Summary:

- Although top line growth slowed down, Mastercard is still reporting high growth rates for revenue as well as earnings per share.

- The three strategic priorities of Mastercard in the years to come are expanding in payments, extending the services Mastercard is offering additionally and finally embracing new networks.

- The stock could be fairly valued right now, but I would still wait for cheaper prices.

jbk_photography

In my last article about Mastercard (NYSE:MA), I argued that the stock is still overvalued, and I see some downside risk for the stock. And as the stock is trading for almost the same price as during my last article, it might seem like the issue is not yet resolved. But usually there are two major ways how the “problem” of overvalued stocks can be solved. In most cases, overvalued stocks decline rather steep at some point, but it is also possible that overvalued companies and stocks “grow into the valuation”. And Mastercard’s stock is now moving sideways for several years and is rather stagnating somewhere between $300 and $400. At the same time, the fundamental business of Mastercard is constantly improving and this could make the stock fairly valued at some point.

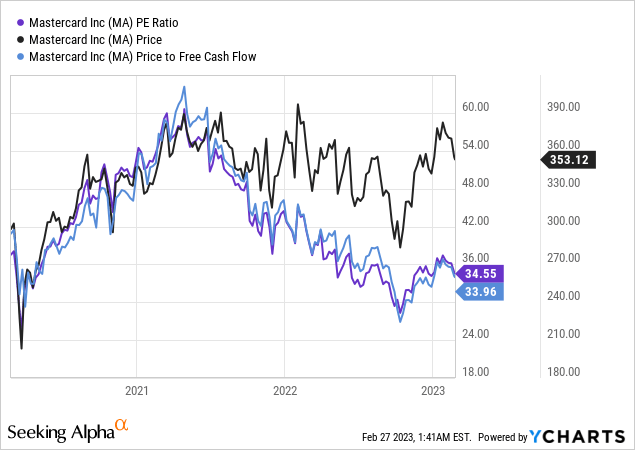

When looking at the stock price as well as the two most important simple valuation multiples – the price-earnings ratio as well as the price-free-cash-flow ratio – we can see how the stock price is stagnating at a “high level” since early 2021 while the P/E ratio and P/FCF ratio are constantly declining.

At the time of writing, Mastercard is trading for 34 times free cash flow and 34.5 times earnings, and these are certainly not cheap valuation multiples. Most companies and stocks would be clearly overvalued when trading for more than 30 times earnings or free cash flow. But in the case of Mastercard we should not ignore that we are dealing with a high-quality business that might deserve a higher valuation multiple.

In the following article we are looking at Mastercard once again and will try to determine if the stock is trading near its fair intrinsic value.

Solid Annual Results

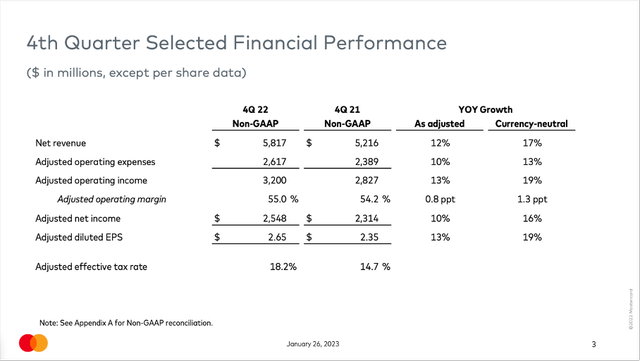

When looking at the last reported results, Mastercard is still reporting strong growth rates and in Q4/22, the company beat on revenue estimates by $10 million as well as on non-GAAP earnings per share by $0.07.

Looking at full year results for fiscal 2022, revenue increased from $18,884 million in fiscal 2021 to $22,237 million in fiscal 2022 – resulting in 17.8% year-over-year growth. Operating income increased 21.6% year-over-year from $10,082 million in fiscal 2021 to $12,264 million in fiscal 2022. And finally, diluted earnings per share grew 16.7% YoY from $8.76 in fiscal 2021 to $10.22 in fiscal 2022.

While Mastercard still reported high growth rates for fiscal 2022, growth rates in the fourth quarter slowed down and the company is continuing a trend of declining top line growth rates for six quarters in a row. Since 2021, this was the lowest top line growth, but Mastercard was still able to grow revenue from $5,216 million in Q4/21 to $5,817 million in Q4/22 – resulting in 11.5% YoY growth. Operating income increased from $2,827 million in the same quarter last year to $3,184 million this quarter – resulting in 12.6% YoY growth. And finally, diluted earnings per share increased 8.7% YoY from $2.41 in Q4/21 to $2.62 in Q4/22.

