Summary:

- Mastercard’s stock is poised for a potential breakout, despite concerns over a proposed bill in Washington aimed at reducing credit card costs.

- Mastercard is expanding its business beyond traditional payments, with its services segment now accounting for one-third of the company’s total net revenues.

- The services division has grown through a combination of organic initiatives, acquisitions, and building services based on customer demand.

- Despite current consumer sentiment being low, Mastercard’s long-term growth and valuation remain strong.

- The company’s use of AI and data analytics in various services, from consumer engagement to fraud detection, is also seen as a positive move.

s99/iStock Editorial via Getty Images

Introduction

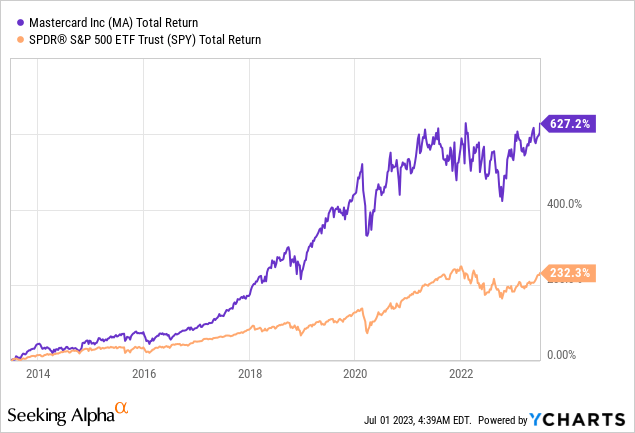

Mastercard Incorporated (NYSE:MA) is a fascinating stock for a number of reasons. Not only does this credit card giant tell us a lot about the state of the (global) consumer, but it’s also a company that has handsomely rewarded its investors with strong long-term returns. It’s fair to say this New York-based financial corporation is one of the best compounders of modern history, returning close to 630% in the past ten years alone.

In this article, I will assess the company’s risk/reward, as it seems the stock is headed for a breakout. We’ll look into its financials, its dividend, fundamental tailwinds, and potential headwinds.

So, let’s get to it!

Mastercard’s Fundamentally-Backed Breakout?

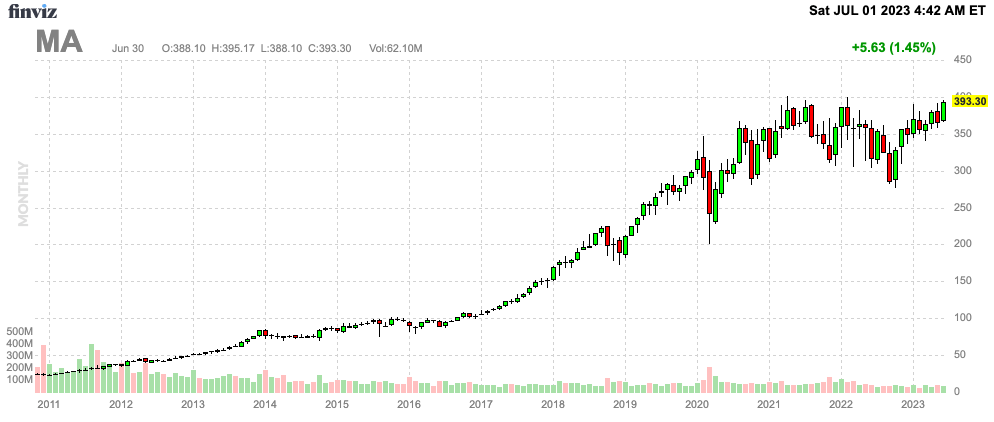

I don’t like technical analysis. I think it’s overrated. However, I did notice that Mastercard’s share price is now where it was in mid-2021 when it was trying to break out.

FINVIZ

The stock has now gone nowhere since early 2021, which could lead to a violent breakout – if it’s backed by the right fundamentals, which is why I’m writing this article.

Washington Headwinds?

With that in mind, it seems that Mastercard is quickly shrugging off negative headlines related to the government’s proposal to lower credit card costs.

