Summary:

- Mastercard’s revenues have nearly tripled over the last ten years, with sales growing steadily and expected to continue growing at a rate of ~13% annually.

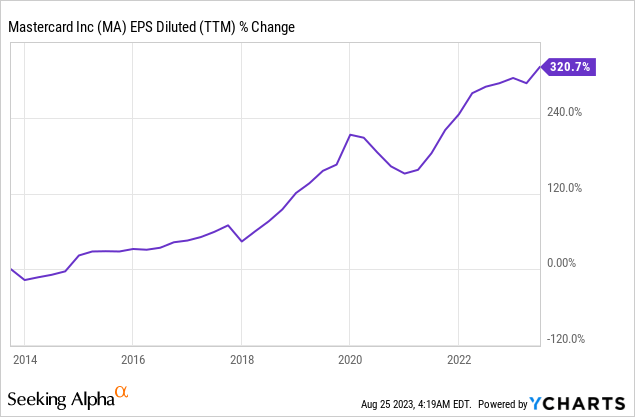

- Mastercard’s EPS has increased by 320% in the past decade, growing faster than sales due to share buybacks and economies of scale.

- Despite all the advantages of investing in Mastercard, its current valuation is high and lacks a margin of safety.

jbk_photography

Introduction

As a dividend growth investor, I focus on discovering new chances for investments in assets that generate income. Whenever I come across appealing options, I frequently bolster my current holdings. For the past several years, I have been following the Mastercard (NYSE:MA) shares and haven’t invested yet due to the high valuation, which implies zero margin of safety. I will revisit the company in this article to see if my investment thesis has changed.

I covered Mastercard nine months ago and found it to be a hold. I stated that the company is extremely attractive, yet the investment is not attractive enough due to the valuation. I added that Mastercard should be on your watchlist as you wait for a better entry point. Back in January, there was a higher level of uncertainty. We weren’t sure about the economy’s direction, with inflation being much higher, and so were the odds for a recession. In this article, I will base my analysis on the latest financial results from Q2 2023. I will combine it with the improved macro situation to determine how attractive the investment is.

The financial sector has been an interesting one lately. We have seen some weakness among regional banks. Some even collapsed. We also see some uncertainty regarding the financial stability of larger banks, despite them passing the stress tests. The payment processor led by Visa (V) and Mastercard is a different segment of the financial sector. While I own shares in Visa, I am also considering buying Mastercard. Both companies offer the infrastructure and not the loans.

My methodology for analyzing Mastercard is the one I use to analyze dividend growth stocks. I am using the same method to make it easier for readers to compare researched companies across different sectors. I will examine four main categories: fundamentals, valuation, growth opportunities, and risks.

To have a better familiarity with Mastercard, Seeking Alpha’s company overview states that:

Mastercard provides transaction processing and other payment-related products and services in the United States and internationally. It facilitates the processing of payment transactions, including authorization, clearing, and settlement, and delivers other payment-related products and services. The company offers integrated products and value-added services for account holders, merchants, financial institutions, businesses, governments, and other organizations, such as programs that enable issuers to provide consumers with credits to defer payments. It also provides value-added products and services comprising cyber and intelligence solutions for parties to transact and proprietary insights, drawing on the principled use of consumer and merchant data services.

Fundamentals

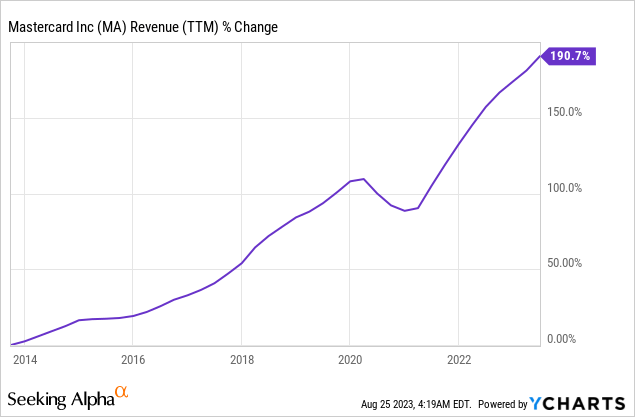

The revenues of Mastercard have increased by almost 200%, meaning sales have nearly tripled over the last ten years. The graph below shows how, besides the pandemic, sales have grown steadily. The sales grow as more merchants connect to its payment network and people use more credit and debit cards instead of cash. Therefore, the payment volume is growing, and so does the sales of Mastercard. In the future, as seen on Seeking Alpha, the analyst consensus expects Mastercard to keep growing sales at an annual rate of ~13% in the medium term.