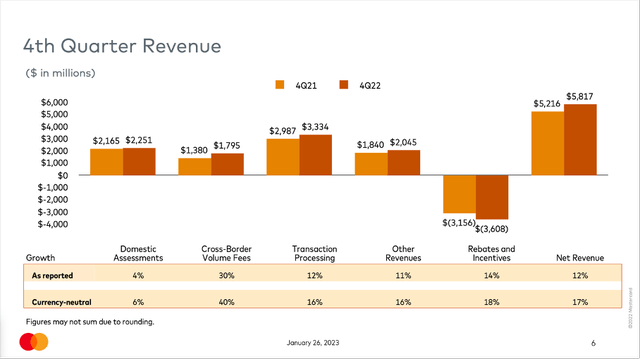

When looking at the different segments, all four contributed to revenue growth (at least on a reported basis). And while “Domestic Assessment” saw revenue decline 6% in currency-neutral numbers, “Cross Border Volume Fee” reported a strong 40% currency-neutral growth in Q4/22.

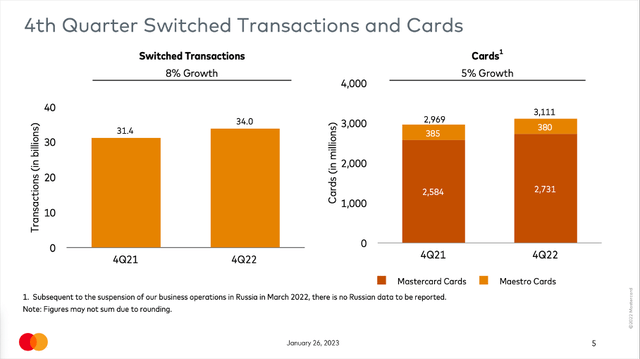

The number of total cards increased from 2,969 million at the end of Q4/21 to 3,111 million at the end of Q4/22. And while the number of Maestro Cards declined slightly, the number of Mastercard Cards grew 5.7% year-over-year – and when adjusted for Russia, growth was even more at 10.6% year-over-year. Switched transactions increased from 31,371 million in Q4/21 to 33,959 million in Q4/22 – and when adjusting once again for Russia, growth was 18% year-over-year. And gross dollar volume increased 8% year-over-year (on a local currency basis).

And finally, when looking at the guidance for fiscal 2023, Mastercard is expecting to grow revenue in the low-double digits on a currency-neutral basis (if excluding Russia-related revenues from 2022, the growth rate would be about 1.5 ppt higher). Especially for its fourth quarter guidance, Mastercard is rather cautious as the suspension of operations in Russia will have a greater impact in Q1 than it had in Q4.

Short-term And Long-term Growth

Despite being a bit cautious, Mastercard is still expecting double-digit growth for its business in fiscal 2023 (and probably beyond). PayPal Holdings, Inc. (PYPL) – which I covered last week – is similar optimistic and in my article I wrote:

Schulman however is expecting inflation to cool and is therefore assuming that discretionary spending vs. non-discretionary spending will increase again, and PayPal will profit from that trend.

And not only PayPal will profit from that trend – Visa (V) and Mastercard will profit as well. Without having reliable data, I would assume that PayPal is profiting more from a trend towards discretionary spending (as many products bought online are discretionary and Mastercard and Visa cards are also used offline for non-discretionary items). But not only PayPal CEO Schulman seems to be slightly optimistic about 2023. CEO Michael Miebach acknowledged macroeconomic and geopolitical issues and a still uncertain environment. But he seems to be rather optimistic and mentioned a resilient labor market with rising wages as well as the reopening of China. Overall, Mastercard’s management team is expecting consumers to keep spending:

From an overall consumer spending standpoint, we expect the consumer to be relatively resilient. Spending patterns have largely normalized relative to the effects of the pandemic with the notable exception of China. In terms of switched volumes, domestic volumes in the fourth quarter remained steady relative to 2019 levels with some slight moderation in the U.S. related to lower gas prices recently.

And while this is the rather short-term outlook for the next few quarters and years, we as long-term investors should rather focus on long-term growth. Mastercard itself is focusing on three pillars of growth – as outlined during the last earnings call in detail. The three strategic priorities of Mastercard in the years to come are expanding in payments, extending the services Mastercard is offering additionally and finally embracing new networks. This three-part strategy was already introduced during the 2021 Investment Community Meeting.

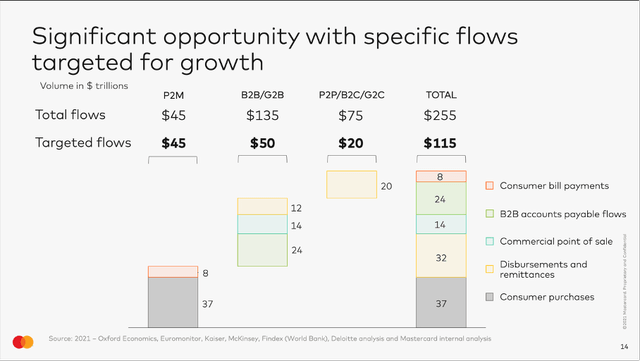

When looking at the first strategy – expanding in payments – part of Mastercard’s strategy is to focus on business-to-business as well as government-to-business payments. As outlined during the 2021 Investment Community Meeting, Mastercard can target about $20 trillion in cash flows in that segment.

