Summary:

- Mastercard operates in a strong oligopoly where its scale provides competitive advantages.

- Inflation and the rise of international market to drive higher total transaction volume.

- Mastercard’s underlying business fundamentals and capital allocation are excellent.

- Currently, a hold due to valuation. I would prefer to wait for a correction.

jbk_photography

Investment Thesis

Mastercard Incorporated (NYSE:MA) is a great business, but it also trades at a steep valuation. Therefore, I believe it is a hold, as I am looking for at least a 15% annual return. Mastercard sits pretty within an oligopoly of a few large and established players. Therefore, it faces little competition. Visa and Mastercard within this oligopoly have pricing power due to their scale. Therefore, this creates a large barrier to entry for new entrants. Mastercard’s Total Transaction Volume should continue to be driven by elevated inflation and further growth in their international segment as improved affluence within the segment drives higher spending. The financials of MA are consistent and are of very high quality, supported by a healthy balance sheet, low teens revenue growth and mid-teens earnings growth. I realize MA is a great business. However, I must also factor in valuation. Hence, MA stock is a hold for now.

Company Overview

Mastercard is a financial services company that facilitates global payment transactions where electronic funds can be easily transferred between institutions, merchants, consumers, businesses, and government bodies. Despite its name, Mastercard does not issue any cards or credit, the company instead generates its revenue through transaction fees that are tied to the volume of activity processed via its network. As a result, Mastercard has created a business that is high margin and very scalable, two large reasons why I believe MA has found success. In the realm of payment processing, rivals include Visa (V), American Express (AXP) and PayPal (PYPL).

Mastercard Operates In A Massive Oligopoly

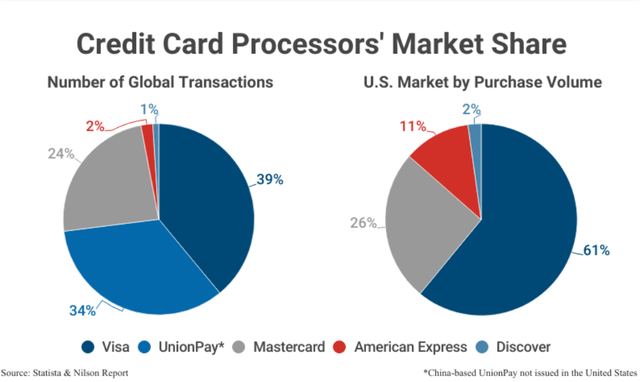

Mastercard operates in a market dominated by only a few large players. As we can see below, Mastercard holds a solid foothold in the United States Credit Card Processing market where based on purchase volume they have 26% of the market share, only behind Visa. On the world stage, Mastercard ranks third in transaction numbers with 24% of the global market share. However, we should take note that UnionPay dominates the Chinese market, though Visa and Mastercard recently in 2023 became available to use in China for foreign travelers. American Express and Discover both hold a smaller share of the global pie, with 2% and 1%, respectively. The oligopolistic environment I believe serves MA well as it means that consumers have fewer choices and MA has less competition meaning the few major companies can control pricing and market dynamics. The sheer scale of businesses such as MA and V make it very difficult for new payment processing providers to enter the market, hence providing Mastercard with a strong competitive advantage.

Total Transaction Volume to Drive Growth

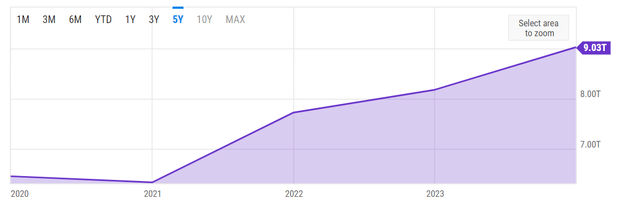

I believe Mastercard will experience growth moving forward, propelled by an increase in Total Transaction Volume, mostly due to inflation and a drive to penetrate international markets that are also becoming more affluent over time. As we can see in the graph below, Total Transaction Volume for Mastercard increased from $6.45 trillion in 2019 to $9.03 trillion in 2023, marking an annual increase of 7%. Since inflation pushes up the prices of goods as well as consumer paychecks, I expect to see transaction values for goods and services increase over time, hence being a tailwind for MA. Additionally, I also see various international regions worldwide becoming banked and more affluent, which has led to a larger global working class. Therefore, overall consumer expenditure has increased. This is also a tailwind for Mastercard. Moving forward, I think Total Transaction Volume will continue to increase about 7% per year, which should help MA continue to increase revenues.