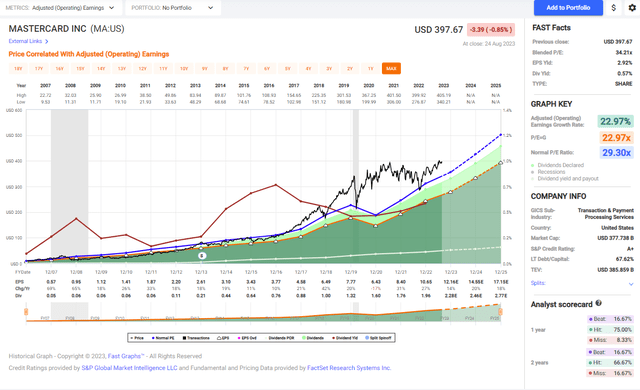

Mastercard’s EPS (earnings per share) during the same decade has increased much faster. The EPS increased by 320% in one decade, which means that the EPS is more than four times higher than it was just a decade ago. EPS is growing faster than sales as the company buys back shares and enjoys economies of scale, allowing it to generate more income without increasing expenses. Once the infrastructure is intact, it takes less effort to maintain it. In the future, as seen on Seeking Alpha, the analyst consensus expects Mastercard to keep growing EPS at an annual rate of ~17% in the medium term.

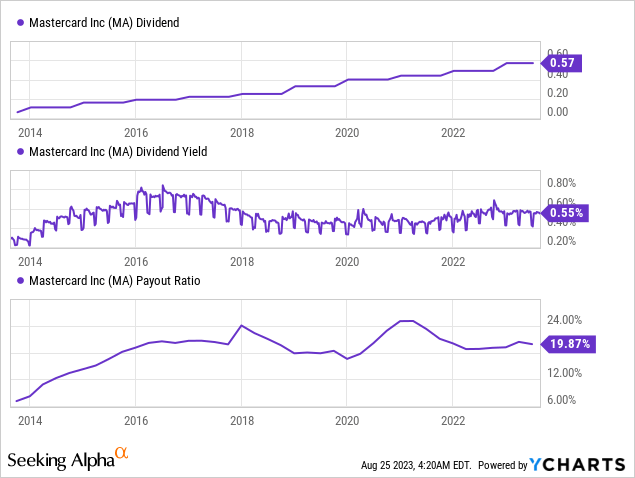

The dividend is one of Mastercard’s crown jewels. The company has been increasing the dividend for over a decade and has not reduced it for over fifteen years. The dividend shines as the company offers a CAGR (compound annual growth rate) of 33% over the last decade. Moreover, despite the fast dividend growth, the company provides a relatively safe payment. The current payout ratio sits below 20%, meaning there is much more room to grow the low initial yield of 0.55%.

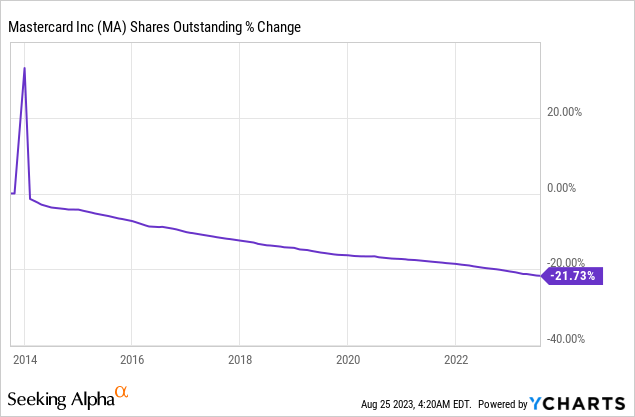

In addition to dividends, Mastercard also returns significant amounts of capital to shareholders via buybacks. Buybacks support EPS growth as they lower the number of shares outstanding. Mastercard has reduced the number of shares by 22% in the last ten years, contributing significantly to the EPS growth. The buybacks are highly efficient when the share price is attractive and the valuation is low. While this is not the case for Mastercard, the company still returned significant capital.

Valuation

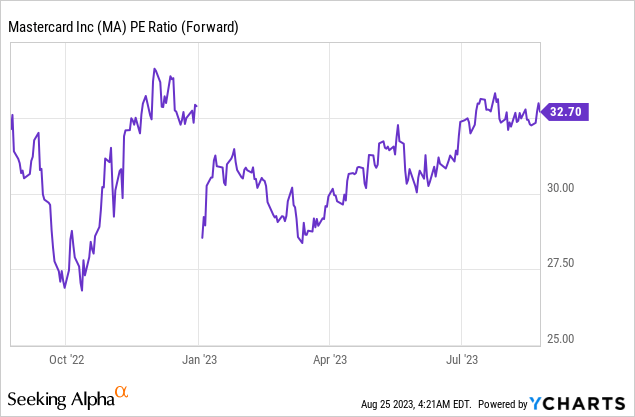

Mastercard’s P/E (price to earnings) ratio based on the 2023 EPS estimates stands at 32.7. The current valuation is high, especially considering the risk-free rate of around 5%. The current valuation is almost at the highest point we have seen over the last twelve months, and investors should consider the lack of margin of safety when paying more than 32 times earnings for a stock.

The graph below from Fast Graphs emphasizes that Mastercard is currently overvalued. Since it started trading, the average P/E ratio of Mastercard has been 29.3, and the company managed to grow the EPS at an annual rate of 23%. Currently, Mastercard is trading for a higher P/E ratio of 33 and is also expected to grow at a slower pace of 17% per year. Therefore, in terms of valuation, the company is not attractive enough right now.