Mastercard Investment Community Meeting

Aside from focusing on businesses and government cash flows, Mastercard is trying to advance the Tokenization, which is helping to keep the ecosystem safe and secure. Mastercard has surpassed 2 billion tokenized transactions per month and the rate is growing 38% year-over-year and Mastercard is now enabling transactions in over 110 countries. Additionally, Mastercard partnered with Adyen to launch “Click to Pay” on their global payment platform and another example to expand payments, CEO Miebach outlined during the earnings call is in-car payments:

One example that I think is particularly cool is the work we are doing with in-car payments. We’re working with car manufacturers and fintechs to integrate payments using our tokenization platform and biometric authentication capabilities. Think about the simplicity it brings to paying for gas, tolls, charging or entertainment right from your car.

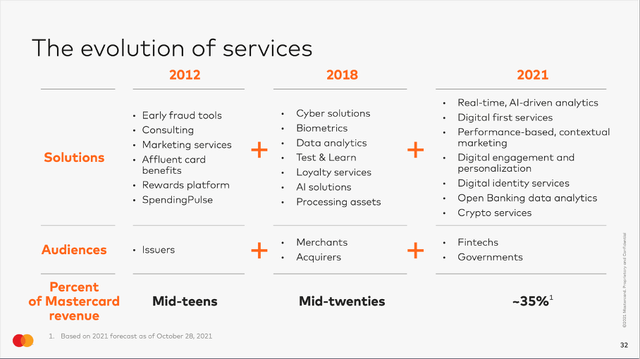

When looking at services, it became a more and more important part of Mastercard’s business – responsible for about 35% of Mastercard’s revenue.

Mastercard Investment Community Meeting

The business is also continuing to grow the services it provides. And a good example is Consumer Clarity – a service providing cardholders with merchant details in digital receipts to reduce disputes, low charge-back costs and improving the consumer experience. In 2022, about 50 financial institutions and merchant partners signed up.

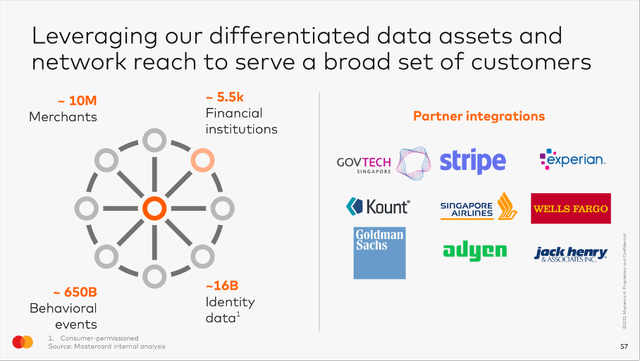

And finally, expanding into new network opportunities is the third pillar of growth – including open banking (help institutions and individuals to exchange data securely), digital identify (enabling to identify solutions across individuals, devices and accounts) as well as other new networks. And as “identity” is core to nearly every digital interaction, it could open a huge potential market with about 10 million merchants and 5.5k financial institutions.

Mastercard Investment Community Meeting

Intrinsic Value Calculation

I already mentioned above that Mastercard stock is still trading for a high valuation multiple – about 35 times free cash flow and earnings – and therefore Mastercard can’t still be described as cheap or a bargain. But of course, Mastercard could grow with a high pace and high growth rates, which usually justifies higher valuation multiples.

|

3-year CAGR |

5-year CAGR |

10-year CAGR |

|

|---|---|---|---|

|

Revenue |

9.62% |

12.22% |

11.64% |

|

Operating Income |

9.48% |

13.54% |

12.31% |

|

Earnings per share |

8.78% |

22.87% |

16.63% |

The best way to account for high growth rates and reach an intrinsic value reflective of the growth potential in the years to come is by using a discount cash flow calculation to determine an intrinsic value. As a basis for our calculation, we can take the free cash flow of the last four quarters ($10,753 million). As always, we calculate with a 10% discount rate and 963 million outstanding shares (last available share count). When calculating with these assumptions, Mastercard must grow about 9.5% in the next ten years followed by 6% growth till perpetuity (the growth rate I always use for high-quality businesses) to be fairly valued.

Starting with these assumptions we can either argue why they are too optimistic or why they are not optimistic enough:

- On the one hand, these assumptions are not taking into account a potential recession in 2023 and/or 2024 and we will most likely see lower free cash flow in the years to come.