Financial Analysis

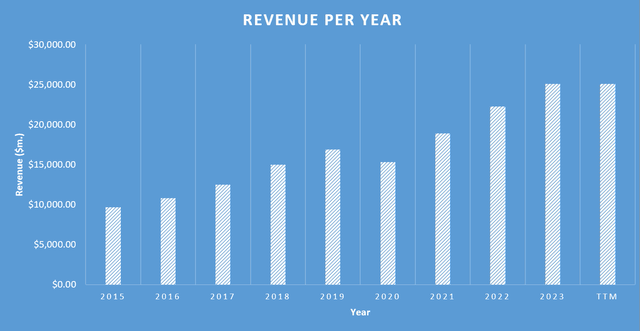

In my opinion, MA from 2018 to 2023 has been an example of a near perfect business in terms of the development of its underlying fundamentals. The company’s revenue increased from $14,950.00 million in 2018 to $25,098.00 million over the trailing twelve months, representing a CAGR of just under 11%. The growth has been very consistent and predictable as seen in the graph below where the only year that MA has experienced any negative growth was 2020 when transaction volumes decreased due to the Covid-19 pandemic.

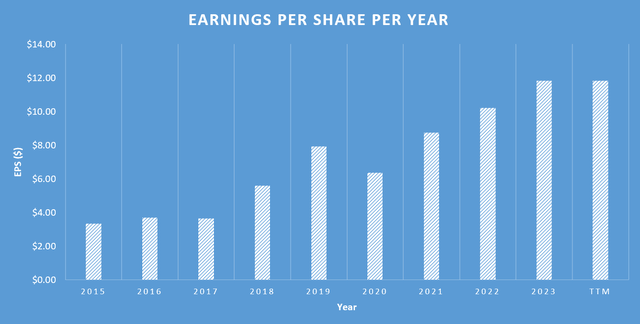

Similarly, there was a rise in earnings per share which rose from $5.60 to $11.83 delivering a compounded annual growth rate of approximately 15%. Over time, operating margins have expanded, where in 2023 MA recorded record operating margins of 58%. The company has also implemented share buybacks into their capital allocation strategy, where we have seen the diluted outstanding shares decrease from 1047.00 million in 2018 to 946.00 million in the past twelve months.

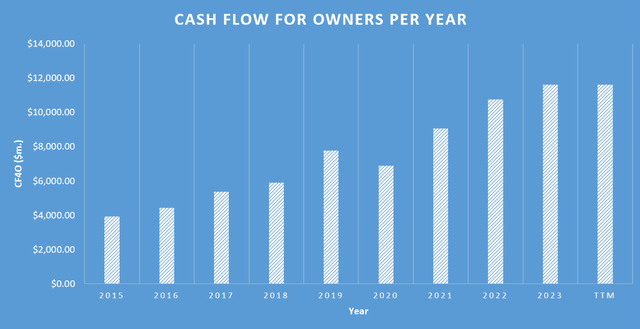

Regarding free cash flow, the company has compounded at a rate of around 13.5%, increasing from $5,893.00 million in 2018 to $11,609.00 million in the preceding 12 months. This illustrates that the business is delivering significantly more cash for shareholders once accounting for capital expenditures when compared to half a decade ago. I expect free cash flow to continue to grow at double-digit rates moving forward. Especially because I think Mastercard will continue to increase transaction volumes, particularly within international markets outside of North America.

