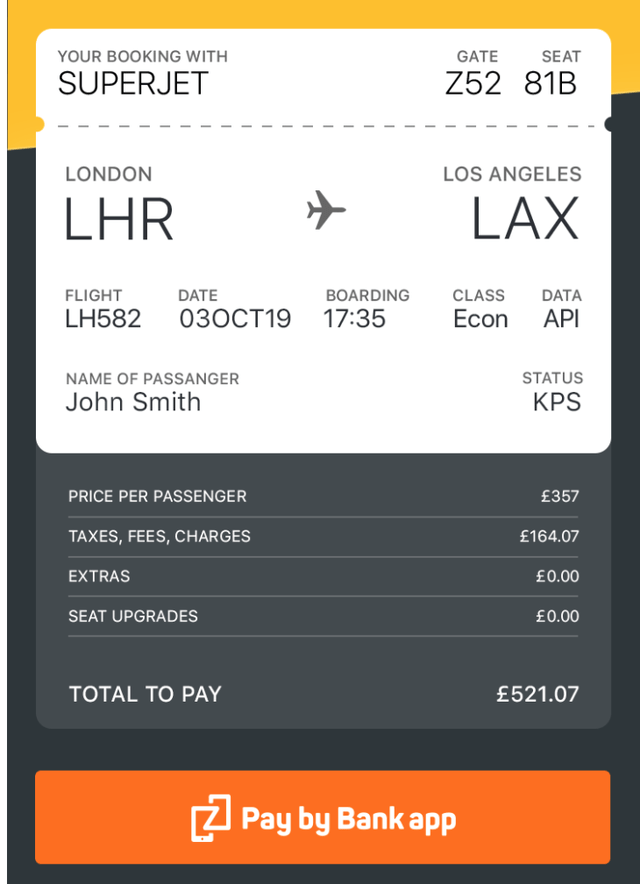

Pay by Bank – Innovation

Mastercard has a partnership with JPMorgan Chase, which it has recently expanded to include a Pay-by-Bank Partnership. “Pay by Bank” is an innovative technology that enables you to pay at an online checkout directly from your mobile banking application. This is a beautiful solution as it means there is no need to put in card details at checkout and thus this improves the user experience. This may seem like a small feat but in the world of e-commerce with billions of transactions, a slightly easier payment option can increase conversion rates which results in millions of dollars of extra benefit at scale. Another positive is Merchants will not need to take on the risk of storing bank account/card information. This is great for Merchants as it reduces liability and admin costs. In addition, it’s great for consumers and banks as it will reduce the likelihood of fraud.

Pay by Bank also uses advanced machine learning methods via Mastercard “Smart Payment decisioning” software, which helps to optimize the best time to collect payments, based on buyers’ historic behavior. This is great for the automating paying of bills and loans. Mastercard has recently partnered with U.K. based Secure Trust bank to offer customers the ability to repay loans directly via their bank account.

Pay by Bank App example flight booking (Worldpay)

Pay by Bank is currently being rolled out across the U.K, with banks such as Barclays, and is been trialed in the U.S. throughout 2023. Mastercard’s Open banking study found that 74% U.S. Consumers have, or would, connect their bank accounts to financial apps, to automate financial tasks. Therefore I believe Mastercard will benefit from the growth in its “Pay By Bank” technology, especially given the open banking industry is forecast to grow at a 26.9% compounded annual growth rate. In addition, I did a quick Google search online and could not find a Visa alternative (yet), thus Mastercard may have a first-mover advantage.

Tokenization and Installments

Tokenization is the process of converting a card into a virtual version with a unique or alternative card number. This can then be used in a virtual wallet such as via Apple Pay or Google Pay. The benefits include more security and it also mitigates the need to carry plastic cards. Mastercard processed over 2 billion tokenized transactions per month in 2022, up 38% year over year. Thus it is clear that this technology is immensely popular and growing. An emerging growth market is “in-car payments” which uses tokenized technology to help pay for gas, tolls, and even 5G. As Mastercard’s business model is based on payment volume, lower friction for consumers generally results in increased volume.

Mastercard also offers an “installments” technology that effectively competes with Buy Now Pay Later Providers [BNPL] such as Affirm (AFRM) and Klarna. Mastercard has recently enabled fintech SoFi to launch its “Pay In 4” program in the U.S. Many more launches are expected throughout the year. Given the BNPL industry is forecast to grow at over a 33.3% CAGR, I expect Mastercard’s platform to do continue to grow.

Partnerships and Deals

Mastercard’s strong brand makes them a “master” at scoring partnerships and deals with many banks and fintechs. The company has previously announced partnerships with Adobe, McAfee, Uber, and Priority Pass to help small business cardholders improve business efficiency and help set up insurance benefits. In addition, the company has expanded its “exclusive” partnership with Citi for a range of credit, debit, and small business cards. Mastercard has also expanded its partnership with Bank of America, to help with a range of SMB cards. Given the small business, market is a historically underserved financial market, this offers potential growth moving forward.

