Summary:

- Mastercard is set to release their Q2 results later in the week.

- The company has a long history of beating expectations on both the top and bottom lines.

- MA shares, despite running higher, remain attractively valued for a long-term investor.

jir

Written by Nick Ackerman.

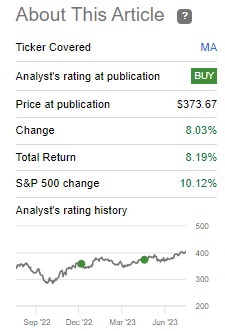

Q2 earnings are coming up for Mastercard (NYSE:MA) on the morning of July 27th, 2023. The company reported solid Q1 results, and we covered those results previously. The shares have been trending higher since that release. The overall market has been heading higher, and that’s been helped along with broader market participation. MA had delivered returns under the S&P 500 during this time, but this is roughly only over the last quarter. Investing is about long-term gains and avoiding short-term noise.

MA Performance Since Prior Update (Seeking Alpha)

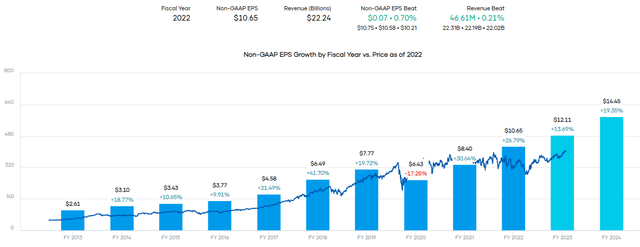

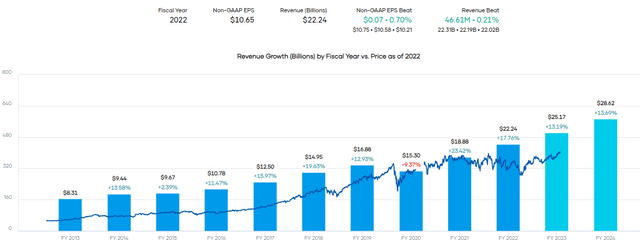

MA has a long history of beating earnings estimates and not disappointing investors when they post their results. In 15 of the last 16 quarters, the company delivered an EPS surprise. This was the same in terms of topping revenue estimates. The only time they missed in the last 16 quarters was in September 2020.

For Q2 specifically, analysts are looking for EPS of $2.83, which would represent around 10.5% year-over-year growth over the $2.56 delivered last year. Revenue is expected to come in at $6.17 billion, marking 12.20% YoY growth for the company over the $5.5 billion reported last year.

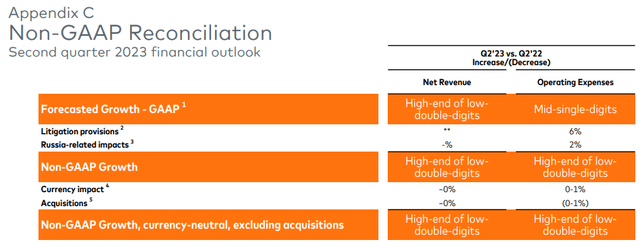

MA’s own financial outlook for Q2 is also looking for some attractive growth. In fact, this could be another sign that they could beat analysts’ estimates as they suggest a “high-end of low double-digits” increase YoY. Analysts expect instead what would be the low-end of low-double-digits at 12.2% YoY.

MA Net Revenue Q2 Outlook (Mastercard)

Admittedly, MA’s forecasts are quite vague without specific metrics being provided. Even their earnings call does not really expand on more specifics.

With respect to the second quarter, year-over-year net revenue is expected to grow at the high end of a low double-digit rate again on a continual basis, excluding acquisitions and special items. Coming off of a strong Q1, this sequentially reflects a tougher year ago comp, lower anticipated FX volatility, partially offset by lapping the suspension of operations in Russia. Foreign exchange and acquisitions are not expected to have much of an impact for the quarter.

Earnings revisions for the company have actually been trending down. This could be even more reason for the shares to be able to beat as the hurdle has been lowered heading into this report. That could put them in a position where it looks more impressive than it otherwise would.

