Summary:

- Mastercard is the world’s second largest payments network with over 100 million acceptance locations globally.

- The company’s value-added services have been a key growth driver, outpacing overall company growth and differentiating it from rival Visa.

- Despite recent litigation and regulatory risks, Mastercard’s strong growth, profitability, and discounted valuation make it an attractive investment opportunity.

jir

Introduction

Mastercard (NYSE:MA) is the world’s second largest payments network behind its rival Visa (V). Mastercard has near universal merchant acceptance with over 100 million acceptance locations globally. The firm is the consummate compounding stock, with a ten-year total return CAGR of 21.5%. The firm’s core payment network growth has slowed to a high-single digit range, but I expect the firm’s complementary value-added services business to help maintain a double digit pace of growth for the next decade.

I believe that due to a recent litigation overhang against the company, that shares are trading at an attractive valuation. Importantly, this attractive valuation comes in conjunction with higher forecast revenue than the recent past, higher returns on capital and higher profit margins. All of this leads me to believe Mastercard represents an attractive Buy at current levels.

Mastercard is a textbook example of secular growth and, as a result, the stock has always been expensive from a valuation perspective, but as we know premium businesses should trade at premium valuations. With that being said however, I believe now might present an opportunity to pick up shares at a reasonable level versus recent history. For me, Mastercard is the essence of what the late Charlie Munger meant when he said:

“A great business at a fair price is superior to a fair business at a great price“. (Charlie Munger)

Value-added services include Cyber and Intelligence Solutions, Data and Services, Digital Identity and more. They represent a core differentiation point versus arch-rival Visa. Having a more developed secondary business line, outside of the core payments network, has allowed MA to outgrow its rival. This has resulted in investors assigning a higher P/E multiple to MA and the shares comfortably outperforming over the past five years.

Recent Earnings

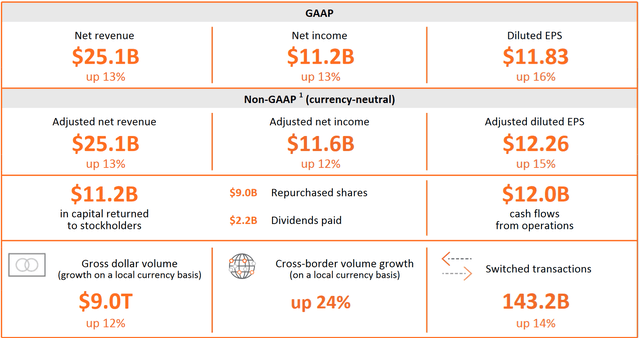

MA reported Q4 earnings at the end of January with an adjusted EPS of $3.18 up 20% year-on-year. Revenue in the quarter of $6.5B represented an increase of 13%. The faster pace of bottom-line growth demonstrated the firm’s ability to add new business, and magnify the impact through the income statement via tight cost control. The firm noted that at the end of 2023, there was an astounding 3.3B Mastercard branded cards in circulation globally.

What I consider important for the company outlook is the continued exceptional performance of value-added services in Q4. These services easily outpaced overall company growth. When we break the top-line growth into its components we see that the payment network grew by 9%, which is a solid result. However, value-added services clocked in at 19% growth, as customers continued to show strong interest, especially for services like fraud prevention and cybersecurity.

I expect the demand for services such as fraud prevention to remain robust and highly price inelastic as financial firms and consumers face an ever-growing threat from fraud, both in its volume and sophistication. As an example, the Financial Times reported 2023 saw a 22% increase in push payment financial fraud in comparison to the prior year. As fraud attempts continue to grow, so must the demand for intelligence and fraud prevention services. I expect MA to continue to see mid-teens growth and above as a result.

Wall Street analysts following the stock anticipate similar growth. I think it’s important to point out with a compounder like MA that the firm has a long standing history of exceeding analyst estimates, which are usually on the conservative side. MA has beaten earnings estimates in 19 of the last 20 quarters, such consistency gives me confidence that there could be upside to the mid-teens EPS growth forecasts.

The infographic below from MA’s annual report displays the double-digit nature of growth right throughout the business. This solid growth in conjunction with ongoing reduction of the outstanding share count via buybacks made 2023 another stellar year for the compounding engine.