On June 30, the Wall Street Journal wrote that there’s a bill aimed at transforming credit-card transactions and reducing fees for merchants, which is generating a fierce debate in Washington.

Essentially, proponents seek to lower the fees paid by merchants while facing strong opposition from major banks, card networks, and even airlines. The proposed legislation covers multiple aspects, including the categorization of credit-card purchases at gun stores and the distribution of reward points.

However (and here comes the good news for shareholders), analysts remain skeptical about the bill’s chances of becoming law, considering the historical challenges of passing legislation that affects powerful interest groups.

Nonetheless, there are two reasons why the bill might pass:

- Firstly, the bill coincides with ongoing discussions about banking reforms in Congress following the recent crisis in Silicon Valley Bank. This additional focus on bank reforms could divide banks’ attention in Washington.

- Secondly, a political coalition has emerged in support of the bill, including retail giants like Walmart (WMT) and Target (TGT), and small local businesses. Co-sponsors of the bill have highlighted the benefits the bill would bring to the table of these groups.

With that said, this isn’t necessarily bearish for Mastercard for a number of reasons. One of them is the complexity of the fee structure.

Opponents of the legislation argue that the fees in question fund important aspects of the credit-card industry, including fraud prevention and credit card rewards programs. Card networks set interchange fees, a portion of which is returned to cardholders as rewards and incentives.

In order to make the case that fees are too high, politicians need to understand what fees are used for. This includes assessing the benefits of cardholders versus the benefits of the company and its shareholders.

That’s going to be a tough task, and I doubt the bill will result in a significant headwind for MA and its peers.

Hence, I’m not surprised that the MA share price doesn’t suggest that bad news might be brewing in the nation’s capital.

Mastercard Is Evolving

While Washington is thinking about ways to punish Mastercard, the company is further expanding its business beyond traditional payments.

During the RBC Financial Technology Conference last month, Mastercard highlighted its services segment.

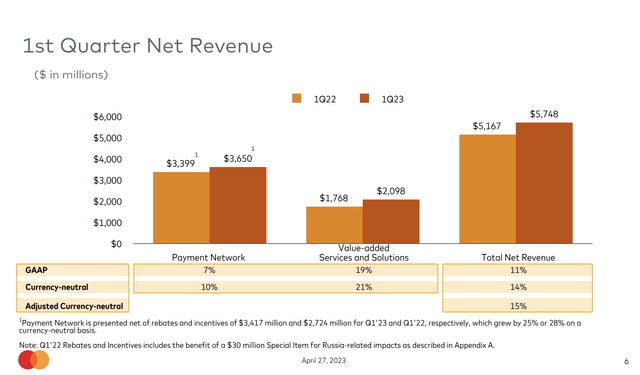

Roughly a decade ago, services accounted for around one-sixth of Mastercard’s total net revenues. By 2021, this segment had grown to one-third. Services accounted for 36% of 1Q23 revenues, as seen in the overview below.

Services are now one of the three key pillars of Mastercard’s strategy, alongside payments and new networks.

Services not only drive value-added services but also enhance the value of payments and support the development of new networks. The services division has grown through a combination of organic initiatives, acquisitions (such as Dynamic Yield), and building services based on customer demand.

In other words, services can be seen as a force multiplier, strengthening both the payments and new network pillars.

- In terms of payments, services help customers acquire consumers, boost portfolio growth, reduce fraud, and optimize portfolios. Examples include cashback offer campaigns and driving contactless adoption.

- In the context of new networks, services enable activities like open banking and identity solutions. For instance, Mastercard’s innovation services helped a bank in Central and Eastern Europe develop a multi-bank app that facilitated access to loans and provided a comprehensive view of financial accounts.

Services act as a force multiplier by driving growth, enabling innovation, and enhancing customer value.

Additionally, services can lead to new payment relationships, where customers initially engage with Mastercard through services and later transition to payment solutions. An example is Mastercard’s Test & Learn services, which eventually led to a partnership with The GAP (GPS), flipping their co-brand portfolio to Mastercard.

Furthermore, the company uses AI to enhance and complement its existing services. AI and (related) data analytics are embedded in various services, from consumer engagement to fraud detection, and have been extended to benefit Mastercard internally.