Opportunities

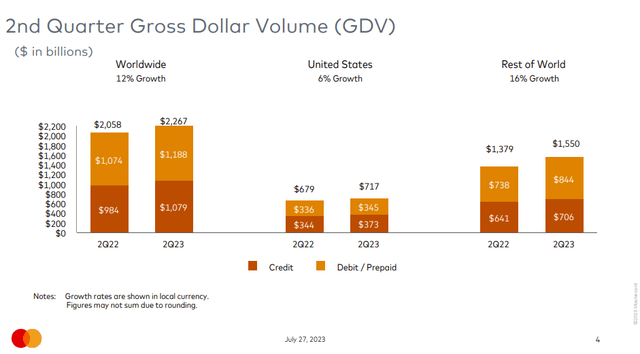

The company is enjoying a steady growth in volumes in dollars. While the volumes in the United States are thriving, with a 6% growth year-on-year, the focus of the growth is abroad. Outside the United States, the high growth rate is 16%. The company is expanding into new markets and working with international partners to have a deeper thorough penetration into lucrative markets, especially in Asia. One example of that can be seen in the quote by the company’s CEO:

In Asia Pacific, we’ve extended our relationship with Standard Chartered Bank, which will enable us to grow our consumer credit presence across key markets in the region. We’ve also expanded our partnership with HSBC through the launch of the Travel One Card in Singapore, Malaysia and Vietnam. Travel One will provide instant in-app rewards redemption powered by the Mastercard Rewards system.

(Michael Miebach – CEO, President & Director, Q2 2023 Earnings Call)

E-commerce and especially integration e-commerce can be a great opportunity. The Chinese and African markets have developed differently due to the later growth of payment methods. They developed p2p solutions that do not necessarily need the Mastercard infrastructure. Mastercard is working with these networks to create partnerships that will allow it to gain exposure to these growing emerging markets. The company did so in China during Q2, when it worked with WeChat and Alipay.

This quarter, we announced partnerships with both Alipay and WeChat Pay to enable international travelers to easily link any Mastercard credit or debit card to Alipay and WeChat Pay digital wallets. The partnership allows visitors to make payments with tens of millions of QR code merchants across China.

(Michael Miebach – CEO, President & Director, Q2 2023 Earnings Call)

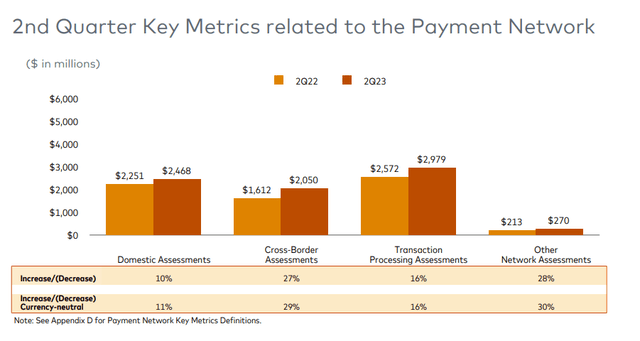

Another growth opportunity for Mastercard is the return of international travel following the pandemic. Cross-border usage has increased significantly, and it is an excellent opportunity for payment networks such as Visa and Mastercard. These are more costly transactions, so the charge is higher, and when people travel, it is more convenient than using cash. As international travel grows, so does that growth engine.

Cross-border travel continues to show strength, reaching 154% of 2019 levels in the second quarter. We remain well positioned to capitalize on this trend with our travel-oriented portfolios and our initiatives in areas like loyalty and marketing.

(Michael Miebach – CEO, President & Director, Q2 2023 Earnings Call)

Risks

Interest rates are higher today than they were a year ago. Unlike what some investors believe, there is a high likelihood that we will see these higher rates for a long time. Higher rates mean that borrowing is more expensive for consumers. Therefore, they will purchase less and will not use their credit card as often as some may expect. Therefore, these higher rates may mean the volume growth may slow down, especially in developed markets.

Competition is another risk for Mastercard. While the company is practically a duopoly with Visa, new emerging fintech companies are trying to compete. We have seen PayPal (PYPL) and Block (SQ) trying to create their networks, cutting Mastercard as the middle-man. While they struggle to do so in the developed world, we see apps like M-Pesa in Africa and WeChat in China do that.

Another risk for the company’s growth, especially in developed countries, is the development of real-time payment services based on bank transfers. In the United States, we have Zelle, for example. That service is used today for p2p payments but can be extended to pay merchants as the payment will be immediate. In that case, Mastercard may find its market shrinking.

Conclusions

To conclude, Mastercard is the blue chip of all blue chips. It shows steady growth in sales, which leads to a continued increase in EPS. The EPS growth is translated into capital returned to shareholders via buybacks and dividends. Moreover, the company has several growth opportunities domestically and internationally as it extends its networks, and people buy more online and use less cash.

There are several risks to the investment thesis, and the long-term dangers involve the company’s competitive position. I believe the company enjoys a great position to compete if needed, so I am not overly concerned. However, I am worried about the company’s current valuation. It leaves investors without a margin of safety; therefore, I am not comfortable investing in it right now. The stock is priced for perfection. Consequently, I’d wait for a more appealing opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.