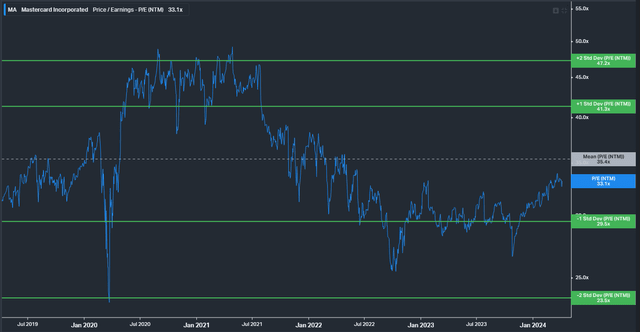

Valuation

MA shares currently trade on a forward P/E of 33.1x which is cheap relative to the five-year average of 35.1x. This valuation seems at odds with the improvement in growth and profitability of the business. The firm has grown its return on capital (ROC), an important measure of managements stewardship of shareholder capital. ROC now stands at close to 41%, which is well above the five-year average closer to 36%. In conjunction, analysts expect revenue growth to be above 12% for the next three years, which is higher top-line growth than the five-year average of 11%.

This combination of higher expected revenue and a more profitable business seems attractive. The shares look to be on sale as a result of the overhang from recent litigation, which I will discuss in the risks section.

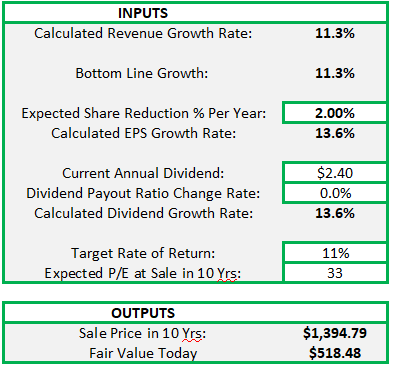

For my own valuation, I value the firm using a DCF approach. I am modelling for slightly above 11% revenue growth, which is in line with the firm’s ten-year revenue CAGR. In the interest of conservatism, I do not model for any expansion of the firm’s net income margin. MA has reduced its share count at a rate of just over 2% CAGR for the past 10 years, I expect this trend to continue at a minimum. The firm has an extremely low dividend payout ratio of less than 20%. I am not modelling for any increase in this payout, but I do expect dividend growth to keep pace with EPS growth.

Using a discount rate of 11%, which is in line with forecast revenue growth and likely below MA’s WACC, I arrive at a fair value price today of $518 which is around 9% upside to the current price. I am comfortable my DCF incorporates a suitable margin for error, noting EPS growth over the past decade has been close to 16.5% CAGR, which is substantially higher than my estimates.

Author

Risks

The most pertinent risk for MA (equally for V), is the risk from a meaningful regulatory change. As recently as last month, MA & V agreed to a settlement that ended a long running legal saga. Bloomberg reported that the deal could save US merchants $30B over five years. The lawsuit related to the charging of “swipe fees” on card transactions, also known as interchange fees. These fees are paid by merchants, with the proceeds divided between the card network (MA/V) and the merchant bank and acquiring bank. Under the settlement, the card companies have agreed to cap their fees for a five-year period. In addition, merchants will have the ability to charge customers extra at the checkout and potentially steer them to using lower-cost cards.

Ultimately, the biggest losers from the settlement are likely to be the card issuing banks. As customers will be steered away from pricier premium issue cards, such as those offered by Chase Bank. For payment networks such as MA, the ruling may have a limited short-term impact. However, given the scale of their network dominance and the universal acceptance of cards at merchants, I think the legal settlement does little to change the long-term thesis.

Conclusion

In conclusion, I see MA shares as attractive at current levels. The firm’s near duopoly standing in the card network business presents an impressive moat. The recent litigation settlement presents a short-term headwind for the firm, however, I think it is beneficial to have the long-standing dispute resolved. To our benefit as investors, the litigation has caused MA to fall below its five-year average valuation, despite the business delivering higher margins and higher returns on shareholder capital.

MA is advantaged versus its larger rival Visa, due to its more advanced value-added services business, which will serve as the growth engine for the firm over the next decade. While I expected we will see higher growth in the ancillary services, I still expect the core network business to deliver a solid high-single digit revenue growth, which will be magnified through operating leverage and buybacks to deliver mid-teens EPS growth for years to come. I think MA looks attractive relative to recent history and I see no reason why the compounding engine won’t continue to deliver. I recommend a Buy on MA at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.