For example, Mastercard has developed a platform that leverages data and AI to match employees with opportunities. They have also used their forecasting and scenario planning work to improve innovation and provide consulting services to others.

With that said, how’s Mastercard doing? Should we buy the (potential) breakout?

Mastercard’s Growth & Outlook

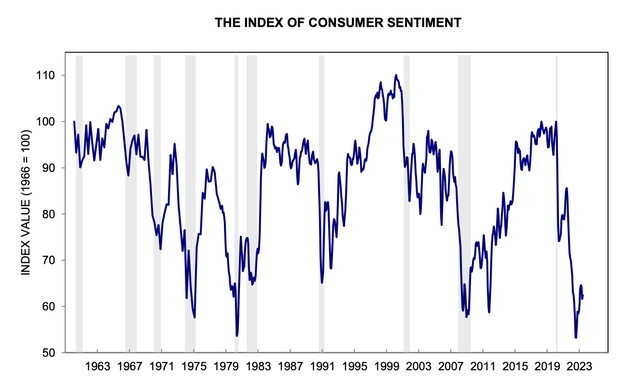

Consumer sentiment is in horrible shape. As the chart below shows, consumers haven’t been this pessimistic since the depths of the Great Financial Crisis.

Despite these issues, the company noted that consumer spending remained resilient, leading to strong revenue and earnings growth.

The macroeconomic factors monitored included the labor market, savings levels, access to credit, inflation, and global economic growth. While economic conditions varied across countries and sectors, consumer spending levels remained strong in 1Q23, with a shift towards spending on experiences, which means that services are outperforming goods.

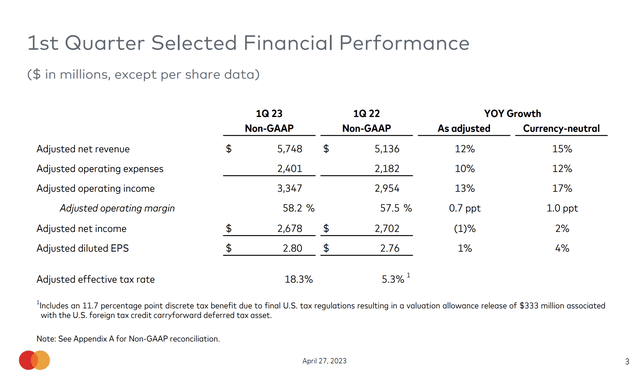

- Net revenue increased by 15% on a currency-neutral basis, driven by resilient consumer spending and the recovery of cross-border travel.

- Operating expenses grew by 12%, including a two points increase related to acquisitions.

- Operating income rose by 17%, and net income increased by 2%.

- Earnings per share grew by 4% to $2.80, with a $0.07 contribution from share repurchases.

Notably, the growth rates of net income and EPS were impacted by a low tax rate in 2022 due to significant discrete tax benefits in the previous year.

Payment network net revenue increased by 10%, mainly driven by domestic and cross-border transaction and volume growth and growth in rebates and incentives.

Value-added services and solutions net revenue increased by 21%, driven by strong growth in cyber and intelligence solutions, higher demand for fraud solutions, and scaling of identity and authentication solutions. These comments make sense in light of the aforementioned comments on Mastercard’s growth in services.

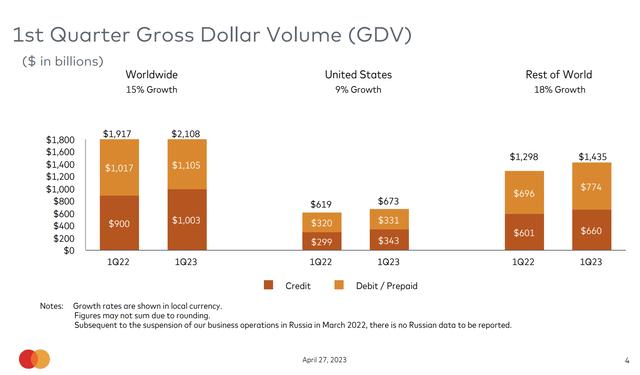

Digging a bit deeper, we find that domestic assessments increased by 9%, while worldwide gross dollar volume grew by 15%. Cross-border assessments increased by 39%, outpacing the 35% growth in cross-border volumes.

