Summary:

- Mastercard’s Q3 earnings are coming up this week, with EPS expectations at $3.21 on revenue of $6.53 billion.

- The company has a history of consistently beating earnings expectations, with 15 out of the last 16 quarters exceeding EPS and revenue estimates.

- Despite potential regulatory challenges and what would appear to be a high valuation, longer-term investors may still find value in Mastercard’s solid growth prospects.

jbk_photography

Written by Nick Ackerman.

Mastercard (NYSE:MA) earnings are on deck this week, giving investors a chance to see the latest Q3 numbers on the 26th. Investors have reasons to be excited as MA regularly beats analysts’ estimates. Despite tighter monetary policy, consumers have shown they continue to be willing to travel and swipe their cards to do so.

In our prior update, we provided a preview of Q2 earnings, which did exceed expectations. The topped EPS estimates by $0.06 per share, and revenue grew 14% year-over-year, topping expectations by $130 million when it came in at $6.3 billion for the quarter.

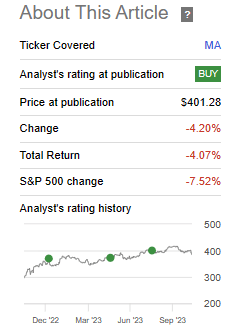

Since then, shares have been down on both a price and total return basis, but that’s similar to what we saw with the broader market. In fact, MA was even able to thwart some of the downside trends and didn’t fall as far as the S&P 500 Index during this time.

MA Performance Since Prior Update (Seeking Alpha)

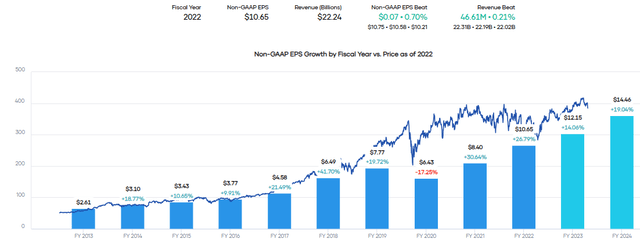

Earnings History

As a reminder, MA provides the infrastructure of the payment network; it isn’t the bank that can often be more cyclical during economic downturns. That’s why the company was often classified in the tech category, but that changed earlier this year when they were put into the financial sector bucket.

During Covid, there was an earnings hit, but, all things considered, it wasn’t an overly dramatic fallout. What hit them the most was the lack of travel.

MA EPS History (Portfolio Insight)

However, we are well past that period now, and earnings have continued to surge as Mastercard turned back to growth. In fact, it only took the company the following year to be back above pre-Covid earnings levels.

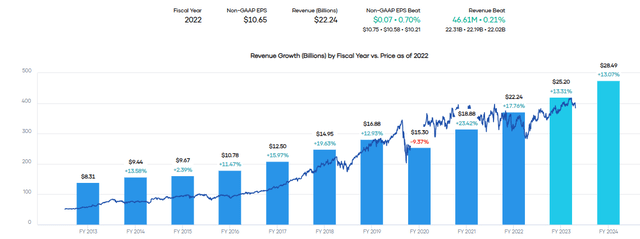

This was the case on the top line as well, with revenue also surging back.

MA Revenue History (Portfolio Insight)

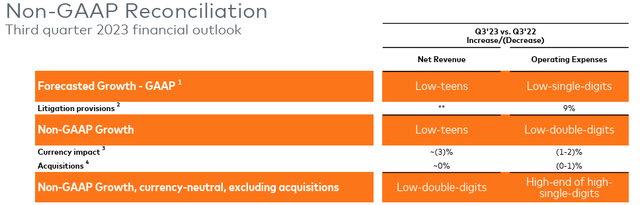

Q3 Outlook

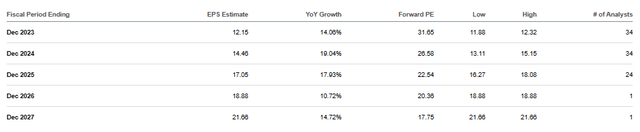

When earnings are announced this week, they are expected to come in at $3.21, with revenue of $6.53 billion. That would represent year-over-year growth of 19.95% and 13.4%, respectively.

On the revenue front, that’s mostly where MA had also forecasted this quarter coming in. However, for EPS, they were forecasting low teen growth, which would put the analysts a bit above MA’s expectations.