B2B accounts payable is also a solid growth market, as virtual cards offer the ability to improve working capital and increase operational efficiency. In Q4,2022, Mastercard scored a partnership with Sabre (SABR) to help power its virtual card programs for travel. Travel booking is a complicated endeavor that often involves multiple third parties from hotels to car rental providers. The travel lockdowns of 2020, highlighted many gaps in the system when it comes to booking refunds, etc. Sabre (with Mastercard) and similar companies can help solve these issues. Given the aforementioned growth in the travel industry and growth border payments, I forecast this segment to continue to grow.

In other markets, Mastercard scored a new partnership U.K. bank Natwest Group which replaced its Visa cards with Mastercard equivalents. Although the details of this deal are unknown I imagine that Mastercard offered a better deal than Visa in terms of fees. In addition, Mastercard has extended its credit deal with Natwest for both consumer and business cards. In Turkey, Mastercard partnered with QNB Finansbank and Trendyol a vast e-commerce website in Turkey to launch a cobranded Mastercard to over 30 million customers. Deals such as these speak to Mastercards global footprint and the benefits it can gain from emerging markets.

Profitability and Expenses

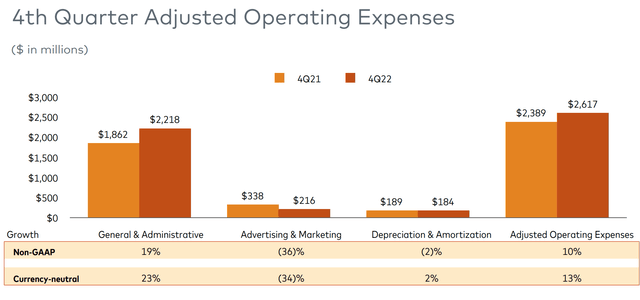

Mastercard reported earnings per share [EPS] of $2.62, which beat analyst estimates by $0.05 and increased by 8.57% year over year. This was at a slightly faster rate than the prior quarter’s growth rate of 5.77% YoY, but lower than the Q2,22 YoY growth rate of 12.27%. Overall this was positive given the company reported a 10% increase in overall operating expenses. The good news is this was mostly driven by increased personnel costs, and investments into its network, which I don’t believe is a negative overall, as the company is invested for the future. Its margin was also impacted by a $91 million headwind related to an adjustment in the fair value of investments, which was expected to the devaluation of the investment market.

Operating Expenses (Q4,22 report)

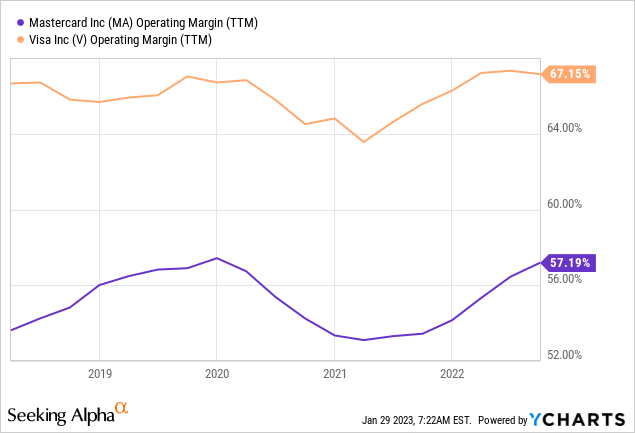

Given Mastercard operates a highly scalable business with a super high trailing 12-month margin of 57%, the company is in a strong position. Competitor Visa does have a higher 67% margin, but if anything this shows the potential increase Mastercard could achieve. For example, I noted prior that Mastercard charges lower cross-border fees than Visa, therefore there is plenty of meat on the bone to match Visa or at least close the gap to increase margins (if necessary).

Mastercard has a strong balance sheet with $7.4 billion in cash and short-term investments. The company does have total debt of $14 billion which is fairly high but the vast majority ($13.7 billion) of this is long-term debt.

Outlook

Mastercard’s management was fairly inexact with its outlook and expects “low teen” revenue growth in a GAAP basis. In addition, to “mid-single digit” operating expense growth. On a non-GAAP basis, the growth rate for its revenue is slightly better at the “high end of low double digits”. Previously throughout this post, I have highlighted my forward-looking forecasts of continued growth in Cross Border Payments, Partnerships, and various new technology solutions such as “Pay by Bank”. In the next section, I will quantify my growth forecasts inside my valuation model.