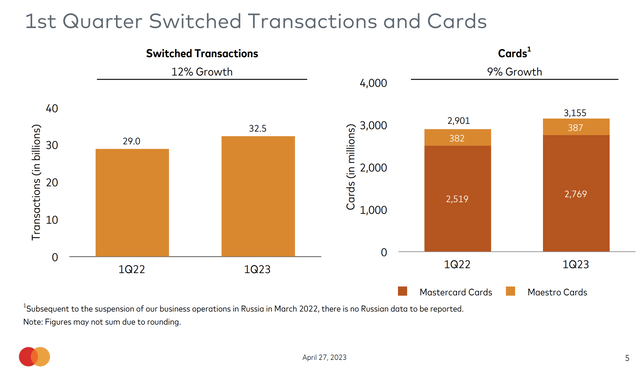

Transaction processing assessments grew by 14%, while switch transactions increased by 12%.

Despite the good news, the company did see some moderation in spending, which was a result of lower tax refunds in the United States. While I believe that this is just one of many factors, I have to say that almost every single consumer-focused company noticed weaknesses related to these lower refunds.

Based on that context, Mastercard raised its outlook a bit (emphasis added).

For the year, our outlook has improved modestly, reflecting our stronger-than-expected performance in Q1. We expect net revenue growth for the full year 2023 to be at a low teens rate on a currency-neutral basis, excluding acquisitions and special items. This growth rate would be higher by approximately 1.5 ppt if you exclude Russia-related revenues from 2022. Foreign exchange is expected to be a tailwind of 1 ppt for the year, and we expect minimal impact from acquisitions.

Our expectations for operating expense for the year are unchanged with growth expected to be at the high end of a high single-digit rate on a currency-neutral basis, excluding acquisitions and special items.

Shareholder Returns & Valuation

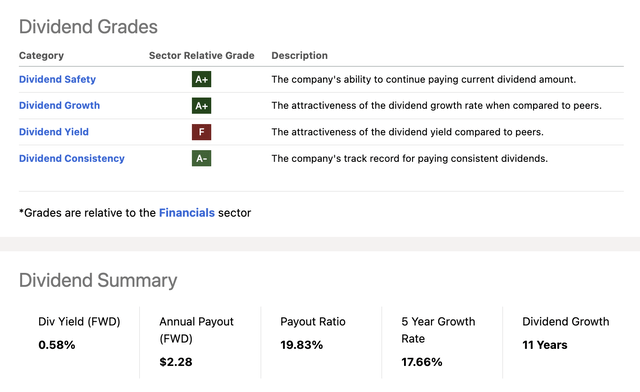

Mastercard isn’t just a regular dividend growth stock. It’s one of the best dividend growth stocks. The problem is that its yield is low.

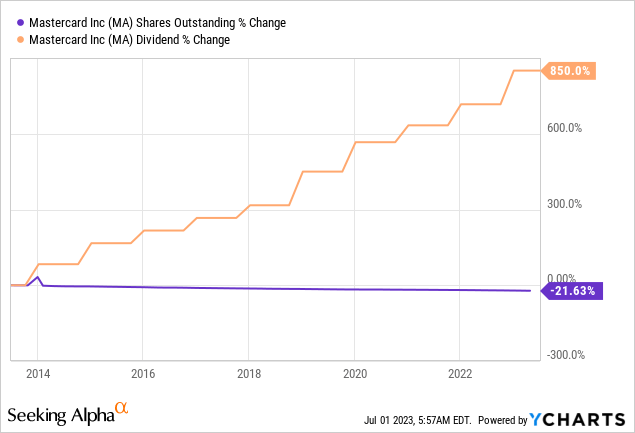

Over the past five years, the average annual dividend growth was 17.7%, which is backed by a payout ratio of less than 20% and 11 consecutive annual dividend hikes.