MA Earnings Revisions (Seeking Alpha)

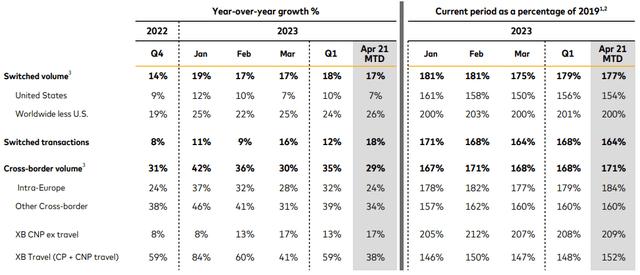

In Q1 2023 MA had reported a beat on both EPS and revenue, and I’d expect that to continue with the latest results. The cross-broader volume will be an area that remains important for MA, with strong gains of 35% in the prior quarter YoY. They noted that it was well above their 2019 levels, which was right before Covid hit and saw travel almost all but stop. The previous quarter was an acceleration from Q4 2022 results that saw an impressive 30% YoY increase.

Adjusted operating margins also saw an increase in the previous quarter, coming in at 58.2%; further margin expansion could help drive further earnings growth. Additionally, switched transactions grew 12% in the last quarter – an accelerated growth of the 8% growth in Q4 2022 – which could help boost revenue and earnings if this momentum keeps up. Gross dollar volume in the prior quarter also grew YoY to go along with the higher switch transactions.

MA’s overall earnings growth history has been incredibly impressive, only going backward in the last decade during Covid.

MA EPS Growth and Estimates (Portfolio Insight)

Even during that time, the hit to revenue was even relatively smaller than the hit to earnings for the company.

MA Revenue Growth and Estimates (Portfolio Insight)

The growth opportunities for MA remain plentiful, even as there is significant competition within the payment network space. There is plenty of room globally to continue expanding, and that’s where most of the growth has primarily been for MA.

MA Switched Volume (Mastercard)

An earnings history of regularly topping analysts’ estimates and the suggestion that they believe net revenue can grow faster than analysts expect would suggest MA could exceed earnings expectations again.

Valuation And Dividend

Despite running higher, MA is still trading below its fair value historical range, making it a worthwhile investment to consider pre-earnings. This is particularly true for a long-term investor that is looking for some attractive growth in their portfolio.

MA Fair Value Estimate Range (Portfolio Insight)

Along with impressive share price appreciation, the company also pays a dividend. The yield is quite low at 0.56%, but the dividend growth has been just as incredible as the growth the company has been able to deliver. The 10-year CAGR comes in at 28.44%, which does mean the 16.3% dividend bump announced late last year could be somewhat disappointing. Along with that announcement, they also announced a $9 billion buyback program that was on top of their previous buyback program. So, MA has definitely focused on returning capital to shareholders to go along with appreciation.

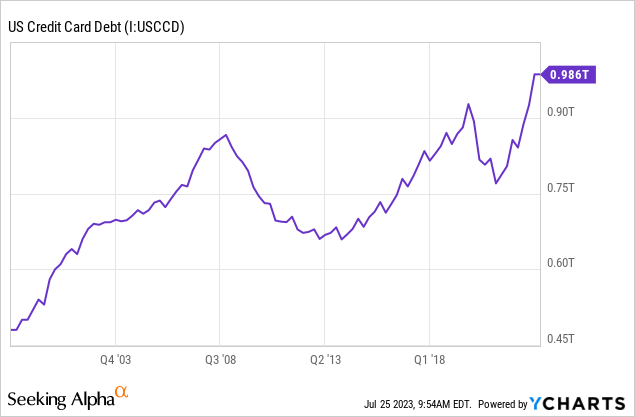

Some investors could choose to wait until after the earnings are announced to consider a position. However, as we noted above, I believe the expectations are that MA can probably exceed expectations. Credit card debt has just hit an all-time high in the U.S., nearing the trillion dollar mark, as consumers and the economy overall have remained resilient. While that could be viewed as a negative, MA doesn’t actually have anything to do with the actual debt, but the more important factor is that consumers seem to be swiping as furiously as ever.

YCharts

Conclusion

With MA’s Q2 earnings, we’ll see if they can hold onto the strong growth the company has been able to deliver. This could also keep their earnings and revenue beat streak alive. Competition has been fierce, but that hasn’t slowed down MA, as there are multiple avenues for growth in the space. The resilient economy and consumer have certainly been helpful, but even during a recession, it isn’t as if people stop swiping their credit and debit cards.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.