Valuation

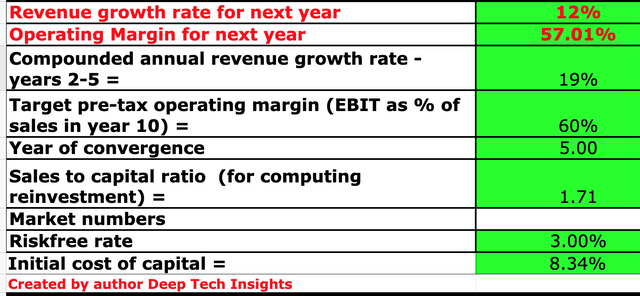

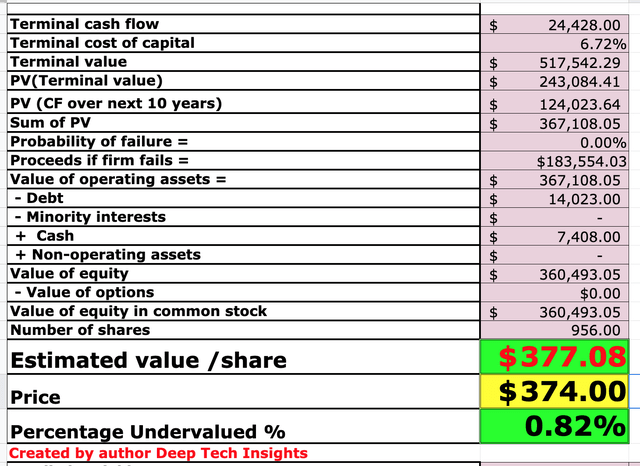

In order to value Mastercard I have plugged its latest financials into my valuation model which uses the discounted cash flow method of valuation. I have forecast 12% revenue growth for “next year” which in my model includes the next four quarters. This is aligned with management expectations and close to the growth rate achieved in the most recent quarter. I expect this to be slightly muted due to the macroeconomic environment. However, in years 2 to 5, I have forecast 19% per year revenue growth, driven by a rebound in payment volume as economic conditions are likely to improve. Inflation is still on a downward trend, thus I forecast interest rates will start to come down in 2024, taking pressure off the everyday consumer who is currently experiencing high mortgage costs. I also expect travel to continue to grow as China reopens and demand rebounds with continued growth in cross-border payments.

Mastercard stock valuation 1 (created by author Deep Tech Insights)

To increase the accuracy of the model, I have capitalized some of Mastercard’s technology investments which has boosted margins slightly. I have forecast a conservative 3% increase in operating margin over the next 5 years. I expect this to be driven by lower inflation and increasing payment volume from new technology solutions such as “Pay by Bank”.

Mastercard stock valuation 2 (created by author Deep Tech Insights)

Given these factors, I get a fair value of $377/share, the stock is trading at $374/share at the time of writing and thus is 0.82% undervalued or “fairly valued” in my eyes.

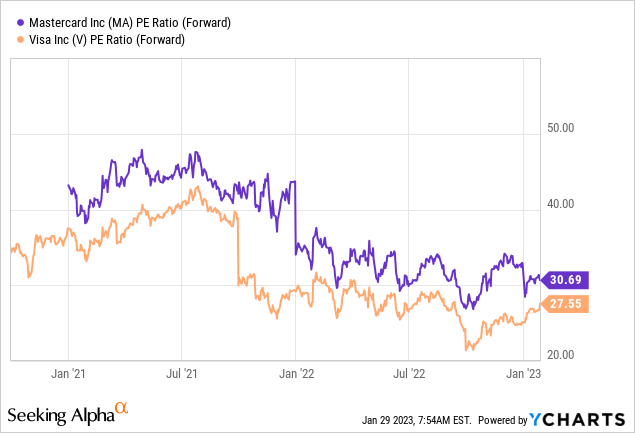

Mastercard also trades at a forward price-to-earnings ratio = 30.79, which is not exactly cheap, for example, the I.T sector average is 24.27. However, relative to its 5-year average Mastercard is 18.33% undervalued. The stock does trade at a slightly higher valuation than Visa (see below chart).

Risks

Recession/Lower payment volume

Analyst forecasts indicate we will have a recession in 2023. This will likely cause consumers to curb unnecessary spending, which will likely cause a slowing growth rate for Mastercard. A positive is this is a global macroeconomic issue and thus I expect this to be cyclical and Visa to be impacted similarly.

Final thoughts

Mastercard is a fintech powerhouse that has a strong brand and a vast network of innovative technology solutions. The company has continued to produce solid financial results despite the forecasted recessionary which is a testament to the quality of the business. It’s not trading at a really “cheap” level at the time of writing but given the quality of the company, I believe it is “fair value”. As travel continues to rebound (as China reopens) and secular growth trends such as Open Banking continue, Mastercard is poised to benefit.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.