Since 2013, the dividend has been hiked by 850%. Excess cash was spent on dividend health, acquisitions, and share buybacks, resulting in a 22% decline in the number of shares.

In this case, I have to say that MA is the perfect example of why buying a low yield isn’t always a problem – unless you are dependent on income.

The only reason why the yield is still so low despite aggressive dividend growth is the fact that capital gains were so high. Long-term MA investors are sitting on a ton of unrealized capital gains and a high yield on cost.

- Investors who bought the stock ten years ago are now sitting on a 4% yield on cost.

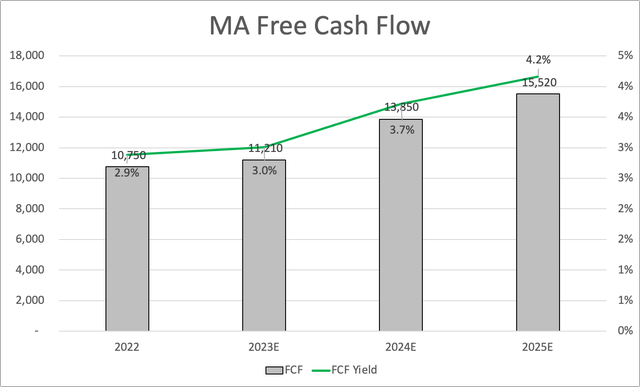

Furthermore, analysts expect free cash flow growth to remain in double-digit territory. Next year, the company is expected to generate free cash flow close to $14 billion, which implies a 3.7% FCF yield. That would mean a 16% cash payout ratio.

Adding to that, next year, the company is expected to lower net debt below $3 billion, which indicates a net leverage ratio of less than 0.2x EBITDA. MA has an A+ credit rating.

So, higher free cash flow can be used to further boost shareholder returns and/or engage in major M&A – if needed.

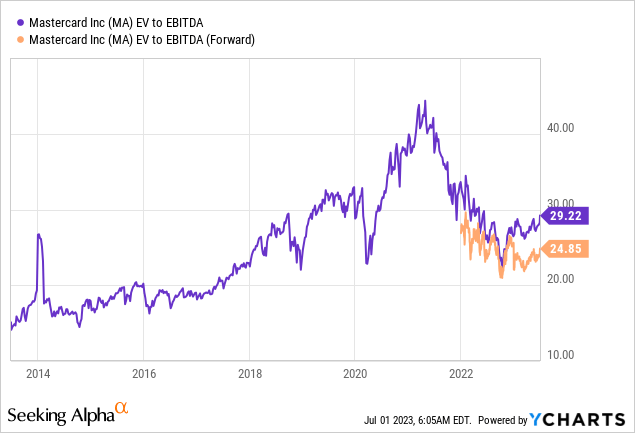

Having said all of that, I cannot make the case that MA shares are significantly undervalued. The company is trading at 24.9x NTM EBITDA, which would erase the post-pandemic valuation surge. However, it’s still elevated compared to levels prior to 2018.

The current consensus price target is $428, which is 9% above the current price.

I believe this price target reflects the current risk/reward quite well.

Based on these developments, I’m contemplating buying Mastercard. I like its performance and developments like services growth that hint at prolonged above-average growth.

However, I’m not chasing the stock at current levels. I only initiate new investments at subdued valuations. While I believe that MA has the power to break out, which could lead to a rapid jump to its consensus price target, I’m willing to wait for weakness.

Takeaway

Mastercard stands out as an exceptional dividend growth compounder with strong long-term returns and potential for a breakout. Despite potential Washington headwinds, the likelihood of significant negative impacts seems low due to the complexity of the fee structure and the historical challenges of passing legislation affecting powerful interest groups.

Mastercard’s expansion beyond traditional payments into services has been a key driver of growth, supporting both payments and new network pillars.

The company’s financials are robust, with resilient consumer spending leading to strong revenue and earnings growth.

Furthermore, Mastercard’s commitment to shareholder returns is evident through its aggressive dividend growth, share repurchases, and solid free cash flow generation.

While the stock is not currently undervalued, waiting for a dip in price before initiating new investments may be prudent.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.