That being said, the name of the game is to underpromise and then overdeliver. That’s something MA has been able to do regularly, with 15 out of the last 16 quarters coming in with an EPS beat. That’s the same on the revenue side as well. Both misses were for the third quarter of 2020.

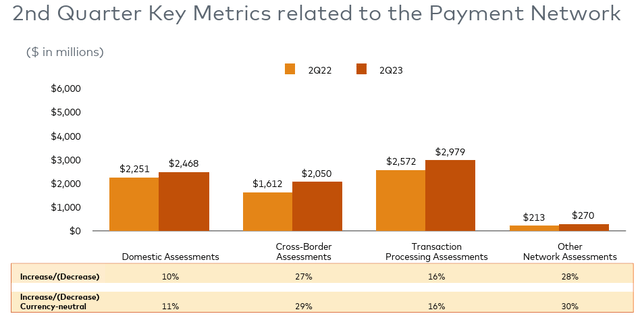

Cross-border assessments are an important part of MA’s business operations. So that’s always one place to watch for their earnings, to see if they can keep up the healthy pace of growth. Of course, as we saw in Q2, there was healthy growth across all segments of their business, which certainly puts MA in a healthy position.

MA Q2 Payment Network Revenue and Growth (Mastercard)

Earlier this year, they noted that demand “remained robust,” and we’ve seen that come through in the numbers since.

As they highlighted in the prior Q2 call, cross-border travel is well above the pre-pandemic levels now.

Cross-border travel continues to show strength, reaching 154% of 2019 levels in the second quarter. We remain well positioned to capitalize on this trend with our travel-oriented portfolios and our initiatives in areas like loyalty and marketing. Cross-border card-not-present ex travel continues to hold up well.

We’re monitoring the environment closely and are ready to adjust investment levels as appropriate while maintaining focus on our key strategic priorities. As a reminder, these priorities are: one, expanding in payments; two, extending our services; and three, embracing new networks.

Fun fact: “Cross-border” comes up 48 times in the last earnings call. Just to put a bit of context on the importance of that part of the business.

Another area that is worth watching out for is on the regulatory front. This is something that pops up fairly regularly for discussions in Congress and the White House. With that, it has popped back up more recently with the Fed set to potentially lower the fee cap.

Additionally, the Credit Card Competition Act is also gathering more support as it was reintroduced. Not only is Mastercard pushing back against this for obvious reasons, but the financial institutions themselves are, too.

Regulatory changes are a regular overhang and risk of investing in this industry. No doubt, the rhetoric should heat up as we enter an election year. With it flaring up once again, it’ll be interesting to see if Mastercard has anything to note on these fronts in their earnings call.

Valuation

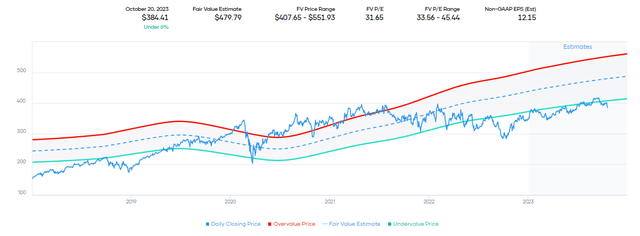

At a P/E of nearly 32x, one could easily say that MA is overvalued. However, history would suggest that just isn’t the case and that an even higher multiple tends to be the norm.

MA Fair Value Estimate Charte (Portfolio Insight)

The company trades at a multiple premium due to the solid strength in earnings we saw above (and with the outlook of seeing more of the same.) The forward PEG ratio comes to 1.62, which is above the sector, but that’s after being put into the financial sector. The forward PEG ratio for the tech sector comes in at 1.71. Overall, it also tells us that MA isn’t egregiously overvalued.

Is it a slam-dunk, buy-hand-over-fist type of valuation? Absolutely not, but longer-term investors looking for a dividend growth play are set to be richly rewarded over time. And sometimes, that means buying at a premium when you are looking at such a solid company.

MA Long Term Earnings Expectations (Seeking Alpha)

Conclusion

MA is looking to post their earnings later this week. History suggests they are ready to announce another top and bottom-line beat. Cross-border travel is still looking robust, and that’s one of the main focuses of MA and its continued growth. Travel has remained robust even while the Fed is trying to slow down the economy. Even outside of travel, consumers have remained resilient, continuing to swipe their Mastercard credit and debit cards.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities, where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investors’ income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.