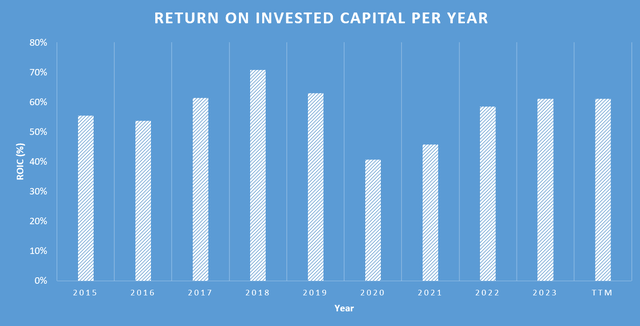

I believe one of the biggest strengths of Mastercard is their ability to maintain a high ROIC, as it is an important indicator of the company’s capability to reinvest profits back into the business for future earnings growth. Through the previous 5 years, Mastercard’s five-year median ROIC was 60%, indicating that when management reinvest back into the business, shareholders can expect that reinvestment to have a positive impact on earnings growth in the future.

Regarding the balance sheet, the last quarterly earnings filing showed cash and cash equivalents of $8,588.00 million. The overall debt that the business is liable for is $14,344.00 million. Considering that the cash on the balance sheet covers 60 percent of the debt load and that total debt can be removed with less than 2 years worth of free cash flow, I see the balance sheet as healthy. Mastercard’s current ratio also stands at 1.17, meaning that the company will not run into any debt issues in the next 12 months. Overall, the balance sheet is strong, and debt is not an issue for Mastercard.

Valuation

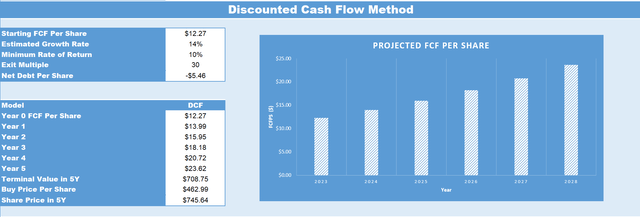

As of Q4 2023 MA’s current TTM cashflow per share stands at $12.27. Considering the long-term growth opportunities such as penetration into international markets which will lead to higher transaction volume, as well as being protected from inflation, I anticipate a growth rate of 14% for MA’s cashflow per share over the five years. This growth rate is also in line with analyst estimates. Taking this growth into consideration, it can be projected that MA’s cashflow per share, by Q4 2028 would amount to $23.62.

Based on an exit multiple of 30, it is estimated that the stock price in five years will reach $745.64. I have selected an exit multiple of 30 as the ten-year median price to free cash flow ratio for MA is 34. Hence, I selected 30 for a degree of conservatism. Consequently, if you decide to invest in MA at its share price of $469.26 you can expect a return of about 10% annually over the next five years according to these calculations. For me, MA is a hold at current valuation, even though I really like the business. I would rather wait for a correction as I aim for 15% annual returns, and I think there are better opportunities in the market.

Risks

While Mastercard is certainly a great business with a durable moat, there are still some risks that investors should be aware of. The first risk is a worsening of the macro environment that could lead to a recession. This would cause transaction volumes to drop as consumers will spend less through a recessionary period. The second risk that I would like to bring to your attention is the possibility of other emerging payment methods/technologies such as cryptocurrency and other fintech firms that bypass the need of Mastercard’s networks. The third risk that I would like to touch on is valuation risk. If growth were to slow for Mastercard or if margins were to be compressed as a result of regulatory changes, I think multiple contraction would occur. Currently, the stock trades at 38 times free cash flow, but if one of these risks ended up occurring, I think I would be possible for the business to fall to 20 times free cash flow, which is close to the lowest multiple through the last ten years. This would imply a downside in the stock price of nearly 50%, though I would likely create a great buying opportunity in this unlikely scenario.

Conclusion

Mastercard is a business that is high margin, highly scalable and very profitable. It faces little competition in its industry, as it sits within an oligopoly of a few large and established players. This oligopoly means that MA along with V have pricing power, hence making it difficult for new competitors to enter the industry. I believe inflation and further penetration into developing international markets will continue to drive Mastercard’s Total Transaction Volume. The underlying fundamentals of MA continue to get better year after year, with consistent low teens revenue growth and mid-teens earnings growth. Capital allocation is also a strong suit for MA, with a very strong historical ROIC and a very manageable debt load. Unfortunately, most of the market has recognized that Mastercard is a great business and trades at a steep valuation. For now, MA is a hold, as I am looking for at least a 15% annual return.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.