- On the other hand, growth rates between 9% and 10% for the bottom line might be too pessimistic when looking at the growth rates Mastercard could report in the last ten years (earnings per share growing with a CAGR of 16.63%).

In my opinion, we could make the argument that Mastercard is fairly valued, but it is certainly not a bargain right now. And when assuming that Mastercard will likely remain in its sideway range, we might wait until the stock declines to its previous low of $275 to $280 again.

Conclusion

I would still see Mastercard as neither overvalued nor a bargain. In my opinion, the stock can be called fairly valued and when purchasing the stock today as a long-term investment, you probably won’t make a huge investment mistake.

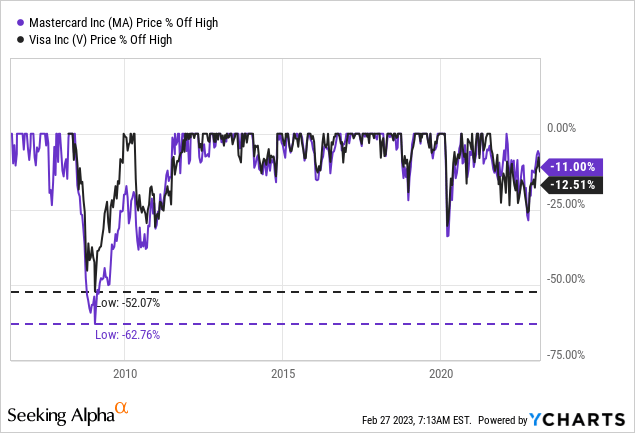

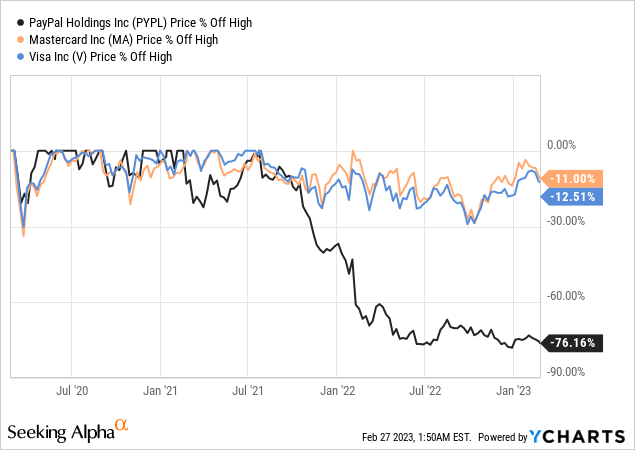

The reason why I don’t buy Mastercard myself is rather complicated. I expect the global economy to hit the wall in the coming quarters and assume a recession is upon us. And in such an environment I don’t want to buy stocks which are not clearly undervalued already. And when looking at the previous recession, Mastercard – as well as its peer Visa – saw its stock price decline between 50% and 60%. To be honest, I see a similar scenario in the coming quarters for both stocks (Mastercard as well as Visa).

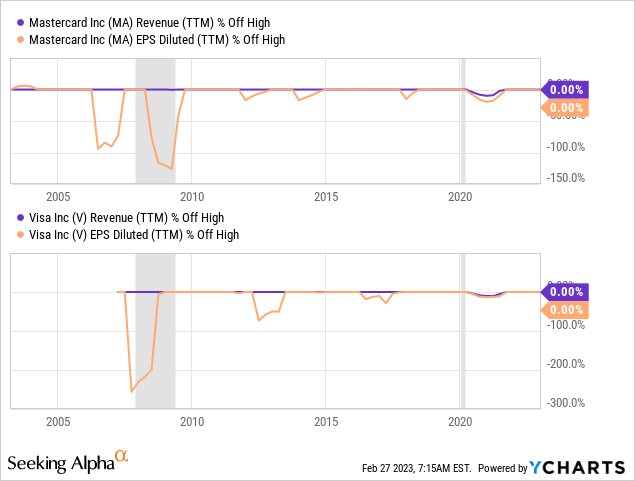

While the stock was cut in half, revenue was pretty stable during the last two recessions – and especially during the Great Financial Crisis which is hardly visible in the chart. Earnings per share also declined steeply but recovered quickly. And even if we assume that Mastercard’s performance will be stable during the next recession – and it can be seen as a recession-resilient business – the stock will probably still decline rather steeply in such an environment. To be honest, most stocks decline in such a market environment and especially the more expensive stocks trading for high valuation multiples.

This is the reason why Mastercard is remaining on my watchlist although it is trading for one of the cheaper P/E ratios and P/FCF ratios in the last five years. Instead I would pick PayPal right now, which is offering the better risk-reward ratio in my opinion.

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.